INSIGHT WEEKLY: February 8, 2026

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

See my website with travel and lifestyle

https://iweekly.news

⏳ A focused, 5 minute reading time, weekly summary

🌐 Markets Overview

📈 Nasdaq drops due to rotation away from tech

Thursday and Friday looked like a classic positioning shock and reversal.

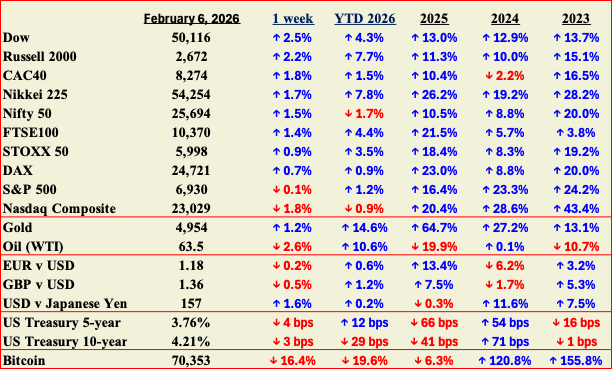

Growth and Nasdaq exposure took the brunt on Thursday, and you can see it in the week’s scoreboard. The Nasdaq was down 1.8% on the week, while the S&P 500 was roughly flat and the Dow and Russell 2000 were up about 2% to 2.5%.

That’s the rotation. Investors lightened up on the crowded AI and mega-cap tech complex, then rotated into broader equity exposure, especially small and mid-caps.

Friday’s rebound was powerful, but it was not a simple “risk-on is back” story. The buying was broad, with most S&P 500 constituents higher on the day, and a sharp rebound in tech. But Nasdaq was still down on the week.

Gold remained strong on the week, while crypto was down.

For AI watchers, even on Friday’s recovery, stocks where expectations got too far did not recover fully. Amazon fell hard after outlining very large spending plans for data centers, chips, and equipment, even as management framed that capex as largely AI-driven.

AI capex is no longer automatically bullish. It depends on confidence in near-term monetization.

So how did AI stocks perform?

Major AI Stocks Performance

Thursday market drop, followed by Friday recovery.

Thursday was a broad risk-off day at the index level, but the AI complex did not trade as one block. The pressure was concentrated in hyperscalers. Meta, Alphabet, Amazon, and Microsoft fell as investors repriced the capex story after Alphabet flagged a much higher 2026 spend path, shifting the lens from “AI spend is bullish” to “show me the return.”

That put Amazon’s results and capex guidance in the crosshairs, and fed the broader worry that hyperscalers are collectively lining up over $600bn of annual spend on data centers, chips, and equipment.

Layered on top was an earlier-week software overhang, as new model capabilities raised questions about how much of the SaaS stack gets competed away.

Thursday looked less like “AI down” and more like a capex and software reset hitting crowded mega-cap growth first.

Semis were mixed. Some names sold off, but others held up or even gained, which underlined that this was not a clean “AI down” tape. Investors were trimming crowded platform exposure and rebalancing risk, while still keeping conviction in parts of the supply chain.

Friday then looked like a snap-back. Many of the Thursday losers bounced, but the rebound was uneven as well. The main story across the two days was dispersion. AI is no longer one trade. Even in a week defined by a sharp down day and a sharp up day, the market is starting to separate hyperscale capex narratives from the chip and infrastructure beneficiaries.

Macro Watch: This Week’s Economic Developments

🇺🇸 United States

The Fed held rates again, and the message stayed consistent. Growth is holding up, inflation is still a constraint, and the bar for near-term cuts remains high. The more interesting part this week was the split inside the Fed conversation. Even some officials who backed the hold are now signalling more sensitivity to labour market softening and tariff-driven price risk.

The data flow also pointed to an economy that is uneven rather than rolling over. Manufacturing flipped back into expansion in January, but a lot of commentary framed it as restocking and tariff-front-running, which is not the same thing as durable end-demand.

🇪🇺 Eurozone

Europe’s picture was stable, not exciting. Q4 GDP came in at +0.3% q/q, and the year finished stronger than 2024, but the bigger development this week was the ECB staying on hold even as inflation eased again. The message was basically policy is already restrictive enough, and they want more evidence before moving.

That leaves Europe steady, but still exposed if trade frictions intensify.

🇬🇧 United Kingdom

The Bank of England held at 3.75%, and the vote was closer than expected. That matters more than any single line in the statement. It tells you the internal debate is active, and that the next shift is likely to come from the labour market and services inflation rather than growth headlines. Housing remains a pressure point, and the BoE is still balancing weak activity against inflation that refuses to fall cleanly.

🇯🇵 Japan

Japan’s key signal this week was the consumer. Household spending fell again in December, which reinforces the idea that demand is still fragile even with wage gains in parts of the economy. With inflation no longer re-accelerating, the market is leaning toward a slower BOJ path, with FX still the swing factor if the yen moves abruptly.

🇨🇳 China

China had two stories running in parallel. Near-term activity surveys improved modestly in the private-sector PMIs, helped by new orders ahead of the holiday period. But the bigger constraint remains fiscal. 2025 revenue fell, and land-sale income dropped again, which matters because it limits how hard local governments can lean into stimulus. The growth model still looks more export and industry-led than consumer-led.

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Elon Musk’s companies were part of this week’s biggest corporate restructure story. This was the decision to merge SpaceX and xAI. The logic is capital and control. Frontier AI burns cash, and xAI has been trying to scale compute fast enough to stay in the game. Folding it into SpaceX gives a deeper funding base and a clearer “one-owner” strategic direction. The market angle is that AI strategy is now being expressed through corporate architecture. That can create real synergies over time, but it also concentrates risk. If the AI buildout runs hot, or if governance gets messy, the pressure lands on SpaceX shareholders too.

Anthropic This week’s Claude update spooked the market for a simple reason. It targeted knowledge work directly, not just coding. Alongside the new Claude Opus 4.6 model, Anthropic added a legal analysis plug-in and pushed deeper “in-app” capability for tools like Excel and PowerPoint. Investors immediately went hunting for business models that charge for research, retrieval, and first-pass analysis. Legal data names took the hit. Thomson Reuters fell close to 16% on the day, RELX about 12%.

The bigger story this week was not legal. It was what the Claude upgrade implies for software in general. As models get better at doing multi-step work, they can take on more of the “first draft” tasks that sit inside many apps. Research, summaries, drafting, and routine analysis.

That puts pressure on software businesses that are mainly a thin AI layer, or that charge for simple knowledge work. When the model does more, those products get easier to copy and harder to price.

Layoffs are now “AI-washing,” the idea that some firms are citing AI as the reason for job cuts that may really be about over-hiring or slower demand. The point is not to deny AI-driven productivity. It is to separate narrative from proof. The proof shows up in follow-through. Output per employee rises, cycle times shrink, and spend shifts into data, tooling, and automation infrastructure. If those signals do not appear, “AI” is doing PR work.

ElevenLabs Voice keeps pulling in serious funding, and this week showed why. ElevenLabs raised $500 million at an $11 billion valuation. Investors are betting that speech becomes a standard interface layer across support, sales, education, and internal tools. The wedge is quality and latency, but the long-term moat is rights management and enterprise deployment. If voice becomes ubiquitous, the winners will be the ones that can ship safely at scale.

OpenAI. OpenAI launched Frontier, an enterprise platform to build and manage AI agents, including agents built outside OpenAI. This is the market moving from demos to control systems. Access boundaries, monitoring, and governance are becoming the buying criteria, because that is what turns experimentation into deployment.

Get your free guide to AI

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.