INSIGHT WEEKLY: May 18, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time. And to refer to during the week.

Stay ahead without the overload.

500+ professionals have subscribed to this magazine.

🌐 Markets Overview

📈 Markets This Week: Is the market recovery sustainable?

Markets recovered strongly in the week in response to the de-escalation of tariffs between the US and China. The de-escalation was agreed as part of the 90-day deferment.

The markets are considering that this is a walk back, but not to pre “Liberation Day” but to a new normal that is not as good.

S&P 500

Will the S&P 500 take out its February all time high? It is just 2.5% below 👇.

Tech stocks

Tesla’s rally suggests it was more sentiment-driven than fundamental. The tariff relief likely boosted confidence in Tesla’s global operations, particularly in China, a key market. It is still down 13% year to date, and 28% off its all time high achieved on December 18, 2024.

What can be inferred from the share price performance over the last twelve months?

Initial enthusiasm that the new administration would provide more opportunities for Tesla, followed by concerns about both tariffs and Musk’s involvement in the new administration, and therefore less time spent on the company.

Nvidia gained 16% in the week, due to orders expected from the Middle East, to expand its business in Saudi Arabia and the United Arab Emirates.

On Tuesday, Nvidia unveiled a commitment to supply hundreds of thousands of AI chips over the next five years to Humain, which is an AI venture owned by Saudi Arabia’s $925 billion public investment fund.

This comes ahead of its quarterly earnings report on May 28.

Micron is up 14% in the week, following last week’s gains. This week, it was optimism about prospects, especially in China, as the US/ China de-escalation of tariffs was announced.

Micron designs and manufactures memory and storage chips, including Dynamic Random Access Memory (DRAM) and high-bandwidth memory (HBM) used in AI servers.

ARM gained 17% on the rising tide of chip stocks.

🧭 US and China Tariff De-escalation

On May 12, 2025, the United States and China announced a 90-day tariff reduction agreement. The U.S. slashed its tariffs on Chinese goods from 145% to 30%, while China lowered its retaliatory tariffs on U.S. goods from 125% to 10%.

The agreement also includes a suspension of China’s recent non-tariff measures, such as export controls and blacklisting of U.S. firms.

Some damage has already been done.

Costs have risen, and supply chains have been disrupted. The uncertainty created by erratic trade policies and market turbulence is not what markets and investors are looking for.

🧭 Macro Watch: This Week’s Economic Developments

Here’s a quick roundup of this week’s key economic developments across major economies.

🇺🇸 United States

GDP contracted in Q1 by 0.3%, the first quarterly decline since 2022.

Credit rating cut by Moody’s from AAA to AA1 on May 16, reflecting the government's inability to reduce its debt, which is now over $36 trillion.

Moody's held the perfect AAA credit rating for the US since 1917 and had warned in 2023 that this was at risk.

Fitch Ratings downgraded the US in 2023, and S&P Global Ratings downgraded in 2011.

🏛️ Europe - Mixed Signals Across the Continent

🇨🇭 Switzerland

Switzerland’s economy grew by 0.7% quarter-on-quarter in Q1 2025, driven by robust performance in the services sector and a notable 7.3% increase in industrial production.

🇵🇱 Poland

Poland’s GDP grew by 0.7% quarter-on-quarter and 3.2% year-on-year in Q1 2025, surpassing forecasts.

🇹🇷 Turkey

Turkey’s economy grew by 3.0% year-on-year in Q1 2025, maintaining steady growth despite ongoing inflationary pressures. QonQ is not available yet.

🇬🇧 United Kingdom

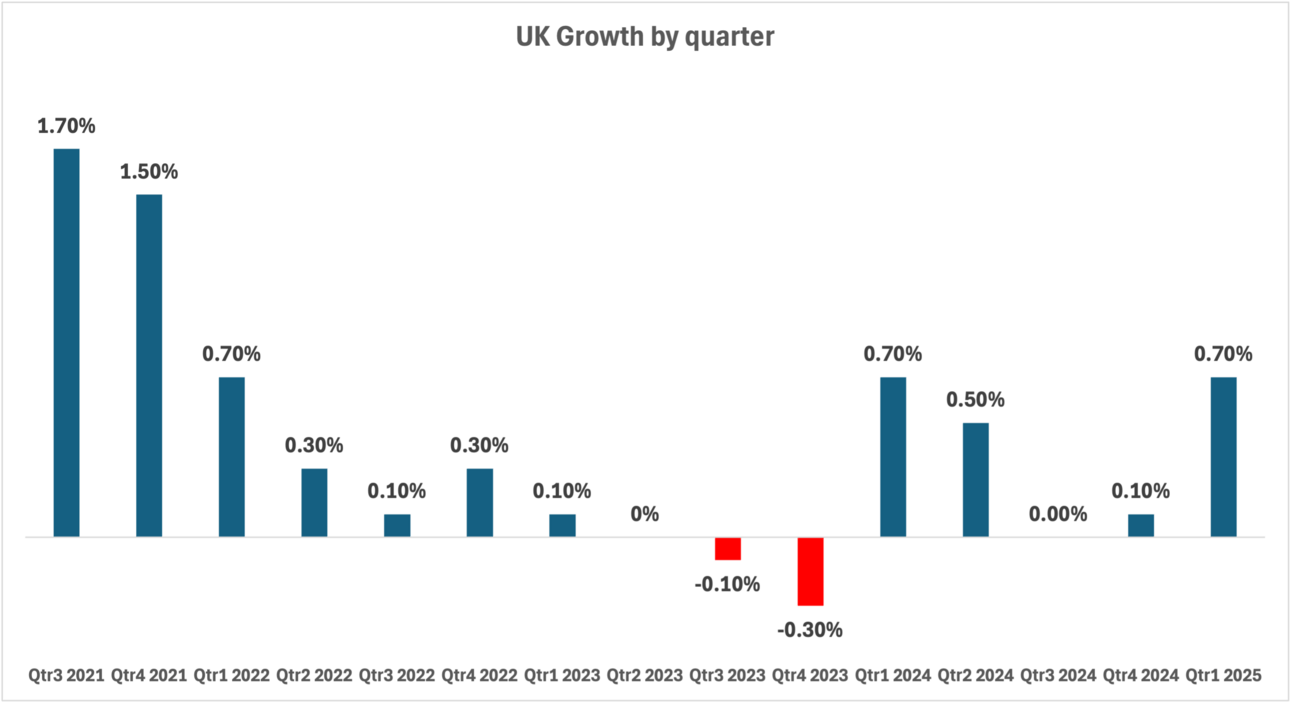

Growth was 0.7% in Q1 2025 (forecast was 0.6%). This makes it the fastest growing economy in the G7. It was the services sector that drove most of the growth.

But this was before the US tariffs were imposed and then amended per the agreement last week. What next? The effect of tariffs and declining global trade may make this a blip.

Interest rate cuts may help to keep growth at a good level. Last week the Bank of England cut rates by 0.25% to 4.25%.

Inflation numbers are due next week, and the Bank of England's Monetary Policy Committee (MPC) will hold its next meeting on June 19, 2025 to decide on interest rates.

Jobs market weakens as both workers in jobs and job vacancies declined.

Reasons?

April's increase in employer National Insurance contributions and the National Living Wage could both be contributing factors.

But earnings increased at 5.6%, outpacing inflation.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

SPOTLIGHT: The Rolling AI Boom

The AI boom is often talked about as if it’s happening inside the models. But what powers those models is becoming just as important.

AI at scale isn’t just a software problem. It’s an infrastructure problem.

The Energy Behind Artificial Intelligence

Training and deploying AI models require a lot of electricity. A single hyperscale site can draw tens or even hundreds of megawatts, which is on a par with entire cities.

What is hypercale? These are large data centers of between 10-100 MW, built for the cloud giants such as AWS, Microsoft, Meta etc.

There are even bigger data centers being planned called AI-Centric / Mega-Scale AI Campuses. These sites often exceed 100 MW per campus, with high-density liquid cooling and power substation integration.

Microsoft recently secured 2.5 gigawatts of future capacity in Virginia. Google and Meta are expanding rapidly across the U.S., Scandinavia, and Canada. In some states, grid operators are issuing warnings about load constraints. As power grids tighten, the next constraint on AI isn’t the algorithm. It’s the megawatts.

The IMF has said that data centers are expected to consume 1,500 terrawatt hours by the end of the decade. That would be more power than the projected power consumption of all countries, except China, United States and India.

As demand ramps up, how will the supply be delivered?

Energy sources:

Regions with stable, low-carbon, high-capacity energy grids

In the U.S., advanced nuclear technologies for small modular reactors (SMRs), which are located at the data center, are being promoted as part of the long-term energy solution for AI infrastructure.

Hydropower-heavy regions like Norway, Quebec, and Oregon are becoming key hubs for hyperscale data centers

Renewables:

Future setups will lean on hybrid systems:

Solar + battery

Wind + grid fallback

Clean firm power (like hydro and nuclear)

Efficiency and Chip Innovation

Nvidia, AMD, and others are no longer just chasing raw power but designing chips that use less energy per unit of useful output, especially for AI workloads.

Where the AI Boom Is Going

Hyperscalers like Microsoft, Google, Amazon, and Meta are buying land, locking in long-term energy deals, and investing billions in energy-efficient infrastructure.

Data center REITs such as Equinix and Digital Realty are expanding in regions with stable, low-carbon power and generous permitting regimes.

Utilities and power infrastructure players are back in the spotlight, especially those serving AI-heavy regions like Northern Virginia, Oregon, and parts of Canada.

Semiconductor firms like Nvidia, AMD, ARM, and ON Semiconductor are developing chips optimized not just for performance, but for energy cost per token - a shift in design philosophy.

The AI boom is rolling outward, from model breakthroughs to land, power, chips, and cooling.

The boom is real, but it’s playing out on the balance sheets of hyperscalers, and not widely reflected in public markets.

Other AI news:

AI with Memory Is Coming

OpenAI, Google, Meta, and Microsoft are building persistent memory into their AI models. Right now, most AIs forget everything after each session. They don’t retain context, can’t personalize, and don’t learn over time.

What’s coming is different: models that remember your preferences, recall past conversations, and adapt across sessions like a real assistant. You’ll be able to see, edit, or delete what’s remembered, but the shift raises new questions about privacy and control.

OpenAI is planning a giant AI data center in Abu Dhabi, so large that it would cover an area bigger than Monaco.

Anthropic rolled out a new Web Search API for its Claude models. Developers can now feed Claude live internet data in structured formats, allowing it to deliver real-time, cited answers. This makes Claude far more competitive in the emerging battle for AI-powered search, especially against Google’s Gemini and ChatGPT’s browsing tools.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

Ethereum jumped +10.3% and is now +64.0% in one month, helped by growing DeFi activity and optimism around network upgrades.

Polkadot rose +7.9%, lifted by momentum around parachain upgrades and improved block finality. It’s now up +35.5% on the month.

Coinbase joins S&P 500 - a watershed moment, becoming the first pure-play crypto company to enter America’s benchmark stock index. Inclusion in the index reflects not just Coinbase’s market cap and liquidity, but the broader normalization of digital asset firms within traditional finance.

It also opens the door for passive investors and index funds to gain exposure to crypto infrastructure.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.