INSIGHT WEEKLY: November 2, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

See my website with travel and lifestyle pieces - the latest is on Osaka, Japan

https://iweekly.news

⏳ 5 minutes reading time.

🌐 Markets Overview

📈 10 months of strong AI/Tech-driven performance

Six of the major market indexes set new records this week (highlighted in blue).

Surprisingly, the UK’s FTSE 100 outperformed the S&P 500 so far this year despite the gloomy economic news. However, the UK stock market differs from the UK economy.

Why? See the full article on my website, https://iweekly.news.

Will the S&P 500 and the Nasdaq deliver greater than 20% returns for the third year in a row?

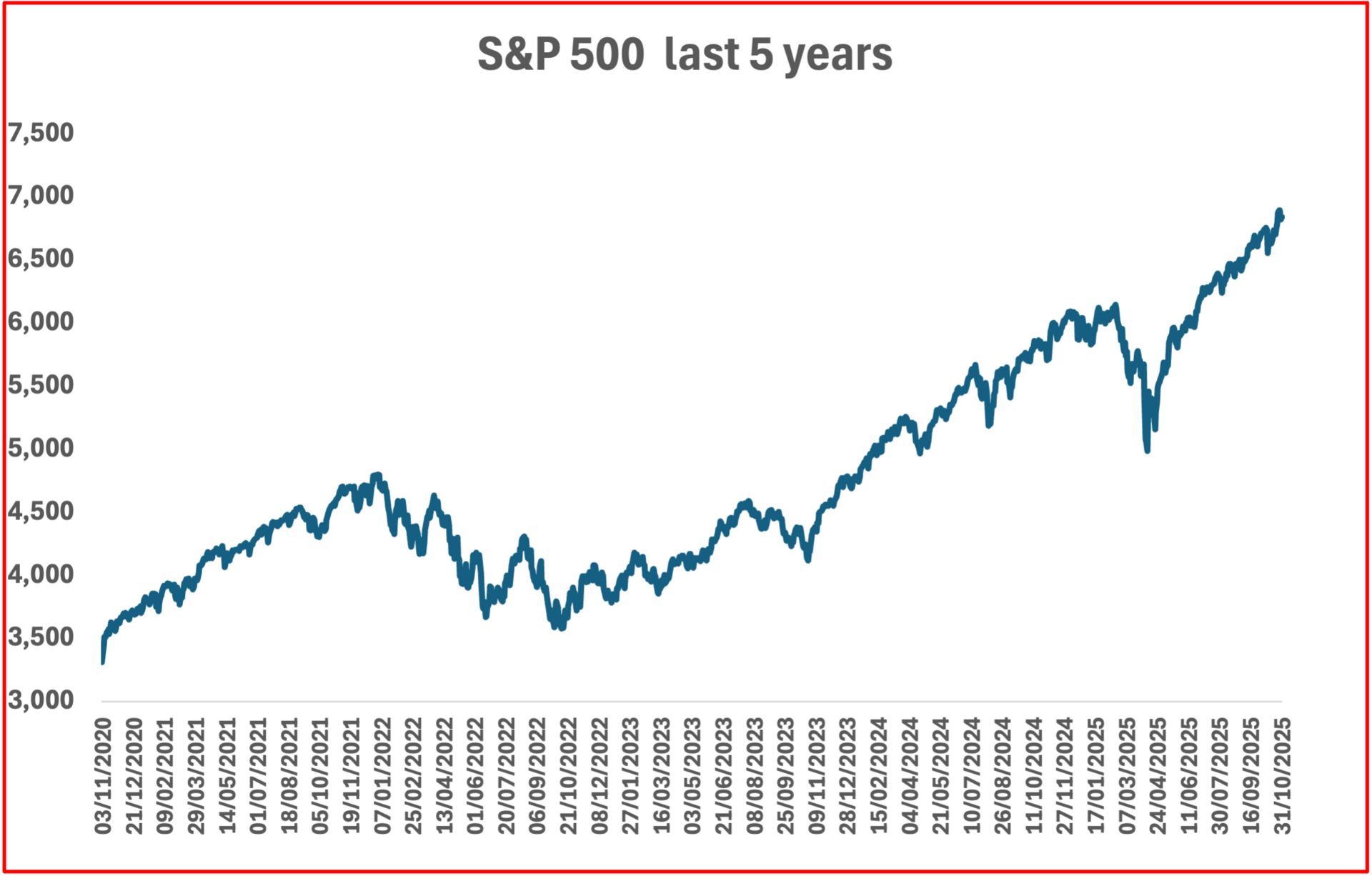

The bellwether S&P 500 - an unstoppable trend?

Amazon and Apple earnings helped drive a risk-on tone, lifting the Nasdaq and S&P 500 to further weekly and monthly gains, even amid lingering concerns over Federal Reserve rate policy and a government shutdown that investors appeared to look past. October marked the sixth consecutive month of gains for both the Dow and S&P 500, their best streak since 2018 and 2021 respectively, a testament to market optimism around robust tech sector fundamentals and hopes for eventual policy easing as yields retreated from cycle highs.

Gold’s standout YTD performance of over 50% reflected ongoing geopolitical unease, while oil and Bitcoin saw year-to-date retracements and gains, respectively, underscoring divergent sector narratives.

For a more detailed look at gold, see the full article on my website, https://iweekly.news.

Tech Stocks Weekly and YTD Performance

The "Magnificent 7" continued to dominate market narratives into the close of October, powering much of the US equity advance and once again highlighting the sector concentration driving major index gains. Despite some investor caution about valuations, these names delivered another strong wave of earnings, with big tech’s substantial weight in the S&P 500 magnifying their market impact.

Sentiment around the "AI boom" and cloud growth remains a principal driver, with Nvidia’s leadership and strong demand for next-generation chips emblematic of the enduring appeal of this theme. Nvidia struck a deal last week to supply Samsung and the South Korean government with 260,000 advanced AI chips. Also, last week, Nvidia’s capitalization reached $5 trillion - the first company to get to this level.

Still, the rally beneath the surface was far from uniform. Tesla and Meta demonstrated more modest gains, suggesting a maturing bull cycle for some high-flyers, while questions emerged around slowing earnings revisions and the sustainability of extreme price-to-sales multiples in this group.

Semiconductor stocks were the clear market standouts fueled by relentless investment in AI infrastructure and global chip supply chain dynamics.

The PHLX Semiconductor Index raced well ahead of the broader Nasdaq, underlining how chipmakers’ performance has become a bellwether for market optimism about future technology adoption.

Macro Watch: This Week’s Economic Developments

🇺🇸 United States

The Federal Reserve cut interest rates by 25 basis points to a range of 3.75% to 4.00% in October, but Chair Jerome Powell quickly tempered expectations for further easing stating that another rate cut at December's meeting "is not a foregone conclusion.

The economic backdrop remains complicated by data gaps from the government shutdown, making it difficult for policymakers to assess real-time conditions with confidence.

On the diplomatic front, President Trump and Chinese President Xi Jinping agreed to a one-year trade truce during meetings in South Korea. The agreement includes a reduction in U.S. tariffs on Chinese imports, China's resumption of U.S. agricultural purchases, and a suspension of Chinese export controls on rare earth materials. While the concessions were relatively modest and leave room for future escalation, the temporary détente provided welcome relief and reduced one near-term source of economic uncertainty.

Treasury yields rose across most maturities following Powell's hawkish commentary, reflecting recalibrated expectations for the pace of monetary easing ahead.

🇪🇺 Europe

The European Central Bank held interest rates steady for the third consecutive meeting, maintaining its data-dependent stance as inflation hovers near the 2% target. President Christine Lagarde acknowledged continued economic growth but noted persistent uncertainty from global trade disputes and geopolitical tensions.

Economic data painted a picture of modest improvement. Eurozone GDP expanded 0.2% in the third quarter, slightly above the 0.1% growth in the prior period, with France and Spain driving the acceleration. Headline inflation slowed to 2.1% in October from 2.2% in September, as lower energy prices offset higher services costs.

The UK housing market showed resilience, with the Nationwide House Price Index rising 0.3% in October. Net mortgage approvals reached 65,900 in September, the highest level in nine months, signaling improving sentiment in the property sector despite broader economic headwinds.

🇯🇵 Asia

The Bank of Japan held rates steady, with Governor Kazuo Ueda maintaining a hawkish tone by reiterating that "the likelihood of a rate hike is increasing," though he introduced a new caveat by emphasizing the need to monitor spring wage negotiations, particularly in the tariff-impacted auto industry. This subtle shift in messaging pushed back expectations for imminent rate increases.

Expectations for a large-scale economic stimulus package have also boosted sentiment.

China's economic outlook remains clouded by concerns about sluggish growth, despite optimism from the U.S.-China trade truce. A recent high-level Communist Party plenum disappointed by failing to deliver substantial policy stimulus. While Beijing pledged to develop "an economic development model driven more by domestic demand and powered by consumption," it stopped short of setting specific targets.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Meta introduced a powerful AI editing feature within Instagram Stories called Restyle. This tool allows users to easily modify their photos and videos by typing simple commands. For example, users can add or remove objects, change backgrounds, or apply artistic effects like watercolor or vintage film styles. This capability makes advanced creative editing accessible to a broad audience and enhances user engagement on the platform, while also raising conversations about digital content creation and privacy.

Samsung’s semiconductor division showed a strong recovery driven by rising demand for AI chips and infrastructure hardware. After several quarters of decline, Samsung’s turnaround reflects the critical role of chipmakers in supporting AI systems worldwide. Increased investment in advanced semiconductor manufacturing and supply chain improvements contributed to this positive momentum.

Google launched Veo 3, an AI-powered video creation tool that is now widely available. This product illustrates the growing competition and innovation in AI-driven media production, offering enhanced creative options to consumers and professionals alike.

A significant multi-billion-dollar partnership was announced between major cloud providers and AI research labs. This deal expands access to specialized computing hardware such as tensor processing units, which are crucial for training and running large AI models with efficiency and speed.

Thailand made a strategic advance in AI adoption by launching the Sora app, positioning itself as one of Asia’s pioneers in consumer-facing AI applications. This launch points to expanding AI engagement in the Southeast Asian region.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

Crypto’s Uneven 2025: A Year of Divergence and Rotation

Binance Coin (BNB) leads major assets with a +55.4% YTD gain, bolstered by founder Changpeng Zhao’s pardon and the continued dominance of the Binance exchange.

XRP follows at +20.6%, maintaining momentum from 2024’s explosive rally (+237.9%), driven by speculation around ETF approvals and growing institutional interest.

Bitcoin remains the anchor, posting a respectable +17.4% YTD, building on two years of strong gains. However, volatility remains, with periodic liquidation events testing long positions.

Ethereum trails slightly at +15.5%, reflecting concerns about Layer 2 competition and diminishing narrative dominance, even as institutional adoption persists.

Among layer-1 challengers, Solana is flat YTD (–0.9%), a surprising underperformance given its technical reputation, suggesting investor rotation away from high-beta plays amid ETF-driven flows into XRP and Bitcoin.

Cardano (–27.8%) and Polkadot (–56.5%) have struggled severely, both showing weak ecosystem traction despite previous bull market success. Polkadot’s plunge continues a two-year downtrend, now erasing most of its pandemic-era gains.

Stablecoins like USDT, USDC, and BUSD have held their pegs with minimal movement, though the flatlining of their caps suggests waning market demand relative to past cycles.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.