INSIGHT WEEKLY : May 19, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

See Spotlight on Gold below

A 5 minute easy to read weekly summary to be well informed of topical issues.

🌐 Major indexes and major stocks

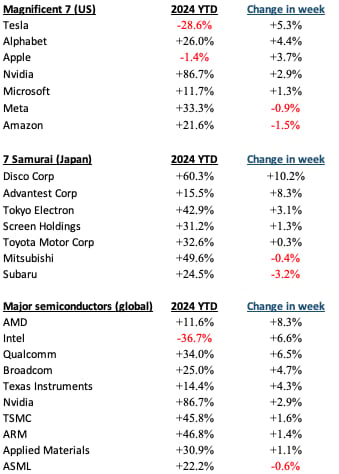

Markets in US and UK hit new highs on interest rate cut hopes. Four records were broken during the week (highlighted in blue).

Major stocks of interest :

Tesla recovered 5% this week but is nearly 29% down year to date

Intel recovered 6% this week but is nearly 37% down year to date

🇬🇧 UK

Labor market softened as the unemployment rate increased to 4.3%, and job openings declined for the twenty-second consecutive month. This news led to optimism that the Bank of England may cut rates in June.

Pay growth excluding bonuses held steady at 6% for the three months ending in March, slightly surpassing expectations. Private sector pay growth was slightly below the anticipated 5.9%.

FTSE100 was almost flat last week but hit a new record at 8,474 on Wednesday, and is over +9% this year.

🇺🇸 US

Inflation as measured by the April Consumer Price Index (CPI) report showed figures that met or were slightly below expectations. This marked a change from the previous three months of unexpectedly high inflation data. Inflation was driven mainly by a rise in service costs, particularly transportation, which saw an 11.2% increase over the past year.

Retail sales in April’s were unchanged, defying expectations of a 0.4% increase and adjusting March’s figures downward. This slowdown, particularly in discretionary online spending and dining out, suggests consumers are becoming more cautious, a signal some investors interpret favorably for controlling inflation.

10-year bond yield reached its lowest in over a month due to renewed optimism about interest rate cuts. The tax-exempt municipal bond market saw robust demand despite a heavy week of new issuances. Meanwhile, the investment-grade bond market experienced initial spread widening, which later tightened. High yield bonds saw increased trading volumes and positive flows following favorable inflation data.

S&P500 is up +1.5% in the week and nearly +11% so far this year. So far this year market sentiment has oscillated with changing expectations of rate cuts.

🇯🇵 Japan

Growth of Japan’s economy was a significant first-quarter contraction of 2.0% annualized, more severe than anticipated. This downturn was partly due to the January earthquake on the Noto peninsula and halted auto production activities. Weaknesses were evident in capital expenditure and external demand, although increases in public demand and private inventories provided some offset.

Yen remained stable, trading in the high-JPY 155 range against the USD. Market sentiment was influenced by expectations of U.S. Federal Reserve rate cuts and potential further monetary policy normalization by the Bank of Japan. The yen held steady, supported by suspected intervention by Japanese authorities.

Nikkei 225 Index saw a 1.5% increase, while the broader TOPIX Index rose by 0.6%, ending the week on a positive note despite economic challenges. This increase occurred amidst a stagnant yen and expectations of U.S. interest rate cuts, contrasting with the Bank of Japan’s (BoJ) slightly hawkish stance which nudged Japanese government bond (JGB) yields higher.

Nikkei 225 was up 1.4% in the week, and is up nearly 16% YTD

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Chat GPT 4o is the new model from OpenAI, where "o" stands for "omni."

How is this different from Chat GPT 4 ?

This upgrade can understand and generate text, audio, and images, making it much more versatile than earlier versions. It’s designed to respond almost as quickly as a human in a conversation, with impressive response times.

GPT-4o marks a significant upgrade because it combines processing for text, sound, and visuals into one system. This integration helps the model maintain context and subtle details that previous versions might miss, which is particularly useful for complex tasks like translating languages in real-time or managing dynamic customer service scenarios.

Beyond its technical capabilities, GPT-4o is also designed to be safer and more user-friendly. It includes enhanced safety features to manage risks effectively and has undergone rigorous testing to ensure reliability across various applications.

For developers, this model is accessible via API, offering faster speeds and reduced costs compared to earlier models.

OpenAI has made GPT-4o available, with some features free to use. More functionalities, particularly in audio and video, will be rolled out gradually to ensure they meet high safety and quality standards.

This was the presentation by OpenAI : https://www.youtube.com/live/DQacCB9tDaw?si=FUzALRc1DfHhz8dY

Gemini, (from Google) began as a basic chatbot, and is transforming into a powerful AI assistant integrated across Google's services. Announced at Google's annual developer conference, this expansion will see Gemini being implemented in more Google apps and features. According to Amar Subramanya, Vice President of Engineering for Gemini, this upgrade signifies a move from simple commands to using Gemini's full capabilities to enhance Google's applications.

One of the major updates that will impact most Google users is the introduction of Gemini summaries directly in search results. These AI-generated summaries will appear above traditional search results, changing how information is typically found on Google. This feature, known as AI Overviews, is initially rolling out in the U.S. and is set to expand globally by the end of the year.

AI Overviews will automatically show up in search results for certain queries and are designed to provide quick, summarized answers. Although users cannot turn off this feature, they can still filter results to see more traditional links. The summaries will include citations, linking back to their sources for users interested in further information.

The move to integrate AI more deeply into search results reflects Google's broader vision for the future of search, aiming to make it more efficient and user-friendly. However, it also raises questions about how much users will engage with the original sources of information. Liz Reid, Vice President of Search at Google, notes that while these summaries aim to enhance user experience, it's uncertain if users will explore beyond the AI-generated content.

The presentation was part of Google’s keynote, and can be watched from 1:08:20

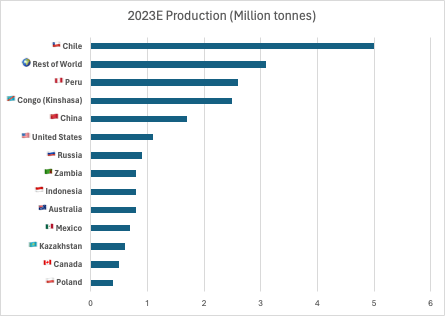

🟠 Copper

Copper prices have caught the attention of investors. The recent increase is mainly due to supply issues in China as well as increased demand for the metal in power generation, electric vehicles and electronic devices.

These are the major producers :

source : Visual Capitalist

🌐 Crypto Corner

Bitcoin price broke its run of down weeks since the halving. The price is approaching $67k. There has been an increase in trading volumes in the last week, especially in the ETF’s.

Hong Kong crypto ETF’s launched earlier this month have so far not performed well, unlike the US, with outflows in the last week.

Previous newsletter spotlight on Bitcoin halving.

🪙 Spotlight on Gold

Designed by Freepik” www.freepik.com

Gold: A Timeless Asset in the Modern Economy

Gold has captivated humanity for millennia, serving as a symbol of wealth, power, and beauty across various cultures and civilizations. This precious metal is not only cherished for its aesthetic appeal but also for its unique physical and chemical properties, including its malleability, resistance to tarnish, and conductivity, making it invaluable in industries ranging from jewelry to electronics and dentistry.

Gold’s cultural significance remains undiminished, symbolizing wealth and status in societies around the world and playing a central role in various traditions and ceremonies.

Gold’s Economic Influence and the Gold Standard

Gold used to play a central role as “the gold standard” in the global economy. Gold was used to back currencies, providing tangible assurance of the paper money's value. This worked with a system of fixed exchange rates between countries adhering to the gold standard.

However, during the Great Depression, it was seen as a rigid system as it restricted policymakers' ability to respond to economic crises. Post-World War II, the Bretton Woods system attempted a modified gold standard, but this too collapsed in the early 1970s. The gold standard is no longer used, yet gold’s legacy in economic thinking continues to influence its demand.

Will the gold standard return ? The notion of returning to the gold standard has been occasionally proposed in recent times. Proponents of the gold standard argue that it would limit the ability of central banks to inflate currency through unchecked money printing, potentially stabilizing the economy and preserving the value of money. However, this idea has not been accepted among economists and governments as the rigidity of such an approach will limit flexible monetary policy to deal with uncertain events and in the management of inflation.

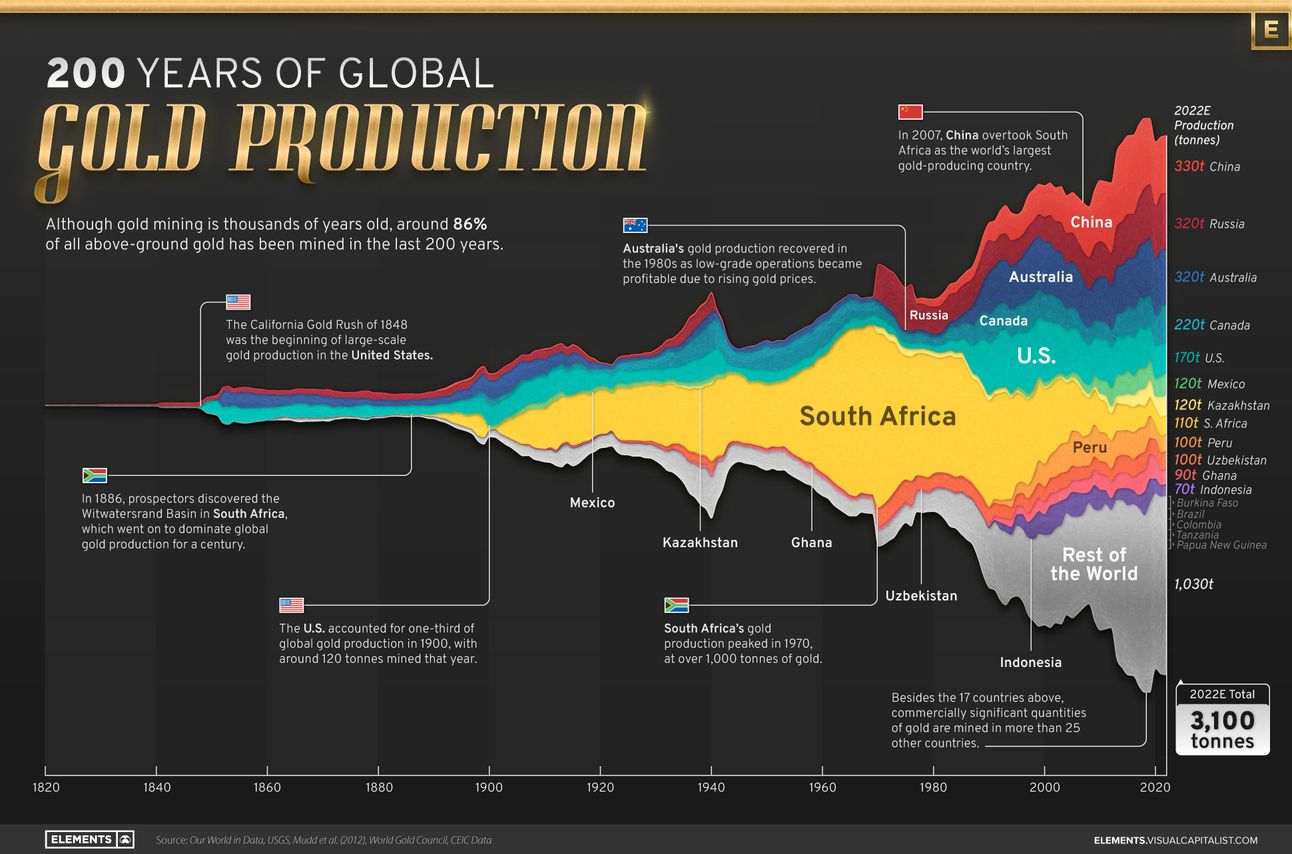

Producers of gold by country

China has emerged as the world’s biggest producer, and South Africa’s once dominant position has diminished to just 4% of world production.

Graphic from Visual Capitalist, https://www.visualcapitalist.com

Gold as a financial asset

Besides gold’s cosmetic allure, and some industrial uses, what role does it play in investment ?

Despite fluctuations, recent trends in gold prices have shown resilience, influenced by factors such as inflation, currency value shifts, and geopolitical tensions. These attributes make gold a favored choice for investors seeking a safe haven during times of economic uncertainty.

Investing in Gold

Investors turn to gold for its reputation as a hedge against inflation and currency devaluation. The market offers various investment avenues, from physical gold, such as coins and bullion, to gold exchange-traded funds (ETFs), stocks of mining companies, and mutual funds that focus on the precious metal. Each option comes with its own set of benefits and risks, tailored to different investment strategies and risk tolerances.

Looking Ahead

The future outlook for gold appears promising. Economic forecasters predict that the demand for gold will likely continue to grow, influenced by economic factors, market trends, and new uses in technology. As investors and consumers alike navigate the complexities of the modern economy, gold’s role is expected to evolve, potentially offering new opportunities and challenges.

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Bernard Arnault and family (LVMH) $214bn no change

Jeff Bezos (Amazon) $202bn ⬇️ $3bn

Elon Musk (Tesla, SpaceX) $196bn ⬆️ $5bn (Tesla +5% in the week)

Mark Zuckerberg (Facebook/Meta) $165bn ⬇️ $2bn

Larry Ellison (Oracle) $153bn ⬆️ $8bn (Oracle +6% in the week)

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates in a 5 minute round up each week.