INSIGHT WEEKLY: July 27, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time.

And to refer to during the week.

Stay ahead without the overload.

500+ professionals have subscribed to this magazine.

🌐 Markets Overview

📈 S&P 500, Nasdaq, and FTSE 100 set new records in the week

📊 U.S. Stock Markets posted modest gains this week, supported by resilient economic data and strong corporate earnings in the communication and technology sectors.

S&P 500 rose 1.5%, while the Nasdaq advanced 1.1%, extending recent upward momentum. The Dow gained 1.0%, lifted by industrial strength and earnings surprises from several blue-chip companies. In contrast, the Russell 2000 lagged, inching up just 0.3% as mixed economic data and tighter lending standards continued to weigh on small-cap sentiment.

Year to date, the Nasdaq is up 9.3% and the S&P 500 has gained 8.6%, underscoring investor preference for growth and technology exposure.

🇪🇺 European Markets

European markets delivered mixed results. The FTSE 100 rose 1.6%, buoyed by strength in commodity and utility names alongside a weaker British pound. France’s CAC 40 edged up 0.2%, while Germany’s DAX slipped 0.6% and the STOXX 50 fell 0.5%. The pullback in some continental indices reflects profit-taking following recent gains and investor caution ahead of upcoming European Central Bank communications.

Despite the weekly softness, the DAX remains a standout performer, up 21.6% year to date, highlighting resilience in Germany’s manufacturing and industrial sectors.

🌏 Asian Markets

Asian equities diverged.

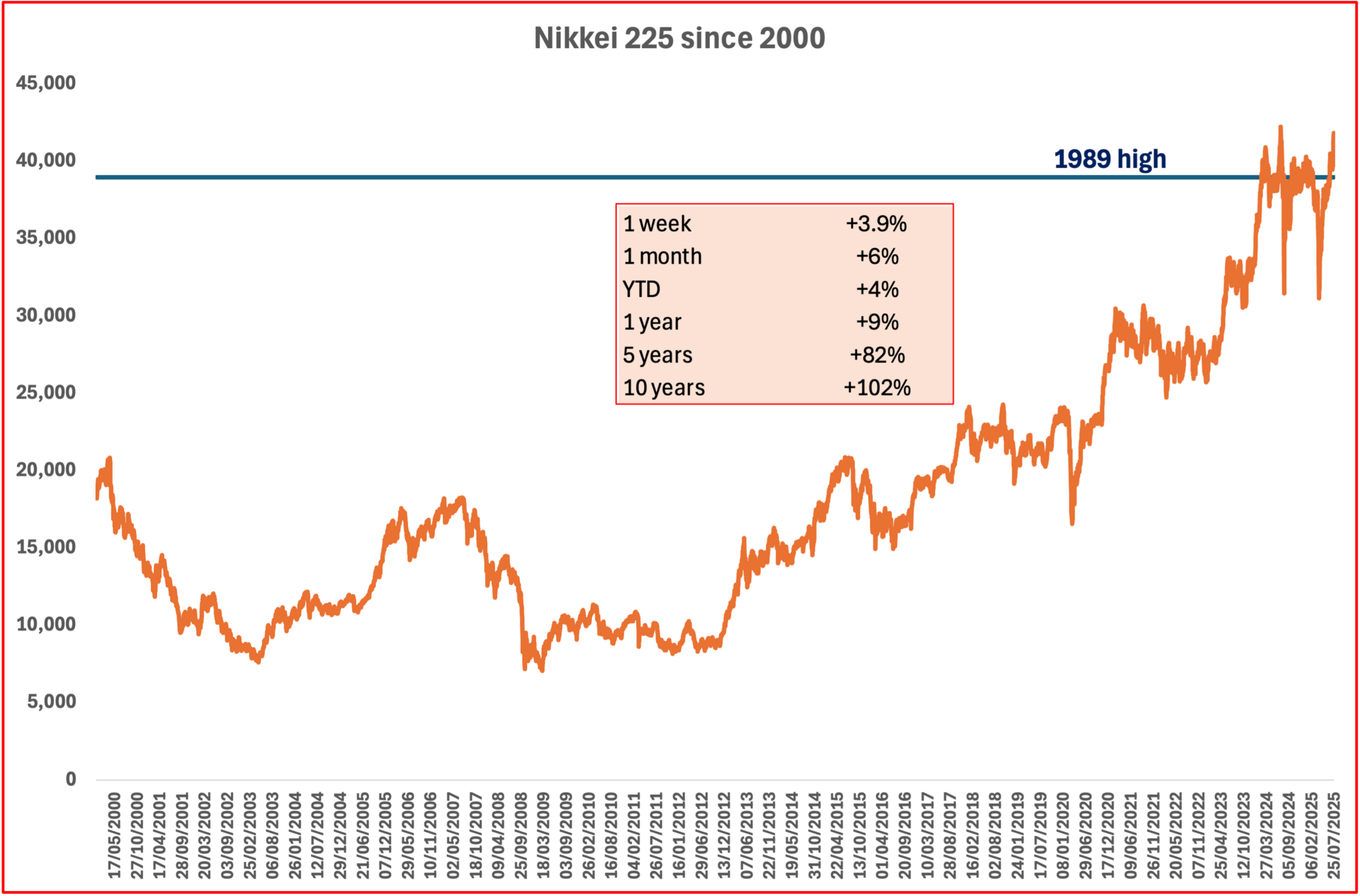

Japan’s Nikkei 225 rose 3.9% last week, propelled by the U.S.–Japan trade deal. The rally again brought the index above its 1989 high, which was cleared for the first time in 2024. It had taken 35 years to break the record!

India’s Nifty 50 declined 1.1%, pausing its rally amid elevated valuations and a pullback in the financial sector. Nevertheless, the Nifty remains among the top global performers, up an impressive 121.9% over five years.

💰 Commodities

Gold slipped 0.5% to $3,337 per ounce, weighed down by modest U.S. dollar strength and slightly higher real yields. Despite the weekly retreat, gold is still up more than 27% year to date, maintaining appeal as a macro hedge.

WTI crude oil fell sharply by 5.0% to $65.10 per barrel, pressured by rising U.S. inventories and concern over softening global demand, particularly from China. The commodity is now down 9.3% year to date.

Tech stocks

Alphabet gained 4.4% after Q2 results surpassed expectations. Strong momentum in Google Cloud and a rebound in ad spending reassured investors following earlier regulatory and cost concerns.

Amazon rose 2.3%, driven by positive sentiment on the previous week’s Prime Day, and continued optimism around AWS margins and logistics efficiency.

Meta gained 1.2% following the debut of its new AI video generation tool “Emu Video,” reinforcing its push to monetize Threads and Reels.

Microsoft, up 0.7%, reported solid Azure growth, though guidance on AI infrastructure spending in FY26 moderated the response.

Apple added 1.3%, but remains down sharply YTD. A Nikkei report on major Vision Pro production cuts and lingering weakness in China iPhone sales weighed on sentiment.

Tesla fell 4.1% after Q2 results showed margin compression and delivery uncertainty, making it the group’s weakest performer this year.

AMD led with a 6.0% gain, preannouncing better-than-expected Q2 sales tied to its MI300 AI chips. Analysts raised price targets, positioning AMD as a rising contender in the AI hardware space.

ARM gained 4.1% on reports that Samsung and Qualcomm will adopt its next-gen architecture, further reinforcing its central role in mobile AI.

Broadcom rose 2.4%, helped by progress on VMware integration and growing custom AI chip exposure. But not all chipmakers fared well.

Intel tumbled 10.4% after missing earnings expectations and issuing weak Q3 guidance.

Texas Instruments fell 14.6% as industrial demand faltered and guidance was slashed.

ASML and Micron also declined, with the former hurt by soft EUV orders and the latter downgraded on DRAM price pressures.

Macro Watch: This Week’s Economic Developments

🇺🇸 U.S. Economic Sentiment and Policy Pressure

President Trump’s recent meeting with Fed Chair Jerome Powell signaled a shift in tone, with Trump expressing confidence that interest rate cuts may be on the horizon. While the Fed is widely expected to hold rates steady at its upcoming July meeting, Trump’s rhetoric, backed by White House officials, continues to apply political pressure on the central bank to begin easing. Budget Director Russ Vought and Treasury Secretary Scott Bessent have both called for a broader review of the Fed’s operations, including concerns over its financial shortfalls and institutional accountability.

Small business confidence has surged, with 46% of owners now rating the economy as “good” or “excellent,” up sharply from 30% last quarter. While inflation and trade policy remain concerns, optimism around sales, hiring, and regulation is notably improving.

🇬🇧 UK Borrowing Surges, Raising Budget Pressures

UK government borrowing hit £20.7 billion in June. Rising debt interest payments (£16.4 billion) and increased public spending outpaced tax revenues, despite April’s rise in National Insurance. Total borrowing for the year to date is £57.8 billion.

The IMF praised the UK’s reform agenda, but urged caution: a small fiscal buffer leaves little room for shocks.

🌏As deadlines near, the U.S. and EU are close to a deal that could avoid a costly trade war. President Trump and EU chief Ursula von der Leyen will meet in Scotland to finalize terms, with talks centering on a 15% tariff framework - down from earlier threats of up to 200%. While some issues remain, optimism is growing as both sides aim to avoid €93 billion in retaliatory EU tariffs.

🌏 Asia Economic Summary

Two landmark trade deals - India/UK and US/Japan - are reshaping Asia’s economic outlook.

India and the UK have signed a landmark trade deal cutting tariffs on goods like textiles, spirits, and cars, with 99% of Indian exports to the UK and 92% of UK goods to India benefiting. Expected to boost trade by over £25 billion by 2040, the pact also exempts Indian workers from UK social security contributions and protects sensitive Indian sectors. It’s a strategic move for India ahead of critical U.S. trade talks.

Japan reached its own headline-grabbing deal with Washington. Tariffs on Japanese autos entering the U.S. will fall from 27.5% to 15%, giving Japan’s exporters a clear edge over regional competitors. In return, Japan pledged $550 billion in U.S.-bound investment aimed at semiconductors and pharmaceuticals, while increasing purchases of American rice.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Anthropic has unveiled autonomous AI auditing agents - software tools built to evaluate models like Claude Opus 4 for safety and alignment. These agents work independently, detecting hidden objectives and anomalous behaviors without direct human input. The approach shifts auditing from manual spot checks to a scalable, repeatable process, marking a step forward in internal accountability and more trustworthy AI deployment.

OpenAI CEO Sam Altman warned that jobs involving routine, rules-based tasks, like customer support, could vanish entirely. He also highlighted potential national security threats from AI misuse, including synthetic fraud. While new job types may arise, Altman stressed the urgency of policy frameworks and workforce retraining to cushion the disruption. Some economists forecast up to 20% unemployment in entry-level white-collar roles by 2030.

OpenAI and Oracle are adding 4.5 GW of data center capacity to their Stargate AI project, supporting over two million chips. With sites in Texas, Michigan, Wisconsin, and Wyoming under evaluation, the project is part of a wider $500 billion infrastructure initiative anticipated to support up to 100,000 jobs across construction and operations.

Apple is taking a deliberate approach to AI, delaying major features, like a revamped Siri, until 2026 or later. This reflects a focus on privacy, reliability, and quality over speed. While rivals rush to market, Apple is choosing to perfect its offering, even if it risks falling behind in the short term.

AI stack - see my earlier post on LinkedIn

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

Binance Coin (↑ 6.4%) posted a solid gain, though not widely covered in the news cycle. Its performance may reflect steady DeFi activity and user confidence in Binance’s exchange ecosystem.

Solana (SOL) (↑ 3.5%) posted a weekly gain, but saw momentum soften midweek as sentiment turned cautious following XRP’s drop and Bitcoin’s pullback. Broader market volatility dampened follow-through buying.

XRP (↓ 8.9%) following Ripple co-founder Chris Larsen transferring $175 million (~50m XRP) to exchanges between July 17–24, sharply weakening investor confidence. Analysts warn that additional liquidity could be forthcoming from Larsen’s remaining holdings, posing further near-term downside risk.

Polkadot (DOT) (↓ 4.8%) amid broader altcoin weakness tied to ETF outflows.

Bitcoin (BTC) (↓ 1.1%) After sustaining fresh all-time highs (~$120K–123K), Bitcoin pulled back toward $115–118K. The decline followed profit-taking and ETF-related outflows, testing resistance near the psychological $120K threshold.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.