INSIGHT WEEKLY: March 16, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time. Stay ahead in markets, the economy, AI, and crypto without the overload.

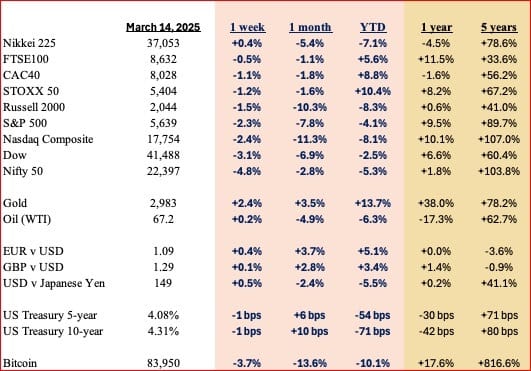

🌐 Markets Overview

Markets:

More of the same this week. More tariff announcements, more concerns about growth, and more worries about recession sent markets down.

Right now, it is difficult to see reasons for the markets to change direction and start to move up again.

What could be the possible reasons for the curve to inflect up?

Agreements to limit tariffs, a peace deal in Ukraine, the easing of geopolitical tensions, and renewed enthusiasm for AI and tech could be some of the reasons.

Deals made to decrease proposed tariffs will reduce inflationary pressures and pave the way for interest rate cuts, which in turn will stimulate growth and reduce recessionary risks.

The markets have experienced four successive weeks of declines.

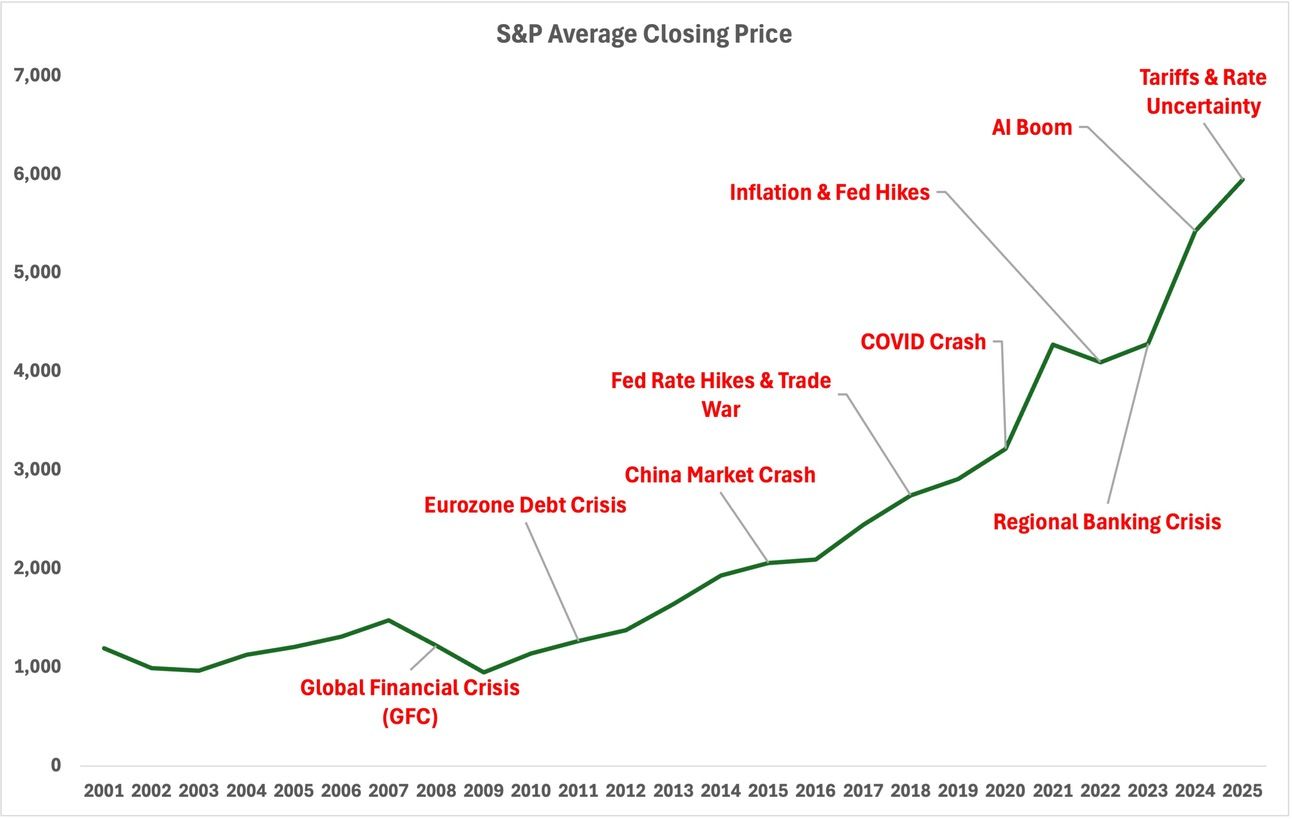

Let’s take a longer term look back at the S&P 500.

The chart below shows the average closing price over each year for the last 25 years. Averaging in this way smoothes out the curve. We can see that despite the major events over the last 25 years, long-term holders who kept calm and did not sell have benefited greatly from the uptrending S&P 500.

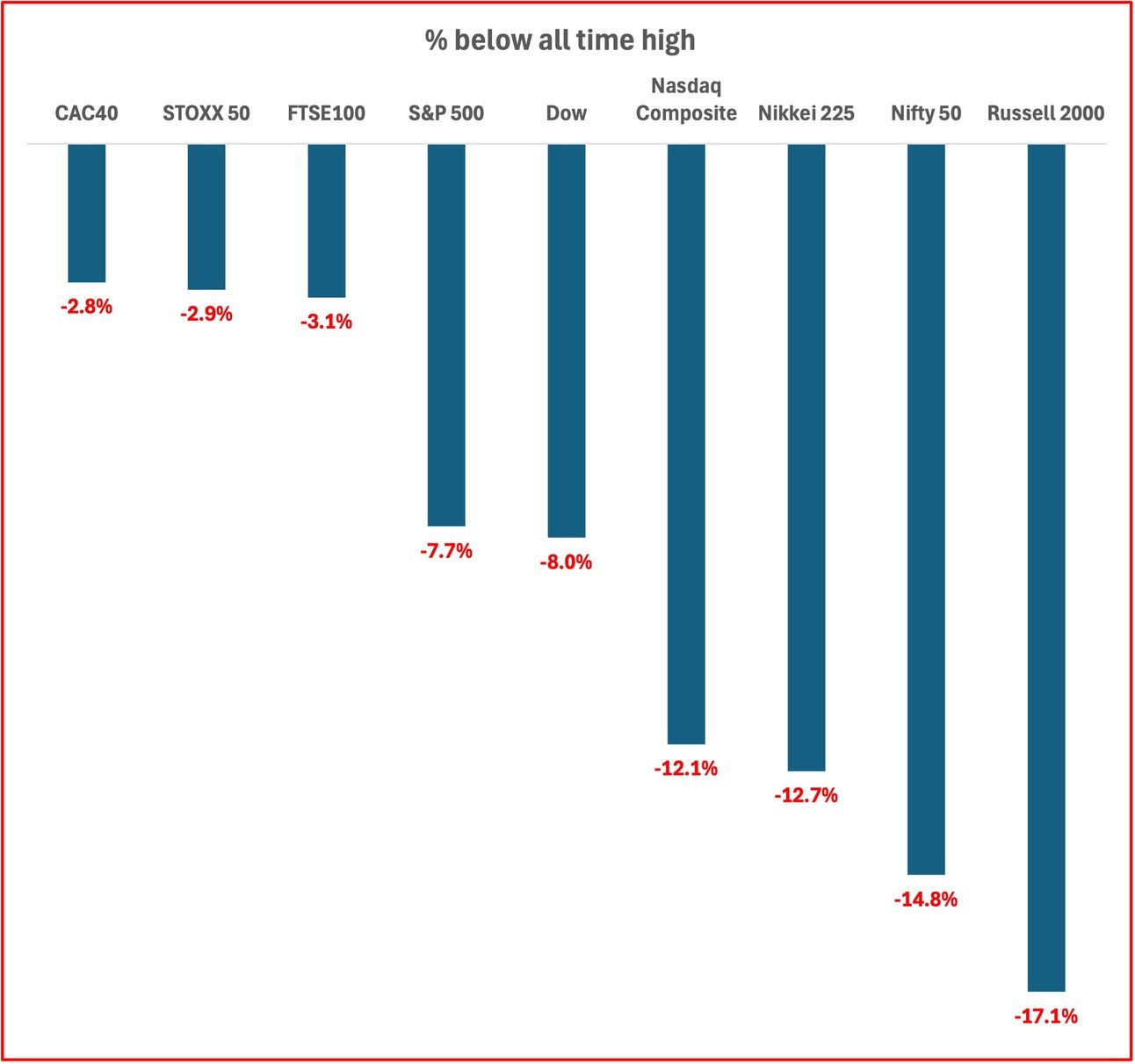

Market decline v all-time highs

The bars have got a little longer this week as most markets declined in the week. It was just a few weeks ago (on February 19) that the S&P 500 reached a record high of 6,111.

Some definitions:

A market correction is a decline of 10% or more from a recent high.

A bear market is a decline of 20% or more from a recent high.

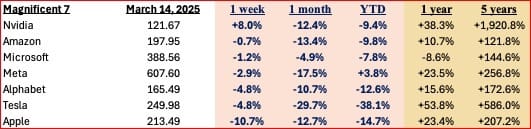

Magnificent 7:

Nvidia gained 8% in the week before the GPU Technology Conference next week. But it did drop nearly 10% in the prior week.

Tesla continues its decline, dropping nearly 5% in the week, following the 10% drop in the previous week. It is now down 38% in 2025. Falling sales in the EU and UK, competition from other EV makers, and Elon Musk’s political activism has driven down the share price.

Major Semiconductor stocks:

Intel has a new CEO, Lip-Bu Tan and stock responded positively and is up over 16% in the week. Is Intel a turnaround story? Intel’s all time high was back in August 2000.

Tariff Update (March 3 – March 8, 2025):

U.S. Tariffs on Canada & Mexico – 25% tariffs took effect on March 4, but USMCA-compliant goods remain exempt until April 2. Canada postponed retaliatory tariffs on C$125B of U.S. goods until the same date.

U.S.-EU Trade War – The U.S. imposed 200% tariffs on European wine & spirits, retaliating against EU tariffs on U.S. whiskey. The EU is weighing countermeasures.

U.S.-China Tensions – The U.S. increased tariffs on solar panels, batteries, and rare earths; China retaliated with tariffs on U.S. agriculture and energy.

🪙 Spotlight on Gold

Gold price hit a record high of $3,000 per ounce, as demand continues to push the price up.

Some history on gold:

Gold: A Timeless Asset in a Changing Economy

Gold has fascinated civilizations for millennia, serving as a symbol of wealth, power, and stability across cultures. Beyond its beauty, gold’s unique physical and chemical properties make it indispensable in industries such as jewelery, electronics, and medicine. Its resistance to tarnish, malleability, and conductivity ensure its continued relevance in both tradition and technology.

Gold’s Economic Influence and the End of the Gold Standard

For much of modern history, gold was central to the global monetary system. Under the gold standard, national currencies were directly backed by gold reserves, creating a fixed exchange rate system. However, this framework proved too rigid during economic crises, restricting policymakers’ ability to respond effectively. The system was largely abandoned after the Great Depression, with the final collapse occurring in the early 1970s when Bretton Woods agreement broke down.

Though no longer in use, the gold standard continues to influence economic thinking. Some advocates call for its return, arguing that it would prevent inflation and limit excessive money printing by central banks. However, critics contend that such a rigid system would eliminate monetary flexibility, making it difficult to manage recessions, financial crises, and inflationary pressures.

Who Produces the Most Gold?

Gold mining has undergone significant shifts over the years. China is the world’s top gold producer, surpassing traditional leaders like South Africa, whose share has fallen to just 4% of global production. Meanwhile, other key players like Russia, Australia, and the United States continue to shape the global gold supply.

As gold prices surge to new highs, its role as a safe-haven asset remains strong. The question remains: Will gold continue to dominate as a store of value, or will emerging financial assets challenge its place in the global economy?

Gold is a strategic reserve for the U.S. government, among other reserves.

These reserves are seen as economic buffers, strategic assets, and financial stabilizers.

Gold has historically been a hedge against inflation and financial crises.

How much gold does the US hold?

The U.S. holds 8,133.5 metric tons of gold, making it the largest sovereign gold holder in the world. Much of it is stored at Fort Knox, the Federal Reserve Bank of New York, and West Point.

🌐 Economy Overview

🇺🇸 US economy

On the inflation front, there was a silver lining. The Consumer Price Index (CPI) rose by 0.2% in February and 2.8% year-on-year, and the core CPI (excluding food and energy) saw its lowest year-over-year increase since April 2021, rising 3.1% over the prior 12 months. These figures were slightly below what analysts had expected, easing some fears about stagflation—a scenario where growth stagnates while inflation and unemployment rise.

The risk is that as a consequence of tariffs, inflation could start to move up again.

The next Federal Reserve meeting on interest rates is scheduled for March 18,19.

S&P 500 is -4.1% in the year to date.

🇪🇺 EU

The ECB’s next rate cut in April is now in doubt, as policymakers highlight “exceptionally high uncertainty” in the economy. ECB President Christine Lagarde and other officials warn that inflation could remain stubbornly high, while Portugal’s central bank chief argues for quicker cuts to support growth. Markets remain divided.

🇬🇧 UK

The UK economy shrank by 0.1% in January, surprising economists after December’s 0.4% expansion. The drop was driven by weaker production, though the quarterly growth rate improved slightly to 0.2%. While not a deep contraction, the numbers highlight ongoing economic challenges as the country grapples with sluggish momentum.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Google is phasing out Google Assistant and replacing it with Gemini AI across phones, tablets, smart devices, and even cars. The switch promises smarter, more natural conversations, deeper personalization, and the ability to handle text, voice, and images all at once. Over the next few months, Assistant will be gradually retired. While Google says this will create a more intuitive AI experience, some users are concerned about lost features and compatibility issues.

Want to know more? See their blog:

Apple’s AI Gamble—Is It Falling Behind? While Google is pushing forward with Gemini AI, Apple’s AI efforts seem stuck in neutral.

Siri was supposed to get a major AI upgrade, but those features—first promised at WWDC 2022 and showcased in iPhone 16 ads—are still nowhere to be seen. This delay has frustrated users and raised concerns among investors. Apple’s stock price is down 15% so far this year. While some argue Apple is playing the long game, others worry it’s falling behind rivals like Google and OpenAI.

Manus, the Autonomous AI Agent has arrived. China is making big moves in AI, and Manus is the latest example. Developed by startup Monica, this AI agent isn’t just another chatbot—it can analyze stocks, plan trips, and even create interactive coursework, all with zero human input. Early benchmarks suggest it outperforms OpenAI’s DeepResearch, putting it in direct competition with other AI models. To level up even further, Manus is teaming up with Alibaba’s Qwen AI team.

Like DeepSeek earlier, Manus is getting a lot of attention.

Quantum Computing & AI: A Powerful Combo?

Quantum computing could supercharge AI, solving complex problems far faster than today’s systems. AI depends on massive computational power, and quantum’s ability to optimize and accelerate machine learning makes it a game-changer.

This week, D-Wave claimed a breakthrough, solving a materials simulation problem in 20 minutes—a task they say would take a classical supercomputer nearly a million years. Recently, Microsoft unveiled its new quantum chip (featured in an earlier newsletter) intensifying competition with Google, IBM, and D-Wave in the race to integrate AI and quantum computing. As these companies push the limits, could quantum AI be the next big leap?

Get your free guide to AI

See the previous spotlight on AI chips

🌐 Crypto Corner

Top 10 cryptos:

An uneventful week in cryptoworld as prices retreat.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.