INSIGHT WEEKLY: September 7, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time.

Stay ahead without the overload.

500+ professionals have subscribed to this magazine.

🌐 Markets Overview

📈 Markets are positive year to date - is 2025 going to be another year of good returns?

Global equity markets diverged this week, shaped by weaker US jobs data, shifting Fed expectations, and regional political uncertainty in Europe.

In the US, the S&P 500 dipped 0.3%, while the Nasdaq Composite was flat after a brief midweek rally faded. Small-cap stocks outperformed, with the Russell 2000 gaining 0.5%. Soft payroll numbers increased expectations of a September Fed rate cut, but investors remain cautious about growth prospects.

Europe lagged notably. Germany’s DAX fell 1.8%, and France’s CAC 40 dropped 1.1%, driven by sharp moves in bond yields and continued political jitters. The pan-European STOXX 50 lost 1.5% on the week, weighed down by soft retail data and a strong euro. In contrast, the UK’s FTSE 100 was flat, underpinned by services strength.

In Asia, Japan’s Nikkei 225 edged up 0.4%, supported by renewed trade deals and stronger auto sector performance. India’s Nifty 50 rose 1.0% despite tariff tensions, while China saw broad weakness with the Shanghai Composite down, reflecting continued economic uncertainty.

Gold jumped 4.0% in a safe-haven move, setting a new record and reaching 36.7% YTD gains, while oil dropped 3.3% on demand concerns. Bond yields fell sharply, with the US 10-year yield down 14 bps, the lowest since April, amid rising rate cut expectations.

Most major banks and financial institutions now forecast year-end targets for the S&P 500 in the 6,300–7,100 range. The median consensus has moved up since earlier this year due to resilient corporate earnings and expectations for Fed rate cuts.

Tech stocks

Tech stocks delivered a mixed performance this week, with clear outperformance from select names in the Magnificent 7 and semiconductor sectors.

Alphabet soared 10.4%, fueled by investor relief after a key antitrust ruling came in less punitive than expected. Tesla rebounded 5.1%, and Apple rose 3.3%, despite ongoing regulatory pressure. However, Microsoft (-2.3%) and Nvidia (-4.1%) saw declines, partly due to profit-taking and chip sector rotation.

In semiconductors, Broadcom (+12.6%) and Micron (+10.4%) led gains, with investors bullish on AI infrastructure demand. TSMC and ASML rose over 5%, benefiting from stabilization in global chip inventories and fresh demand signals. Intel added just 0.6% despite its recent push into advanced packaging. On the downside, AMD (-7.1%) and Texas Instruments (-7.2%) saw pressure on demand concerns.

The divergence between winners and laggards within tech highlights a more selective investor appetite, with AI infrastructure plays and resilient cloud-adjacent firms attracting capital, while legacy or cyclical names face headwinds.

Macro Watch: This Week’s Economic Developments

United States:

August’s nonfarm payrolls report showed just 22,000 new jobs, far below expectations. The unemployment rate ticked up to 4.3%, and June’s figures were revised down, while July saw a slight upward revision. The data added momentum to expectations of a Fed rate cut, now increasingly priced in by markets.

The ISM manufacturing index remained in contraction for the sixth month at 48.7, while services improved slightly to 52.0, leaving the overall economic picture mixed. Treasury yields fell across the curve, and equities posted modest gains early in the week before fading.

Eurozone & UK:

Euro area inflation ticked up to 2.1%, while core held steady at 2.3%. Retail sales softened slightly, and unemployment declined to 6.2%. The ECB is widely expected to hold rates steady at its next meeting.

In the UK, mortgage approvals came in above expectations, while house price data was mixed across different indices. Bank of England officials adopted a more cautious tone on further rate cuts, pointing to persistent wage growth and elevated services inflation.

Asia:

In Japan, stocks gained modestly following tariff agreements with the US and a 4.1% rise in nominal wages. For the first time this year, real wage growth turned positive, raising expectations for a potential Bank of Japan rate hike as early as October.

In China, markets gave back some August gains, with liquidity-driven rallies fading amid weak fundamentals. Retail investor dominance continues, while property and trade concerns weigh on sentiment.

India posted strong Q2 GDP growth (7.8%), but faces pressure from rising US tariffs, even as it strengthens diplomatic and economic ties with Japan and China.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Microsoft is extending its AI reach into government, announcing that U.S. federal workers will now get free access to its Copilot services. This strategic move underscores Microsoft’s push to embed generative AI across public sector workflows, while also cementing its dominance in enterprise-grade productivity tools. The offering includes secure, government-compliant versions of Microsoft 365 Copilot, designed to boost efficiency in bureaucratic tasks like report drafting, scheduling, and data summarization. By making this a free service, Microsoft signals confidence in Copilot’s value - and in the long-term payoff of AI lock-in across government infrastructure.

Tesla is courting headlines - and controversy - once again, this time with a proposed $1 trillion pay package for Elon Musk. The deal includes dramatically toned-down versions of Musk’s past promises: 20 million total EVs (not per year), one million robotaxis (eventually), and one million humanoid bots (with no commercial roadmap yet). Critics point out that many of the goals are recycled from previous pledges that have either stalled or shifted timelines. Still, with Tesla’s fervent shareholder base and past success in reaching big milestones, the package could easily pass in November.

Meta is back in the spotlight after revising its AI chatbot policies amid growing pressure over child safety. The move comes after criticism from regulators and advocacy groups about how generative AI tools interact with minors. While Meta hasn’t released full details, early reports suggest more robust filters, stricter content moderation, and limits on certain age groups. The company is attempting to balance innovation in conversational AI with mounting scrutiny over user protections, especially as it continues rolling out new AI products across its messaging apps and metaverse platforms.

Isotopes AI is a new entrant in the enterprise AI agent race, founded by big data veterans from Yahoo, Hortonworks, and Scale AI. Their core product, Aidnn, aims to solve a perennial problem: business decision-makers often lack direct access to the data they need. By letting managers query fragmented datasets using natural language, Aidnn retrieves, cleans, joins, and analyzes complex data from apps like Salesforce, Snowflake, and ERP systems - then explains its reasoning. The agent can also flag anomalies and generate reports autonomously. Backed by a $20 million seed round, Isotopes may have the technical edge to challenge incumbents like Salesforce’s Tableau.

Switzerland has released a 100% open-source multilingual AI model called Apertus, developed by EPFL, ETH Zurich, and CSCS. Licensed permissively for commercial use, Apertus is positioned as Europe’s most transparent response to closed foundational models like GPT-4 and Claude. The model supports over 20 languages and is trained on publicly documented datasets, with all training code and evaluation tools freely available. In a landscape dominated by proprietary giants, Switzerland’s push for openness could appeal to both academic researchers and EU-aligned policymakers seeking more transparency and control.

Get your free guide to AI

🌐 Crypto Corner

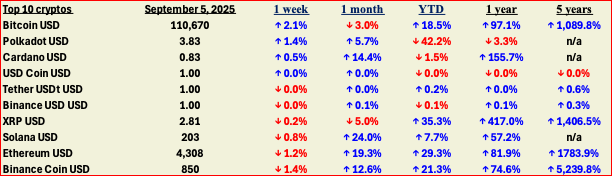

Top 10 cryptos:

Bitcoin

While Bitcoin shows a respectable +18.5% YTD, its modest weekly gain of +2.1% and –3.0% over the past month point to a consolidation phase. Analysts suggest the September slowdown is partly seasonal and tied to portfolio rebalancing and tax planning ahead of year-end. Bitcoin’s behavior increasingly resembles a safe-haven asset, moving in parallel with gold despite stronger rate-cut expectations.

Polkadot

Polkadot remains a laggard with a dramatic –42.2% YTD, despite slight upticks in the short term. A recent slip below the key $3.80 support level triggered heightened selling pressure, visible volume spikes, and technical breakdowns. Broader ecosystem challenges, declining transaction activity and reduced user engagement, further undermine confidence in the token’s midterm outlook.

Cardano

Cardano’s -1.5% YTD figure masks deeper structural worry. Broad market caution continues to drag it lower, and analysts warn of potential downside to $0.60, driven by macroeconomic uncertainty and waning bullish sentiment. However, on-chain data also shows a silver lining: bearish sentiment among retail traders is measuring a five-month low, even as large holders quietly accumulate - a setup that often precedes technical breakouts.

Stablecoins (USD Coin, Tether, Binance USD)

As expected, these stablecoins remain pegged close to $1 with negligible YTD movement. USD Coin is flat, while Tether and Binance USD have only marginal positive or negative changes (±0.1%). Their performance simply reflects their utility as transaction mediums, not speculative assets.

XRP

Despite its impressive +35.3% YTD, XRP is showing signs of fatigue, with a modest weekly decline of –0.2% and a 5.0% dip over the past month. The token’s pullback follows gains earlier in the summer, including a record high near $3 - and underscores how quickly investor sentiment can shift post-regulatory optimism.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.