INSIGHT WEEKLY: November 16, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

See my website with travel and lifestyle pieces - the latest is on Osaka, Japan

https://iweekly.news

⏳ A focused, 5 minute reading time, weekly summary

🌐 Markets Overview

📈 A week of measured gains

The gains of the week were modest after the previous week’s nervousness on valuations. AI-inspired euphoria was checked, but the nervousness remained.

Many have commented on the inexorable rise of markets and how this cannot be sustained. The most well-known was Michael Burry, who not only took out put options on Nvidia and Palantir, but also announced the deregistration of his fund, Scion Capital, stating that he is “on to much better things November 25”. In his announcement letter, he said, “my estimation of value in securities is not now, and has not been for some time, in sync with the markets”.

One of the criticisms that he made, and others have also commented on, is that the hyperscalers are understating depreciation by estimating that chips have a longer useful life than is realistic.

What’s next for markets? It looks like there is a growing feeling that gains from here on could be more modest.

Markets below all-time highs:

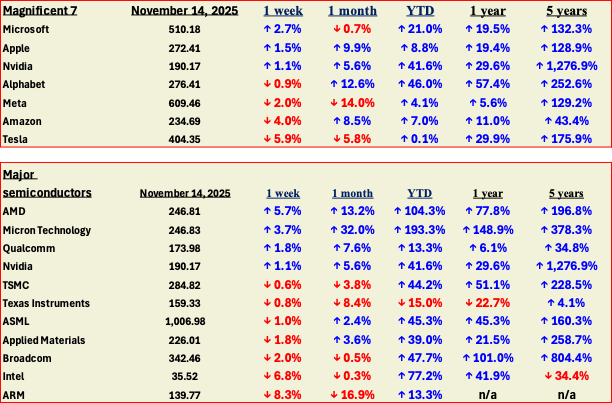

Tech Stocks Performance

Meta, which was among the leaders in the AI pack earlier this year, has now slumped 10% in the month and is up just 4% year to date. Meta’s Llama is behind its peers, and its Chief Scientist, Yann LeCun, has left following the arrival of Alexandr Wang, after Meta acquired 49% of Scale AI for $14.8 billion. Alexandr Wang was the CEO of Scale AI and is now working at Meta.

Amazon and Tesla both retreated as AI fears triggered risk-off rotation, with Tesla briefly dipping below $400 before recovering.

AMD surged as CEO Lisa Su projected average annual revenue growth exceeding 35% over the next three to five years, with AI data center revenues expected to grow 80% annually, targeting a double-digit market share of a projected $1 trillion data center chip market by 2030. The rally was bolstered by strong demand for AMD's 5th Gen EPYC processors and Instinct MI350 Series GPUs, along with a strategic partnership with OpenAI worth over $100 billion.

Micron benefited from tight supply and strong demand for high-bandwidth memory chips deployed in AI servers, with its cloud memory business unit revenue jumping 3.5x in the previous fiscal year to $13.5 billion.

While questions mount about the mega-caps' ability to monetize AI investments, the infrastructure providers building the underlying hardware continue to see tangible, accelerating demand.

Macro Watch: This Week’s Economic Developments

🇺🇸 United States

The US economy ended the longest government shutdown on record during the week, which had dampened sentiment and daily operations. Missing vital government economic data has increased uncertainty. Private reports show limited job growth and elevated layoffs in 2025.

The odds of a December rate cut declined as Federal Reserve policymakers gave cautious statements, dampening expectations of a rate cut.

Treasuries firmed on risk aversion while risk assets struggled, reflecting caution over political gridlock, softening demand signals, and the difficulty of assessing the underlying economic picture without full data visibility.

🇪🇺 Europe

UK: The Bank of England cutting rates in December has become more likely as the labor market weakened, as unemployment rose to 5% for the first time since January 2021.

Wage growth also slowed.

Economic growth slowed to 0.1% in the third quarter, and in September by 0.1% sequentially, mainly due to the cyberattack at Jaguar Land Rover.

Eurozone retail sales declined for the third month, highlighting a fragile recovery with modest gains in German industrial output but overall weak order intake. Scandinavian central banks maintained rates to combat persistent inflation.

🇯🇵 Asia

Japan’s new prime minister is expected to loosen fiscal policy, and the Bank of Japan is also expected to defer rate increases. The yen felt the pressure and weakened.

Public expenditure is expected to increase to boost economic growth.

China’s latest economic data showed clear signs of weakening as the fourth quarter began. Fixed-asset investment fell 1.7% in the first 10 months, its largest drop on record for this period. Industrial production grew a softer-than-expected 4.9% in October, and retail sales slowed for a fifth straight month at 2.9%. The property slump also deepened, with new and existing home prices recording their steepest monthly declines in a year, reinforcing weak consumer sentiment and ongoing deflationary pressure. Even so, most economists still expect China to meet its roughly 5% growth target, supported by RMB 1 trillion in recent stimulus and a temporary easing in US-China trade tensions.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Microsoft unveiled its new “MAI Superintelligence Team”, led by Mustafa Suleyman, marking a strategic shift from broad artificial general intelligence ambitions to focused, human-centred applications. According to a company blog, the team emphasises “humanist superintelligence” – AI systems built not to chase an undefined endpoint, but to solve concrete challenges like medical diagnosis, clean-energy innovation, and advanced scientific research. The initiative was formally revealed in early November and has already begun recruiting across US sites. By pivoting to domain-specific usage and emphasising ethical controllability, Microsoft is positioning itself as a leading contender in the next wave of purpose-driven AI.

OpenAI confirmed a small but telling update to its flagship chatbot, ChatGPT. CEO Sam Altman announced on social media that the system now reliably respects user instructions to avoid using the overused em-dash punctuation mark – a quirk that had drawn attention as a characteristic signal of AI-generated text. While the change is modest, it highlights OpenAI’s ongoing refinement of language models to support more natural, human-centred communication and give users finer control over output style.

Google introduced “Private AI Compute”, a new cloud-based architecture designed to bring the power of its Gemini-series AI models to enterprises while maintaining on-device-level privacy. Announced in mid-November, the platform isolates data and processing within secure enclaves and custom Tensor Processing Units (TPUs), ensuring that even Google’s own teams cannot access user input. The move addresses growing concerns around cloud-based AI, data sovereignty, and privacy, and signals Google’s commitment to delivering advanced AI experiences without compromising trust.

Anthropic revealed a landmark investment: a US-based infrastructure programme worth approximately $50 billion, starting with new data-centre campuses in Texas and New York in partnership with Fluidstack. The expansion, announced 12–14 November, aims to meet the soaring compute demand of frontier AI models such as Claude, and to anchor AI infrastructure firmly in the United States. The facilities are expected to be operational in 2026 and underscore the company’s ambition to scale both research and production capabilities for next-generation AI systems.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

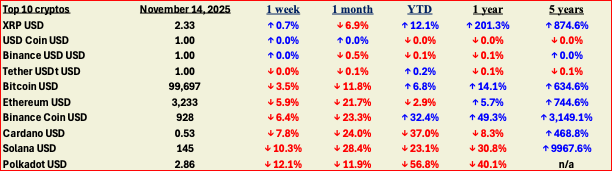

Cryptos continue to decline

Bitcoin slipped 3.5 percent this week to just under $100k. The move extends its one-month decline to almost 12 percent.

The week included renewed chatter about Strategy, the company formerly known as MicroStrategy. Its leveraged balance sheet and large Bitcoin holdings prompted speculation about whether pressure could eventually force asset sales, although the company has not signalled any intention to sell.

Ethereum fell 5.9 percent for the week and is now down 21.7 percent over the month. It has slipped into negative territory for 2025, down 2.9 percent year to date. The recent decline reflects the broader pattern of investors reducing exposure to higher-beta assets as liquidity eases and macro signals stay mixed.

Solana was again among the weakest performers, down 10.3 percent for the week and 23.1 percent year to date.

XRP was the only major token to finish the week in positive territory, edging up 0.7 percent. Its one-year return of more than two hundred percent shows how much momentum it has carried into 2025, even though the pace has slowed in recent weeks.

Cardano remained under pressure, falling 7.8 percent and extending its year-to-date drop to 37 percent.

Polkadot also struggled, down 12.1 percent for the week and nearly 57 percent in 2025 as capital continues to move away from some of the earlier generation layer-ones.

Stablecoins such as USD Coin, Tether and Binance USD stayed anchored around one dollar with minimal movement across all time horizons, reflecting lower trading intensity during the week.

Across the top ten the pattern is clear. Capital is rotating back into safer positions and the appetite for high-beta exposure has cooled. The longer-term numbers still favour core assets like Bitcoin, but the short-term tone remains cautious as markets reassess leverage, liquidity and the durability of this year’s gains.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.