INSIGHT WEEKLY: October 26, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

See my website with travel and lifestyle pieces - the latest is on South African safaris

https://iweekly.news

⏳ 5 minutes reading time.

🌐 Markets Overview

📈 U.S. equities had a solid week, buoyed by easing inflation data and strong corporate earnings

Despite concerns about US-China trade, a rise in oil prices following US sanctions on two Russian oil companies, and ongoing commentary about the AI bubble, stocks advanced to new records on Friday.

Investor optimism is driven by expectations of Federal Reserve rate cuts in the near term and robust corporate earnings, particularly in AI-related technology sectors, so the investors don’t see the formation of an AI bubble - just yet.

European markets continue to benefit from stabilizing economic indicators and ongoing corporate resilience, although the pace of gains varies across countries.

Asian markets showed mixed but generally positive results. Japan’s Nikkei 225 led the region with a 3.6% weekly gain and an impressive 23.6% rise so far in 2025. It has overtaken the DAX as the best-performing major market this year.

Commodity prices diverged: gold fell 3.3% on the week but remains a standout with a 56.8% year-to-date gain, while oil rebounded 6.8% this week despite being down 14.3% YTD, reflecting ongoing volatility in energy markets.

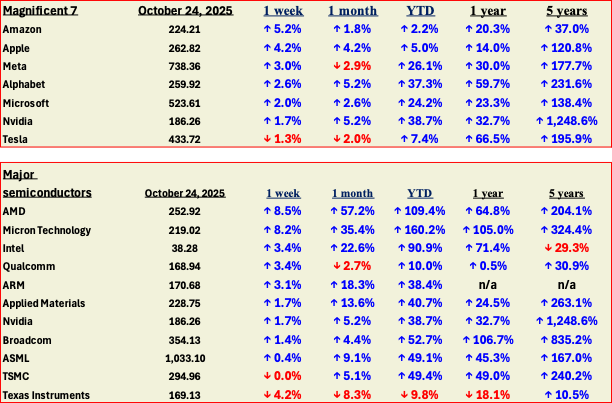

Tech Stocks Weekly and YTD Performance

The Magnificent 7 tech stocks showed mostly positive performance during the week, led by Amazon (+5.2%), Apple (+4.2%), and Meta (+3.0%), with Nvidia and Alphabet also gaining moderately. These moves were driven by optimism surrounding AI growth and easing macroeconomic concerns, supporting the ongoing AI-driven equity rally.

Semiconductor stocks also performed well, with AMD and Micron rising 8%+ to reflect strong AI-related demand, while some chipmakers faced geopolitical export concerns.

This week's tech performance embodies the complex AI bubble narrative: strong fundamentals and enthusiasm drive gains, yet elevated valuations and concentrated market leadership fuel caution over sustainability. Investors balance the promising AI-driven growth upside with risks of overvaluation, making recent gains appear as a careful rebound amid underlying volatility.

Macro Watch: This Week’s Economic Developments

🇺🇸 United States

Inflation figures released were slightly below expectations, with headline CPI up 3.0% year-over-year. This makes a cut in interest rates more likely, with dissent in the Federal Reserve expected to be minimal.

Purchasing Managers Indexes (PMIs) indicated stronger business activity, especially in services, reaching a three-month high, while manufacturing improved slightly, but optimism among manufacturers decreased.

Consumer spending accelerated in Q3, supported by solid business investment, notably in AI and high-tech sectors. Treasury yields moved mixed, reflecting uncertainty about monetary policy amid expectations of future rate cuts.

The U.S. labor market showed signs of slowing heading into mid-October 2025. Private sector employment declined by 32,000 jobs in September, marking the steepest drop since March 2023 and the first back-to-back monthly decline since 2020.

Additionally, the overall unemployment rate hovered near 4.3%, indicating a stable but softening labor market. Notably, some labor market data releases have been delayed due to the ongoing federal government shutdown, complicating real-time analysis.

Right now, labor market data appears to be taking prominence over inflation data, and the Federal Reserve is more likely to favor a cut, rather than hold.

🇪🇺 Europe

The Eurozone saw its strongest business activity since May 2024, led by German manufacturing growth, while France’s activity contracted sharply. Consumer confidence improved to its highest level in eight months. UK inflation remained steady at 3.8%, with retail sales continuing to grow. These signs suggest moderate economic strengthening, though challenges persist regionally. Financial markets are anticipating potential interest rate reductions before year-end.

🇯🇵 Asia

Japan’s markets surged after Liberal Democratic Party leader Sanae Takaichi became prime minister, with market optimism around potential fiscal stimulus and policy stability. Inflation remained above the Bank of Japan’s 2% target, while the yen weakened amid stimulus speculation. China’s economy grew 4.8% in Q3, buoyed by exports despite weak domestic demand and sluggish retail sales. Policy signals focused on boosting science, technology, and manufacturing self-reliance to sustain growth.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

The browser wars have started. Opera Neon, Perplexity Comet, and OpenAI's ChatGPT Atlas herald a new era where browsers don't just display pages - they think, strategize, and assist with unprecedented intelligence.

Opera Neon champions privacy-conscious productivity, executing sensitive tasks locally through specialized "Chat / Do / Make" agents that handle everything from form-filling to complex bookings without exposing your data to external servers.

Perplexity Comet builds trust through radical transparency, delivering meticulously source-cited answers that transform research from tedious tab-juggling into an elegant, autonomous workflow where information flows seamlessly.

ChatGPT Atlas weaves conversational AI directly into the browsing experience itself, learning your preferences and patterns while offering proactive assistance through its experimental Agent Mode - anticipating needs before you articulate them.

So Neon for the privacy-focused professional, Comet for the discerning researcher demanding verifiable truth, Atlas for OpenAI devotees seeking immersive integration.

Anthropic launched a new “Memory” feature for its Claude Pro and Max subscribers, enabling the AI assistant to remember user-specific context like project details, preferences, and instructions from prior conversations. This persistent memory helps create tailored interactions, reduces repetition, and improves continuity across sessions, which is invaluable for business users managing ongoing workflows. Anthropic’s memory function safeguards user privacy by allowing easy review, edits, and deletions of stored data. The feature represents a significant step toward more personalized, context-aware AI assistants that can act as long-term collaborators rather than one-off tools.

Microsoft Photos has added powerful AI tools like “Restyle Image” and “Image Creator,” enabling users to apply artistic effects or generate images from text prompts. Powered by Microsoft’s proprietary multimodal AI - which blends visual and textual understanding - these features make advanced image editing accessible to everyone, from casual users to professionals. The update reflects a broader shift toward intuitive, AI-driven creative tools that unify text, images, and design into seamless workflows.

AI healthcare is accelerating a shift toward faster, more personalized medicine - from automated heart scans to predictive lifetime risk models. Companies like Ultromics and Us2.ai are pioneering AI-powered echocardiography, enabling near-human accuracy in detecting structural heart issues from ultrasound images. Others, such as Owkin, are fusing imaging, lab results, and clinical histories to forecast risk across over 1,000 diseases. This fusion of diagnostics and predictive modeling is pushing medicine toward precision care - where early detection, tailored interventions, and data-driven decisions become the norm.

AI brain-computer interfaces are advancing rapidly, with non-invasive systems now achieving faster, more accurate neural control using external sensors and AI decoding. These technologies translate brain signals into real-time device commands - empowering users with disabilities and enabling hands-free interaction. Unlike invasive approaches like Neuralink, which require surgical implants for higher signal fidelity, non-invasive AI BCIs offer safer, more accessible solutions that are already usable in everyday settings, highlighting a more immediate path to human-AI integration.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

Macro :

Trump granted a full pardon to Binance founder Changpeng Zhao, wiping away his 2024 conviction for violating US anti-money laundering laws

The CMC Crypto Fear & Greed Index remained in fear territory at 32, up from the week's lowest score of 25

Market is recovering from a significant liquidation event earlier in October

XRP: +10.8% (week), +22.2% (YTD)

XRP dominated the week with the strongest gains among major cryptocurrencies. The rally was fueled by expectations around SEC decisions on eight XRP ETF applications from major asset managers, including Grayscale, WisdomTree, and Franklin Templeton, due between October 18-25.

XRP has become the third-largest cryptocurrency by market cap at $143.8 billion, with institutional backing from the UN Capital Development Fund.

Solana: +6.4% (week), +2.6% (YTD) posted solid weekly gains but remains surprisingly flat for the year at just +2.6%, significantly underperforming given its technical capabilities. Investor holdings in SOL declined by 35% since October 2024, with capital rotating toward XRP ahead of expected ETF approvals.

Polkadot: +5.6% (week), -53.9% (YTD) reveals fundamental struggles. The sharp annual decline suggests Polkadot is losing ground in the competitive layer-0 blockchain space, with developers and capital migrating to alternative ecosystems. The weekly bounce appears technical rather than driven by fundamental catalysts.

Cardano: +4.8% (week), -22.4% (YTD) indicates persistent challenges. The negative annual return, despite a bull market in major assets, suggests that Cardano continues to struggle with ecosystem development momentum and competition from faster-moving chains. The weekly uptick lacks specific fundamental drivers.

Bitcoin: +4.4% (week),+19.0% (YTD) as medium-sized investors holding 100-1,000 BTC added roughly 907,000 BTC over the past year, representing strong accumulation. The solid +19.0% YTD performance reflects continued institutional demand, though Bitcoin liquidations totaled approximately $12.4 million in four hours, with long positions dominating, indicating selling pressure from a long squeeze during the week. Bitcoin remains the market anchor.

Binance Coin: +4.2% (week), +59.4% (YTD) Trump granted a full pardon to Binance founder Changpeng Zhao, wiping away his 2024 conviction for violating US anti-money laundering laws, providing a significant catalyst during the week. The exceptional YTD performance reflects the strength of the Binance ecosystem and reduced regulatory overhang, with the CZ pardon potentially removing further headwinds.

Ethereum: +2.4% (week), +17.9% (YTD), but lags BNB, XRP, and even Bitcoin. Ethereum continues to benefit from DeFi dominance and institutional adoption, but faces growing competition from high-performance L1s and concerns about L2 value capture. The muted weekly performance suggests ETH is treading water in the current rally phase.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.