INSIGHT WEEKLY: June 9, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online. An easy to read, weekly summary to be well informed of the hot topics of our times.

🌐 Major indexes and major stocks

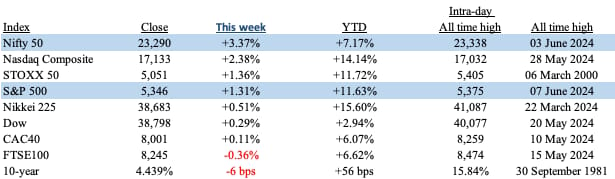

There were two new records in the week.

S&P500 hit a new record, with strong performances from Nvidia and other tech.

India’s Nifty 50 also set a new record this week after the conclusion of the elections and the expected continuity of the government’s economic program.

Major stocks of interest :

See Spotlight on Nvidia below

🇪🇺 European Union

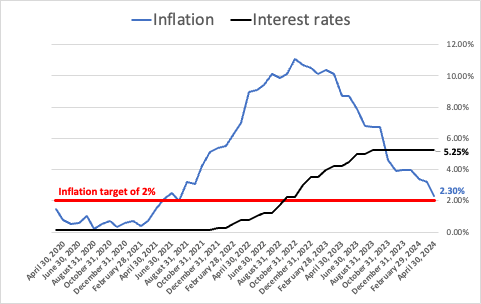

Interest rates cut to 3.75% from 4% by the European Central Bank following Canada's rate cut earlier this week. This move comes as EU-wide elections are underway, reflecting public discontent over cost of living issues. The ECB's decision is ahead of potential cuts from the Bank of England and the US Federal Reserve. Central banks have kept rates high for two years to curb inflation, targeting 2%, but this has slowed economic growth. The ECB's rate cut aims to boost economic activity by lowering borrowing costs. Despite a slight increase in inflation to 2.6% in May, the decision was made to stimulate the economy. There may be further rate cuts by the ECB, potentially lowering rates to 3.5% or below by year-end, as growth slowly recovers.

Will the Bank of England be the next to cut?

🇬🇧 UK

UK house prices have shown signs of stabilization, due to a stronger labor market with low unemployment and wage increases.

Halifax reports that housing transactions have been running at about 15% below pre-pandemic levels, with transactions involving mortgages down by 25%. Cash transactions have been unusually high, as those with available funds take advantage of the current market conditions.

Despite these positive signs, comments from Nationwide and HSBC suggest that a rapid rebound in house prices is unlikely. They predict a gradual improvement in affordability driven by solid income growth, modestly lower house prices, and easing mortgage rates, rather than a significant market upswing.

Interest rate cuts are looking more promising with inflation approaching target rates. The European Central Bank has cut rates despite inflation not hitting the target, and the Bank of England may be tempted to also move sooner than expected.

Inflation hasn’t yet hit the target but the BOE may be tempted to cut rates in anticipation of inflation running below target shortly.

FTSE100 is -0.3% this week and +6.0% this year.

🇺🇸 US

Stagflation worries? Lower manufacturing as the Institute for Supply Management (ISM) reported that its gauge of manufacturing activity at 48.7 indicating contraction. Labor Department reported that April job openings in April fell to 8.059 million. This is the lowest level since February 2022.

The “quits rate” of employees leaving jobs increased, which is a sign of a strong economy.

Inflation remains sticky.

Performance summary :

If you like this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

Yen hovered around the JPY/USD 157 level against the U.S. dollar. The government confirmed that there was intervention to support the yen. It has been reported that $62bn was spent in May, and $35bn in April. This exceeds the amount spent on a similar exercise in 2022.

Interest rates remain unchanged reflecting a cautious approach to rate increases. Speculation suggests the Bank of Japan (BoJ) might reduce bond purchases signaling a shift from its stimulative policies. While rates are expected to remain unchanged in the short term, gradual tightening is likely due to improving global growth and Japan's inflation trends.

In the fixed income markets, the yield on the 10-year Japanese government bond (JGB) dropped to 0.98% from 1.07%, following U.S. Treasury yields lower.

Nikkei 225 Index was +0.5% this week, and up 15% in the year.

See previous spotlight on Japan.

SPOTLIGHT ON NVIDIA

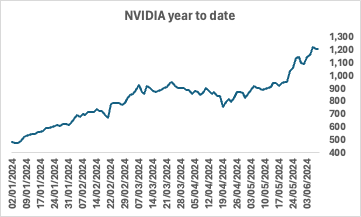

The superlatives have been used to describe it, and Nvidia's share price performance has been truly spectacular.

Why is Nvidia unique?

Nvidia initially specialised and built an expertise in designing chips for games. These chips are called Graphical Processing Units (GPU). GPUs are different to Central Processing Units (CPU) that we have in our phones, computers and many other devices in that GPUs can process calculations in parallel or simultaneously, making them able to cope with higher demand. CPU’s handle work sequentially. Other companies make GPUs but Nvidia has a first mover advantage and was in a clear leading position when the demand for AI related computing power took off.

What is Nvidia’s defensive “moat”?

Its chips have a suite of accompanying software which is a preferred combination.

Its designs are leading edge.

It has a strong supply chain that allows it to produce GPUs in larger volumes, faster, and more reliably, than its rivals.

It is the leading supplier for the AI revolution.

It is the leading supplier of chips for electric vehicles and the soon to arrive self-driving capability for cars (Tesla cars have Nvidia chips).

Who makes Nvidia’s chips?

Mainly TSMC, a Taiwan based manufacturer, also enjoys a major competitive advantage over its rivals.

Nvidia is a designer of chips, and not a manufacturer. Like Apple, its products are manufactured by others.

Nvidia’s share price outperformance is shown in the chart and tables below :

Over different time periods, Nvidia is outperforming its Magnificent 7 peers.

And outperforming its semiconductor peers.

Top ten companies by market capitalisation (value) in USD billions :

Nvidia briefly took the number two spot at $3 trillion, but fell back at the end of the week.

Where does Nvidia go from here?

Nvidia is projected to reach a $10 trillion market cap by 2030, up from its current near $3 trillion market cap, driven by advancements in AI technology and strategic growth in various sectors. This ambitious prediction comes from Beth Kindig, a tech analyst at I/O Fund.

Key Factors Driving Growth :

1. Next-Generation GPUs: Nvidia's Blackwell GPU chip is expected to surpass the performance of its H100 AI chip, significantly boosting data center revenues. Kindig anticipates that by the end of Nvidia's fiscal year 2026, the Blackwell GPU will generate $200 billion in data center revenue alone.

2. CUDA Software Platform: Nvidia’s CUDA software is a crucial component in its growth strategy. CUDA has become an essential tool for AI engineers, similar to how iOS locked in mobile app developers for Apple. This integration of software and hardware creates a substantial competitive edge, or what Kindig describes as an "impenetrable moat" around Nvidia's business.

3. AI Data Center Market: Nvidia is well-positioned to dominate the AI data center market, which is projected to reach $400 billion by 2027 and $1 trillion by 2030. The company’s leading role in AI GPU development puts it ahead of competitors like AMD and Intel.

4. Automotive Sector Expansion: Nvidia’s expansion into the automotive sector is another critical growth area. As autonomous vehicles and AI-driven automotive technologies advance, Nvidia’s hardware and software solutions are expected to capture a significant market share in this sector.

Potential Market Impact

Nvidia's projected growth could have broader implications for the tech and AI sectors, influencing investment trends and market dynamics. As Nvidia continues to innovate and expand its product offerings, it could drive substantial gains in related markets, including AI-driven applications and services.

Accelerated computing has reached the tipping point. General purpose computing has run out of steam

Jensen Huang

Who is Jensen Huang? He is the CEO of Nvidia and now has mass appeal. He has been described by Mark Zuckerberg as “Taylor Swift, but for tech”.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

OpenAI has disrupted five such IOs that used AI models for deceptive activities across the internet over the past three months. These operations attempted to manipulate public opinion and political outcomes without revealing the true intentions of the actors.

The interventions prevented these campaigns from significantly increasing their audience engagement. The disrupted operations included generating fake comments, articles, social media bios, and debugging code.

Despite using AI, none of the disrupted operations managed to engage a substantial audience. They primarily aimed to create the appearance of engagement rather than genuine interaction. The safety systems and AI tools seem to have worked.

Apple is set to integrate OpenAI's ChatGPT into iOS 18 as an opt-in feature, according to Bloomberg. Alongside ChatGPT, iOS 18 will introduce other AI features, including enhanced search functionalities, an upgraded emoji library, and built-in apps.

Apple reportedly chose OpenAI's ChatGPT over Google's Gemini chatbot due to better deal terms. It’s not yet confirmed which version of ChatGPT will be used.

Additionally, Apple is working on long-term projects involving AI-powered consumer robots. These include a tabletop robotic arm with a smart display and an autonomous vehicle that can follow users and perform tasks.

🌐 Crypto Corner

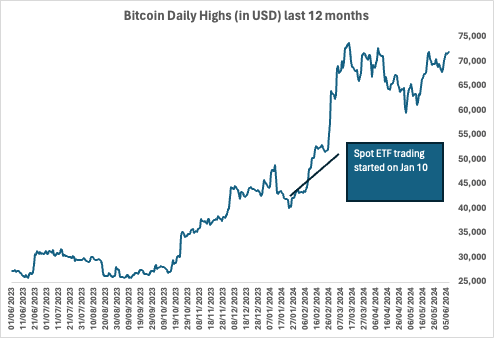

Bitcoin US spot ETF market extended its net inflow streak to five weeks, driven by weaker-than-expected US economic indicators. Overall, the US BTC-spot ETF market saw total net inflows of $1,828.5 million, compared to $170.9 million the previous week.

Bitcoin price over different time periods :

see previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $209bn ⬇️ $1bn

Bernard Arnault and family (LVMH) $208bn ⬆️ $7bn

Jeff Bezos (Amazon) $201bn ⬆️ $7bn

Mark Zuckerberg (Facebook/Meta) $172bn ⬆️ $9bn

Larry Ellison (Oracle) $155bn ⬆️ $9bn

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.