INSIGHT WEEKLY: April 13, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time. Stay ahead without the overload.

500+ professionals have subscribed to this magazine.

🌐 Markets Overview

📉 Markets This Week: Rebound or Just a Pause?

It has been two weeks of dramatic swings. And there could be more to come.

After last week’s steep losses, global markets bounced but did not recover all of the declines of the previous week. Investors are still absorbing the shock from the sudden tariff escalation, as well as the on/off policies on tariffs which have made the markets so volatile.

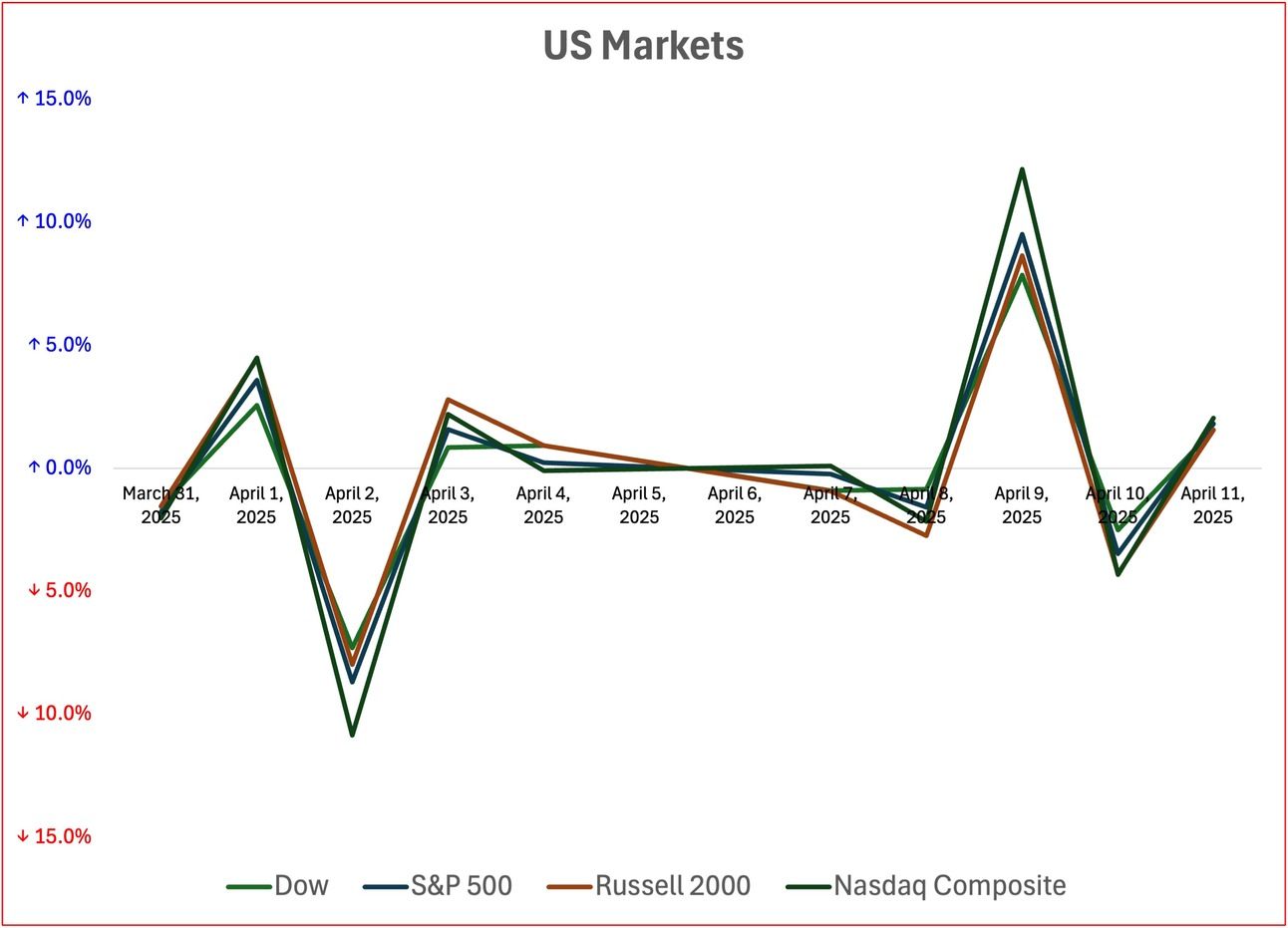

These charts show the volatility over the last ten trading days.

Meanwhile, U.S. Treasury yields surged past 4.5% on the 10-year note. A week ago, they were under 4%. Investors are clearly worried about inflation heating up again due to tariffs.

Gold rose nearly 6%, reinforcing its role as the go-to safe haven. It dropped last week.

What is causing these oscillations in global markets?

The changing tariffs policy in the US. It is unlikely that markets will go back to where they were in February. The S&P 500 has declined about 1,000 points since then. The issue of tariffs hangs over almost all markets.

Tech stocks:

Primarily a rebound, as these had been oversold.

🇺🇸 Tariffs summarized

Recent timeline:

April 2, 2025 (“Liberation Day”): President Trump announced a 10% baseline tariff on all imports, effective April 5. Additionally, higher “reciprocal” tariffs for specific countries were scheduled to take effect on April 9.

April 5, 2025: The 10% baseline tariff came into effect

April 9, 2025: While higher tariffs were set to be implemented, a 90-day pause was announced for most countries, maintaining the 10% rate. However, tariffs on Chinese imports were increased to 145%.

April 10, 2025: In response, China announced retaliatory tariffs of 125% on U.S. goods.

April 12, 2025: US excludes smartphones, computers, and some other electronic devices from tariffs.

✈️ For Travellers, Nomads, Freelancers & Global Professionals

I’ve used Wise for years to manage money across borders. It’s one of the few financial tools that truly gets international life right.

With Wise, you can:

Hold and convert 40+ currencies in one account

Send and receive money with the mid-market exchange rate with no hidden markups

Get local account details in major currencies:

GBP, USD, EUR, AUD, NZD, SGD, CAD, JPY, THB, VND, and more

Spend globally using the Wise debit card with no foreign transaction fees

(Affiliate link — using this link costs you nothing extra compared to going directly to Wise, but it helps support Insight Weekly.)

🧭 Macro Watch: This Week’s Economic Developments

🇺🇸 United States - Mood souring, despite market bounce

Consumer sentiment fell sharply in April, with the University of Michigan index plunging to 50.8, the weakest since mid-2022. Forward-looking expectations dropped to 47.2, while 1-year inflation expectations surged to 6.7%, the highest since 1981.

In this economic climate, it would have been surprising to see anything different.

Consumers like to see stability, falling inflation, and falling interest rates.

GDP growth forecasts have been revised down: economists now expect just 0.8% growth for Q4, with recession odds up to 45%. Bond yields are rising again, and the Fed faces a dilemma on its dual mandate - stimulate growth or contain inflation?

The Federal Reserve released minutes from the Fed’s March meeting show growing concern about downside risks to growth and jobs, alongside upside risks to inflation.

🇨🇳 China - Not backing down

After the U.S. spared most countries from blanket tariffs, China was notably excluded. In response, it imposed tariffs as high as 125% on certain U.S. goods.

China’s trade ministry framed the move as “protective, not provocative.” There are growing concerns that foreign capital will continue to retreat from Chinese equities and bonds, further challenging China’s efforts to stabilize growth.

🇯🇵 Japan: Yen strengthens amid sell-off in U.S. Treasuries

Concerns over rising volatility and recession risks in the U.S. triggered a flight to safety last week, boosting demand for the yen. The Japanese currency climbed JPY 143 against the dollar, from JPY 147 a week earlier.

Japan remains the largest foreign holder of U.S. Treasuries with over $1.1 trillion in holdings. Recent moves suggest selective rebalancing rather than a broad retreat.

🇪🇺 Eurozone - Watching the dollar

There were no major data releases this week, but eurozone policymakers are increasingly focused on interest rate differentials and their impact on the euro/dollar exchange rate.

However, this week, the euro gained nearly 4% against the dollar, so a stronger dollar is a longer term concern.

Meanwhile, the EU is still subject to the 10% U.S. blanket tariff, and although no retaliation has been announced, officials in Brussels are exploring options. Germany and France are among those most exposed to US bound exports, and pressure is building for a coordinated response.

🇮🇳 India: Tariff Risks Rise, but Core Exports Stay Resilient

India was included in the latest U.S. tariff package, with a 26% duty announced on selected goods — though enforcement is suspended until July 9. Among India’s top exports to the U.S. are electrical machinery, pharmaceuticals, precious stones and metals, and refined fuels. The gems and jewelry sector is especially exposed, both because it was explicitly targeted and because of its heavy reliance on the U.S. market. Other key sectors remain unaffected for now.

The Nifty 50 dipped slightly last week, and the Reserve Bank of India has eased policy with two rate cuts in 2025. India continues to attract long-term capital as a supply chain alternative to China.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

EU Bets Big on AI with €20 Billion ‘Gigafactories’ to supercharge its computing power.

The plan? To build massive infrastructure hubs packed with cutting-edge AI chips, rivaling what’s currently available in the U.S. and China. Each center is expected to house over 100,000 processors. Critics are already sounding alarms over the environmental cost, particularly the enormous energy and water usage required. The EU insists sustainability will be a core part of the buildout, but that’ll be closely watched.

Scale AI’s CEO Sounds the Alarm for America. Alexandr Wang, the 27-year-old founder of Scale AI, isn’t mincing words: he believes the U.S. is falling behind China in the AI arms race. In public remarks this week, he warned that while America still leads in research breakthroughs, China is rapidly catching up and pulling ahead in areas like deployment, infrastructure, and state-backed coordination.

China Leads in AI Paper Volume, Says Stanford Report. Stanford’s latest AI Index just dropped. It confirms a trend many have suspected. While the U.S. still leads in producing the most advanced models, China has now taken the top spot when it comes to raw research output. In 2024, China led the world in AI-related academic papers and patents. The report doesn’t suggest America’s slipping just yet as it still dominates in compute and high-performing models, but it does highlight how aggressively China is scaling its research machine. The global AI race isn’t just about tech, it’s also about talent, publishing, and policy too.

OpenAI Plans to Retire GPT-4. Yes, Already! In a surprising move, OpenAI confirmed that it will begin phasing out GPT-4 from its ChatGPT product. The same model that’s powered millions of queries over the past year is being sunsetted in favor of newer, more advanced models. The transition will likely roll out gradually, with power users getting first access to the next-gen model family. The shift also signals a deepening focus on model efficiency, reasoning capabilities, and integration across platforms.

OpenAI Countersues Elon Musk! The legal saga between OpenAI and Elon Musk took a sharp turn this week. After Musk sued OpenAI for allegedly straying from its nonprofit mission, OpenAI fired back with a countersuit, accusing Musk of launching a “sham” takeover bid and attempting to destabilize the company. The dispute dates back years, rooted in Musk’s 2018 departure and disagreements over OpenAI’s strategic direction. Now, the case is headed for a jury trial in 2026.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

The U.S. Department of Justice is closing its crypto-specific task force, the NCET. Instead of regulating the industry directly, the DOJ will now focus on crypto’s role in organized crime and terrorism. It’s a clear sign of a more hands-off federal stance on digital assets.

Ripple just made headlines with plans to acquire London-based prime broker Hidden Road for $1.25 billion. The deal would give Ripple deep access to traditional finance infrastructure — a major play to bring crypto and Wall Street closer together. Regulatory approval is pending, but it’s a bold signal of Ripple’s expanding ambitions.

Argentina’s Meme Coin Meltdown, $LIBRA, a meme coin hyped by Argentina’s President Milei, soared and then crashed. Now it’s under fire, with accusations of manipulation and investor losses piling up. Milei claims he had no direct involvement, but the political fallout is real.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.