INSIGHT WEEKLY: February 15, 2026

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

See my website with travel and lifestyle

https://iweekly.news

⏳ A focused, 5 minute reading time, weekly summary

🌐 Markets Overview

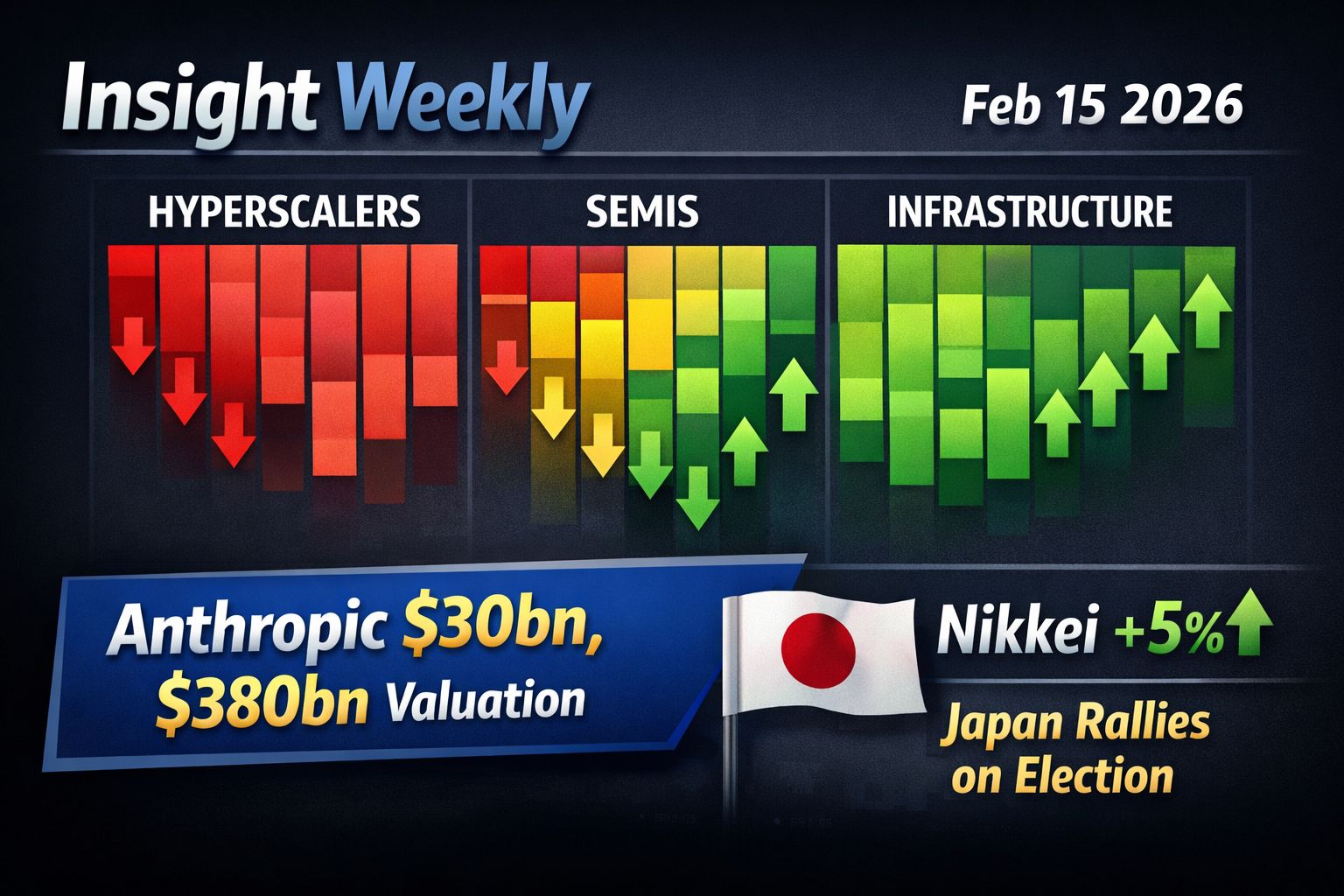

📈 Nasdaq drops due to rotation away from tech

The week split cleanly into two tapes. Japan kept powering higher, while the US looked tired and expensive.

Japan was the standout. The Nikkei jumped 5% on the week and is up 13% year to date, with the rally tied to the Feb 8 election result. Markets took the landslide win as political clarity, and a mandate for policy action and investment plans. The risk is that a stronger mandate can also mean bigger spending plans. If investors worry that spending is not funded, bond yields can rise, which can later become a headwind for equities.

In the US, the S&P slipped 1.4% and the Nasdaq fell 2.1% on the week, pushing both slightly negative year to date. After two huge years in tech, that is a reminder that 2026 is not starting with the same one-way momentum. But tech is not all the same - some parts of tech have dropped and some have gained.

The Dow also eased, but the Russell is the more interesting tell. It slipped 0.9% on the week in the same risk-off tape, yet it is still up 6.6% year to date. This is the early-2026 rotation as small caps have led as money has moved away from crowded mega-cap tech.

Europe looked steadier than the US. DAX, CAC and FTSE were modestly higher on the week, and all are positive year to date. It is not a boom story. It is a relative one.

Gold remained the anchor trade. Up again on the week and up 17% year to date, it is still behaving like insurance.

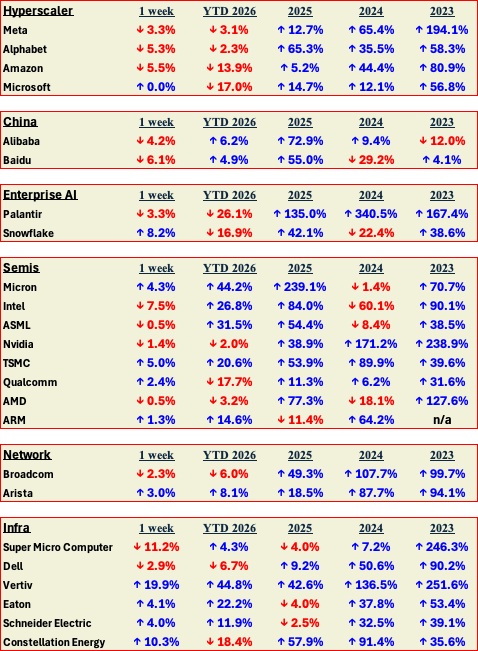

Major AI Stocks Performance

Hyperscalers stayed under pressure this week. Meta, Alphabet and Amazon all fell, and Microsoft was flat on the week but is still deeply negative year to date. Nothing “new” happened here. The same theme kept running. The market is still uncomfortable with how much cash is being committed to AI infrastructure before the payback is visible. When that mood dominates, the biggest spenders get treated like mature businesses with a cost overhang, even if the long-term story is intact.

China was also soft on the week. Alibaba and Baidu both slid, which fits the broader risk tone and the fact that China tech still trades with an extra policy and sentiment discount. Even when year to date is positive, the tape remains jumpy.

Software had an interesting development this week. Anthropic’s Claude update pushed agent-style coding and multi-step tool use forward, and investors took it as a reminder that some software products will have to defend their pricing. Many firms sell “AI helpers” as an add-on. Summaries, drafting, search, basic task execution. If the core model can do more of that directly, buyers start asking why they should pay twice. The software that holds up best is the software that is embedded in real work. Access controls, logs, reliability, and integration into company systems.

Semis were mixed, with a split between physical bottlenecks and crowded trades. Memory and foundry exposure held up better than the more sentiment-driven names.

Infrastructure was the clear winner. Vertiv surged after its earnings and guidance surprised to the upside, which matters because it sits right where AI spending becomes real demand. Data centres need power and cooling capacity before they can add more compute. When a supplier like Vertiv reports stronger orders and raises its outlook, it suggests the buildout is still moving from budgets into purchase orders, and that is supportive for the wider “data-centre enablers” group.

Macro Watch: This Week’s Economic Developments

🇺🇸 United States

This week’s macro signal was a softer inflation print alongside slower consumer momentum. January CPI ran at 2.4% y/y with a 0.2% monthly rise, helped by lower energy. Core prices were firmer on the month, which keeps the Fed in a cautious stance even as the trend improves. Retail sales also disappointed, and the “control group” that feeds into GDP fell, pointing to a softer consumption impulse into Q1.

Bond markets responded in the usual way. A weaker growth impulse and easing inflation pressure supported Treasuries, with yields falling across much of the curve over the week.

In equities, the useful context is breadth. The Russell remains up sharply year to date despite a down week. That suggests January’s tone was a rotation into smaller and more cyclical parts of the market, and this week was a pullback in risk appetite rather than an immediate unwind of that rotation.

🇪🇺 Eurozone

Eurozone growth data confirmed a modest improvement versus last year. Q4 GDP was reported at +0.3% q/q, taking full-year 2025 growth to 1.5% versus 0.9% in 2024, ahead of the European Commission’s 1.3% forecast. The internal mix matters. Spain and Italy have been contributing more of the momentum, Germany has improved at the margin, and France remains the laggard.

This keeps Europe in “stable but exposed” territory. Growth is positive, but the region still has limited buffer if trade conditions deteriorate or if energy becomes a constraint again.

🇬🇧 United Kingdom

UK GDP ended 2025 softly. Output rose 0.1% in Q4, with services flat for the first time in two years, and construction was a material drag. Manufacturing provided the incremental lift, helped by a recovery in vehicle production after earlier disruption.

Full-year growth for 2025 was reported at 1.3%, which was slightly stronger than many expected, but the late-year pattern still looks subdued. This is why the Bank of England debate remains active. Growth is not strong enough to feel secure, while inflation and wage dynamics keep policymakers cautious about moving too quickly.

🇯🇵 Japan

Japanese equities reacted positively to the election result because it reduced near-term political uncertainty and increased confidence that fiscal plans will be executed. That supports sentiment, particularly in domestically exposed sectors.

The risk sits in the bond market. If fiscal measures look underfunded, long yields can rise quickly and the yen can become unstable. That is the channel to watch, because it can tighten financial conditions even while equities initially welcome clarity.

🇨🇳 China

China’s data continue to show a split economy. Export and industrial activity is holding up better than domestic demand. The main limitation is fiscal capacity at the local level, because weaker land-sale revenues constrain how aggressively local governments can support activity.

That keeps the policy response incremental. Targeted support can stabilise conditions, but it does not automatically produce a clean rebound in consumption.

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Anthropic raised $30bn at a $380bn valuation. That level of funding reflects investor belief that enterprise AI spending will keep rising, and that a few model providers will take a large share. Once a model is embedded in workflows, switching is costly, usage scales with activity, and contracts renew.

Anthropic needs repeatable revenue growth and improving economics while compute remains expensive and competition is strong. For enterprise buyers, reliability, security, and governance matter as much as raw model performance.

Barclays is positioning AI as part of its 2026 efficiency and returns plan, which makes it measurable rather than aspirational. The benefits should show up in high-volume operations. Document processing, call handling, fraud triage, KYC refreshes, credit workflows, reconciliation, internal reporting. The test is whether it feeds through into faster turnaround, fewer errors, lower losses, and an improving cost-to-income ratio over the year.

Alibaba’s push into “physical AI” through its RynnBrain model. RynnBrain is Alibaba leaning into “physical AI,” which matters because it shifts the AI story from office productivity to capex. If robotics adoption accelerates, the spend migrates into equipment and infrastructure. Sensors, industrial compute, power, automation software, and the data-center build that supports training and simulation. That is a different market structure from chat and SaaS. Slower rollouts, bigger upfront budgets, tighter integration with manufacturers, and winners determined by supply chains and deployment partners as much as model quality.

Singapore is leading the shift from AI pilots to production deployment in financial services, which is consistent with how the country positions itself. Establish governance frameworks, align incentives, then push adoption through coordinated execution. In finance, that usually means controlled use cases where productivity gains are measurable and risk can be managed. Customer service support, compliance assistance, document processing, transaction monitoring, internal knowledge systems. The significance is that AI’s economic impact is now more about diffusion than novelty.

Healthcare. University of Hertfordshire researchers are testing an operational AI forecasting model with regional NHS bodies to improve resource efficiency across hospitals. Built on five years of data, it combines admissions, treatments, re-admissions, bed capacity, and infrastructure pressures with workforce availability and local demographics, including deprivation. It produces short-, medium-, and long-term forecasts that show how demand is likely to change, plus a “do nothing” baseline showing what happens if no action is taken.

The next phase expands the dataset to a wider regional population as local NHS structures merge, which should improve predictive accuracy and make the tool more useful at system scale.

Get your free guide to AI

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.