INSIGHT WEEKLY: May 11, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time. And to refer to during the week.

Stay ahead without the overload.

500+ professionals have subscribed to this magazine.

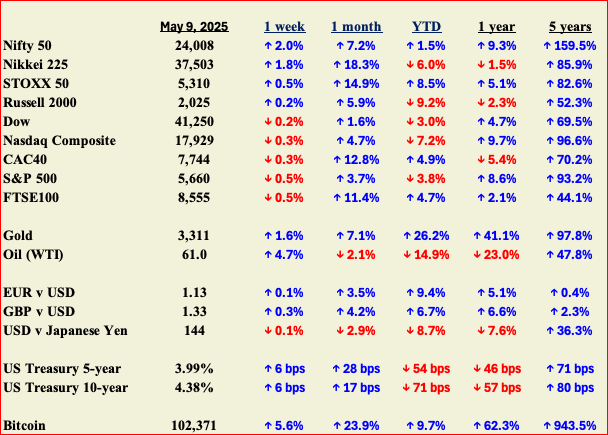

🌐 Markets Overview

📈 Markets This Week: Will Easing Trade Tensions Revive Markets in 2025?

Is the gloom from tariffs over? Not yet.

The markets picked up on Thursday after the US and UK signed an agreement on tariffs (see summary below), but the optimism petered out on Friday.

The markets had already “priced in” some agreements between the US and its trading partners, and so the uptick on Thursday was relatively small for this first agreement.

But it is widely expected that there will be no going back to the previous trading arrangements. There is a paradigm shift going on, and the global trading system will settle into a new structure.

And some tariffs will remain.

The US and China are engaged in talks in Switzerland. President Trump has stated that the tariffs of as much as 145% could be reduced to 80%, so the residual tariffs may still be high.

In terms of deficits in trade (excluding services), it is China and the European Union that are the biggest. So the next set of talks could be with the EU.

The future direction of the S&P 500 and major markets will be driven by the net effect of:

Upward pressure due to optimism on upcoming tariff agreements

and

Downward pressure due to expectations of tariff induced inflation, low or negative growth, and higher unemployment.

S&P 500

A minor uptick on Thursday due to the US/UK agreement, but still a decline of 0.5%.

Oil prices bounced back in the week, but down by almost a quarter since the same time last time last year, due to falling demand, and expectations that oil producers will be boosting supply.

Tech stocks

Micron is up 6% in the week as investors anticipate very good earnings in its upcoming release. Micron designs and manufactures memory and storage chips, including Dynamic Random Access Memory (DRAM) and high-bandwidth memory (HBM) used in AI servers. Investors are also rotating away from Nvidia to other chip stocks.

Other semiconductors gained, but ARM gave up some of the gains from last week.

Tesla gained this week on news that proposed tariffs to China could be cut (from as high as 145% to 80%). While it does do manufacturing in both countries, its US manufacturing does have a supply chain that is exposed to tariffs. The stock has gained for three straight weeks. Also, responding to investor comments, Elon Musk indicated that he will spend more time on Tesla by spending less time on his government role.

🧭 US and UK Tariff Deal

This new agreement has been named the “US and UK Economic Prosperity Deal”. It is the first deal the US has signed since “Liberation Day”.

This table summarizes the deal, which is not a legally binding agreement. Both parties intend to expand this bilateral deal further into other areas.

🧭 Macro Watch: This Week’s Economic Developments

Here’s a quick roundup of this week’s key economic developments across major economies.

🇺🇸 United States

Interest rates: The Federal Reserve maintained its benchmark interest rate at 4.25%–4.50% during its May 7 meeting. With tariffs and inflationary pressures, the Fed was expected to do nothing.

Services Activity picked up in April, with the ISM Services PMI nudging up to 51.6, marking the 10th straight month of expansion.

But prices are surging again. The prices paid index jumped to 65.1, the highest in over two years, and a lot of that spike seems tied to tariff-related costs working their way through supply chains.

🏛️ Europe excluding the UK

Interest rates: The central banks of Sweden and Norway held their policy rates unchanged this week. Sweden’s Riksbank kept rates at 2.25%, but softened its stance, acknowledging that downside risks have grown, particularly due to the ripple effects of U.S. trade policy. A rate cut is expected.

Norway’s Norges Bank also left its benchmark rate at 4.5%, maintaining a more hawkish posture for now. With inflation still hovering above target, officials are wary of easing too soon, but a rate cut sometime in 2025 is now expected.

Germany’s industrial sector showed unexpected strength. March factory output soared 3.0%, far above expectations, while new orders climbed 3.6%. Much of this appears to be a pre-tariff production rush, as exporters race to fulfill orders before U.S. trade measures bite.

🇬🇧 United Kingdom

Interest rates: The Bank of England trimmed interest rates by 0.25% to 4.25% this week. Five members of the panel voted for a 0.25% cut, two for a 0.5% cut, and two voted for no cut.

The bank still favors a “gradual and careful” path ahead.

Housing market: the Royal Institution of Chartered Surveyors (RICS) said that the housing market slowed after the expiration of the tax break for first time buyers.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

SPOTLIGHT: The Battle for Search — Can AI Replace Google?

🔍 Spotlight: The AI Search War — Can Google Hold the Line?

Over the past decade, the phrase "just Google it" became shorthand for finding anything online.

Now, there are challengers.

Anthropic Goes Real-Time

On May 8, Anthropic announced the launch of its new Web Search API, allowing its Claude language models to retrieve live internet data in real time. Unlike traditional static LLMs that rely on old training sets, this integration gives Claude the ability to reference up-to-date web content, deliver sources, and cite materials directly within its responses.

"Developers can now provide Claude with real-time web search results in structured formats, enabling grounded, timely answers with inline citations."

This means that data can be provided to Claude in a clean and organised format (like JSON), making it easier for Claude to interpret correctly.

Want to know more? Take a look at:

Apple Eyes AI Alternatives to Google

Searches on Apple’s Safari are down for the first time in 22 years! Consumers are already starting to use AI rather than Google. Apple reportedly pays Google $20 billion per year so that its customers use Google as the default search engine.

Apple is reportedly considering adding AI-native search engines like Perplexity and You.com to Safari’s default search options. That means that users could soon have an alternative to Google built directly into their browser.

Why AI Search Feels Different

Unlike traditional search, which returns pages of links, AI search engines aim to return direct, conversational answers, grounded in web sources. With features like:

Real-time data access

Summarization across multiple sites

Source citations

Tools like Claude, Perplexity, and soon ChatGPT with browsing, are positioning themselves as the go-to interface for how people want to interact with the web.

The core advantage? Less time digging. More time understanding.

Google Isn’t Sitting Still

Its Gemini-powered Search Generative Experience (SGE) is being gradually rolled out to users. It uses the Gemini model to give AI-generated answers right at the top of Google search results instead of just showing links. Deeper integrations are expected to be shown at the Google I/O 2025 conference.

And this week, Google announced a new feature called "implicit caching" for its AI platform. This means that if the same request has been made before, Google recognizes it and returns the previous result instantly, instead of rerunning the whole model.

Want to learn more - see:

https://developers.googleblog.com/en/gemini-2-5-models-now-support-implicit-caching/

Google’s search business is still tightly tied to advertising revenue and link-based web architecture, while LLMs point toward an answer-first, ad-light future.

What to Watch

The big questions going forward:

Will consumers start defaulting to AI search for everyday queries?

How will Google balance its ad business with the new demand for direct answers?

Will Apple fully integrate an AI engine of its own?

Can smaller players like Anthropic and Perplexity scale fast enough?

For now, Google Search remains the incumbent, but its lead is no longer untouchable.

The AI search war has officially begun, and the winner may not be the one with the biggest index, but the one that answers best.

Other AI news:

Microsoft has announced it will adopt Google’s open protocol for AI agent integration. This standard enables different AI assistants and services to work together more seamlessly, and is designed to reduce fragmentation as agent-based tools go mainstream. It’s a practical move that could accelerate the adoption of modular AI systems and reflects growing industry consensus that no single platform will dominate the agent ecosystem alone.

Microsoft has prohibited employees from using the DeepSeek AI app, citing security and data governance risks. The company has not disclosed specifics, but this follows a broader trend of tightened internal AI usage policies among major tech firms. Large companies are becoming increasingly cautious, particularly when AI models operate in a black-box manner or are trained outside trusted ecosystems.

OpenAI is in early-stage talks with the U.S. Food and Drug Administration to explore how large language models like ChatGPT could assist in drug evaluation workflows. The goal is to use AI to interpret clinical trial data more efficiently.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

As the stock market recovered on hopes of tariff deals, cryptos gained in the week. Ethereum recovered from declines earlier in the year, mainly due to inflows from institutional investors during the week.

Bitcoin topped $100,000 again this week.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.