INSIGHT WEEKLY: August 18, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Major market indexes and stocks

Major market indexes:

Markets recovered after the turbulence of the previous two weeks. The impact of the Japan carry trades has stabilized. The carry traders were borrowing at low interest rates in Japan and investing in the US for higher returns. The risk for them is that the USD/JPY exchange rate could move against them.

However, the indications of the Bank of Japan (BOJ) are that there won’t be interest rate hikes in the near term. This has brought back some carry traders. Will we see a repeat of the volatility? There is a risk that history will repeat itself and create market volatility and instability.

What is the trigger? The USD JPY exchange rate. If JPY appreciates, the risk will amplify. There was an estimated $4 trillion of carry trades two weeks ago, of which 75% were said to have been unwound. The value of carry trades now is not known.

Why has the volatility in the markets decreased?

The VIX index shows volatility returning to usual levels after the events of the last two weeks. There is renewed interest in the large-cap tech stocks and also the Japan carry trades were mostly unwound.

In the meantime, Japan’s normalization effort is on hold as its interest rate is stuck at the exceptionally low level of 0.25%.

Markets v all-time high:

Small and medium-sized companies:

In the last few weeks, there was a shift away from large-cap stocks to medium and smaller cap as measured by the Russell 2000. This “broadening” has been limited, and large caps are rebounding (see below).

Magnificent 7:

Nvidia gains on increased confidence of growth in future earnings.

Major Semiconductor stocks:

Nvidia has recovered nearly all of its declines in the last month.

Longer-term investors know that the dips and blips happen regularly in the markets.

A quote from Charlie Munger:

"The big money is not in the buying and the selling, but in the waiting."

🇬🇧 UK

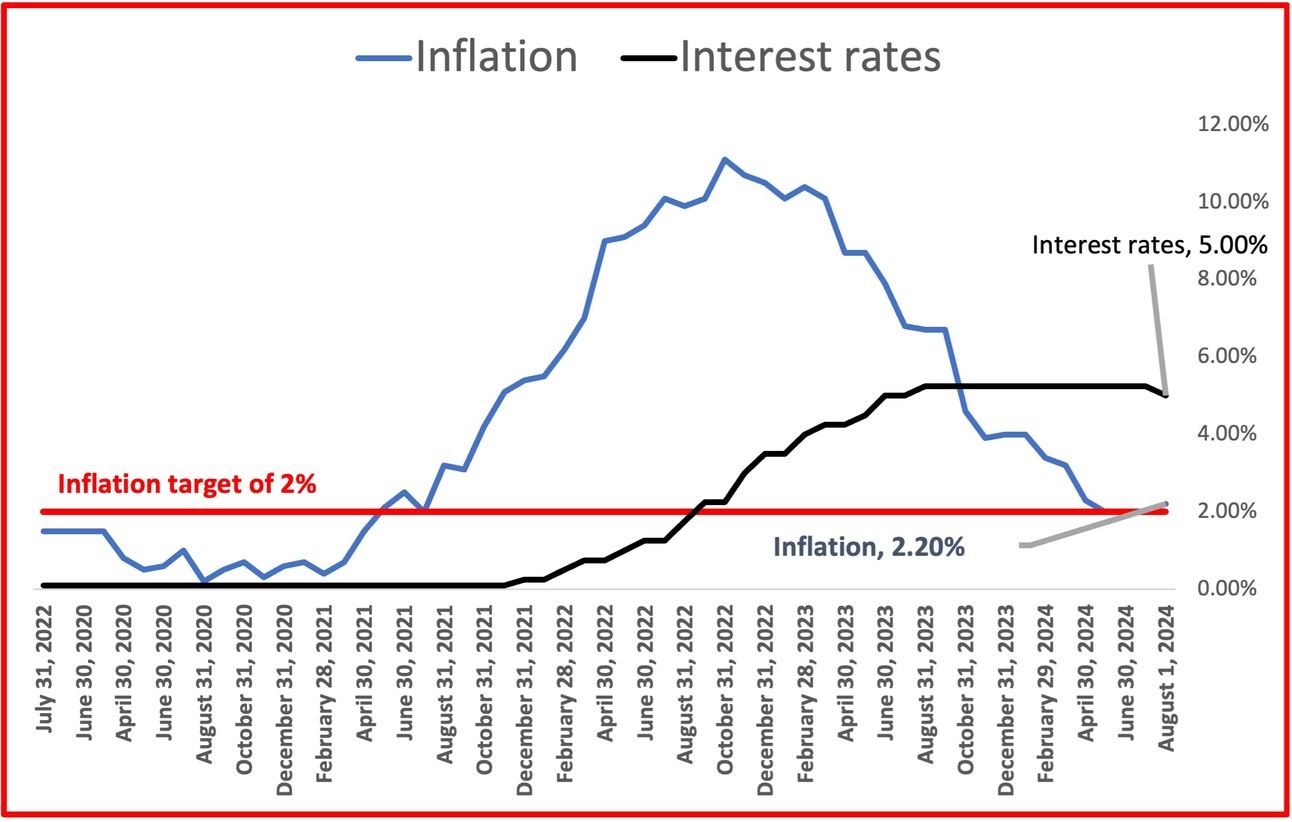

Inflation in July was a small uptick from 2% to 2.2%. Energy prices fell a year ago, so this uptick was expected. The Bank of England expects inflation to increase to 2.75% before falling again.

Interest rates will next be considered at the Bank of England meeting on September 19. Another set of inflation data will be available before this meeting. It will also have employment and wages data to review.

Growth was 0.6% between June and April as the economy continued its recovery after the recession at the end of last year. Growth was mainly in the services sector, specifically the IT industry, legal services and scientific research.

FTSE100 is +1.8% this week and +7.5% in the year to date.

🇺🇸 US

Retail Sales increased by 1% in July, the best in 18 months. The increase was across the board, the highest being in autos.

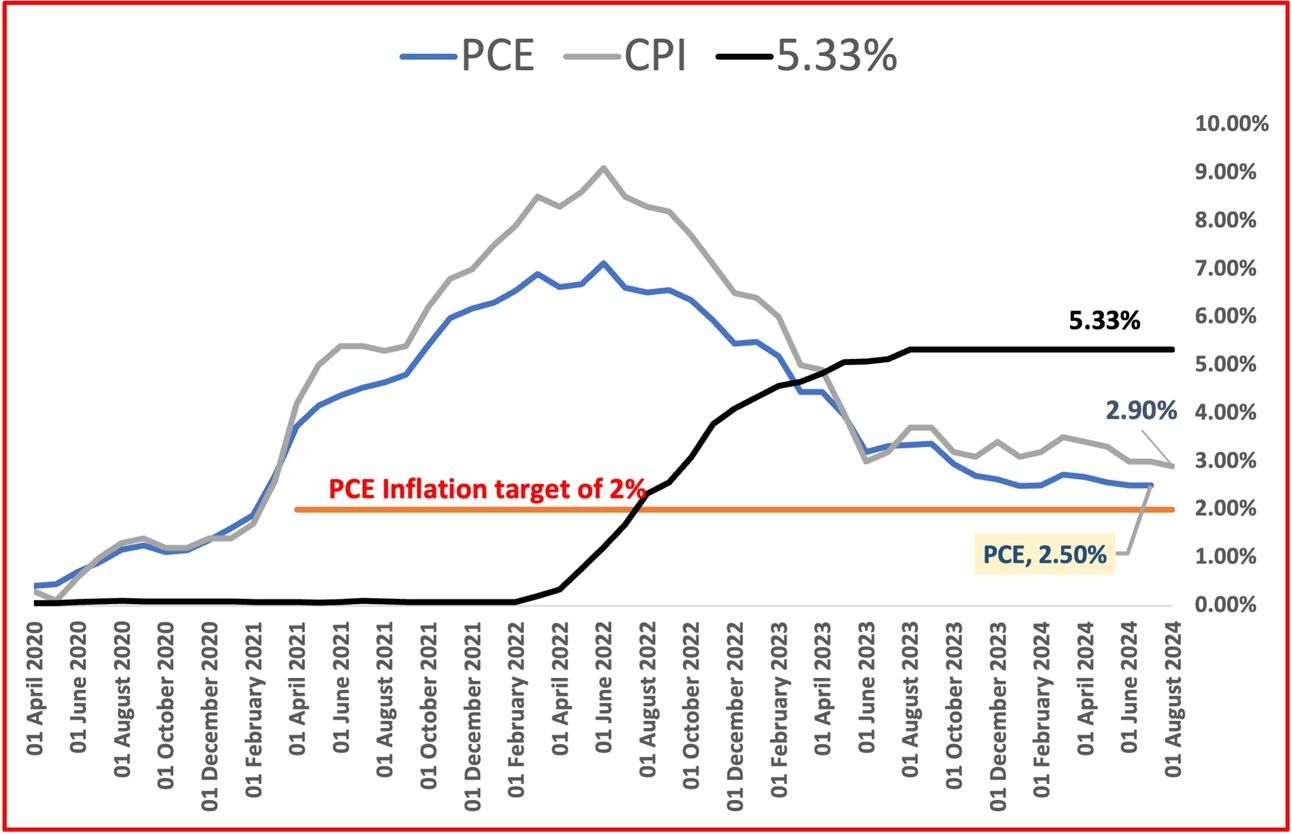

CPI inflation was 2.9% compared to a year ago, the lowest in three years. The Federal Reserve prefers the PCE inflation metric which comes out on August 30.

Rate cuts and the economy will be discussed at the Jackson Hole annual symposium next week. The consensus is that there will be a cut in September of 0.25%.

The next Fed meeting on interest rates is scheduled for September 17-18.

S&P500 is +3.9% in the week and +16.4% year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

Interest rate hikes are on hold say the Bank of Japan (BOJ). The market volatility, especially in the US, showed how the low Japan interest rate played a part in the carry trades.

The rate was increased to 0.25% from 0.1%. Japan had negative interest rates till March this year.

Yen ended the week at 149. The currency is only slightly weaker than at the end of last year. The BOJ has stopped interest rate hikes but will be hiked at some point in the future when market conditions allow at which point the Yen will start to appreciate.

Stock markets rebounded strongly with Nikkei 225 +8.7% in the week after the volatility in global markets during the previous two weeks.

Nikkei 225 Index is +8.7% in the week and +14% in the year to date.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Google has unveiled new Pixel phones with Gemini AI features. Calling it the “Gemini era”, Google has brought out new hardware designs and AI tools. These include the ability to search for information from a screenshot, and speaking to a “live” Gemini chatbot. Google has brought forward the announcement to the summer as the competition heats up. Apple plans to launch its version in September.

xAi launches Grok-2, as well as Grok-2 mini in beta mode. Grok-2 is reputed to have capabilities in coding, reasoning and chat, and image generation.

Intel and Softbank had planned to challenge Nvidia with a new chip but that plan has been dropped. Softbank had a plan for chips, software and data centers but the talk is that Softbank now thinking of collaborating with Taiwan Semiconductor Manufacturing Company (TSMC). As chipmaking is a large-scale endeavour, TSMC may be better suited.

See previous spotlight on AI chips

🌐 Crypto Corner

Tracking Bitcoin price (up to August 16):

Bitcoin declines despite net inflows into ETFs this month after outflows in previous weeks.

Tracking Eth price (up to August 16):

Ether has dropped 25% in the last month as interest in the ETFs wanes.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $222bn ⬆️ $22bn Tesla stock is +8% in the week

Jeff Bezos (Amazon) $195bn ⬆️ $9bn

Mark Zuckerberg (Facebook/Meta) $184bn ⬆️ $3bn

Bernard Arnault and family (LVMH) $184bn ⬆️$7bn

Larry Ellison (Oracle) $169bn ⬆️$6bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.