INSIGHT WEEKLY: September 8, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Major market indexes and stocks

Major market indexes:

Economic slowdown in the US weighed heavily on markets. The US stocks had the worst week in 18 months due to weak economic data. S&P500 had the worst weekly drop since March 2023.

The markets have had a tremendous run and such gains could not be sustained. The S&P500 had gained 14% by the mid-year. If the gains had continued as a straight-line extrapolation, the year-end gains would have been 28%, which would be exceptional.

A market turn was inevitable. When this would happen was unknown. This was a conversation point in some circles for some months.

The market moves like a herd. There was a collective feeling that stock prices were too high and not backed by fundamentals and the market turned.

With headwinds and tailwinds, will markets flatline for the rest of the year?

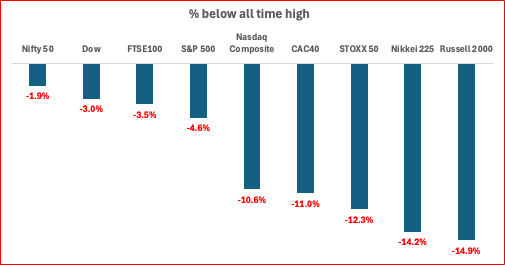

Markets v all-time high:

US Small and medium-sized companies (Russell 2000):

The trend has been higher in the past few months, followed by a larger shift. The “broadening” has leveled off.

About 40% of the companies in the Russell 2000 are unprofitable! So the interest of investors will be highly selective.

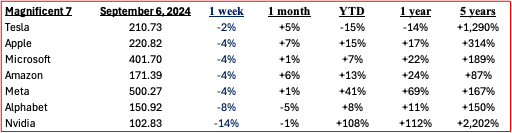

Magnificent 7:

Nvidia falls out of favor with a 14% drop in the week as investors review their estimates of future earnings. A correction was inevitable.

Hyperscaler capital expenditures are at record levels.

What are hyperscalers? These are large scale data center providers offering massive computing resources, with a high density of computing and storage equipment for cloud computing so that companies can use these resources rather than build their own. With large scale, unit costs can be lower.

Mag 7 capex is now more than the entire energy sector. In Q2, hyperscalers spent $53 billion on capex, up 58% year on year compared to Q1 year on year.

This is mostly to do with AI, due to the need to train the AI models.

The basis of the capex spend is that if the infrastructure is built, the customers will come.

The question being asked now is whether the capex spend will produce the required returns. The level of skepticism is increasing.

Major Semiconductor stocks:

Chip stocks moved down significantly as the earnings outlook for chip companies attracted scrutiny from investors.

🇬🇧 UK

£1 trillion investment needed say London Executives. This amount is needed to boost growth. A new report by the Capital Markets Industry Taskforce highlights that £100 billion in annual investment could boost the UK economy, leading to 3% growth in both real wages and GDP per capita. Priority areas for funding include housing, which requires £30 billion, and the water sector, needing £8 billion.

As concerns grow over London's status as a financial hub, especially after ARM Holdings chose to list in New York, UK regulators are reforming policies to make the city more competitive. The report suggests incentivizing pension investments in UK companies and reforming taxes, such as the stamp duty reserve tax, to encourage more domestic investment.

UK pension schemes’ allocations to domestic stocks decrease to 4.4%, among the lowest of any global pension market. Canada, Norway, and the Netherlands have a lower allocation than the UK. Will the new government incentivize pension schemes to invest more in the UK?

UK house prices hit a 2-year high. Halifax reported that average prices are higher by 4.3% compared to last year.

The outlook is good for interest rate cuts and this is likely to have a stimulative effect on house prices. Affordability is still an issue with mortgage rates still high. Much depends on interest rate cuts in the next few months.

UK interest rates will be decided at the Bank of England’s next meeting on September 19.

FTSE100 is -2.3% this week and +5.8% in the year to date.

🇺🇸 US

The U.S. job market is slowing, but economists say it's not time to panic just yet. Key metrics like job growth and unemployment are weakening, partly due to the Federal Reserve's earlier interest rate hikes aimed at controlling inflation.

Employers added 142,000 jobs in August, up from 89,000 in July, but overall hiring is slowing, with job growth averaging just 116,000 over the past three months. However, jobs growth over the previous two months was revised down by 89,000.

While layoffs haven’t spiked, a rise in labor supply means more people are looking for jobs, which increases the unemployment rate. Economists suggest a recession could be on the horizon if this trend continues, but there’s optimism since permanent layoffs remain low.

Relief could come as the Federal Reserve considers lowering interest rates, but it will take months to see any real impact. For now, the U.S. economy is still on track for a “soft landing” rather than an outright recession.

Interest rate cut in September is looking more likely as more voices are backing the Fed to cut. This cut is expected to be 0.25% but a 0.5% cut is also a possibility.

The next Federal Reserve meeting on interest rates is scheduled for September 17-18.

S&P500 is -4.2% in the week and +13.4% year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

Wage growth increases the chances of a rate hike. Weak U.S. economic data sparked concerns of a potential recession, pushing investors towards safer assets like Japanese government bonds (JGBs), causing the 10-year JGB yield to drop from 0.90% to 0.86%. Meanwhile, Japan's real wages rose 0.4% year-on-year in July, marking the second consecutive monthly gain due to pay hikes and bonuses. However, household spending remained sluggish, increasing just 0.1%.

Inflation and Interest Rates. This economic environment strengthens the case for the Bank of Japan (BoJ) to consider further rate hikes, as it aims for sustainable 2% inflation and wage growth. BoJ Board Member Hajime Takata reiterated that while rate adjustments will be made as needed, the bank is closely monitoring both domestic and global market fluctuations to ensure economic stability.

Yen ended the week at 142 v the dollar showing further strength.

Stock markets fell over the week, with Nikkei 225 down 5.8%

Nikkei 225 Index is -5.8% in the week and +9% in the year to date.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

xAI, Elon Musk’s AI startup, has introduced the record-breaking "Colossus" AI training system. The Colossus cluster, which currently operates 100,000 H100 GPUs, will soon double in size to 200,000 GPUs, making it the largest system of its kind. Developed in partnership with Nvidia, Colossus is expected to surpass the GPU capabilities of tech giants like Google and OpenAI.

The system, powered by Nvidia’s advanced H100 chips and soon to integrate the newer H200 chips, boasts groundbreaking speed and energy efficiency. Colossus is set to significantly accelerate AI advancements in areas such as natural language processing and complex problem-solving.

Amazon is set to launch a revamped version of its Alexa voice assistant in October, powered by Anthropic’s Claude AI models. Internally named "Remarkable," the new Alexa will leverage advanced generative AI to handle more complex queries. The new version will be offered as a subscription service, priced between $5 and $10 per month, while the classic Alexa will remain free.

The updated Alexa will offer features like conversational mode, personalized shopping advice, and advanced home automation, with the aim of turning Alexa into a profitable venture.

Anthropic, an AI startup backed by Amazon, has introduced Claude Enterprise, its latest product aimed at businesses integrating AI solutions. Claude Enterprise builds on the success of Anthropic's chatbot, Claude, which has gained traction since its 2023 debut. Competing with ChatGPT and Google's Gemini, Claude Enterprise offers businesses enhanced AI capabilities with larger context windows, allowing for more comprehensive tasks such as processing financial reports and sales conversations.

Claude Enterprise follows the launch of Anthropic’s Team plan for smaller businesses and introduces "Artifacts" workspaces, allowing real-time collaboration on AI-generated documents, code, and forecasts.

Get your free guide to AI

See previous spotlight on AI chips

🌐 Crypto Corner

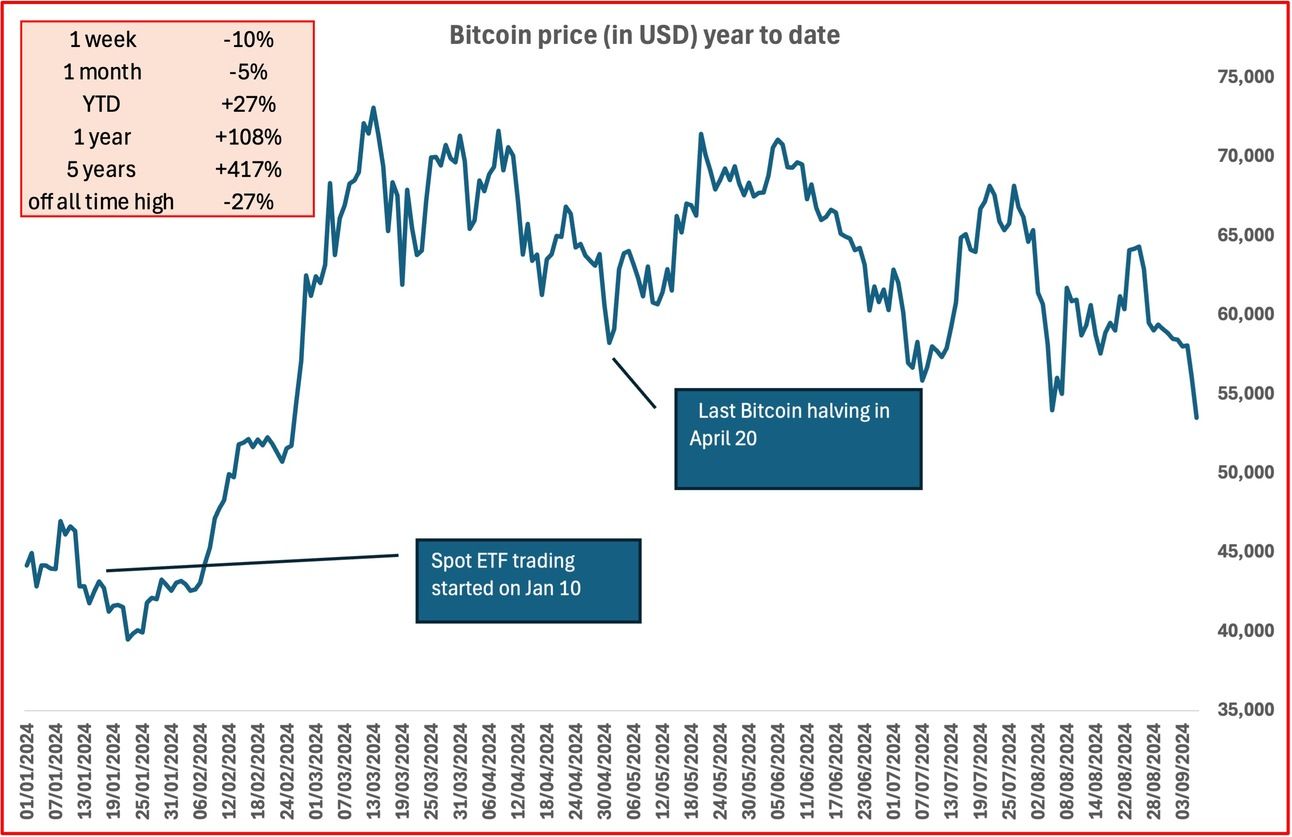

Tracking Bitcoin price (up to September 6):

Bitcoin fell below 53,000, dropping 10% in the week. The price is in a downtrend due to low ETF flows and macroeconomic factors.

Tracking Eth price (up to August 30):

Ether price continues to decline after the unimpressive ETF launch.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $241bn ⬇️ 2bn

Jeff Bezos (Amazon) $190bn ⬇️ 7bn

Larry Ellison (Oracle) $175bn ⬆️$1bn up two places

Bernard Arnault and family (LVMH) $173bn ⬇️ 16bn down one place as LVMH stock drops 8%

Mark Zuckerberg (Facebook/Meta) $173bn ⬇️ 7bn down one place as Meta stock drops 4%

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.