INSIGHT WEEKLY: January 18, 2026

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

Next newsletter will be in 2026!

See my website with travel and lifestyle

https://iweekly.news

⏳ A focused, 5 minute reading time, weekly summary

🌐 Markets Overview

📈 Markets get off to a positive start

Looking back at 2025, the best performing markets were not the US markets, despite the AI surge - the table below shows the currency effects.

The USD declined in 2025, so if you were a US based investor and had invested in the DAX, you would be looking at a nearly 40% gain, amplified by a higher EUR/USD rate.

A EUR based investor, would have gained a mere 2.6% on the S&P 500.

What will the 2026 year end S&P 500 look like - here are some forecasts:

Institution | Year-end 2026 S&P 500 |

|---|---|

Bank of America (BofA) | 7,100 |

Barclays | 7,400 |

CFRA | 7,400 |

BMO Capital Markets (BMO Nesbitt Burns) | 7,400 |

HSBC | 7,500 |

J.P. Morgan | 7,500 |

BNP Paribas | 7,500 |

Yardeni Research | 7,700 |

UBS | 7,700 |

Citi | 7,700 |

Morgan Stanley | 7,800 |

Deutsche Bank | 8,000 |

Capital Economics | 8,000 |

Some of the major topics for the markets in 2026:

The AI diffusion from tech to other parts of the economy

The approach of the Federal Reserve to monetary policy

The narrowing of the spread between corporate debt and sovereign debt - will this continue? Will cash rich, high earning tech companies continue to use debt markets to finance data center expansion?

Will AI related capex continue at the same pace?

Will the dollar continue to decline in 2026?

Will gold continue to rise?

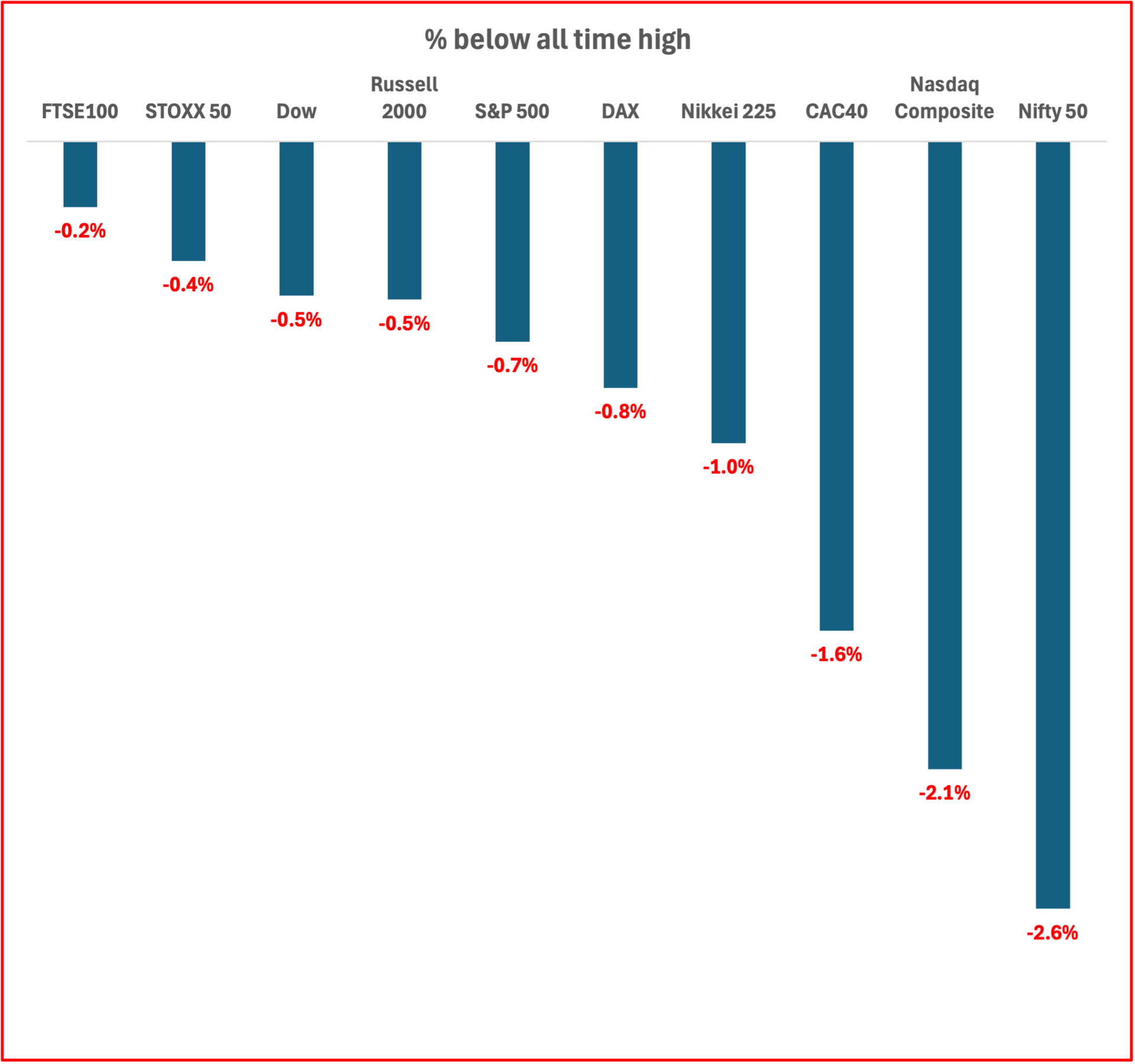

Markets below all-time highs:

Nasdaq was the only major index not to break a new record in January 2026 so far.

Tech Stocks Performance

The performance of the “picks‑and‑shovels” of AI and high‑performance computing continues into 2026.

The Mag 7 has continued to decline or go sideways, with the exception of Alphabet, which is performing very well due to its continued success integrating AI into its search as well as producing its own GPUs.

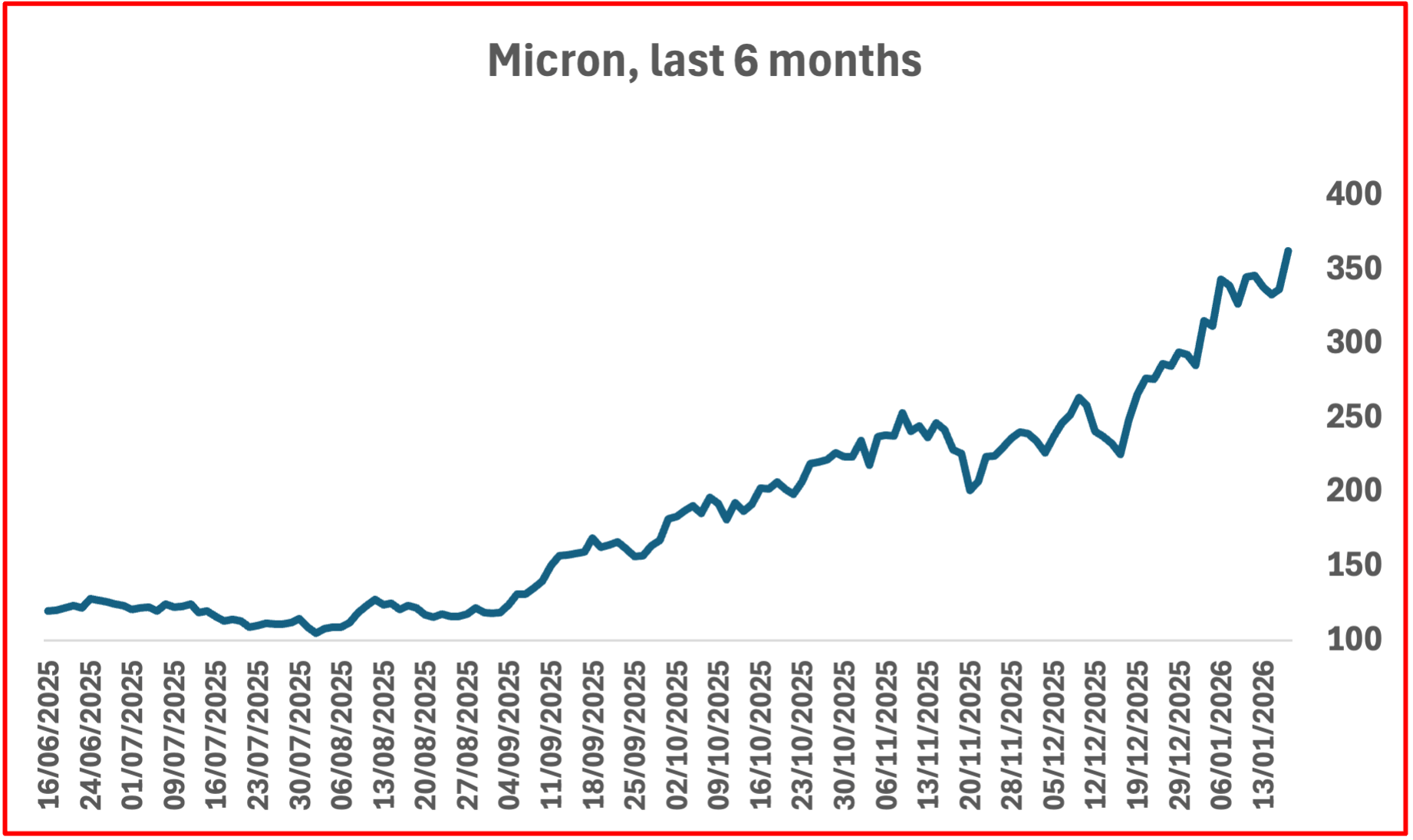

There is a worldwide shortage of memory (RAM) for all computing devices, and especially for AI devices.

Micron, SK Hynix and Samsung Electronics are the major producers of RAM. Revenues are expected to increase substantially. Micron’s share price performance has reflected the potential earnings.

Macro Watch: This Week’s Economic Developments

2026 Global Market Outlook

🇺🇸 United States

America heads into 2026 with decent momentum. The economy has been growing at a healthy clip through 2025, and the labour market has held up better than many expected.

Most 2026 forecasts still sit in the low 2% range, mainly because many economists assume growth cools as interest rates are still high compared to recent history.

The Federal Reserve’s interest rate is in the 3.50% to 3.75% range.

Inflation has stopped getting worse and is gradually drifting down.

🇪🇺 Eurozone and United Kingdom

Europe looks steadier than it did a year ago, but it is still not a high-growth story. The euro area is likely to muddle through with modest expansion in 2026, helped by easier monetary policy than in the recent past, but held back by weak productivity and a complicated trade backdrop. If the US and China both push harder on trade, Europe feels it quickly.

The UK picture is similar. Rates are lower than they were, which helps, but the recovery is still fragile. Growth should improve from the soft patches, yet it remains vulnerable to energy prices and any renewed squeeze on household budgets.

🇯🇵 Japan

Japan is one of the more interesting macro stories because policy is shifting. The Bank of Japan has already moved away from ultra-low rates, and investors are watching how far that process goes in 2026. Wage growth and domestic inflation will be the deciding factors, and so will the yen. Equities have a supportive backdrop from ongoing corporate reform, but anyone giving you a precise end-2026 yen level is making a punt.

🇨🇳 China

China is likely to keep leaning on policy support to keep growth respectable in 2026. The aim is simple. Stabilise housing, encourage consumers to spend, and keep the manufacturing engine running. The problem is that structural issues have not disappeared, and exports face a tougher global environment. That leaves China as a market where policy headlines matter more than they do elsewhere, and where confidence can change quickly.

Cross-Market Themes

AI investment remains the big narrative, but markets already know that. The more important question for 2026 is whether earnings deliver what valuations are already pricing in.

The main risks are a return of inflation pressure, rate cuts arriving later than investors hope, and trade or geopolitical shocks.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Healthcare with AI has been in the news.

OpenAI launched ChatGPT Health, which lets users connect records and wellness apps and ask questions grounded in their own documents.

Anthropic rolled out Claude for Healthcare, with a strong emphasis on HIPAA-friendly use cases and the boring but valuable admin layer, things like forms, coding and insurance workflows.

Google came at it from a different angle, publishing updates to its open medical models, including MedGemma 1.5 for medical image understanding and MedASR for medical speech to text. The common thread is that these are serious moves, but they are not a green light for autonomous diagnosis. Regulation and clinical validation still sit in the critical path.

AstraZeneca agreed to buy Modella AI to strengthen oncology R & D, particularly around biomarkers and trial work. The subtext here is control. Big drug makers want the data, the models, and the iteration loop inside the building, rather than renting it from partners and hoping it sticks.

Retail is getting its own “AI layer”. First Insight has launched Ellis, a conversational interface that sits on top of consumer feedback and planning decisions, so non-technical teams can query pricing, product concepts, and demand without waiting on an analytics queue.

Elon Musk is now seeking up to $134 billion from OpenAI and Microsoft in a case headed for trial in April, arguing OpenAI drifted from its original mission. OpenAI’s response is that the history is being rewritten.

OpenAI says it will begin testing ads in ChatGPT for some US users on Free and Go tiers, with ads separated from responses. This is an attempt to increase monetization as it heads to a possible IPO in 2026.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

Binance Coin’s 2025 strength is due to it benefiting from Binance platform usage and BNB Chain activity while many large alts de-rated. A big overhang also eased. Reuters reported the SEC dismissing its civil lawsuit against Binance with prejudice. Early 2026 looks like steady follow-through plus the broader “regulatory clarity” bid.

Bitcoin traded mainly as a “high-beta macro asset” in 2025, driven by the big economy-wide forces that move equities, rates, the dollar, and liquidity, and it typically moved more than those markets rather than acting as a safe haven. The positive start to 2026 fits the same pattern, a return of risk appetite plus improving sentiment around the regulatory backdrop.

Ethereum lagged in 2025 as investors debated value capture. The FT noted that scaling via Layer 2s can divert fees away from L1, while competition intensified. Early 2026 performance is mostly “beta,” but the stablecoin angle matters.

Solana fell hard in 2025 because a lot of the activity that had been powering its ecosystem cooled sharply. When fewer people trade, swap tokens, and use apps on a network, enthusiasm drops and prices usually follow. The strong start to 2026 looks like a mix of improved risk appetite and signs that activity is stabilising.

Cardano’s 2025 result shows how quickly markets punish projects that go quiet. When fewer people use the network’s apps and less money sits in them, confidence fades and prices can slide hard. The early-2026 rebound is partly a normal bounce after a very weak year, and partly renewed attention around Cardano’s privacy-focused Midnight project and its planned NIGHT token. That can lift sentiment fast, but it does not prove long-term adoption is fixed

Polkadot had a tough 2025 because the market worried the coin supply was growing faster than real demand. In 2026, part of the recovery is down to changes the project has approved to slow that supply growth over time, which reduces the background pressure on price.

XRP’s long-running SEC case ended in 2025, which removed a major uncertainty, but it did not guarantee a straight line up. After that, XRP largely traded like a normal risk asset. It fell with the broader market when sentiment cooled in 2025, then bounced in early 2026 as crypto mood improved and investors leaned back into the “clearer rules are coming” narrative in the US.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.