INSIGHT WEEKLY: July 20, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time.

And to refer to during the week.

Stay ahead without the overload.

500+ professionals have subscribed to this magazine.

🌐 Markets Overview

📈 Markets were again mixed during the week

Despite volatility across global equity markets, 2025 continues to favor risk assets, led by U.S. technology and select European and Asian equity indices.

Nasdaq and S&P 500 posted gains in the week, and Year-to-date, both indexes reflect confidence in the earnings power of leading technology firms, a stable inflation environment, and resilient U.S. consumer spending.

Dow slipped 0.7% in the week, and YTD, it has not kept pace with the Nasdaq and S&P 500 due to limited exposure to high-growth technology firms.

Russell 2000 (small caps) declined on rising recession fears, with only a slight year-to-date advance. The index remains sensitive to economic fluctuations and is particularly affected by high borrowing costs.

FTSE 100’s (UK) strong 10% year-to-date performance as energy and financial stocks have led gains as global investors rotate into value and income-generating assets.

DAX (Germany) fell 0.7% as sluggish Eurozone industrial activity weighed on sentiment. It’s still among the year’s strongest indices, up 22% YTD thanks to resilient automotive and machinery sectors, improved Asian demand, and easing supply chains.

CAC 40 (France) slipped 1.0% amid political uncertainty and mixed results from consumer staples. It’s up 6% YTD, driven by luxury exports and tourism recovery.

STOXX 50 dropped 1.5% following soft PMI data and ECB policy divisions. Still, it’s gained 9.5% YTD, buoyed by strong bank earnings and improving consumer outlook.

Nikkei 225 (Japan) edged up 0.4% on yen weakness and solid industrial production, although it remains slightly negative for the year.

Nifty 50 (India) fell 1.5% as portfolio rotation followed national elections, but is up 5.6% YTD due to foreign inflows, infrastructure spending, and strong IT earnings.

Gold pulled back a little as the U.S. dollar steadied and yields ticked higher. It is still over +27% YTD, supported by geopolitical tensions and central bank buying across emerging markets.

WTI crude dropped 3% after bearish IEA forecasts and rising U.S. inventories. The nearly 8% YTD decline reflects weaker global growth sentiments, especially in China, as well as increased supply.

U.S. dollar gained 0.9% against the yen and 0.5% vs the euro and pound. It remains softer on the year, pressured by narrowing rate spreads and softer inflation

The question for global investors is whether future declines in the dollar will wipe out any gains on US stocks.

Treasury yields were largely steady. Strong demand at recent auctions underscores investor confidence in the Fed’s disinflation trajectory, ongoing fiscal restraint, and a global appetite for relatively safe yield.

Crypto (see below)

Tech stocks

This week, technology stocks mostly made gains on continuing AI interest, the US government’s $70 billion plan on AI and energy, and the lifting of specific chip export restrictions to China.

Nvidia gained over 8% reaching a market capitalization of $4 trillion during the week, becoming the most valuable business in history! Demand for its H100 and Blackwell processors is unabated as the AI revolution rolls on.

AMD surged nearly 14% in reaction to the relaxation of restrictions on trade.

ASML dropped over 7% in the week in reaction to its second quarter earnings, which were better than estimates, but the company indicated that it cannot confirm growth for 2026. Why? The ongoing US and China tariff discussions may have an impact on customers’ capital expenditure plans. ASML is the world’s leading producer of EUV lithographic machines - the machines that chip manufacturers use to make chips.

Qualcomm, Micron declined as buyers moved to other stocks, but analysts are still optimistic.

Macro Watch: This Week’s Economic Developments

🌍 Global Outlook

S&P Global’s July 2025 outlook points to a soft global landing, with growth slowing in the second half but recession risks receding. Inflation is easing in most regions, though price pressures persist in the U.S. due to tariffs. Central banks are diverging: while the Fed remains cautious, others including in Europe and Asia-Pacific, are moving toward rate cuts. Global trade remains fragile, and weaker industrial momentum is weighing on forecasts, especially in manufacturing-led economies.

🇺🇸 United States

The tariff situation remains fluid, with President Trump announcing 25% tariffs on South Korea and Japan, raising Brazil’s tariffs to 50%, and signaling a forthcoming 50% tariff on copper.

The June Federal Reserve meeting notes showed that policymakers were divided, with most expecting at least one interest rate cut in 2025, some open to cutting as early as July, and others anticipating no cuts at all.

🌐 Europe

President Trump said he would notify the European Union of higher tariffs, but despite the announcement, markets rose, showing limited concern.

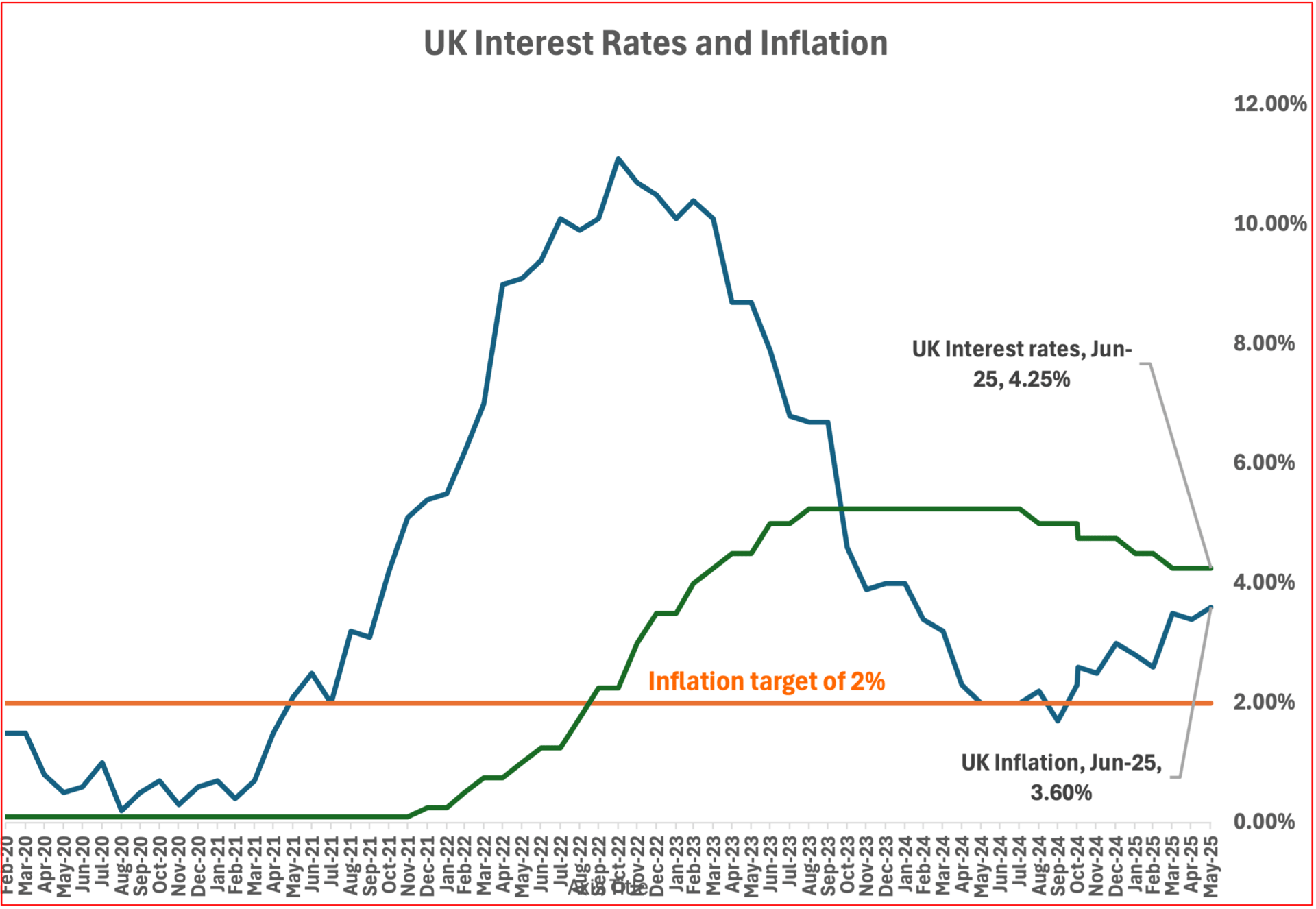

UK inflation remains above target and is proving persistent, limiting the Bank of England’s scope to cut interest rates soon. CPI rose to 3.6% in June, the highest since January 2024. Growth is weak and contracted by 0.1% in May, and that is after contracting 0.3% in April.

🌏 Asia

In China, producer prices fell 3.6% in June, the sharpest drop in two years, marking the 33rd straight month of factory deflation. Consumer prices edged up 0.1% after four months of declines, prompting speculation about further stimulus as falling prices, profits, and wages weigh on the economy. Officials also pledged to tackle disorderly price competition and phase out outdated industrial capacity.

In Japan, the U.S. raised tariffs on Japanese imports from 24% to 25%, set to take effect on August 1, leaving some room for potential negotiations. Meanwhile, a sharp slowdown in May wage growth has raised concerns about the recovery and may prompt the Bank of Japan to delay rate hikes until 2026.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Meta declined to sign the European Union’s voluntary AI Code of Practice this week, underscoring ongoing tensions between US tech firms and EU regulators. The code aims to bring transparency and accountability to advanced AI systems, particularly frontier models. Meta’s refusal signals resistance to regulation it views as burdensome or misaligned with its internal governance. The EU is expected to respond with increased pressure for binding compliance as part of its broader AI Act enforcement rollout.

Meta has launched a new elite AI research unit called “Superintelligence Labs” and committed $15 billion to recruit top AI talent worldwide. The team is expected to focus on training next-gen large language models and competing directly with OpenAI and DeepMind. The hiring spree is already intensifying a global talent war, as Meta seeks to leapfrog rivals in foundational model capability.

Google announced new enterprise-facing upgrades to its Gemini platform, including a real-time AI-powered business calling tool. The feature allows AI agents to autonomously place and manage routine phone calls on behalf of businesses. Gemini 2.5 Pro has also been embedded into “AI Mode,” enhancing real-time decision-making and summarization features. Google is positioning Gemini as a full-stack enterprise assistant, directly targeting Microsoft 365 Copilot and OpenAI integrations.

The US Department of Defense awarded new AI development contracts to OpenAI, Anthropic, Google, and Elon Musk’s xAI. These multi-year deals center on planning systems, autonomous logistics, and battlefield simulations. The move reaffirms Washington’s reliance on private-sector innovation to maintain technological edge in defense, amid rising global military AI competition.

The AI Stack. This week, I shared an explanation of the full AI stack on LinkedIn:

Get your free guide to AI

🌐 Crypto Corner

The US Congress has officially enacted the Genius Act, marking its first federal law regulating stablecoins. President Trump signed it into law on July 18, 2025 . The legislation requires stablecoins to be fully backed by U.S. dollars or short-term Treasuries, with regular public audits, laying the groundwork for broader institutional and consumer use. While hailed by the crypto industry, critics warn that oversight gaps remain.

This framework could reshape digital payments.

Top 10 cryptos:

XRP led the crypto market with a 23.6% weekly jump, boosted by clearer U.S. regulatory signals and renewed discussions with the SEC. Its strong year-to-date gain of 62.4% reflects growing momentum from Ripple’s expanding payment network in Latin America and Southeast Asia, with institutions showing more interest after recent legal wins.

Ethereum climbed 18.2% this week, helped by growing use of faster, cheaper Layer-2 tools like StarkNet and zkSync. But its year-to-date gain remains modest at 5%, with some delays in development, stronger competition from other networks, and cautious investor interest holding it back.

Cardano gained 13.5%, although it’s still down 4.5% so far this year. Progress has been slowed by delays in its Hydra scaling project and a slower rollout of apps. Still, rising community activity and better compatibility with other networks may help in the second half of 2025.

Solana rose 7.2%, supported by a more reliable network and renewed activity in decentralized finance (DeFi), especially through platforms like Solend and Mango. But earlier outages and capital withdrawals in Q1 have left a dent, and growing competition from Ethereum-based solutions remains a challenge.

Polkadot was up 6.8%, yet it’s still one of the weakest performers this year, down 37%. Investors remain wary due to slower adoption of new projects and concerns about how well its updated governance system is working.

BNB added 4.6%, backed by steady demand within the Binance ecosystem and token buybacks. Regulatory issues from earlier in the year are still a drag, but user engagement tools like Launchpool continue to support interest.

Binance USD stayed flat, as expected for a stablecoin. Minor gains reflect its role in navigating currency volatility, though regulatory limits in the U.S. continue to cap its growth.

Bitcoin dipped 0.4% this week, after the Fed took a more cautious tone. Still, it’s up 25.4% this year, helped by April’s halving, strong ETF inflows, and continued interest as a safe-haven asset amid global uncertainty.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.