INSIGHT WEEKLY: September 14, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

See my website with travel and lifestyle pieces on Rio, Paris, wines of the Loire Valley, cigars, and much more

https://iweekly.news

⏳ 5 minutes reading time.

🌐 Markets Overview

📈 Global markets advanced this week as investors positioned for a widely expected rate cut from the Federal Reserve. Markets set new records (highlighted in blue).

U.S. stocks hit fresh record highs on AI momentum and rate optimism, with the Nasdaq and S&P 500 both logging solid weekly gains. Oracle’s upbeat AI guidance reinforced bullish sentiment. Despite hotter CPI figures (headline inflation at 2.9% y/y), weak jobless claims, and downward payroll revisions, fueled hopes for a September rate cut.

Treasury yields fell, with long-dated bonds outperforming. Consumer sentiment dipped, reflecting renewed concern over labor markets and inflation risks.

In Europe, the ECB held rates steady at 2% but raised its 2025 inflation forecast to 2.1%. Markets interpreted this as a potential end to the rate-cutting cycle. Germany’s exports fell on weaker U.S. demand, while the UK economy stalled in July amid weak manufacturing output.

Japan’s Nikkei jumped 4% as Prime Minister Ishiba announced his resignation. Revised GDP figures showed stronger-than-expected growth (2.2% annualized in Q2), driven by resilient consumer spending. The Bank of Japan is expected to hold rates steady at its next meeting.

Chinese stocks rallied on domestic liquidity and AI optimism, despite persistent deflation pressures. Producer prices remained negative for the 35th consecutive month, while consumer prices dipped again.

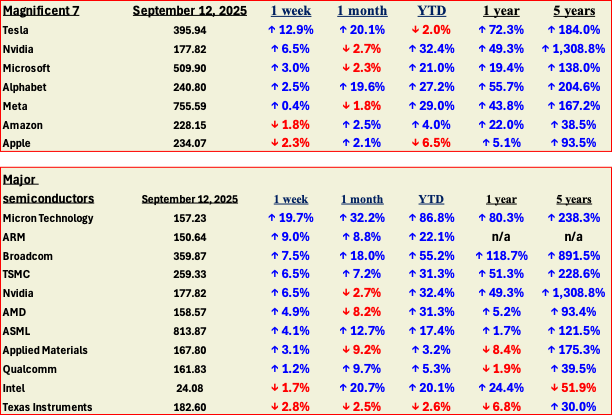

Tech stocks

Tesla surged 12.9% in one week driven largely by fresh enthusiasm in EV / AI crossover stories, renewed optimism around its Full Self‑Driving (FSD) roadmap, and possibly some short‑squeeze activity. Despite being slightly negative YTD (−2.0%), this strong week helped regain some momentum and suggests that investors are looking for near‑term catalysts to close that gap.

Nvidia is up 6.5% this week, as it benefits from its leading position in AI infrastructure. New enterprise announcements, cloud partnerships, or demand signals for AI‑capable hardware seem to have underpinned the move.

Microsoft’s 3.0% gain this week can be tied to investor expectations that enterprise cloud & AI product lines will continue growing, along with anticipation of favorable macro / rate news.

Alphabet’s 2.5% weekly gain followed a favorable U.S. antitrust ruling that imposed behavioral remedies but stopped short of a structural breakup. This legal clarity eased regulatory fears and supported investor confidence.

The stock was also lifted by strong momentum in its cloud unit, which grew 32% year-over-year, beating expectations. Alphabet’s increased capex guidance to $85 billion further signaled its commitment to AI infrastructure, which markets view as a long-term growth driver.

Major Semiconductors:

Micron was the stand‑out: +19.7% in a week. The reason? Strong analyst upgrades and direct evidence of surging demand for memory and high‑bandwidth chips in AI/data centre infrastructure.

Broadcom, TSMC, ARM also posted solid gains, helped by the same AI tailwinds: chip supply tightening, positive enterprise commentary (especially from big consumers), and strong expectation that required memory, bandwidth, and processing capacity will keep rising.

Overall, the pattern is one of rotation within tech: high growth / AI / infrastructure names are getting strong inflows, while more mature, hardware adjacent, or consumer/analog names are lagging. YTD performance largely tracks this: the biggest gains are in AI‑exposed semis; the laggards are those where future growth is less tied to AI.

Macro Watch: This Week’s Economic Developments

🇺🇸 United States

A growing body of data points to a weakening U.S. labor market just as inflation proves stubborn, sharpening the Fed’s dilemma ahead of next week’s meeting. Jobless claims rose to 263,000, the highest since 2021, while revised payroll data showed 911,000 fewer jobs were created between March 2024 and March 2025 than originally reported!

Inflation, meanwhile, remains above target. August CPI rose to 2.9%, with core at 3.1%. Producer inflation eased slightly overall but remained firm at the core level.

Markets now expect a rate cut, with the Fed likely to prioritize labor market softness over still-elevated prices. Sentiment data echoed the caution: the University of Michigan index fell to 55.4, with long-run inflation expectations ticking up to 3.9%.

The Fed faces a tough balancing act, but right now, jobs are taking precedence over inflation.

🇪🇺Eurozone

The ECB held rates steady at 2%, signaling a pause in further cuts despite slightly upgrading its 2025 inflation (2.1%) and growth (1.2%) forecasts. But concerns linger over U.S. tariffs, euro strength, and political instability—especially in France, where Macron replaced his prime minister after a failed budget vote.

Germany’s export picture weakened in July, down 0.6%, with a sharp 7.9% drop to the U.S. Industrial output rose modestly, but factory orders disappointed, falling 2.9%.

🇬🇧 United Kingdom

UK GDP stalled in July, with a sharp 1.3% drop in manufacturing erasing gains in services and construction. The outlook remains cautious, as persistent wage and price pressures make the Bank of England hesitant to commit to further rate cuts.

🇯🇵 Japan

Prime Minister Shigeru Ishiba resigned after two electoral defeats, triggering a leadership vote on October 4 that could shift fiscal policy. Meanwhile, Q2 GDP was revised up to +2.2% annualized, driven by resilient consumer spending supported by anti-inflation measures. While the Bank of Japan is not expected to act on September 19, markets increasingly anticipate a rate hike later this year.

🇨🇳China

Chinese equities rose again, powered by retail enthusiasm and AI-driven tech optimism, rather than improving fundamentals. Deflation remains entrenched: August PPI dropped 2.9% YoY (35th consecutive decline), and CPI fell 0.4% on falling food prices. Policymakers continue to battle sluggish domestic demand and property market weakness.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Oracle stunned Wall Street this week with news of a $300 billion, five-year cloud infrastructure deal with OpenAI, set to begin in 2027. The agreement, one of the largest ever in AI infrastructure, positions Oracle as a serious contender in the race to supply compute power for large models.

Investor reaction was swift: Oracle shares surged more than 36% in a single day, marking the company’s largest one-day gain in history. While the company’s latest earnings missed revenue expectations, the stock rally was driven by a sharp rise in future bookings and the sheer scale of the OpenAI partnership.

Google is advancing efforts to track and trace synthetic content with the release of SynthID, an invisible watermarking tool for AI-generated audio. Developed by DeepMind, SynthID embeds inaudible markers in synthetic speech that allow creators and platforms to identify and verify AI content without affecting audio quality. The release comes amid growing regulatory and societal concerns over misinformation, deepfakes, and authenticity in political and commercial media.

Amazon is upgrading Alexa with new generative AI capabilities, bringing more fluid, human-like conversation to its voice assistant. The enhancements allow for better handling of follow-up questions and more context-aware interactions across smart home devices. The updated version of Alexa will begin rolling out to U.S. users in English this month, as Amazon continues to integrate multimodal AI across its consumer ecosystem.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

Solana led the week’s crypto gains, surging nearly 20% as bullish technicals and institutional buying drew strong market attention. A breakout above the $239 resistance level was supported by a classic “cup-and-handle” pattern, with analysts flagging upside targets as high as $314. Confidence was further reinforced by Galaxy Digital’s reported $1.16 billion acquisition of SOL tokens, a sign that large players are backing the network’s role in decentralized finance and tokenization infrastructure.

Polkadot rallied over 12%, rebounding from previous underperformance. The move was driven by excitement over the upcoming Snowbridge upgrade, which aims to enhance cross-chain interoperability between Polkadot and Ethereum. Traders also pointed to a technical breakout near $4.45, with volume picking up as it approached next resistance around $4.63. Despite a weak year-to-date showing, the recent momentum has improved short-term sentiment.

Cardano climbed more than 10% this week, riding the wave of renewed risk appetite across altcoins. While fundamental headlines were limited, on-chain sentiment indicators show bearish retail positioning at a five-month low - a setup that often precedes sharp reversals. Coupled with accumulation by large holders, Cardano appears to be benefiting from its reputation as a more stable layer-one bet in times of renewed macro optimism.

XRP added over 10%, extending its gains after strong summer performance and partially recovering from recent pullbacks. Traders cited technical resilience above key support levels and expectations of continued institutional interest following recent regulatory clarity. The rally helped bring XRP’s year-to-date gain above 49%, reinforcing its position as one of the top-performing large-cap tokens in 2025.

Ethereum rose nearly 10% on the week, outperforming Bitcoin and boosting its already strong 2025 gains. The rally was driven by improved sentiment around Ethereum’s role in AI-related token projects and infrastructure plays. Technical support held near $4,300, and analysts flagged potential upside continuation toward the $5,000 level if macro conditions remain favorable.

Bitcoin saw a more modest 4.9% gain, as capital rotated into altcoins with higher beta. Still, its steady climb to $116,000 keeps it near yearly highs. Analysts see Bitcoin entering a consolidation phase, with seasonal portfolio shifts and rate-cut expectations supporting its role as a macro hedge - though its leadership has temporarily faded in favor of higher-growth plays.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.