INSIGHT WEEKLY: June 1, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time.

And to refer to during the week.

Stay ahead without the overload.

500+ professionals have subscribed to this magazine.

🌐 Markets Overview

📈 Markets Year to Date: Uncertainty affects markets

At the end of the first five months of the year, the bellwether S&P 500 is a mere +0.5%, after gaining over 20% in each of the last two years. There are strong headwinds for the rest of the year. Concerns on growth and inflation due to tariffs, and de-dollarization are among the uncertainties.

Non-US markets have gained this year, partly due to rotation out of the US.

What could change?

Agreements on tariffs with the EU and China. These cannot come soon enough.

Lack of agreements will be damaging to both sides.

It is game theory at play.

Once agreements are made and the calculations of the effects are completed, the attention will move from tariffs to technology and the productivity gains that AI will bring.

This week, markets bounced up again, continuing the oscillation as tariff news alternates between positive and negative.

Some analysts are calling it the “TACO” (Trump always chickens out) trade.

What was it this week?

A pause on tariffs for goods from the EU, just a few days after these were imposed, following an earlier similar pattern with China.

Investors are looking for stability, and they are not getting it.

(see the section below on the changing picture of tariffs).

Tech stocks

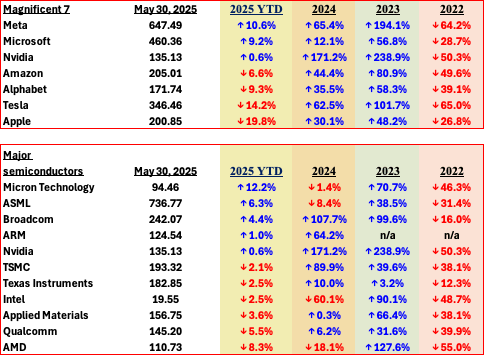

Tech stocks continue to shape the direction of U.S. equity markets, but 2025 has delivered a more uneven picture. Nvidia is up just +0.6% year-to-date, a sharp contrast to its explosive 2023–2024 run.

Why the slowdown? The “Deepseek effect” spooked investors. Can advanced AI models can be trained more efficiently and with fewer Nvidia chips? Attention has shifted to who is doing what in AI.

Meta is up +10.6%, Microsoft +9.2%, and several semiconductor peers have outperformed. The market is now parsing winners beyond the headline names.

Alphabet, which owns Google, faces challenges to its search domination from other AI-based searching and reporting capabilities.

Tesla is facing challenges from other EV manufacturers, and some unease about Elon Musk’s role in the Trump administration, and therefore, distraction from his company roles. His government role has come to an end, but there has not been a significant uptick in its stock price.

Micron is up over 12% this year due to demand for High Bandwidth Memory (HBM) driven by AI.

🧭 The Changing Tariffs Picture

1. EU Tariffs

Trump threatened a 50% tariff on EU goods on May 24, but delayed it to July 9 after speaking with European leaders. A prior 20% tariff threat was reduced to 10% for 90 days to allow for negotiations.

2. EU Wine

A 200% tariff on EU wine was announced in response to a threatened 50% tariff on American whiskey. The dispute was defused, and wine imports remain under a general 10% tariff.

3. Canada and Mexico

Early in his term, Trump imposed 25% tariffs on imports from Canada and Mexico over fentanyl. After multiple pauses and adjustments, most goods from both countries were excluded under USMCA.

4. Foreign Films

On May 4, Trump proposed a 100% tariff on foreign-made movies. Within hours, the White House backed off, saying options were being explored. No action followed.

5. Reciprocal Tariffs

Trump announced tariffs of 10% to 49% on nearly all countries, set for April 9. He paused them until July 2 for bilateral talks. A flat 10% tariff remains in place.

6. China

Tariffs reached 145% on Chinese goods before being cut to 10% for 90 days. A separate 20% fentanyl-related tariff was also struck down in court but remains pending appeal.

7. iPhones and Electronics

After exempting iPhones from earlier China tariffs, Trump proposed a 25% tariff on all smartphones. Officials later clarified the focus was on chips, not finished devices.

8. Colombia

Trump threatened a 25% tariff after Colombia refused landing rights to two U.S. military flights for deportations from the US. The country responded in kind, but both sides de-escalated within a day.

9. Toys and Dolls (Mattel)

Trump threatened a 100% tariff on Mattel’s imports after the company said it wouldn’t move production to the U.S. Days later, he shifted focus to higher-tech reshoring.

10. Autos

A 25% tariff on imported cars was announced in April, then eased to protect U.S. manufacturers using foreign parts. U.K. vehicles were granted a lower 10% rate under a pending deal.

🧭 Macro Watch: This Week’s Economic Developments

Here’s a quick roundup of this week’s key economic developments across major economies.

🇺🇸 United States

Inflation Eases Slightly:

The headline PCE index, the Federal Reserve’s preferred measure of inflation, rose 2.1% year-over-year in April, while core PCE (excluding food and energy) eased to 2.5% - the lowest since early 2021.

It is getting close to the target, so will there be an interest rate cut soon?

Chair Powell met with President Trump this week, and the Fed issued a statement saying that Powell “did not discuss his expectations for monetary policy, except to stress that the path of policy will depend entirely on incoming economic information and what that means for the outlook.”

Consumer Confidence Rebounds:

The Conference Board’s Consumer Confidence Index rose sharply in May to 98.0, up from 85.7, ending five straight months of declines. Consumers reported improved expectations for business and labor market conditions, though sentiment remains below long-term averages.

Tariff Policy Uncertainty Returns:

A federal appeals court reversed a prior trade ruling, reinstating Trump’s “reciprocal tariffs” on most countries. Although a 50% tariff on EU goods was delayed to July, the ruling adds fresh legal and geopolitical uncertainty for importers.

On Saturday, President Trump announced a doubling of tariffs to 50% on aluminium and steel.

🇩🇪 Germany

Labor Market Slips:

Germany’s unemployment rose by 34,000 in May, the largest monthly increase in over a year. The total jobless number climbed to 2.96 million, raising concerns about persistent weakness in domestic demand despite stronger Q1 GDP growth.

🇪🇺 Eurozone

Inflation Cooling Across Bloc:

Preliminary data for May showed inflation easing across several major Eurozone economies. Spain and Italy both reported 1.9% year-over-year inflation, just below the ECB’s 2% target. Germany’s inflation slowed to 2.1%, reinforcing expectations of a rate cut at the ECB’s June 6 meeting.

🇯🇵 Japan

Inflation Pressures Persist:

Tokyo’s core CPI rose 3.6% year-over-year in May, the fastest pace in over two years. This adds pressure on the Bank of Japan as it weighs further adjustments to its ultra-loose policy amid yen weakness and rising long-term bond yields.

🇨🇳 China

Targeted Stimulus Announced:

China unveiled a $70 billion infrastructure stimulus, focused on AI, digital platforms, and domestic consumption. The move comes amid sluggish credit growth and external demand, as Beijing attempts to stabilize momentum without triggering excess leverage.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Anthropic achieves a $3 Billion Annualized Revenue run rate, tripling its revenue from just five months earlier.

Claude, the company’s family of models, is increasingly being adopted by large organizations seeking alternatives to OpenAI and Google.

The firm’s backers include Google parent Alphabet and Amazon, and carries a private valuation of over $60 billion. Investors see Anthropic’s disciplined product roadmap, safety-focused development, and cloud integrations through Amazon Web Services as key.

Anthropic CEO Dario Amodei Warns AI Could Displace 50% of Entry-Level Jobs. Tasks that involve summarizing documents, generating reports, and even writing basic code are increasingly handled by models like Claude.

He suggested that policymakers consider taxing large AI labs (including his own) to fund retraining programs and universal benefits.

Meta (owner of Facebook, Instagram, WhatsApp) has split its AI division into two newly formed units: “AI Products” - which will focus on shipping user-facing tools and applications - and “AGI Foundations,” which will push forward Meta’s long-term research and core model development.

See above - Meta’s stock is the top performer in the Magnificent 7 this year.

Amazon Web Services expands data centers to meet surging AI demand as it announces a major expansion of its global infrastructure footprint, adding new data centers in Chile, New Zealand, Saudi Arabia, and Taiwan.

AWS, already a leader in cloud infrastructure, is positioning itself to compete with Microsoft Azure and Google Cloud as the preferred platform for AI developers and enterprises.

The announcement follows Amazon’s push to strengthen its in-house model capabilities (Olympus) while doubling down on AI services like Bedrock and SageMaker.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

Bitcoin continues to outperform peers in 2025, acting as a relative safe haven amid volatility in altcoins, regulatory uncertainty, and as an alternative asset class to equities and bonds. Institutional adoption remains steady, and ETF inflows, though slower than Q1, are still positive.

Solana (–18.2%)

After a stellar 2023, SOL is under pressure from profit-taking, network issues, and fading NFT momentum.

Cardano (–21.5%)

Slow development and weak dApp adoption continue to frustrate investors, with momentum shifting elsewhere.

Ethereum (–24.5%)

Despite strong fundamentals, ETH is losing ground to BTC and rivals amid fee concerns and scaling delays.

Polkadot (–40.2%)

DOT leads losses as its multichain vision fails to gain traction. Low usage and lack of catalysts remain key risks.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.