INSIGHT WEEKLY: November 17, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Markets Overview

Major market indexes:

The momentum from last week continued till Monday, with the S&P500, Dow, and Nasdaq setting new records this week before falling back. The post-election gains have been partly given up as markets await further indications on how the incoming administration will govern.

The Trump trade for stocks has paused.

Markets v all-time high:

S&P 500:

S&P 500 gave up some of the post-election gains from the Trump trade. Some concerns about the policies of the incoming administration and the appointments made led to a drop in the market, especially in healthcare stocks.

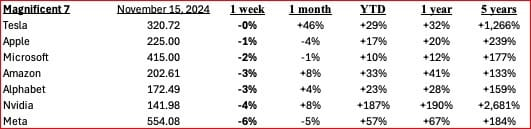

Magnificent 7:

Tesla and other electric vehicle makers stalled at the end of the week as the consumer tax credit of $7,500 for EV purchases is likely to be scrapped by the new administration.

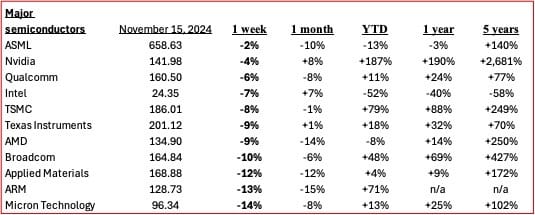

Major Semiconductor stocks:

Micron dropped after Edgewater Research published a paper indicating that demand for its NAND and DRAM chips will be weak. Other stocks also sold off on revised outlook on earnings.

US smaller cap companies (Russell 2000):

After last week’s gain of over 8%, the Russell 2000 fell back 4%. Tax cuts and less regulation will help smaller companies but the markets are re-assessing the impact of the new policies.

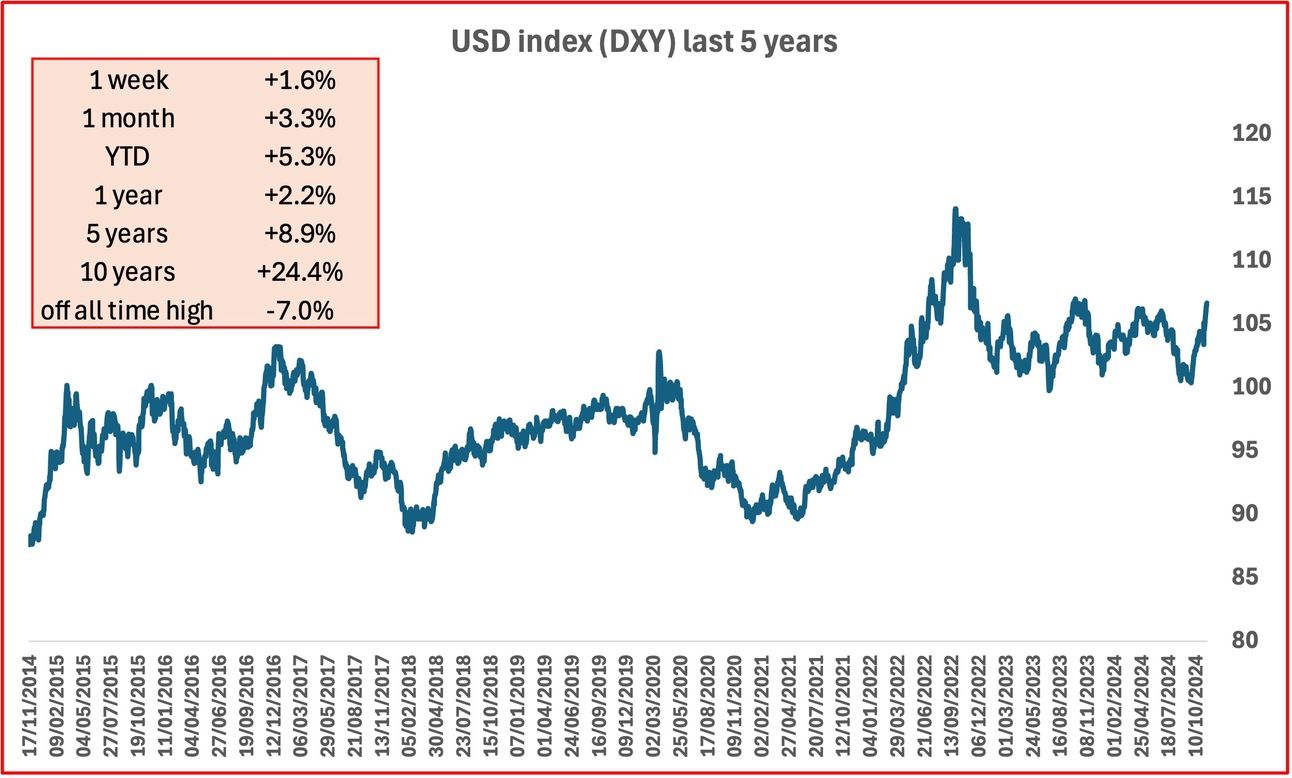

US Dollar

new

The USD index has gained over the last two weeks due to the election results. Also the Federal Reserve may delay interest rate cuts due to the inflation outlook. Higher interest rates support the dollar.

Gold weakened another 5% this week in response to a stronger dollar. There is also the sentiment that geopolitical risks could be less under the incoming administration. Gold has had a history of correlation to the geopolitical risks.

🇺🇸 US economy

US deficit reduction? Elon Musk and Vivek Ramaswamy are to lead a newly created “Department of Government Efficiency” in the new administration, aiming to cut government regulations, bureaucracy, and spending. This advisory team, named "Doge" after the cryptocurrency Musk promoted, will work with Trump and the Office of Management and Budget to suggest reforms until July 4, 2026. Musk, a strong Trump supporter, and Ramaswamy, a biotech entrepreneur and former Republican primary candidate, are tasked with advising on ways to “dismantle” government bureaucracy and streamline agencies. Musk has stated that $2 trillion could be cut out of a total of $6.7 trillion.

Additionally, there is the prospect of deregulation leading to more efficiencies in corporate America.

The US debt is now at $35.7 trillion and the 2024 deficit is over $1.8 trillion.

Inflation (as measured by CPI) rose in October, marking its first increase since March, with consumer prices up 0.2% month-over-month and 2.6% year-over-year. Housing costs drove half the monthly increase, though energy prices remained steady. While inflation has significantly declined from its peak of 9.1% in June 2022, economists expect less frequent rate cuts from the Federal Reserve due to the stickiness of inflation.

Looking under the hood, services inflation (mostly staff costs) is keeping inflation at its current levels. Energy and goods inflation are negative, and food prices are only slightly higher.

President Elect Trump’s proposed tariffs and policies that could spark an “inflation shock,” as warned by economist Larry Summers.

PCE (the preferred metric of the Federal Reserve) will be released on November 27.

Interest rates were cut by 0.25% last week. Is the rise in CPI likely to make the Federal Reserve keep rates steady? This depends partly on the October PCE data due to be released on November 27.

The next Federal Reserve meeting on interest rates is scheduled for December 17-18.

10 year yield increased in the week. It is now at the highest level since June. Chair Powell of the Federal Reserve indicated that inflation is showing signs of persistence, but getting closer to 2%. He said “The economy is not sending any signals that we need to be in a hurry to lower rates”. This could mean that the Fed will not cut in December.

S&P500 is -2.1% in the week and +23.1% year to date.

🇬🇧 UK economy

Growth in the UK slowed to 0.1% in the third quarter of which September was a contraction of 0.1%.

The new government has prioritized growth as a major objective. Will the tax rises in the October National Budget further decrease growth due to reduced spending and hiring in the economy?

Interest rates were cut by 0.25% by the Bank of England (BOE) in early November. Will the reduced growth prompt the BOE to cut rates again in December? The consensus appears to be that there won’t be a cut.

The next Bank of England meeting on interest rates is scheduled for December 18.

Tariffs applied by the US may impact the UK by £22 billion say the economists at the University of Sussex's Centre for Inclusive Trade Policy (CITP). The earlier Goldman Sachs estimate that the UK growth forecast for 2025 will drop from 1.6% to 1.4% because of tariffs.

Will the UK be looking at alternative markets? In the EU? The US is the UK’s biggest trading partner so it will not be an easy substitution.

FTSE100 is -0.1% this week and +4.3% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

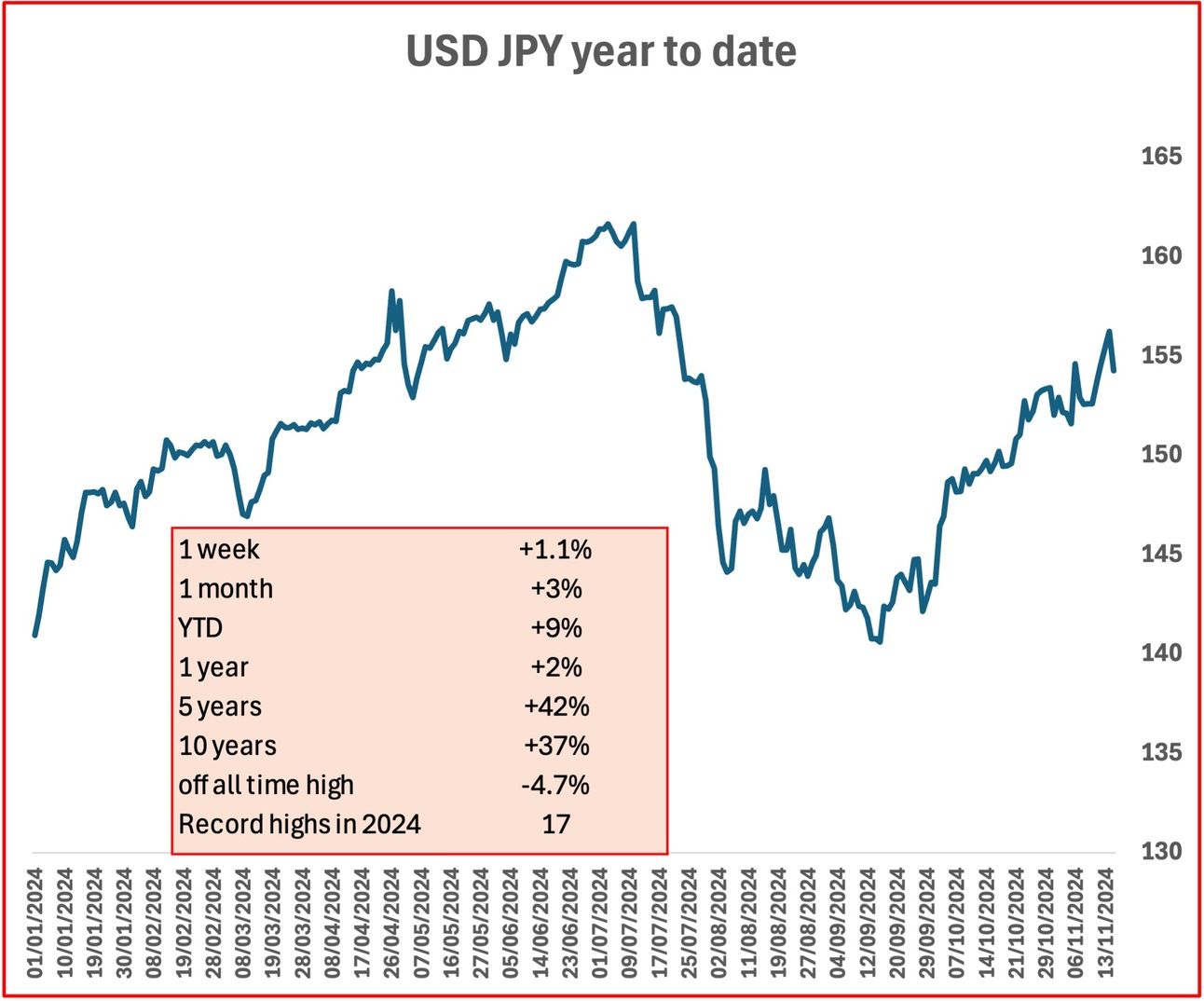

🇯🇵 Japan economy

Yen has weakened in response to the elections in the US. The authorities have again indicated that there will be intervention to support the currency. Will 160 be the intervention level?

Nikkei 225 dropped 2.2% in the week on concerns about US tariffs affecting Japanese companies exporting to the US.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

xAI has completed fundraising of $5bn, implying a valuation of about $45bn, according to the Financial Times. xAI’s Colossus data center, powered by 100,000 GPUs designed to support the Grok AI model, has rapidly become a powerhouse, though its fast development has raised concerns. The center was built in just 122 days, a fraction of the usual timeline. However, it faces significant power challenges. Additionally, Musk plans to double the facility's capacity, further increasing concerns over grid reliability and the environmental impact of such a large power draw.

Elon Musk has expanded his legal battle against OpenAI, adding Microsoft and LinkedIn co-founder Reid Hoffman as defendants in an amended lawsuit filed in California. The suit accuses OpenAI and its key investor, Microsoft, of monopolistic practices, including exclusive licensing agreements that stifle competition in the generative AI sector. Musk alleges that the transition of OpenAI from a nonprofit to a $157 billion for-profit entity prioritized profits over its original mission and unfairly sidelined competitors, including his company, xAI. The lawsuit also accuses OpenAI CEO Sam Altman of "self-dealing" and claims the partnership with Microsoft amounts to a merger without regulatory approval.

OpenAI and Microsoft have dismissed the allegations as baseless, with OpenAI asserting that Musk’s repeated claims lack merit. Musk’s suit seeks to void OpenAI’s licensing deal with Microsoft, force divestments, and address what he describes as unjust enrichment by the defendants at the expense of competitors and the public.

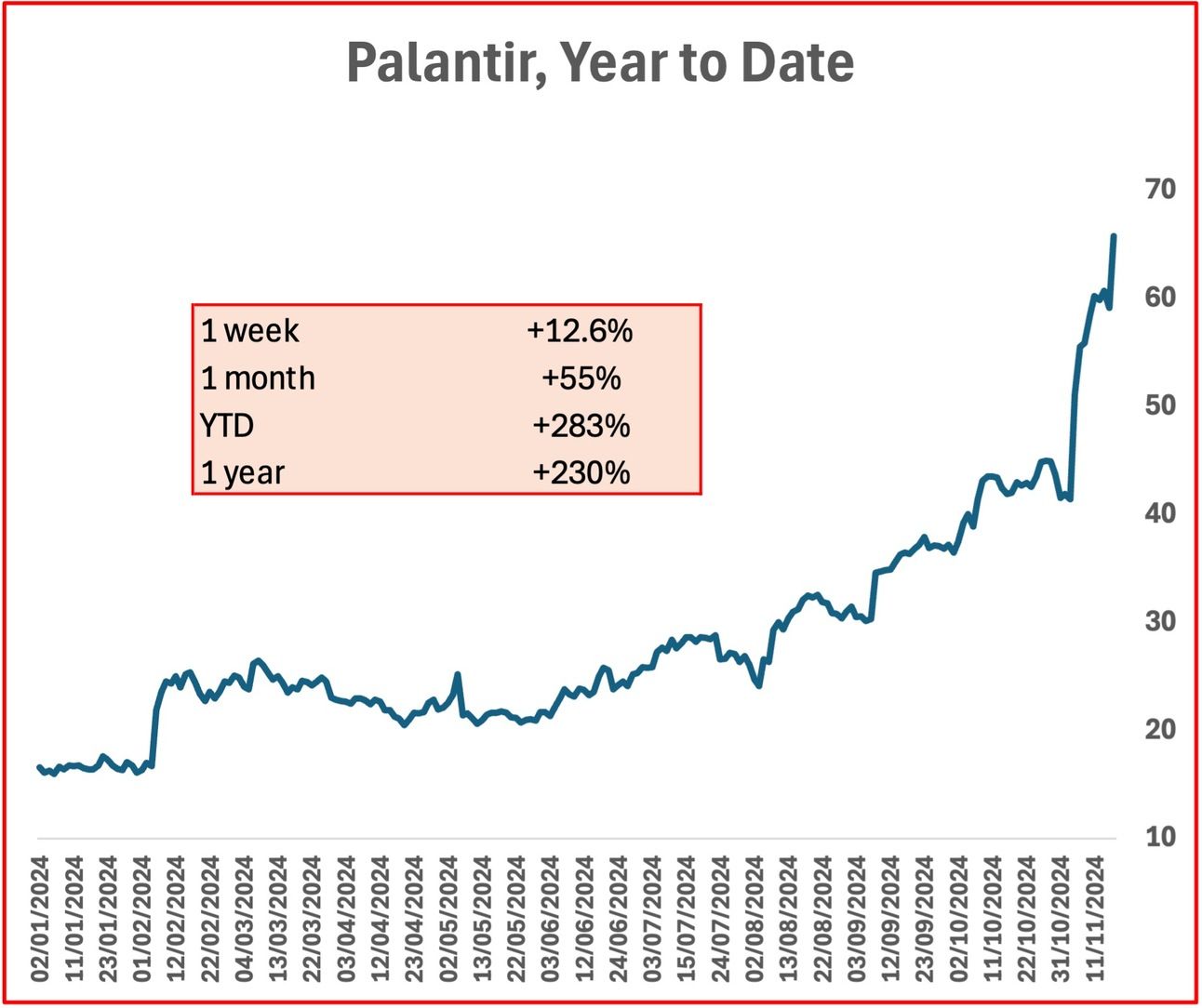

Palantir has been in the news, especially as its stock has soared this year. Another AI wonder stock?

What does Palantir do? It specializes in data analytics and artificial intelligence (AI) solutions for both government and commercial sectors. Its platforms, such as Gotham and Foundry, enable the integration and analysis of vast datasets.

The company has just announced plans to transfer its stock listing from the New York Stock Exchange to Nasdaq, which will likely be included in the Nasdaq 100 index. This could spur further buying.

In the U.S., Palantir's Gotham platform is widely used by intelligence and defense agencies for counterterrorism, military logistics, and public health responses. The company recently secured substantial government contracts, reflecting its integral role in federal operations.

In the UK, Palantir's Foundry platform has supported National Health Service data integration during the pandemic and since. Recent discussions with the UK Ministry of Justice on using AI to calculate prisoners' reoffending risks further emphasize Palantir's growing influence in government decision-making and predictive analytics.

Get your free guide to AI

See previous spotlight on AI chips

🌐 Crypto Corner

Top 10 cryptos:

XRP has surged over 60% in the week driven by positive legal and regulatory developments. 18 US states filed a suit against the Securities and Exchange Commission and its commissioners, including Chair Gary Gensler, for “unconstitutional overreach” of the crypto industry. Analysts cite a potential shift toward crypto-friendly policies in the US and favorable court rulings as catalysts for XRP's growth.

Ripple (the company behind XRP) CEO Brad Garlinghouse predicts a U.S. crypto market boom fueled by clearer regulations. Additionally, the increasing adoption of XRP for cross-border payments and investor optimism about Ripple's expanding global partnerships have further fueled the cryptocurrency's upward momentum.

Cardano's ADA token has rallied nearly 60% in a week, driven by significant network milestones and growing market confidence. The surge coincides with the Cardano network nearing 100 million transactions, highlighting its increased adoption and activity. Analysts attribute the rally to advancements in smart contracts and decentralized finance (DeFi) capabilities, which position Cardano as a strong Ethereum competitor. The network’s scalability and energy-efficient proof-of-stake model continue to attract developers and users. This historic transaction milestone, combined with optimism around upcoming upgrades and partnerships, has bolstered ADA’s price.

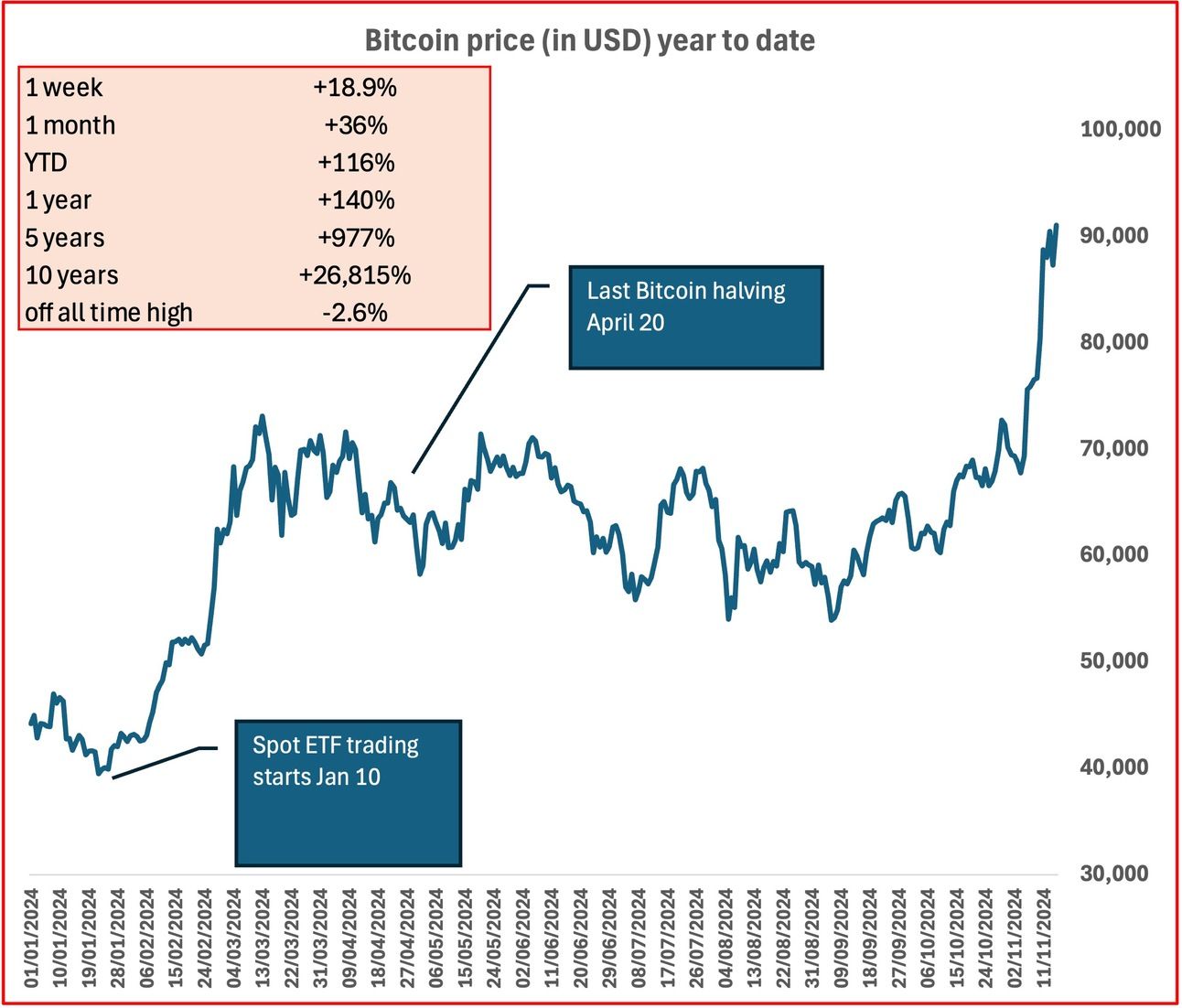

Tracking Bitcoin price (up to November 15):

Tracking Eth price (up to November 15):

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $303bn ⬆️ $2bn

Larry Ellison (Oracle) $224bn ⬇️ $4bn

Jeff Bezos (Amazon) $219bn ⬆️ $14bn

Mark Zuckerberg (Facebook/Meta) $191bn ⬇️ $12bnn

Bernard Arnault and family (LVMH) $158bn ⬇️ $6bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.