INSIGHT WEEKLY : February 4, 2024

An easy to read economic and financial summary. If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

🌐 Overview

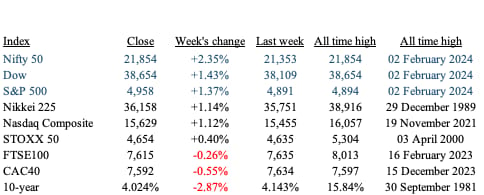

Nifty 50, Dow and S&P500 set new records this week. There is a general consensus that there will be a soft landing globally, despite an increase in global tensions and worries about the attacks on shipping in the Red Sea.

🌐 Major indexes

India’s Nifty 50 was the best performer this week, reaching all time highs, after the government’s interim budget plans a cut in borrowings in 2025.

S&P 500, the Dow hit record highs during the week due to a good jobs report showing a gain of 355,000 jobs. Tech reported good earnings.

🇬🇧 UK

Interest rates The Bank of England keeps interest rates at 5.25% but indicates that “things are moving in the right direction”. Two members of the committee wanted to increase rates by 0.25% ! Three voted to hold, and one to cut. It might be mid year before there is a consensus for the first cut.

Residential property prices increased in January by 0.7% (according to Nationwide) but there is no expectation of strong price growth even with benign interest rate expectations.

🇺🇸 US

Interest rates were left unchanged at between 5.25% and 5.5%. The Federal Reserve is not ready to cut rates yet, but there is still the expectation of three rate cuts in 2024. Timing is important though some are critical that the Federal Reserve is late in both raising and in cutting.

S&P500 had another record this week. Dow also reached a new high. Tech stocks reported results in the week.

Microsoft (good, with Cloud earnings increasing)

Alphabet (good with increasing Cloud earnings)

Amazon (good and also with increasing Cloud earnings)

Meta Platforms (good results, first dividend and planned share buyback)

Apple (good but there are concerns about the China slowdown)

The jobs report provided a reason for a further uplift to the market. 355,000 new jobs were added.

Manufacturing stablised in January after a dip in December as measured by PMI. Is a manufacturing recovery about to start ?

If you are liking this newsletter, please send this link to friends, family and colleagues

🇯🇵 Japan

Nikkei 225 In the year to date, it is up 8.6%. International investors keep buying, fuelling stock market growth

Factory output and new orders declined for the 8th consecutive month

Job market remains tight, wage hikes may result

See previous spotlight on Japan.

🚢 Shipping

Red Sea The first reported economic effects of the Red Sea attacks are in the UK. The manufacturing sector is reporting supply chain difficulties due to the addition of 12 to 18 days to deliveries.

Panama canal Continuing drought causing concern.

🛢️ Oil prices are down this week : Brent is down $6 at $77, WTI is down $6 at $72. Continued volatility.

💰 Gold prices are up $21 this week at $2,039 per ounce. Continued volatility.

🚢 Spotlight on India

‘So far as I am able to judge, nothing has been left undone, either by man or nature, to make India the most extraordinary country that the sun visits on his rounds. Nothing seems to have been forgotten, nothing overlooked’

Mark Twain

A brief history

A mixed planned economy was the economic orthodoxy in India’s post independence days, when the economy was run in accordance with economic plans. It was protectionist, had state owned monopolies, regulation and generally influenced by dirigisme. Dirigisme (from the French word diriger “to direct”) is an economic doctrine in which the state plays a strong directive role in the economy.

Post liberalisation started from 1991, and the reforms included reduced tariffs, lower interest rates, deregulation and the ending of public monopolies. The Indian economy started to grow, and in the last few years has surpassed Brazil, UK, Italy and France in size and is now the fifth largest economy in the world.

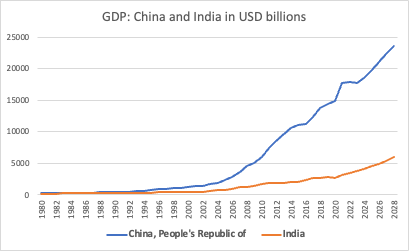

Comparison to China is inevitable for the two most populous countries in the world. Both have grown rapidly, lifting hundreds of millions of people out of poverty. Both have well developed strengths in science and technology (including membership of the exclusive moon landing club), outstanding educational and research institutions and world class companies. India’s growth has overtaken China’s in the last few years as the graph below shows. This trend is likely to continue. Much depends on the economic direction that each takes. There once was another country that was on the path to global domination of industry, commerce and finance, and then faded. That country was Japan. It is election year in India (as in many other countries), so the interim budget presented in January is a temporary one until the new government presents a new budget. The objective is for India to be a developed economy by 2047.

Is India the new China ? India is not the new China, anymore than China was the new Japan. It is very different. China can marshal huge amount of resources in order to pursue its objectives. India has a different political and cultural milieu which doesn’t easily allow such an organisation of resources in the pursuit of objectives.

Growth

India’s expected to be growing faster than China for the next few years.

Size of economy

China growth accelerated since the 1990s, and India is unlikely to catch up in the foreseeable future.

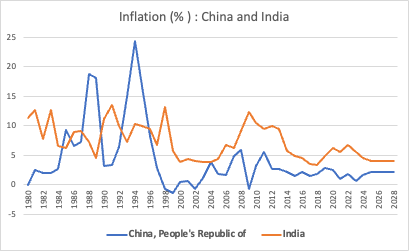

Inflation

Inflation is expected to be stable.

Population growth (projected) :

India’s population exceeded China’s in 2023.

India’s population is younger than China’s, with high rates of digital adoption.

Top Indian companies :

Top 10 Indian Companies | Category | Market Cap (USD) |

|---|---|---|

Reliance Industries | Oil and Gas | $230.7B |

Tata Group | Information Technology | $186.7B |

HDFC Bank | Financial | $135.1B |

Infosys | Information Technology | $94.4B |

Hindustan Unilever | Personal Care | $85.6B |

Housing Development Finance Corporation (HDFC) | Financial | $66.0B |

ICICI Bank | Financial | $65.7B |

Bajaj Finance | Financial | $61.7B |

State Bank of India | Financial | $54.3B |

Kotak Mahindra Bank | Financial | $53.3B |

🏅5️⃣ Billionaire Leaderboard

Mark Zuckerberg is up to 4th place, replacing Larry Ellison. This was due to Meta’s good results, first ever dividend.

Elon Musk Tesla’s share price continues to slip and is now down 24% this year. A Delaware court has scrapped a $55.8bn compensation package for Elon Musk prompting him to propose a move of Tesla to Texas.

Top 5 and change in week :

Bernard Arnault and family (LVMH) $211bn ⬆️ $4bn

Elon Musk (Tesla, SpaceX)$198bn ⬇️ $7bn

Jeff Bezos (Amazon) $194bn ⬆️ $13bn

Mark Zuckerberg (Facebook/Meta) $167bn ⬆️ $28bn (moves up 1 place)

Larry Ellison (Oracle) $144bn ⬆️ $2bn (moves down 1 place)

If you liked this newsletter, please send this link to friends, family and colleagues https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates in a 5 minute round up each week.