INSIGHT WEEKLY: October 19, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

See my website with travel and lifestyle pieces on Rio, Paris, wines of the Loire Valley, cigars, and much more

https://iweekly.news

⏳ 5 minutes reading time.

🌐 Markets Overview

📈 Most markets advanced this week as AI momentum kept markets on an upward trend.

Major Indexes Weekly and YTD Performance

Are the markets over valued?

The Bank of England highlighted the risks of a sharp downturn if investor sentiment sours toward AI, flagging significant impacts on the financial system. The IMF echoed these concerns, comparing current valuations to those of the dot-com bubble. JPMorgan CEO Jamie Dimon predicted a serious correction within 6 to 24 months due to speculative excesses. Federal Reserve Chair Jerome Powell acknowledged high equity prices reminiscent of past market exuberance.

Surveys show more than half of investors believe AI stocks are in a bubble, signaling rising anxiety.

US markets continued to gain from AI optimism despite concerns about a crisis among regional banks’ loan portfolios - Nasdaq is up 2.1% in the week and S&P 500 is up 1.7%.

Europe: The CAC40 and STOXX 50 improved by 3.2% and 1.4% respectively, signaling positive investor sentiment driven by stronger earnings and economic data. On a YTD basis, European markets generally posted solid gains with the DAX showing the biggest gain at 19.7%.

Asia:

Nikkei 225 down 1.1% for the week but up 19.3% YTD well above its 1989 high which it had been struggling to clear.

Nifty 50 was slightly positive, up 1.7% weekly and 8.7% YTD, underscoring steady growth in Indian equities amid robust economic activity.

Gold had a strong week with a 5.9% rise, continuing its safe-haven appeal, while oil prices declined 3.0%, pressured by supply concerns (see article on gold on my website iweekly.news).

Fixed income markets showed decreasing yields on the 5 and 10-year US Treasuries, reflecting some risk-off investor behavior.

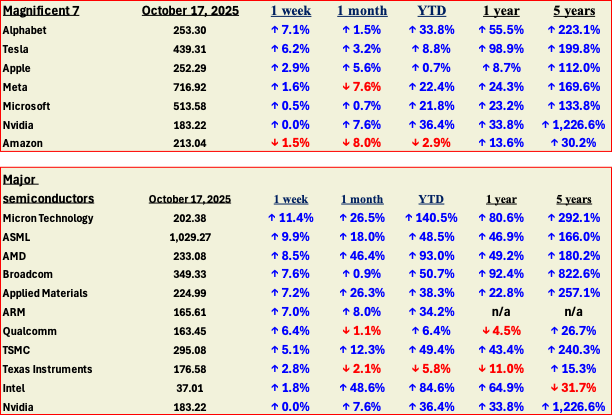

Tech Stocks Weekly and YTD Performance

Despite some nervousness on Friday, tech stocks continues the impressive gains fo previous weeks.

Alphabet led the pack with a 7.1% weekly rise and a robust 33.8% YTD return, driven by strong advertising revenue and AI advancements.

Tesla showed a similar surge of 6.2% weekly, attributed to product launches and positive sales outlook.

Semiconductor stocks performed well again due to the AI factor.

Micron Technology surging 11.4% weekly and 140.5% YTD, driven by demand for its high-bandwidth memory (HBM) and other specialized memory chips used for artificial intelligence (AI) data centers.

ASML, AMD, and Broadcom also posted double-digit weekly gains and strong YTD performance, underscoring investors’ confidence in the sector's growth driven by global chip shortages and new technology investments.

Nvidia, interestingly, was flat weekly but up 36.4% YTD, reflecting some consolidation after rapid gains this year.

Spotlight on gold

Gold's Golden Year: Understanding 2025's Remarkable Rise

See full article on my website covering the historical safe haven perspective, forces driving the rally, and the market :

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

Macro Watch: This Week’s Economic Developments

🇺🇸 United States

The U.S. labor market showed signs of slowing heading into mid-October 2025. Private sector employment declined by 32,000 jobs in September, marking the steepest drop since March 2023 and the first back-to-back monthly decline since 2020. The losses were concentrated in service sectors such as leisure and hospitality, professional/business services, and financial activities, partly offset by gains in education and health services. Manufacturing and construction also saw job declines. Wage growth remained steady at around 4.5% for existing workers but slowed slightly for those changing jobs. Additionally, the overall unemployment rate hovered near 4.3%, indicating a stable but softening labor market. Notably, some labor market data releases have been delayed due to the ongoing federal government shutdown, complicating real-time analysis.

🇪🇺 Europe

Industrial production in the eurozone fell 1.2% in August, driven by sharp declines in capital goods and significant drops in Germany’s automotive sector. Economic growth was minimal in the U.K., with GDP expanding just 0.1% in August while signs of labor market easing emerged with a slight rise in unemployment to 4.8%. France underwent political uncertainty as Prime Minister Sebastien Lecornu survived no-confidence motions related to contentious pension reforms. Overall, Europe faces ongoing challenges, including subdued industrial output, cautious growth, and political instability.

🇯🇵 Asia

Japan’s political landscape remains unsettled with the collapse of the previous coalition and negotiation efforts for a new government. The yen strengthened against the U.S. dollar, pressuring exporters. The Bank of Japan maintained a cautious approach to monetary policy, signaling ongoing support rather than imminent tightening.

In China, inflation pressures persist with continued deflation in producer prices for the 36th consecutive month and consumer prices falling more sharply than expected in September. Policymakers prepare for the upcoming Communist Party plenum to outline economic priorities amid sluggish domestic demand and a struggling property market.

This summary emphasizes a global environment of economic softness, politically sensitive landscapes, and central banks navigating cautious monetary strategies amid mixed growth signals.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

DeepMind’s AlphaEvolve: Autonomous Theorem Discovery

In October 2025, DeepMind unveiled AlphaEvolve - an AI system that can find and verify new mathematical proofs completely on its own. It recently solved complex problems in graph theory and proved them without needing any human help. Unlike past tools that only suggested ideas, AlphaEvolve delivers fully checked answers in a fraction of the time. It’s a breakthrough that shows how AI is becoming a real partner in scientific discovery.

AI Hardware Advances: AMD and IBM

October saw AMD finalize a $100 billion deal to supply GPUs for OpenAI’s expanding AI infrastructure, while IBM unveiled an energy-efficient analog AI chip complementing digital accelerators. These advances address the need for scalable, affordable computational power to run increasingly complex AI models.

Edge Computing and AI Chips: Qualcomm and Huawei

Qualcomm’s acquisition of Arduino targets embedding AI in IoT and edge devices for real-time actions. Huawei introduced agentic AI systems with autonomous decision-making at the edge, helping shift AI processing from centralized clouds to distributed intelligent devices for improved latency and privacy.

Commercial AI Infrastructure: Google, Meta, Oracle, NVIDIA

Google Cloud launched its AI Arena Impact Challenge to promote innovative use of its AI platform. Meta and Oracle chose NVIDIA’s Spectrum-X hardware for next-gen AI data centers, emphasizing infrastructure investment to support large-scale AI workloads.

AI Job Market and Workforce Impact

Recent reports highlight AI’s dual impact: automation risks for some jobs, but creation of new AI-driven roles requiring reskilling. This fuels policy debates and enterprise initiatives focused on balancing productivity gains with inclusive workforce transition.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

The Crash

Trump’s tariff threats against China triggered a $19 billion crypto flash crash on October 10–11.

The sudden spike in political risk hit a highly fragile market - the open interest which is the total value of outstanding futures contracts, had surged 374% for Bitcoin and 205% for Solana since the start of the year. This explosive growth in leveraged positions left the market vulnerable to forced liquidations. When prices began to fall, cascading sell-offs followed - amplifying the move and wiping out billions in minutes.

By Asset

Bitcoin ($107,137): Down 5.2% in the week, but +14.8% YTD. Despite falling 15% at crash lows, institutional ETF buyers supported recovery. The buy-the-dip narrative remains intact as long-term holders accumulated.

Ethereum ($3,875): Up 1.0% in the week, +16.3% YTD. Outperformed Bitcoin YTD despite similar crash severity. Whales added 80,000 ETH post-crash; Layer 2 strength and staking ETF hopes support bullish sentiment.

Solana ($185): Down 2.1% in the week and YTD. Remarkably resilient given 75% staking ratio, limited panic selling. October's 24.5% monthly decline erased summer gains, but spot SOL ETF speculation offers upside.

XRP ($2.34): Down 1.5% in the week, +12.5% YTD. ETF approval decisions due October 18-25 provided support during crash. The token's 329.9% one-year return reflects post-SEC settlement regulatory clarity.

Cardano ($0.63): Down 3.9% in the week, -25.0% YTD. Underperforming despite Trump reserve speculation. Slower development relative to Solana and concerns about near-term catalysts weigh heavily.

Binance Coin ($1,092): Down 1.1% in the week, +55.8% YTD. Exchange token utility insulates BNB from volatility - trading fee mechanics create built-in demand separate from sentiment.

Polkadot ($2.94): Down 6.4% in the week, -55.7% YTD. Catastrophic performance: token crashed from $6.40 to $2.94 despite no fundamental changes. Lost developer narrative to Solana and Layer 2s; staking yields (11.2%) can't attract new capital.

Stablecoins (USDT, USDC): Maintained ~$1.00 pegs, functioning as intended during market shock.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.