INSIGHT WEEKLY: October 13, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Major market indexes and stocks

Major market indexes:

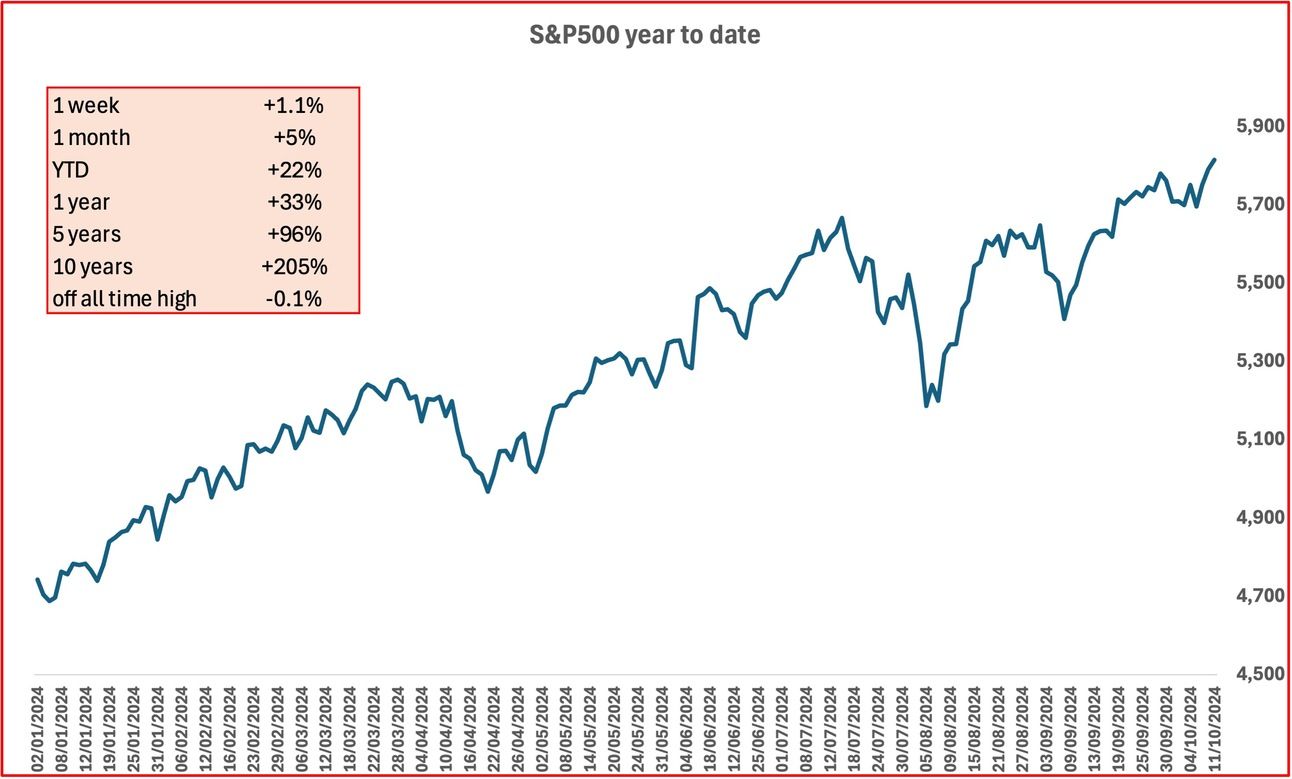

Markets gained with the S&P500 and the Dow making new records.

Nvidia gained 8% on renewed confidence, pushing the index higher.

Alphabet’s (Google) dropped 2% on the news that the Justice Department may force a breakup of the company.

Bank stocks rose as earnings decline are expected to be smaller than expected.

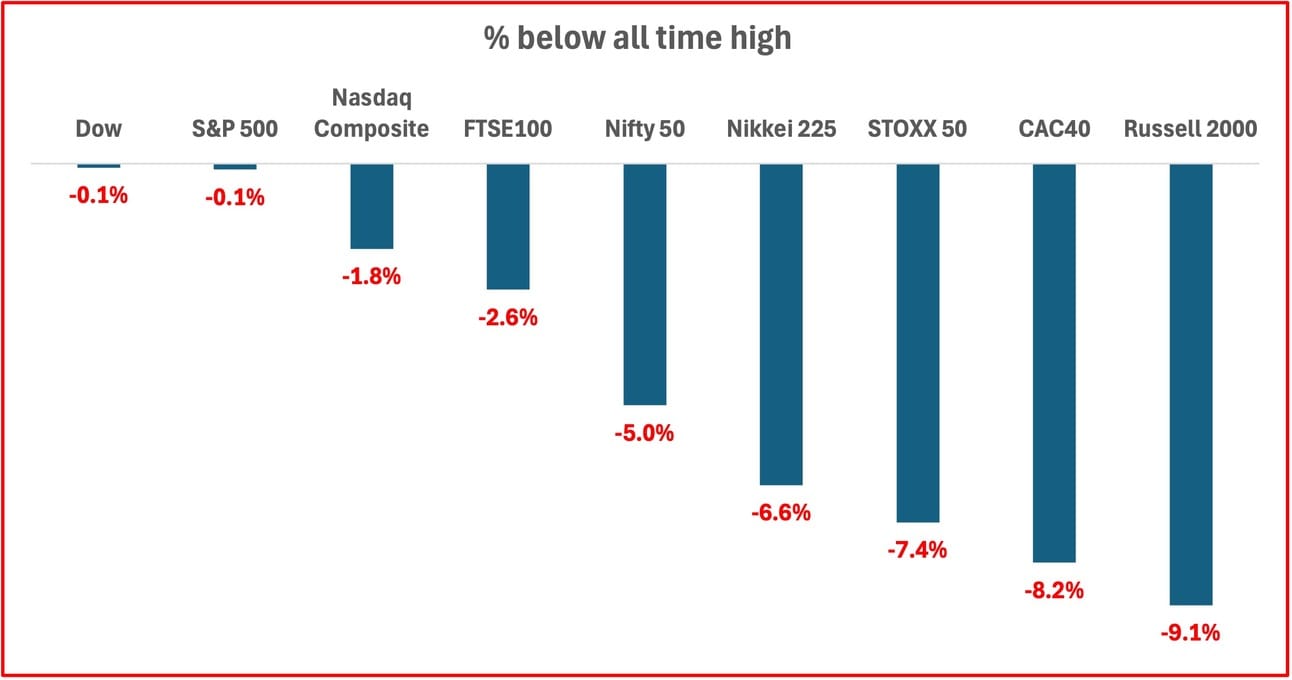

Markets v all-time high:

While the smaller companies (as in the Russell 2000) have benefited from the broadening of interest beyond the big-cap tech stocks, there is less rotation between the two groups as seen earlier.

S&P 500 :

Another record this week. That’s 45 records this year for the S&P 500.

What will the picture be in 12 months? In 24 months? A post AI hype, leveling out with single digit returns?

US smaller cap companies (Russell 2000):

A rising trend due to rebalancing and diversification away from tech-heavy portfolios.

Magnificent 7:

Nvidia is up on optimism of future earnings as analysts upgrade the stock.

Tesla drops as investors were unimpressed after the presentation on Robotaxi, and Robovan.

Major Semiconductor stocks:

Nvidia, ARM gain on analyst upgrades.

TSMC (supplier to Nvidia) reported a 40% increase in sales in September compared to a year ago.

🇺🇸 US

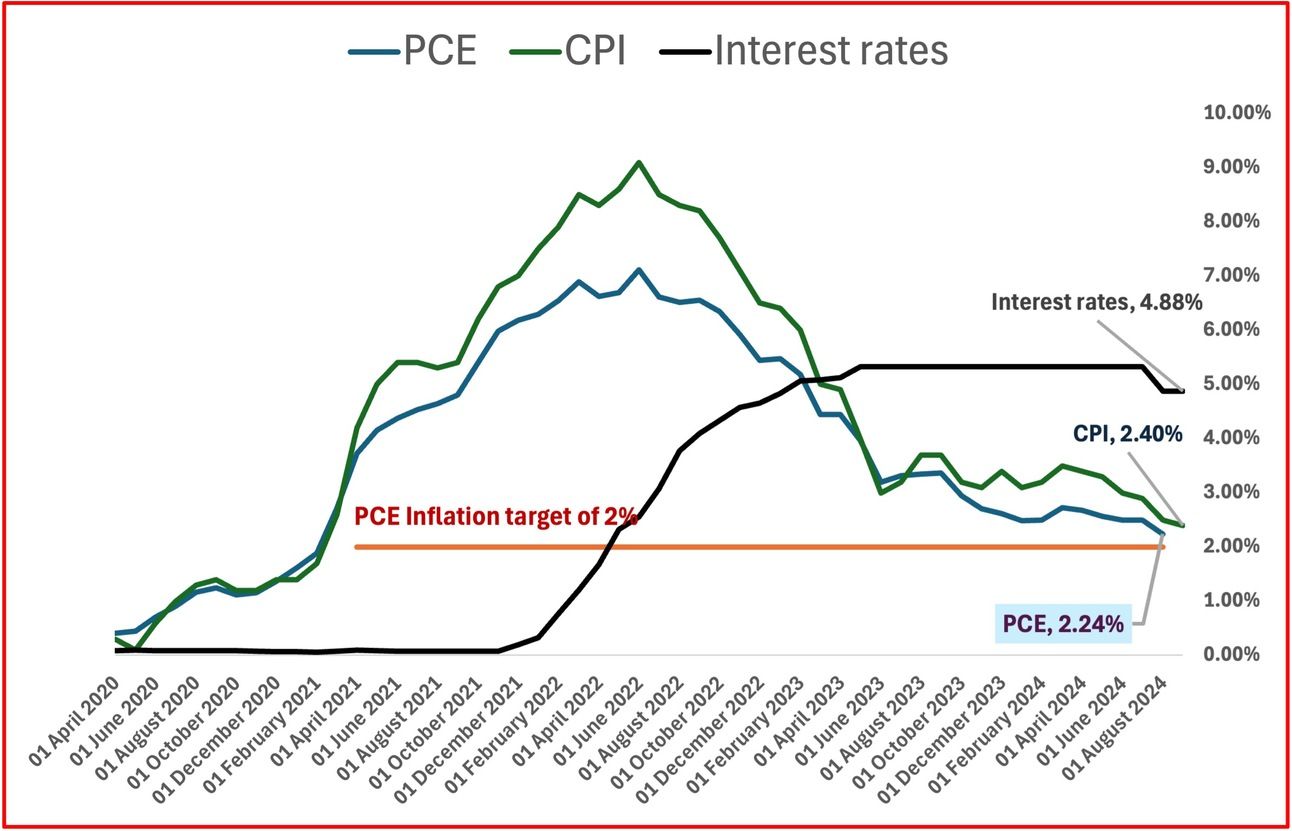

Inflation in the U.S. is returning to pre-pandemic levels, with the Consumer Price Index (CPI) rising by 2.4% year-over-year in September, marking the slowest growth since February 2021. This follows a 2.5% increase in August, and while it was slightly less than economists’ expectations of 2.3%, some inflationary pressures remain. Food prices, for instance, jumped 8.4% last month, mainly due to bird flu affecting egg supplies. However, shelter costs, which account for over one-third of the CPI, are easing, though they significantly contribute to overall inflation. Food and energy rose by 0.3%. Despite signs of improvement, the Federal Reserve faces a complex situation as inflation lingers in certain sectors. Moreover, external risks like geopolitical tensions and rising energy prices could disrupt the disinflationary trend, leaving the Federal Reserve to evaluate future interest rate cuts carefully.

Recession risk is fading. The talk has been about a soft landing. Is this likely? It is looking that way. Much depends on corporate earnings. The expectations are that these are likely to be encouraging. Growth in the quarter is estimated to be around 3%. Jobs growth has been good. Inflation outlook is promising. By most measures, the economy looks to be recovering well.

PCE (the preferred metric of the Federal Reserve) for September will be released on October 31.

The next Federal Reserve meeting on interest rates is scheduled for November 6-7.

S&P500 is +1.1% in the week and +21.9% year to date.

🇬🇧 UK

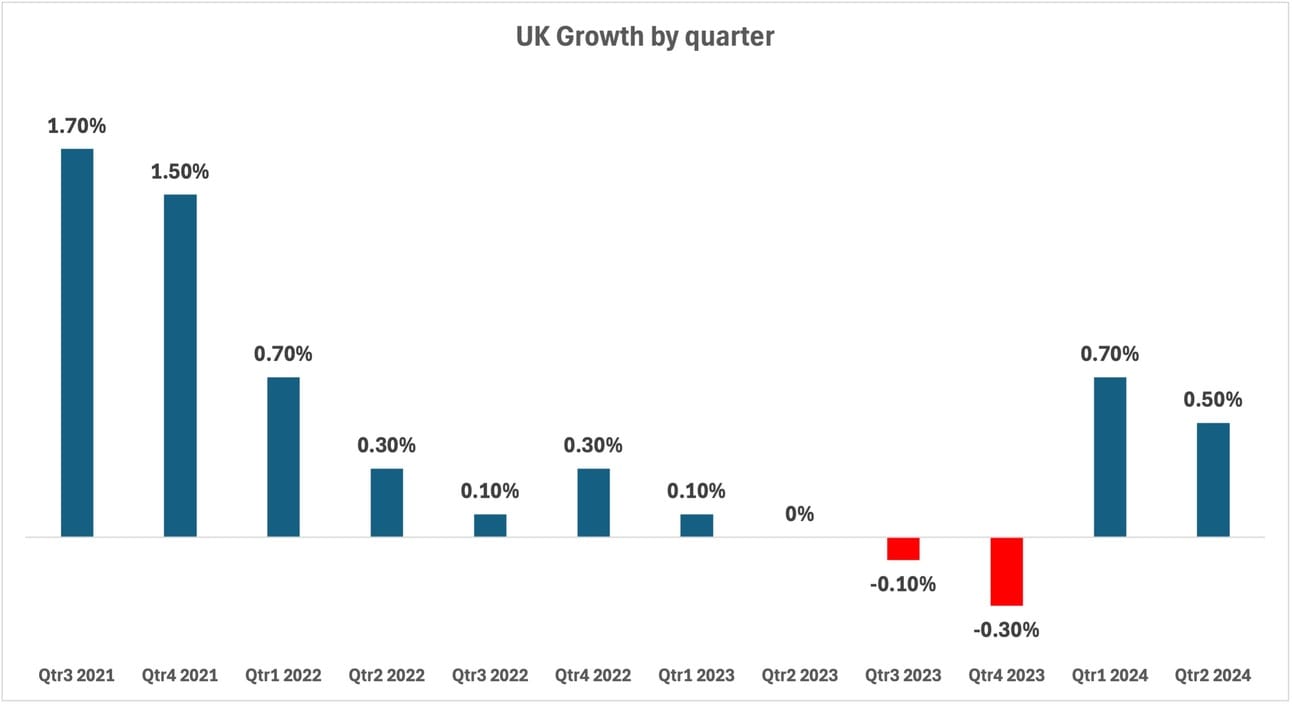

Growth in the UK is recovering after slipping into recession at the end of last year.

Full-year growth is expected to be 1.1% this year, which is faster than the OECD's previous estimate. This level of growth puts the UK in second place in the G7, tied with France and Canada.

UK interest rates are unlikely to fall in the short term. In the mortgage market, the rate reductions have ended, and lenders are likely to increase rates in the coming days and weeks. Just over a week ago, the Bank of England governor said that interest rates could be cut if “prices remain under control”.

FTSE100 is -0.3% this week and +6.7% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

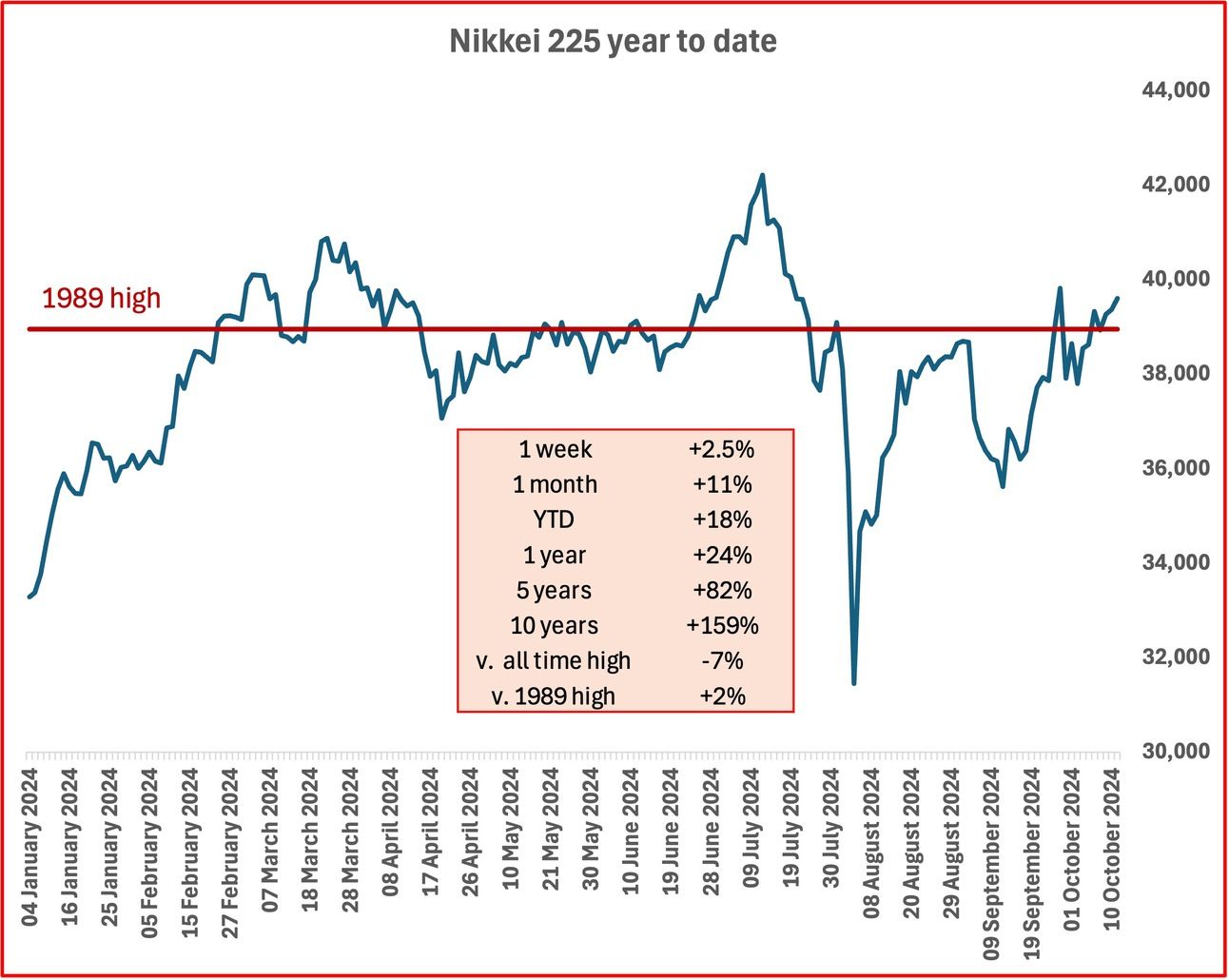

🇯🇵 Japan

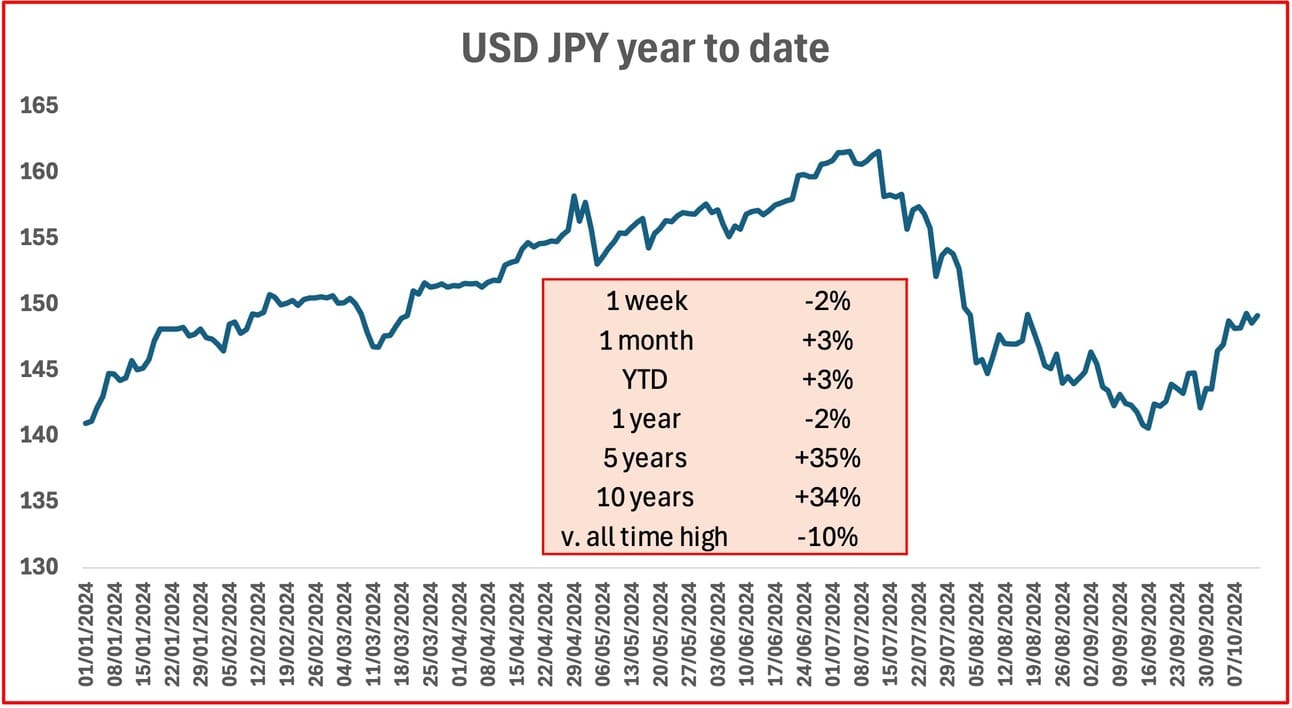

Wages in Japan fell in real (inflation adjusted) terms by 0.6% in August compared to last year. This has impacted the Bank of Japan’s deliberations in hiking interest rates.

Household spending decreased by 1.9% in August compared to last year. Though this was a lesser drop than expected, this does not help the BOJ to increase interest rates.

Stock markets continued to gain strength following earlier news of China’s stimulative actions on the economy and recent weakness in the yen.

Yen weakened a little in the last week.

Nikkei 225 Index is +2.5% in the week and +24% in the year to date.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

OpenAI is a nonprofit or for profit company? OpenAI, founded as a nonprofit in 2016 in Delaware, was originally focused on advancing AI to benefit humanity without prioritizing financial returns. The organization, which received a $10 million loan from its CEO Sam Altman, initially communicated to the IRS that it had no commercial ambitions and intended to make its research freely available. However, over the years, OpenAI’s mission has evolved, and it now operates as a for-profit entity, with recent valuations reaching $157 billion. OpenAI’s early goals, such as building AI to perform household tasks, have expanded significantly, resulting in innovations like ChatGPT and other advanced AI models. Although the shift to commercial partnerships and profit-driven activities has raised concerns, OpenAI asserts that these developments are aligned with its mission of using AI to solve global problems. Legal experts have noted that while the organization's structure has evolved, it continues to adhere to nonprofit regulations, though questions remain about the balance between its charitable and commercial goals.

Google has introduced a new search feature that allows users to search by taking a video, marking another significant step in integrating artificial intelligence (AI) into everyday tasks. With this feature, users can point their camera at something, record a video, and ask questions about it to receive search results. Initially available in English through the Google app on Android and iPhone, this tool leverages AI to analyze the video and provide answers based on the visual input.

This move follows Google's efforts to integrate AI into search, building on earlier updates like AI-generated search results and Google Lens for image-based queries. Despite some early issues with inaccurate AI responses, improvements have been made. The addition of video search demonstrates Google's commitment to evolving how people interact with information online, especially in light of increasing competition from companies like OpenAI, whose SearchGPT feature offers similar AI-driven search capabilities.

Additionally, Google has improved its shopping results and introduced a music-identifying tool as part of its broader push to enhance search functionality.

Anthropic CEO Dario Amodei’s positive view of AI?

He envisions a future where AI solves global challenges and brings unprecedented progress, but his optimism raises questions. In a recent essay, Amodei predicts that "powerful AI" — smarter than Nobel laureates and capable of automating most jobs — could emerge by 2026. He envisions this AI advancing medicine, curing diseases, and addressing major issues like climate change and world hunger. However, some claims seem overly ambitious, as current AI struggles with bias and implementation challenges.

Amodei acknowledges the risks of AI, including societal disruptions, yet offers limited solutions for the economic impacts of AI replacing human jobs. His essay suggests AI will improve civil society, but critics argue it may exacerbate inequalities and environmental harm. While Amodei positions AI as a technological accelerator, he omits key concerns about its broader consequences, leading some to question the timing of his claims, especially as Anthropic seeks further investment.

Get your free guide to AI

See previous spotlight on AI chips

🌐 Crypto Corner

Tracking Bitcoin price (up to October 11):

Bitcoin is leveling out on low volume.

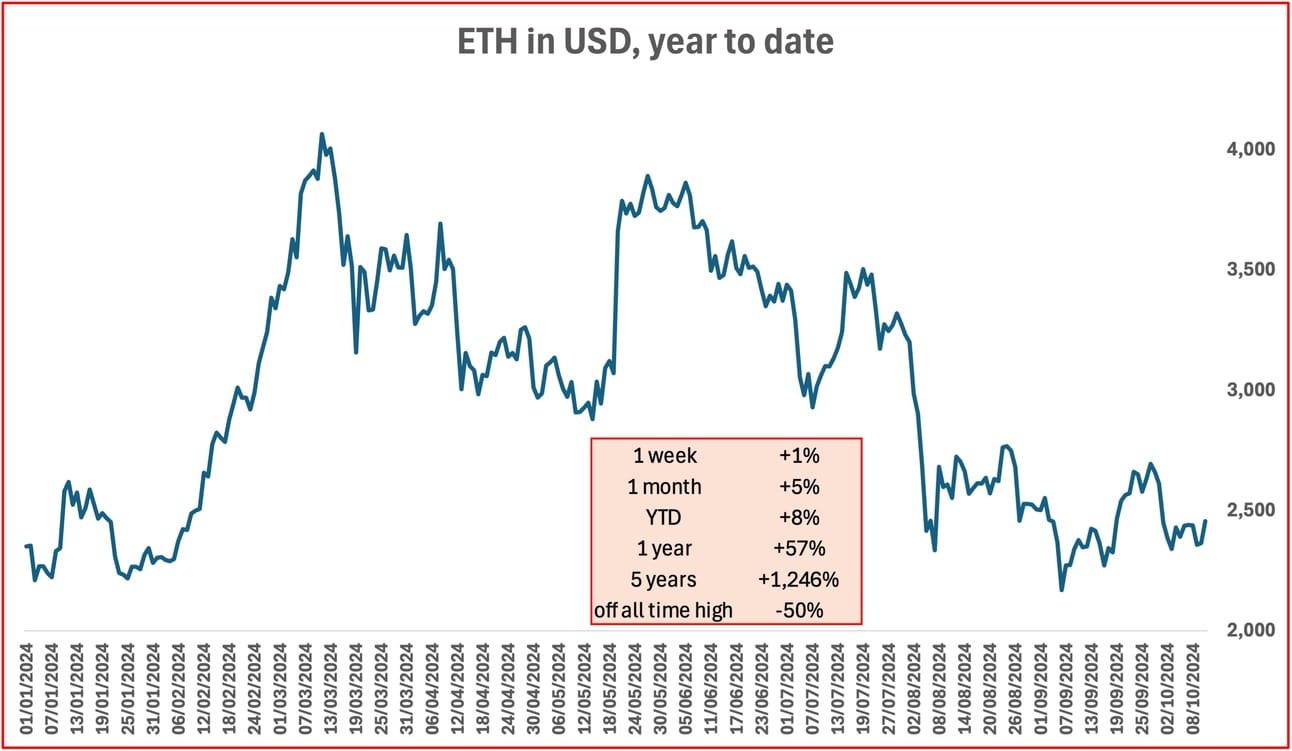

Tracking Eth price (up to October 11):

Ether at key support level and at risk of sell off.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $245bn investors unimpressed by Robotaxi, Robovan event. Tesla is down over 12% in the week.

Larry Ellison (Oracle) $212bn

Jeff Bezos (Amazon) $206bn

Mark Zuckerberg (Facebook/Meta) $204bn

Bernard Arnault and family (LVMH) $182bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.