INSIGHT WEEKLY: July 21, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

To be informed in just 5 minutes of the need-to-know topics of our times.

🌐 Major indexes and major stocks

Three records were set during the week (shaded in blue below) as the Dow and the S&P500 moved in opposite directions.

What is the difference between the Dow and S&P500?

The Dow has 30 stocks and the S&P500 has 500 stocks

All of the Dow is included in the S&P500

Both track large companies. To track smaller cap companies, look at an index such as the Russell 2000.

There are no utilities or transportation companies in the Dow

The Dow is price-weighted, so higher priced shares can distort the index

The S&P500 is market capitalization (value) weighted, so high value companies get a higher weighting. Hence the big tech companies have a bigger influence on the S&P500.

There was selling of tech/AI growth stocks as rotation to smaller cap and value stocks continued.

This explains why the Dow and the S&P500 moved in opposite directions.

Although the Cloudstrike security update disrupted computer systems around the world, it did not affect the markets much.

Magnificent 7:

All of the Magnificent 7 declined in the week due to rotation.

Major Semiconductor stocks:

All of the major chip stocks declined in the week due to fears of a US-China “chip war”.

PHLX Semiconductor index (SOX):

A wider “capitalization-weighted” index composed of the 30 largest semiconductor companies traded on US exchanges.

There has been a rotation out of chip stocks and fears of a US-China trade war.

Highest value companies (market capitalization) in $ trillion:

As chip stocks decline, Nvidia drops below $3 trillion, and TSMC drops one place to 9th place.

🛡️ Spotlight on Crowdstrike

What happened?

Many users, including airlines, news organizations, rail companies, banks, and health services, experienced BSOD (Blue Screen of Death) as many computers could not function. A security software update for computers running from Crowdstrike was faulty. 8.5 million computers were affected according to Microsoft.

What is CrowdStrike?

CrowdStrike is a leading cybersecurity company known for its advanced threat intelligence and endpoint protection solutions. One of its flagship products is the Falcon platform, which provides comprehensive protection against cyber threats by leveraging machine learning, behavioral analytics, and proactive threat hunting. Falcon is designed to detect, prevent, and respond to security incidents across various devices and environments, offering real-time protection and visibility.

What Was the Timeline of Events?

- July 19, 2024, 10:00 AM (UTC): CrowdStrike released an update for its Falcon platform, a key endpoint protection service.

- July 19, 2024, 10:30 AM (UTC): Customers began reporting issues as the update caused unexpected system failures, preventing Falcon from properly protecting devices.

- July 19, 2024, 12:00 PM (UTC): Widespread disruptions were reported, with businesses and government agencies experiencing severe operational interruptions. Microsoft services, which integrate with CrowdStrike for cybersecurity, were affected.

- July 19, 2024, 2:00 PM (UTC): CrowdStrike identified the faulty update as the cause and initiated a rollback process.

- July 19, 2024, 6:00 PM (UTC): CrowdStrike, along with Microsoft, deployed teams to restore affected services and stabilize systems.

- July 20, 2024, 9:00 AM (UTC): CrowdStrike issued an official statement detailing the cause of the outage and the steps taken to resolve it.

- July 20, 2024, 12:00 PM (UTC): Regulatory bodies announced investigations into the incident, focusing on the implications for cybersecurity standards and the monopolization of tech services.

What Went Wrong?

The issue stemmed from a faulty update to the Falcon platform, which was intended to enhance its security features. Instead, a critical bug in the update caused the system to fail, disrupting Falcon's ability to provide endpoint protection. This led to widespread system failures and left many devices vulnerable to potential threats.

How Is It Being Fixed?

Upon identifying the faulty update, CrowdStrike initiated a rollback process to revert the system to its previous stable state. The company worked closely with Microsoft to deploy teams focused on restoring affected services and ensuring system stability. They conducted a thorough review to understand the root cause of the failure and implemented measures to prevent such issues in the future. Additionally, CrowdStrike is collaborating with regulatory bodies to address concerns and improve its update protocols.

What Is the Current Status?

As of July 20, 2024, CrowdStrike issued an official statement explaining the cause of the outage and the corrective actions taken. Regulatory bodies have announced investigations to examine the broader implications for cybersecurity and the risks of monopolization in the tech industry. CrowdStrike and Microsoft continue to monitor the situation closely, ensuring that systems remain stable and secure while addressing any lingering concerns from customers and regulatory agencies.

The knock-on effect is still causing issues this weekend as backlogs are cleared.

Concerns?

Why does one company have a near monopoly on such updates?

Are software updates being tested properly before being released?

Recovery: Computers need to be rebooted. Microsoft has stated that it may take as many as 15 reboots before the issue is fixed. The impact was widespread and even recovery may not be quick enough.

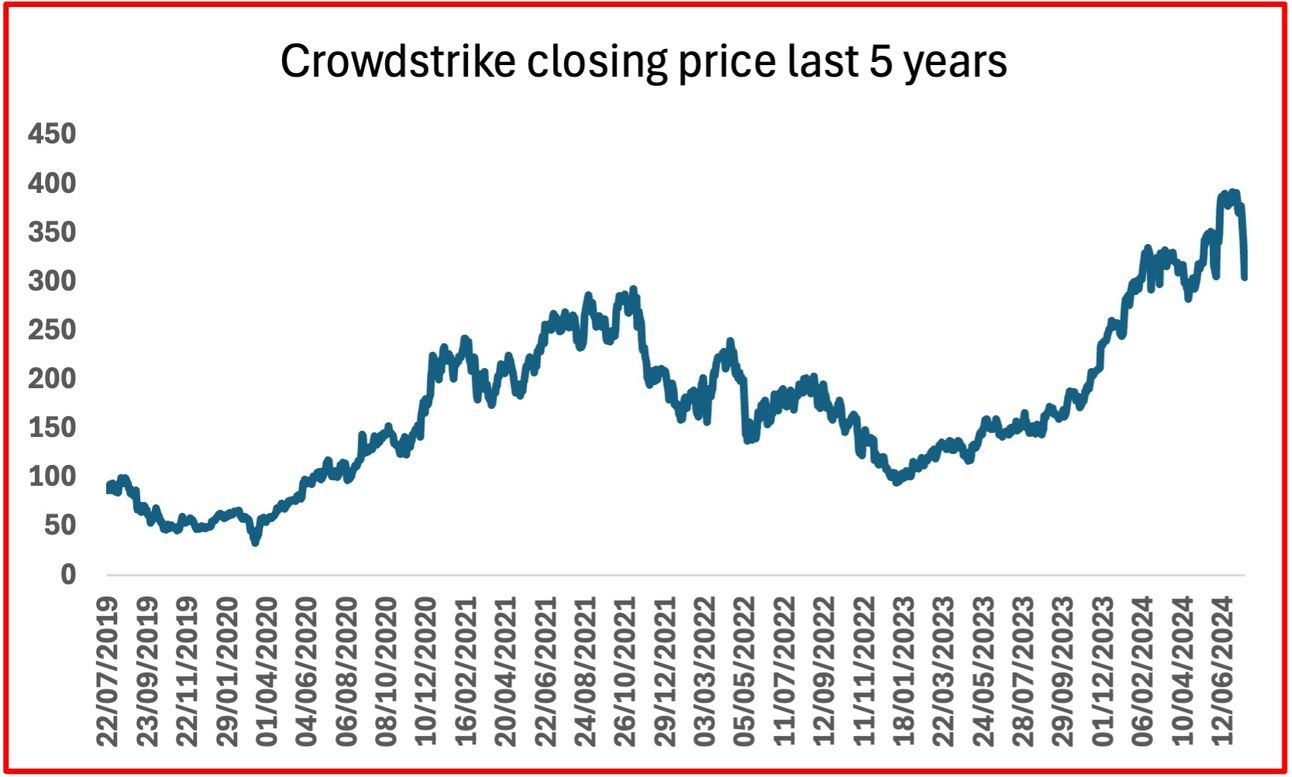

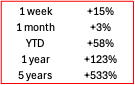

Crowdstrike stock price last 5 years:

The stock declined 11% on Friday.

🇬🇧 UK

Headline Inflation was unchanged at 2%. Core inflation remained at 3.5%, and services inflation was also unchanged at 5.7%.

Earnings increased by an annualized 5.7% in the three months to May, down from 6.0% in April.

Interest rate cuts may not be cut in August due to the strength of the job market.

Mortgages may get cheaper as competition hots up as the next interest rate cut appears to be weeks or months away. The average rate on a two-year fixed deal is 5.92%, according to the financial information service Moneyfacts. The average five-year fixed rate is 5.5%.

FTSE100 is -1.2% this week last week and +5.5% in the year to date.

🇺🇸 US

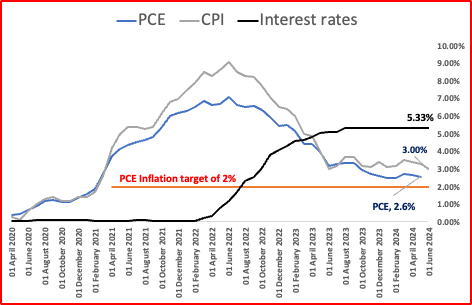

Inflation is now being viewed as on a par with growth. Chair Powell of the Federal Reserve “Now that inflation has come down and the labor market has indeed cooled off, we’re going to be looking at both mandates. They’re in much better balance.” It looks like a two pronged apprpoach will be taken from here on.

What about the 2% inflation target? It is still there but there is a growing consensus that it may not be reached soon and that growth is to be given more focus.

Mortgages are getting a little cheaper in anticipation of interest rate cuts. The average 30-year mortgage reduced to 6.87% from 7%

Stock markets were mixed in the week with the Dow and the S&P500 moving in opposite directions as sector rotation from growth stocks to small caps and value stocks continues.

S&P500 is -2.0% this week and +15.4% this year.

If you like this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

The Yen strengthened against the dollar with suspected government intervention to support the currency.

Stock markets weakened, especially tech stocks due to concerns about US restrictions on chip imports.

Nikkei 225 Index lost -2.7% in the week. It is +19.7% in the year.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Taiwan Semiconductor Manufacturing Company (TSMC), the world's largest contract chipmaker, is experiencing unprecedented growth driven by the surging demand for AI-related technologies. TSMC's Q2 2024 earnings report highlighted a significant profit boost, primarily fueled by the strong performance of its advanced 3nm and upcoming (in 2025) 2nm chips, which are integral to high-performance computing applications.

TSMC has decided against forming a joint venture with other firms, focusing instead on expanding its capabilities. The company forecasts record growth, emphasizing its strategic independence in the semiconductor industry. This decision aligns with TSMC's broader strategy to maintain control over its cutting-edge technologies and production processes.

The demand for TSMC’s chips far exceeds supply and it is likely to hold its dominant position at least for the next few years. It is the major enabler of advancements in AI adoption.

See earlier spotlight on AI chips

OpenAI has introduced the GPT-4o Mini, a new, more affordable, and efficient variant of its renowned AI models. It costs less and is said to be more capable than GPT 3.5.

The GPT-4o Mini is tailored to offer robust performance in natural language processing tasks, from text generation to complex data analysis. Its versatile tools are aimed at a broader audience.

This is OpenAI’s attempt at “multimodality” offering media, text, images, audio and video in one tool.

🌐 Crypto Corner

Tracking Bitcoin price:

Bitcoin also benefited from the move away from large-cap stocks as well as the end of selling pressure. There was a 15% increase in the week.

Germany is reported to have dumped about $3 billion into the open market following the seizure of 50,000 bitcoins from the operator of movie2k.to which was found guilty of money laundering.

UK is said to have $5 billion of seized bitcoins which could also be sold.

Over different periods:

Ether ETFs are expected to start trading on July 23. Will it follow Bitcoin with price increases as retail investors pile into the ETFs?

Over different periods:

see the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $244bn ⬇️ 5bn

Jeff Bezos (Amazon) $200bn ⬇️ 11bn

Bernard Arnault and family (LVMH) $187bn ⬇️ $13bn

Larry Ellison (Oracle) $172bn. ⬇️ $7bn

Mark Zuckerberg (Facebook/Meta) $167bn ⬇️ $7bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.