INSIGHT WEEKLY: March 23, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time. Stay ahead without the overload.

500+ professionals have subscribed to this magazine.

🌐 Markets Overview

Markets:

Markets gained slightly after four successive weeks of declines. Is this the end of market declines? Or are we going to see further declines?

Are there reasons for an equilibrium to develop at current market prices? Only if current values reflect the stalemate on tariffs and geopolitics (especially in Europe).

The AI boom looks to be over - for now.

The conversations on tariffs continued this week and may continue further into the future as measures and countermeasures get evaluated and negotiated each week.

Nikkei 225 gained 1.7% due to inflows from overseas on optimism of corporate governance reforms. Japan’s corporate governance reforms include enhancing board independence, reducing cross-shareholdings, improving transparency, and focusing on capital efficiency.

Year to date, European stocks have outperformed as investors rotated some funds out of the US into European stocks and gold.

Gold continues to improve as central banks continue to buy gold and sell dollars. The de-dollarization continues as countries diversify their reserves due to geopolitical shifts. Some trade agreements are being written in currencies other than the US dollar.

Last week’s newsletter included a spotlight on gold.

Tech stocks:

Nvidia (-3.3%) was the biggest loser among the Mag 7, reflecting ongoing concerns about competitive pressures and general weakness in the semiconductor sector. See AI section below on the announcements by Nvidia.

Tesla (-0.5%) may be levelling out despite some potential Tesla car buyers boycotting the brand. There have also been attacks on Tesla cars, and charging stations in the US. The stock is now -38% this year.

AMD, Intel gain in positive market sentiment on AI prospects.

🇺🇸 Spotlight on US debt

Size of the debt is currently $36 trillion and has grown rapidly over the last decades.

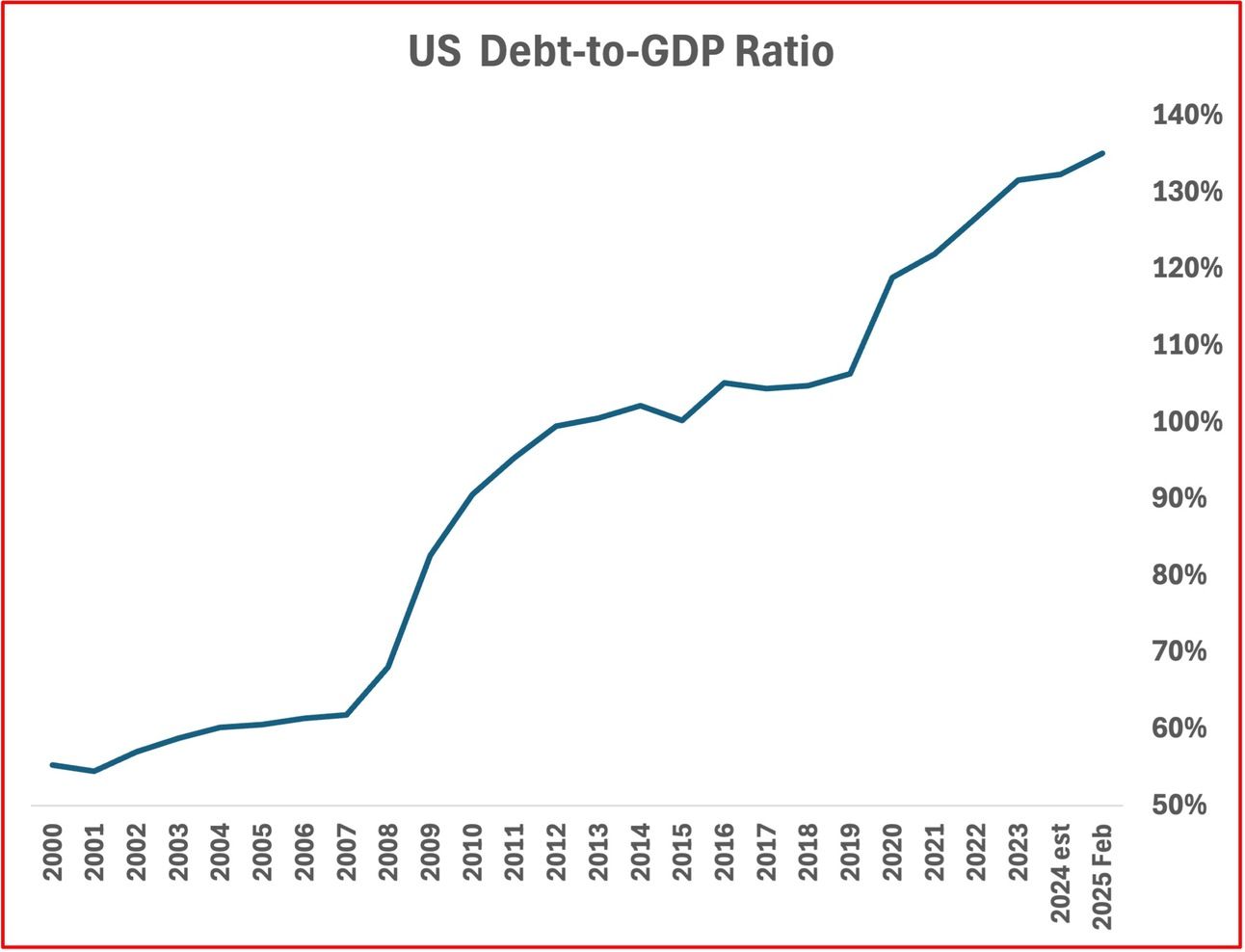

A good way to look at debt is to compare it to GDP to get an idea of proportionality. The chart below shows the history of debt as a percentage of GDP growing from 60% of GDP in 2000, to 135% currently.

Fortune magazine stated today that this ratio could grow to 200% in two decades if tax cuts were implemented.

Who holds the debt? Some of it is held by US government agencies. The chart below shows the growth of the debt by type of holder.

The intergovernmental debt is held by US Federal Reserve system (around $5T) and Social Security and other US agencies (over $2T).

The $29 trillion non US governmental holdings breaks out as:

Around $9 trillion is owned by foreign investors.

The major holders are Japan $1.1T, China $0.7T, UK $0.7T, Luxembourg $0.4T, and the Cayman Islands $ 0.4T.

The remaining $20 trillion is owned by U.S. investors and other U.S. holders

🌐 Economy Overview

🇺🇸 US

Interest rates were left unchanged at 4.25%–4.50%, which aligns with market expectations. The Federal Reserve acknowledged increased uncertainty in the economic outlook, particularly concerning the potential impacts of ongoing trade tensions and tariffs.

Fed Chair Jerome Powell expressed that the effects of these tariffs might be temporary, but the situation requires careful observation.

Retail sales for February saw a modest increase of 0.2%, falling short of the anticipated 0.7% rise. This has been attributed to consumers becoming more cautious with their spending, possibly due to concerns about the broader economic environment.

Additionally, January’s retail sales figures were revised downward by 1.2%, marking the most significant decline since July 2021. However, it’s worth noting that core retail sales, which exclude volatile categories like automobiles and restaurants, rose by 1% in February, surpassing expectations.

SEP (Summary of Economic Projections), which is also sometimes known as the Dot Plot was released by the Federal Reserve. While the median Fed Funds Rate projection remains unchanged, inflation and unemployment have been revised up.

The next Federal Reserve meeting on interest rates is scheduled for May 6,7.

S&P 500 is -3.6% in the year to date.

🇪🇺 EU

Germany’s parliament has approved a €1 trillion spending package aimed at enhancing defense capabilities and modernizing critical infrastructure. The plan includes a €500 billion fund for infrastructure improvements, with €100 billion specifically allocated for climate-related projects.

To enable this very large investment, Germany has made exceptions to its “debt brake” — a constitutional rule that typically limits government borrowing. The amended rule allows borrowing for defense and security spending exceeding 1% of GDP, a response to rising geopolitical threats and the need to bolster military readiness.

Why the Fiscal Expansion?

Germany’s fiscal expansion is driven by geopolitical tensions, economic revitalization, and political change. This is a move away from its traditional fiscal conservatism, allowing higher borrowing to boost economic growth and enhance national security.

Chip shortages in the EU, have resulted in nine EU countries, including Germany and France, pushing for accelerated progress in the semiconductor industry. The plan focuses on streamlining funding processes and boosting chip packaging and advanced production capabilities.

🇬🇧 UK

Government borrowing in February hit £10.7 billion, much higher than the expected £6.6 billion. This sharp increase puts added pressure on Chancellor Rachel Reeves as she prepares for the spring statement. Analysts at the Institute for Fiscal Studies (IFS) warn that if borrowing continues at this pace, it could reach around £151 billion for the year—about £23 billion more than previous estimates. Can the UK move forward without resorting to tax hikes or austerity?

The spring statement may contain a new plan.

Interest rates were held at 4.5% by the Bank of England as widely expected. The 9 member Monetary Policy Committee voted 8 to hold rates at the current level, and 1 to cut rates.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

NVIDIA’s GTC 2025 conference drew a record 25,000 attendees.

Two major announcements were made:

• Blackwell Ultra Architecture (2025): A cutting-edge AI architecture designed for large-scale AI processing. Key systems built on this architecture include GB300 NVL72 (72 GPUs, 36 Grace CPUs) and HGX B300 NVL16 (16 GPUs), optimized for enterprise AI workloads.

• Vera Rubin AI Superchip (2026): An integrated AI platform scheduled for release in late 2026. It combines the Vera CPU Architecture (ARM-compatible CPU) and Rubin GPU Architecture (successor to Blackwell) to deliver enhanced efficiency and performance for massive AI models.

NVIDIA’s latest architecture builds on its lineage of:

• Hopper (2022): Optimized for AI training and inference, featuring the H100 chip used in DGX H100 systems.

• Ampere (2020): General-purpose AI architecture, led by the A100 chip used in DGX A100 systems.

• Volta (2017): Early AI-specific architecture, featuring the V100 chip used in DGX V100 systems.

(see earlier newsletter with a spotlight on AI chips)

Tencent is making waves in China’s AI landscape with the official launch of its T1 Reasoning Model. Designed to improve response times and process longer text with impressive clarity, the T1 model boasts a low hallucination rate—something many AI models still struggle with.

According to Tencent, the T1 model is built for efficiency and scalability, making it a strong contender for enterprise applications where accuracy and responsiveness are key.

What does “hallucination rate” mean?

It’s the frequency at which AI models generate false or misleading information. For example, an AI might produce a convincing but completely fake scientific reference. Reducing hallucination rates is essential for making AI reliable, particularly in high-stakes applications like enterprise use.

Using AI for instant skin cancer diagnosis in a global first, an NHS hospital in Chelsea and Westminster is now using an innovative AI app that can analyze photos of suspicious moles in seconds, providing immediate all-clear results for nearly half of the patients. Those flagged for potential concern are promptly scheduled for specialist consultations.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

Polkadot (+9.1%) gained this week reflecting optimism about upcoming network upgrades. Polkadot is a blockchain framework built to facilitate seamless and secure communication between various blockchains. Its purpose is to support the development of a decentralized internet, often referred to as Web3, where individuals have enhanced control over their data and digital identity.

Binance Coin (+7.9%) also performed well, bouncing back from a month of losses.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.