INSIGHT WEEKLY: November 9, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

See my website with travel and lifestyle pieces - the latest is on Osaka, Japan

https://iweekly.news

⏳ 5 minutes reading time.

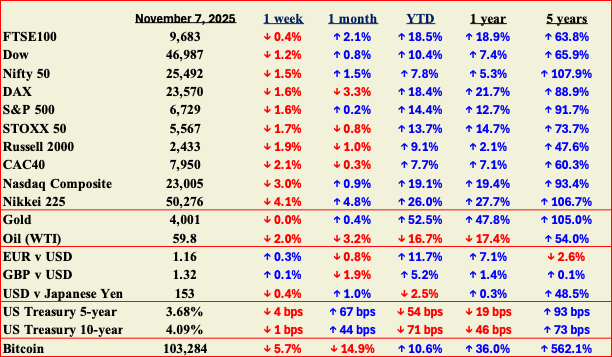

🌐 Markets Overview

📈 Markets reflect on high valuations

After last week’s record highs, markets have checked the seemingly relentless rise of AI-induced euphoria. What next for the markets? The end of the AI boom or more rises followed by occasional retracements?

AI-related productivity gains are just starting, and companies will see the benefits as the diffusion spreads throughout the economy.

The US government shutdown is now the longest on record, affecting market sentiment.

Markets fell in unison, with the UK’s FTSE 100 falling the least - strength despite gloomy economic news. Why? See the full article on my website, https://iweekly.news.

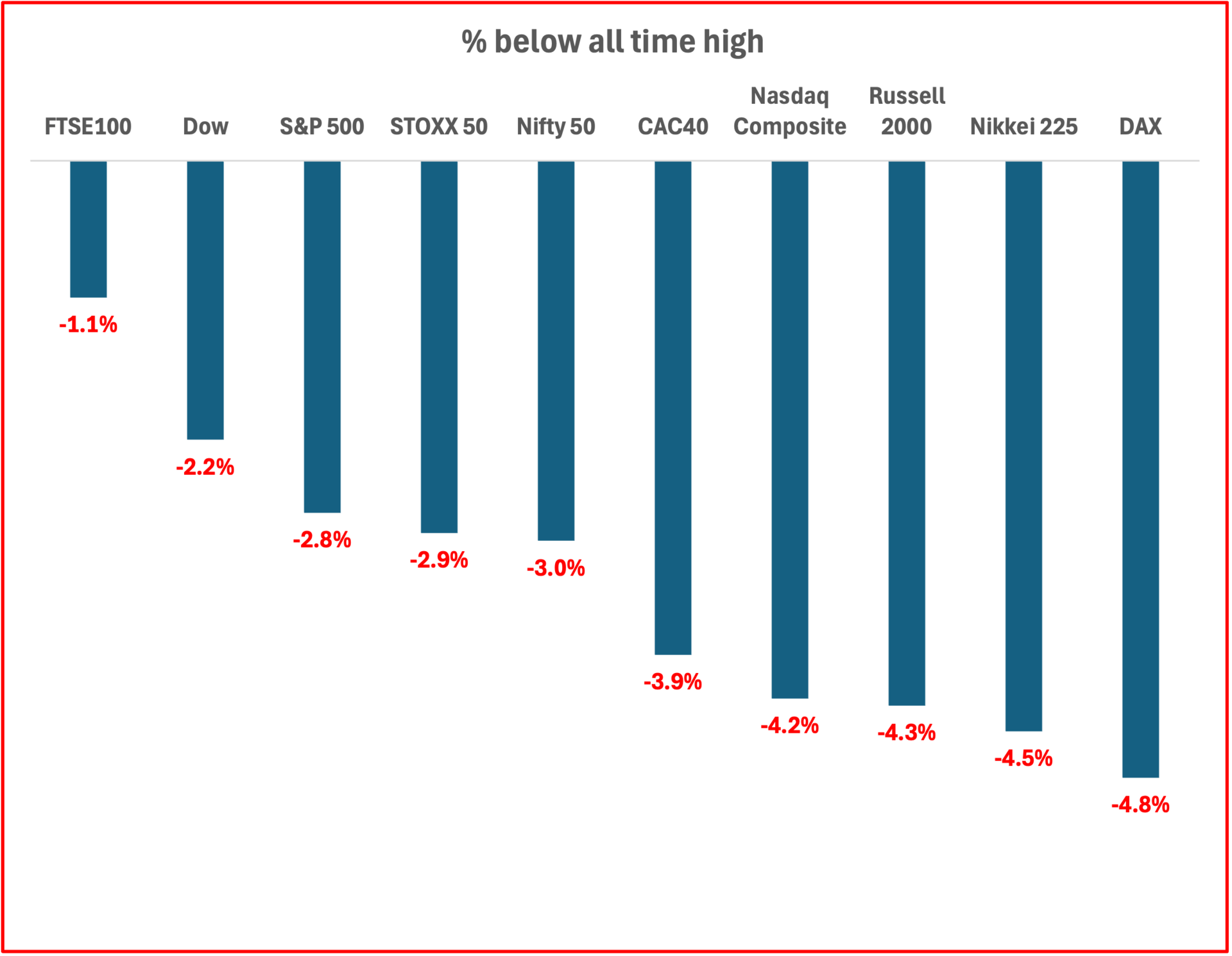

Markets below all-time highs:

Tech Stocks Weekly and YTD Performance

Tech stocks experienced a sharp pullback this week, with the Magnificent 7 tech giants showing declines, led by Nvidia and Tesla.

Temporary setback or will a new trend develop?

The year-to-date performance has been impressive - Alphabet up 47%, Nvidia 40%, and Microsoft nearly 18%. These gains reflect persistent excitement driven by AI and robust earnings reports.

Semiconductor stocks similarly showed mixed performances.

The divergence within tech and chips underscores the market’s nuanced view, rewarding innovation and growth potential while penalizing legacy exposures and macro sensitivity.

Overall, tech remains the key driver of global equity markets, but recent volatility calls for selective positioning.

Macro Watch: This Week’s Economic Developments

🇺🇸 United States

The U.S. government shutdown extended into its longest stretch on record, increasingly affecting sentiment and daily operations. Concerns rose after the Federal Aviation Administration asked airlines to scale back flights due to staffing shortages, while missing government data deepened uncertainty over growth. Private-sector reports filled some gaps: ADP said companies added 42,000 jobs in October, but gains were limited and pay growth flat. Challenger, Gray & Christmas reported nearly 1.1 million job cuts so far this year - up 65% from 2024 - with October alone marking the highest monthly layoffs since 2003.

Economic indicators were mixed. The ISM Services PMI climbed to 52.4, signaling renewed growth as new orders hit a one-year high. Manufacturing, however, shrank for the eighth straight month, falling to 48.7. Consumer confidence slipped sharply, with the University of Michigan index dropping to 50.3, its weakest since 2022, as worries about personal finances and the shutdown grew. Inflation expectations edged higher to 4.7%.

In markets, U.S. Treasuries and municipal bonds gained as yields on shorter maturities declined, while high-yield bonds lagged amid falling equities and reduced risk appetite. The overall tone reflected growing caution and signs that political gridlock is beginning to weigh on the economy.

🇪🇺 Europe

The Bank of England kept its benchmark rate at 4.0%, with a narrow 5–4 vote signaling internal division. Governor Andrew Bailey hinted that an interest rate cut could come in December, saying current market pricing that points to a 3.5% rate within three years aligns with his outlook and reflects a “sensible path.” Markets interpreted his comments as confirmation that policy easing is approaching.

Elsewhere in Europe, the Riksbank and Norges Bank also held rates steady. Sweden’s policy rate stayed at 1.75%, with Governor Erik Thedéen noting it would likely remain there for some time. Norway’s central bank kept its key rate at 4.0%, emphasizing that inflation is still too high and that rate cuts are not yet appropriate.

Across the euro area, retail sales fell 0.1% in September, the third straight monthly decline, while year-on-year growth slowed to 1.0%. Germany’s industrial activity showed modest improvement but remained fragile. Output rose 1.3% month-on-month, missing forecasts for a stronger rebound, and new orders were up 1.1%. Still, total orders over the third quarter dropped 3%, underscoring weak momentum in Europe’s largest economy.

🇯🇵 Asia

Japan

Growing concern over inflated tech valuations pushed investors toward safer assets, strengthening the yen to the mid-JPY 153 range against the U.S. dollar. Finance Minister Satsuki Katayama reaffirmed that authorities are closely watching currency movements. The 10-year government bond yield edged up to 1.68% on expectations that the Bank of Japan could tighten policy further. Nominal wages rose 1.9% year-on-year in September, but real wages fell 1.4% as inflation outpaced income growth. Prime Minister Sanae Takaichi signaled new fiscal measures to support households and spur consumption.

China

Markets gained modestly on easing U.S.–China trade tensions. The CSI 300 rose 0.8%, the Shanghai Composite added 1.1%, and Hong Kong’s Hang Seng advanced 1.3%. Optimism followed a one-year trade truce announced after U.S. and Chinese leaders met at the APEC summit in South Korea. While concrete policy details were scarce, investors welcomed the improved tone. Analysts noted a pragmatic shift among regional leaders toward flexible trade cooperation, even as longer-term strategic rivalry between Washington and Beijing persists.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Talk of an “AI bubble” is getting louder. Companies have rushed to deploy generative and agentic tools across operations, yet the promised efficiency gains often remain hard to quantify. Analysts warn that projects focused on internal automation, without clear returns, risk becoming “costly experiments.” Gartner now expects over 40% of agentic AI initiatives to fail by 2027 due to weak governance and uncertain ROI.

The correction may already be visible on Wall Street, where tech stocks saw their worst week in months. Tech stocks declined amid growing concern that valuations are running ahead of earnings.

Apple is said to have the next generation of Siri powered by Google’s Gemini and will be paying Google $1 billion per year. The deal would give Apple temporary access to Google’s 1.2 trillion-parameter system, far beyond the 150 billion parameters of Apple’s current model, until its in-house AI catches up. The revamped Siri, expected next spring, will rely on Gemini for summarizing and planning tasks while keeping data processing on Apple’s private servers.

OpenAI continues to expand its infrastructure at an unprecedented scale. The company has signed new multi-billion-dollar cloud agreements across Microsoft, Oracle, and Amazon Web Services, securing long-term GPU supply for training and inference workloads. CEO Sam Altman says OpenAI now exceeds $20 billion in annualized revenue and has $1.4 trillion in data-center commitments through 2033. The spending spree signals both confidence in future demand and recognition that compute capacity is now a strategic resource, not a commodity.

In the UK, Carbon3.AI has proposed an “AI factory” in Derbyshire powered by renewable energy from nearby landfill gas. The modular site aims to deliver sovereign computing capacity for the UK, supporting data security, green energy integration, and skilled local jobs.

From market jitters to infrastructure build-outs, the picture is clear: artificial intelligence is entering a more mature phase. The exuberance is giving way to discipline. Firms that survive this recalibration will be those building durable value - balancing innovation with financial and ethical realism.

Meta announced plans to invest $600 billion over the next three years to expand U.S. infrastructure and create new jobs, with a large share directed toward advanced AI data centers. The company is accelerating efforts to build the computing backbone for what it calls the path to “superintelligence” - systems capable of outperforming human reasoning.

This massive commitment marks one of the largest private infrastructure initiatives in U.S. history and underscores Meta’s determination to lead in large-scale AI development. The funds will go into building and upgrading data centers, expanding energy capacity, and hiring thousands of specialists to manage the rollout.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

Crypto’s Broad Pullback: Risk Repricing After the Rally

Bitcoin (–5.7%) led the decline among major tokens this week, slipping to $103,284 as the broader crypto market corrected alongside weaker equities. The pullback followed renewed dollar strength and fading expectations for imminent rate cuts, both of which reduced demand for speculative assets. Despite the week’s decline, Bitcoin remains +10.6% year-to-date and +36% over 12 months, supported by steady institutional adoption and limited new supply.

Ethereum fell 10.7% to $3,434, extending its monthly loss to –22.8%. The drop reflected thin liquidity and concerns that capital is rotating toward larger, ETF-linked assets like Bitcoin and XRP. Longer-term adoption metrics remain solid, but short-term momentum has clearly weakened.

Binance Coin declined 9.0% for the week, trimming its strong +41.4% YTD gain. After months of outperformance, traders locked in profits as broader market sentiment soured.

XRP was also down 7.7%, though still +11.3% YTD, as enthusiasm around ETF applications cooled.

Solana saw the steepest weekly fall (–13.6%), underscoring continued rotation away from higher-beta layer-1s. Its –14.4% YTD showing contrasts sharply with 2023’s spectacular gains. Cardano (–5.4%) and Polkadot (+12.9%) moved in opposite directions, with the latter rebounding from oversold levels but still –50.9% for 2025.

Stablecoins (Tether, USDC, BUSD) held their pegs, though modest declines in total supply hint at softer trading activity.

Crypto’s correlation with equities tightened through the week, with Bitcoin tracking the Nasdaq’s retreat. Analysts note that Bitcoin’s short-term correlation with the S&P 500 has risen toward 0.7, reinforcing its behavior as a high-beta risk asset rather than a hedge. For now, macro sentiment—more than on-chain fundamentals—is steering the market.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.