INSIGHT WEEKLY: April 6, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes reading time. Stay ahead without the overload.

500+ professionals have subscribed to this magazine.

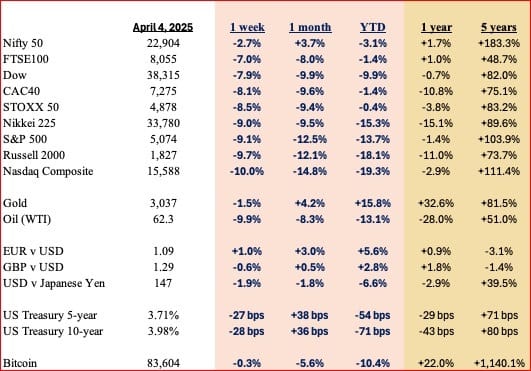

🌐 Markets Overview

Markets:

Tariff worries sent markets down around the world, as the US announced new tariffs on Wednesday, with China announcing retaliatory tariffs and other countries considering the next steps.

See the section below “Tariffs summarized”.

On Thursday, the market declines were the biggest since 2020, and there were further falls on Friday.

Some observations:

S&P 500 peaked at 6,111 just seven weeks ago. It has dropped around 1,000 points since then, 400 of which were in the last two days.

S&P 500 is almost at the same level as a year ago.

S&P 500 gains were around 20% per year in each of 2022, 2023 and 2024.

YTD 2025? It is nearly -14%.

The tech-heavy Nasdaq has dropped 10% this week and 19% this year.

Russell 2000, the smaller companies index is -18% this year.

There has not been a flight to gold during the last week, though YTD, it is up nearly 16%

But there has been a move to US Treasuries, with yields falling as bond prices increased as investors started to buy. Bond yields move in the opposite direction to bond prices. The “flight to safety” to Treasuries is common in times of uncertainty.

Markets relative to all-time highs

Nasdaq, Russell 2000, and India’s Nifty 50 are in bear market territory as these are less than 20% below all-time highs.

The other major markets are near or below correction levels as these are less than 10% below all-time highs.

Tech stocks:

The Mag 7 is being referred to by some as the “Lag 7”, as they now underperform the S&P 500 index.

Chip stocks have performed worse than the Mag 7 this year, with the exception of Intel which appears to be a recovery stock, especially with reports of a tie-up with TSMC to produce chips in the US.

Meanwhile, retail investors stepped into the recent market sell-off with conviction, setting a decade-high for single-day equity purchases on April 3. Platforms like JPMorgan reported nearly $4.7 billion in net buying, concentrated in familiar names like Nvidia and Amazon. This “buy the dip” activity reflects ongoing retail optimism despite broader market weakness driven by trade policy uncertainty.

Does history show that retail investors get the timing right?

Generally, no, as retail investors often enter late or exit early, especially during volatile times. While “buying the dip” can pay off, history suggests the average retail investor tends to misjudge turning points, especially when macro uncertainty is high.

What about day traders? Are they successful?

Rising markets bring on the resurgence of a particular breed of market participants - the day traders. The easy profits when markets rise can make day trading seem like a preferable option to working a regular job.

However, when markets fall or move sideways, profiting from day trading becomes very challenging. How have day traders performed over a longer period of time? This graphic shows the relative performance.

🇺🇸 Tariffs summarized

The US imposed tariffs of 10% on all imports and selective tariffs of half of the tariffs that any country is deemed to have applied to the US.

From a US perspective, these are the top 10 countries by import value:

From a country's perspective - these are the countries most reliant on the US as their biggest market.

How were the tariffs calculated?

President Donald Trump said that the calculation was simple: “Reciprocal - that means they do it to us, and we do it to them. Very simple. Can’t get simpler than that.”

Here is the calculation:

Take the bilateral goods trade deficit, divide it by total imports from that country, and then halve the result.

For China, a $292B deficit ÷ $439B in imports ≈ 66%, halved to produce a 34% tariff. And that’s on top of the existing tariff to get a total effective tariff rate of around 54%.

Economists criticized this as misleading since trade balances reflect complex factors like services, supply chains, and investment — not just goods flows. The method ignores actual sector-level dynamics and risks over-penalizing strategic partners.

The markets have given their take - tariffs will harm global trade and will not provide the stated benefits.

🧭 Macro Watch: This Week’s Economic Developments

🇺🇸 United States

The economic spotlight in the U.S. shifted to policy risk as sweeping new tariffs raised concerns about inflation and growth.

Meanwhile, the labor market added 228,000 jobs in March, but manufacturing showed signs of contraction with the ISM index falling below 50. Services remained solid.

Fed Chair Jerome Powell flagged “considerable uncertainty,” noting tariffs may slow the economy while lifting prices. The Fed is in a difficult position. Raise rates to counter inflation from tariffs and increase the recession risk. Cut rates to avoid the recessionary risk and spur inflation.

🇪🇺 Eurozone

The European Central Bank is likely to delay expected rate cuts, as policymakers weigh the inflationary impact of U.S. trade measures. March inflation eased to 2.2%, and unemployment hit a record low of 6.1%.

As previously mentioned, in Germany, fiscal policy is turning expansionary for the first time in years. The government is loosening its debt brake to invest in defense, green energy, and infrastructure — a significant shift in response to geopolitical and economic pressure.

🇬🇧 United Kingdom

The UK government revised its 2025 growth outlook, with the Office for Budget Responsibility now projecting just 1% expansion, which is half the previous forecast. The downgrade reflects weaker productivity, soft investment, and the impact of recent tax changes.

February inflation eased slightly to 2.8%, helped by falling clothing and footwear prices, though it remains above the Bank of England’s target.

Chancellor Rachel Reeves’ Spring Statement outlined further fiscal tightening and welfare reforms to address a £14 billion deficit, sparking criticism from anti-poverty groups. Planning reforms are expected to support housing supply, with projections for 1.3 million new homes by 2030.

🇯🇵 Japan

Japan is bracing for the impact of U.S. tariffs on its exports, particularly in autos and semiconductors.

Domestically, the country still faces low wage growth and lingering deflation. Although the Bank of Japan ended negative interest rates in March 2024, policy is expected to remain very accommodative.

Fiscal authorities are considering targeted stimulus to support household demand and small businesses.

🇨🇳 China

Beijing has criticized the new U.S. tariffs and may respond with targeted countermeasures.

While March data showed a slight rebound in exports and industrial output, domestic demand is still weak. The central bank is expected to maintain its supportive stance, and local governments have been instructed to accelerate infrastructure investment to boost momentum.

Caution remains high amid global trade friction and fragile consumer sentiment.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

OpenAI has reportedly secured new funding, with SoftBank providing $30 billion out of the $40 billion. This brings OpenAI’s valuation close to $300 billion.

This isn’t just a traditional funding round. How is it different?

It’s structured around compute capacity and AI chip partnerships, so that OpenAI can scale up its infrastructure quickly. Microsoft, already a key partner, is involved, along with other major tech investors. The deal was closed on Monday. OpenAI is planning for a life beyond ChatGPT. It plans to build the backbone for next-generation AI models and services.

Meta has just launched two powerful new AI models, Llama 4 Scout and Llama 4 Maverick.

Both are fully multimodal, meaning they don’t just handle text - they can work across video, images, and even audio.

Scout runs on a single Nvidia H100 GPU, making it accessible for developers and researchers without access to massive compute power.

Maverick is the heavyweight model, designed for more demanding tasks. Meta says this is its most advanced open-source release so far. A larger, even more capable version, Llama 4 Behemoth, is on the horizon.

Google DeepMind calls for AGI Risk Planning. DeepMind, Google’s AI research arm, has released a 145-page paper on what it calls one of the biggest challenges of our time: preparing for Artificial General Intelligence (AGI).

The paper isn’t about what AGI can do but it’s about what it might do, and what the preparation should be. This comes as major AI labs continue racing ahead, and DeepMind is making it clear that speed shouldn’t come at the expense of safety.

Is there a consensus on this? If so, is there a plan to implement an international agreement on this? Human minds are probably distracted by tariffs right now!

Bloomberg’s Chief Technology Officer, Shawn Edwards, shared something striking: AI might be able to automate as much as 80% of a financial analyst’s workload.

How?

By transforming how they work by freeing analysts from repetitive research tasks and letting them focus more on insights and decision-making. Bloomberg, long known for its data edge, is betting that generative AI will be a key part of the analyst toolkit going forward.

Get your free guide to AI

🌐 Crypto Corner

Top 10 cryptos:

More attention is being paid to stock markets rather than crypto markets but here are some important news.

Circle Files for IPO on NYSE This is a major milestone for the crypto industry. Circle is the issuer of USDC, the second-largest stablecoin, and its IPO would bring a core piece of crypto infrastructure directly into public markets. A significant move for stablecoin crypto firms.

Interest-Bearing Stablecoins is a potential game changer. If approved, it could re-ignite competition among stablecoins and shift where people hold their cash-like assets.

See the previous spotlight on Bitcoin halving

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.