INSIGHT WEEKLY : March 24, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

Bitcoin halving outlined below.

🌐 Major indexes

Five records set this week :

Japan’s Nikkei 225 up by over 5% this week after two weeks of declines.

US’s Nasdaq, S&P500, Dow increased on expectations of three interest rate cuts this year

France’s CAC 40 hit a new record during the week but fell back on profit taking. An increase of over 8% so far this year.

Any delays by the central banks in cutting interest rate cuts would affect the markets.

Key global stocks

Magnificent 7 (US) :

Chips, AI and cloud computing are the drivers of growth. Apple and Tesla face declining sales and competitive pressure.

7 Samurai (Japan) :

The market in Japan is up nearly 23% this year. These stocks have been dubbed the “7 Samurai”.

Semiconductors (global) :

Powering the AI revolution.

🇬🇧 UK

Inflation decreased to 3.4% from 4%, the lowest level in two and a half years and down from 10% a year ago. A breakout of the constituents show a decrease in food prices, soft drinks, restaurants and hotels but an increase in petrol and diesel costs.

Interest rate cuts are “in play” and the UK is “effectively disinflating at full employment” according to the governor of the Bank of England. He added that tighter monetary policy has quelled the risk of a wage price spiral. At the last committee meeting, the vote was eight for a hold and one for a cut. Two previously hawkish members changed their position from a hike to a hold.

Growth in Q1 is likely to be a positive but low number, so the UK is expected to be out of recession.

Credit rating outlook from Fitch improved from negative to stable.

FTSE100 is +2.7% since the start of the year, and nearly all of the improvement was in the last week indicating improved confidence in the economy.

Is the UK economy at an inflection point ?

🇺🇸 US

Interest rates were kept flat on Wednesday for the fifth month in succession keeping the benchmark overnight rate at 5.25% to 5.50%. The Federal Reserve indicated that there will be three quarter point rate cuts this year. This news set off a market rally in the US and added impetus globally too. There are contrarian views among some analysts that there there may no rate cuts this year. If this comes to pass, there may be a drop in the stock markets which have assumed rate cuts in 2024.

Inflation is expected (as measured by core CPE) to be up 0.2% to 2.6% by the Federal Reserve. Inflation is still sticky. The inference is that the rate cuts will not be anytime soon because inflation is not going down anytime soon.

S&P500 at 5,234 is up 2.29% in the week and up over 10% this year.

🇯🇵 Japan

Nikkei 225 is up 5.6% in the week, breaking a new record, following two weeks of declines. It is up nearly 23% this year. Two records have been broken this year after a 34 year bear market.

Interest rate increase as the Bank of Japan finally ended its negative interest rate policy as expected and hiked the rates to 0 to 0.1%, up from -0.1%. The next interest rate hike is expected to be in October. This is just the beginning of the change in monetary policy.

Inflation (as measured by the BOJ) is still low and below the 2% target, and interest rates are not expected to go up rapidly. The Consumer Price Index was 2.8% in February, an increase from January’s 2%, and will surely feed into the BOJ’s preferred inflation metrics.

Japan would like some inflation in the economy. Major companies have agreed a set of pay increases in the annual wage talks and these are expected to add to inflation.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

AI Chips - see previous spotlight

Nvidia unveils new GPU “Blackwell” at the Nvidia developers conference. It has been billed as the “world’s most powerful GPU”. This will sell at around $30,000 to $40,000 and likely to be in demand for training and developing AI software. The Blackwell’s predecessor was the H100, called the “Hopper” which costs between $25,000 and $40,000. There are no list prices for these chips as these are made in different configurations for their customers.

Full stack computing is the new mantra from CEO Jensen Huang. This is about designing not just the chip but also the hardware and software to further optimise the combined working of the system.

OpenAI chips are being planned with some funding from the UAE which may help to reduce its dependence on Nvidia’s chips.

AI law in the form of a UN General Assembly resolution was passed last week to help formulate a regulatory framework for the use of AI.

🌐 Crypto Corner

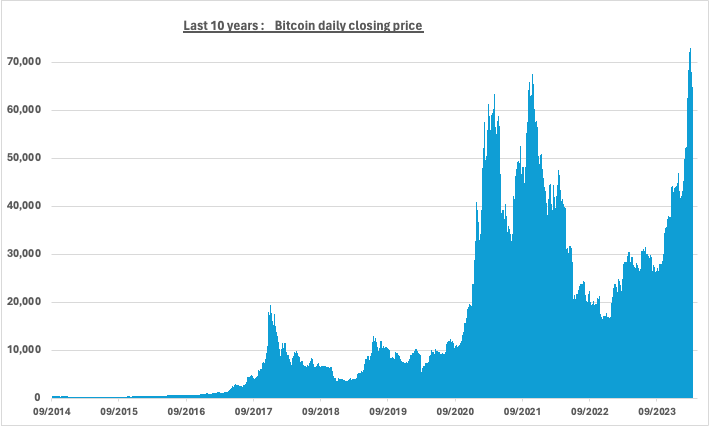

Bitcoin halving is expected in April, though the halving date/time cannot be predicted exactly as the time taken to generate new blocks is not known precisely. A new block is created about every ten minutes. These halving events happen every four years or 210,000 blocks. When the number of blocks hit 840,000 sometime in April, the halving event will take place. There are several countdown clocks online attempting to forecast the time left to the next halving. The halving will reduce the number of bitcoins entering circulation by half by changing the reward for mining bitcoin by half. This is built into the algorithm for bitcoin in order to reduce inflation by maintaining scarcity. There will only ever be 21 million bitcoin of which around 19 million is already in circulation, leaving 2 million to be mined in the future. From the halving in April, the reward will fall from 6.25 to 3.125. Halvings will continue until the last halving which will take place around 2140.

Ark Investment CEO Cathie Wood is expecting Bitcoin to reach $1.5 million by 2030. The current price is around $65,000. She (and some others) think that the halving in April will create a supply side shock.

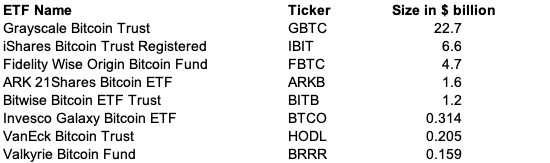

Top Bitcoin ETF’s :

Over $9 billion has come into the market after the SEC approval for Bitcoin ETF’s allowing investors to buy into funds which buy bitcoin. There have been some outflows in the last few weeks.

The table show the biggest ETF’s.

🏅5️⃣ Billionaire Leaderboard

Change in week :

Bernard Arnault and family (LVMH) $225bn ⬇️ $11bn (LVMH declines 3% in the week)

Jeff Bezos (Amazon) $196bn ⬆️ $4bn

Elon Musk (Tesla, SpaceX) $192bn ⬆️ $4bn

Mark Zuckerberg (Facebook/Meta) $178bn ⬆️ $9bn (Meta up 4% in the week)

Larry Ellison (Oracle) $157bn ⬆️ $3bn(Oracle is up 47% this year due to strong earnings from cloud)

and watching

17 (up 3 places this week)

Jensen Huang (Nvidia) $82bn ⬆️ $5bn. Potential entrant to the top 5 depending on the earnings from Nvidia’s GPU’s.

SPOTLIGHTS

Earlier :

Japan ;

Coming soon : More on AI, Cryptos, National debt, future growth sectors, Gold and more !

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates in a 5 minute round up each week.