INSIGHT WEEKLY: June 15, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time.

And to refer to during the week.

Stay ahead without the overload.

500+ professionals have subscribed to this magazine.

🌐 Markets Overview

📈 Markets This Week: Conflict in the Middle East dampens markets

US markets had risen earlier in the week in response to reports that the US and China had agreed to reduce tariffs, but conflict in the Middle East sent markets down.

Treasury Secretary Scott Bessent had also said that the Trump administration’s 90-day pause on tariffs could be extended for countries negotiating in “good faith.”

Regardless of what may be happening in the Middle East, there has been considerable chatter among investors, with portfolio rebalancing a recurring topic.

Why?

Because global ETFs are so heavily weighted on the US at over 60% and even exceeding 70%. Many investors and funds look at the MSCI World Index as a reference, which has the US at 71.46%. Should investors continue to consider this weighting for their portfolio?

US exceptionalism will continue, but can gains of over 20% be expected in future years?

What are the macro level changes that appear to have started?

Rotation out of the US stocks and into other stock markets.

Rotation out of equities into other asset classes like gold. Investors and central banks are holding more gold.

The dominance of the Magnificent 7 is declining, and these stocks were the main drivers of the incredible S&P 500 performance over the last few years (see below).

De-dollarization as some countries develop non-dollar trading networks.

US debt is rising, leading to less appetite for US Treasuries, especially after the recent Moody’s downgrade.

Increased barriers to exports to the US, which may lead to substitution as nations explore new trading relationships and settle in currencies other than the dollar.

US Treasuries and the dollar are less important as safe-haven assets in times of crisis.

Tech stocks this week

Tesla (↑10.2%) as investors rallied behind Tesla this week after a public spat involving CEO Elon Musk settled, boosting confidence ahead of its robotaxi debut.

Micron (↑6.5%) surged on renewed optimism tied to its announcement of a $200 billion U.S. investment plan, including a $30 billion expansion for memory fab production.

Qualcomm (↑3.7%) driven by its $2.4 billion acquisition of Alphawave IP, a strategic move into the data‑center and AI chip market.

TSMC (↑2.9%) reflects renewed foundry demand .

Applied Materials (↑2.3%) continues to rise, reflecting market confidence in its advanced chip manufacturing, which is crucial for AI-based operations.

🇮🇱 🇮🇷 Conflict in the Middle East and likely impact on markets

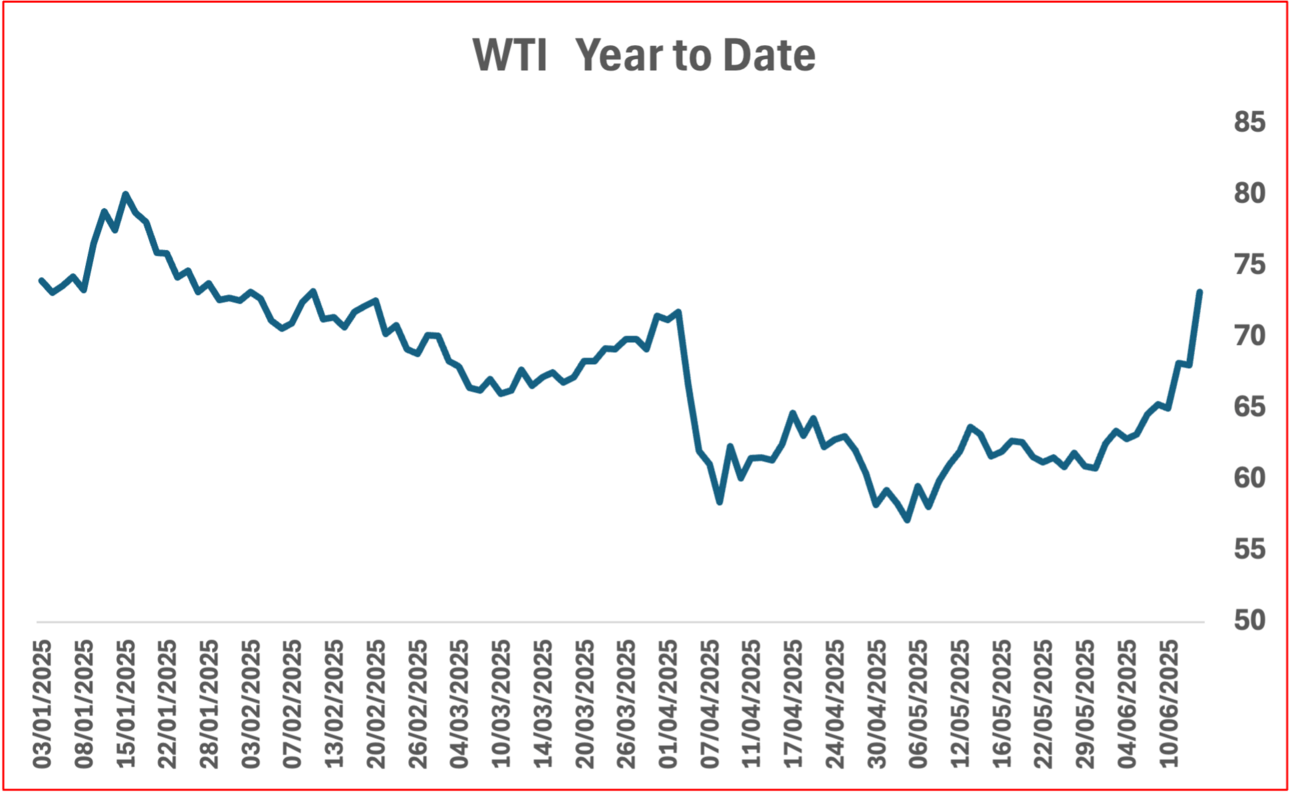

The immediate impact was a spike in oil prices on Friday, and then it settled $5 higher at $73.53 per barrel (WTI). Unless a peace deal is agreed imminently, oil prices are likely to increase further.

Further increases in oil prices are likely to come from any restrictions on the movement of shipping through the Strait of Hormuz (circled in red on the map above). If there were a blockade here, oil prices would rise significantly, doubling or more, as the Strait of Hormuz is the world's most critical chokepoint for oil. A lot of Saudi Arabia’s also goes through the Strait of Hormuz despite having Red Sea ports.

Below is a chart of WTI (oil) for the year to date - oil prices have been higher earlier in the year.

An increase in oil prices would spur inflation in many countries, which would an added problem for economies that are going to be dealing with tariffs. Negative growth and inflation leading to stagflation are possible outcomes of any constriction of oil supplies.

Macro Watch: This Week’s Economic Developments

🇺🇸 United States

Inflation: May CPI came in softer than expected at +0.1% MoM, with YoY inflation at 2.4%, easing pressure on the Fed. PPI also undershot forecasts.

Consumer sentiment: The University of Michigan’s preliminary index rose sharply to 60.5 (from 52.2), reflecting improved inflation expectations.

Markets: The S&P 500 fell 0.4%, Nasdaq 0.6%, and the Dow 1.4%. Mid- and small-caps underperformed, down around 1.6%.

Bonds & dollar: Treasury yields dipped early in the week on soft CPI and a strong 10-year auction, but rose again later in the week on Mideast risk. The U.S. dollar touched its lowest level since April 2022, reinforcing demand for foreign assets and gold.

Outlook: With inflation moderating but growth holding up (nonfarm payrolls previously reported at +139k), expectations for a Fed rate cut are now focused on September, not July.

Coming up: Fed meeting (June 17–18): Rate decision expected to hold steady, but tone may shift in light of oil risks.

🇪🇺 Europe & UK

Equities: European stocks fell. STOXX 50 dropped 2.6%, Germany’s DAX lost 3.2%, and France’s CAC was down 1.5%.

UK economy: GDP shrank 0.3% in April, the first decline in five months. Unemployment rose to 4.6%, and wage growth slowed to 5.2%.

Eurozone: April industrial output fell 2.4%, while the trade surplus narrowed to €9.9B.

ECB outlook: Following its eighth 25bp rate cut last week, ECB officials hinted at a pause, citing uncertainty from tariffs and Middle East tensions despite inflation nearing the 2% target.

🇯🇵 Asia & Japan

Markets: Japan’s Nikkei ended up +0.25%, while the broader TOPIX fell 0.46%. The yen strengthened toward ¥143/USD as geopolitical uncertainty drove safe-haven flows.

Rates: The 10-year Japanese government bond yield eased to ~1.40%, down from 1.46% earlier.

China: CPI was negative for the fourth straight month, and PPI remained in deflation territory. However, preliminary trade truce talks with the U.S. provided modest support to equities.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

TSMC reported record AI chip demand this week, even as the geopolitical fog thickens. Despite looming trade tensions between the U.S. and China, orders for TSMC’s advanced nodes (used in AI training and inference) are surging.

Foundational infrastructure for AI is now so critical that demand may continue irrespective of macro headwinds.

Musk Drops Lawsuit Against OpenAI in a surprise move. While details remain scarce, the decision comes just weeks after his claims were widely criticized as legally flimsy and potentially self-serving.

The lawsuit had accused OpenAI of straying from its original nonprofit charter. But with Musk’s own xAI now directly competing, and OpenAI surging ahead with GPT-4o and iOS integrations, the optics weren’t great.

Apple Bets on Private AI at WWDC 2025 Its newly unveiled “Apple Intelligence” strategy blends on-device models with a secure “Private Cloud Compute” backend. Siri will now be AI-native, and ChatGPT will be integrated (optionally) across iOS and macOS.

Unlike rivals that push everything to the cloud, Apple’s focus is local computation and user control.

Claude 3.5 Sonnet: Faster. Anthropic just raised the bar again. Claude 3.5 Sonnet, launched June 12, reportedly outperforms GPT-4 on key benchmarks like coding and reasoning, while being both faster and more affordable. It’s the first in a new 3.5 series, with the “Opus” flagship and a multi-modal Claude expected soon.

Anthropic’s cadence is quickening. With Claude now powering Notion, Slack, and other integrations, the enterprise use case is getting more compelling.

Meta’s Llama 3 Goes Multimodal. This week, the company teased its next iteration with multi-modal capabilities - early-stage image and video understanding, better context windows, and long-form reasoning.

While OpenAI and Anthropic are battling for premium API dominance, Meta is keeping Llama open-source. That means more experimentation, faster community adoption, and potential spillovers into research and indie dev tools.

Data Centres Expo North America - industry leaders made clear that the current wave of AI demand is pushing existing infrastructure to its limits. Panel discussions focused on the soaring energy requirements of AI workloads and warned that traditional data center models are no longer sustainable.

It is not just cooling and rack density, but grid strain, power procurement, and site strategy are the major challenges. Hyperscalers are fast-tracking investments in AI-optimized facilities, exploring edge deployments, and direct utility partnerships.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

In the world of cryptos, a movement of less than 5% in a week for any of the top 10 is very unusual. And it has been such a week.

Bitcoin declined during the week, but picked up at the start of the conflict in the Middle East at the end of the week.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.