INSIGHT WEEKLY: July 28, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Major indexes and major stocks

Major market indexes:

There has been rotation in the markets in the last few weeks, as funds moved out of large companies into medium and smaller sized companies.

Why is there a rotation?

The big stocks are starting to look expensive and the stock price performance between these stocks and the rest of the market is diverging. This divergence is the largest in 20 years.

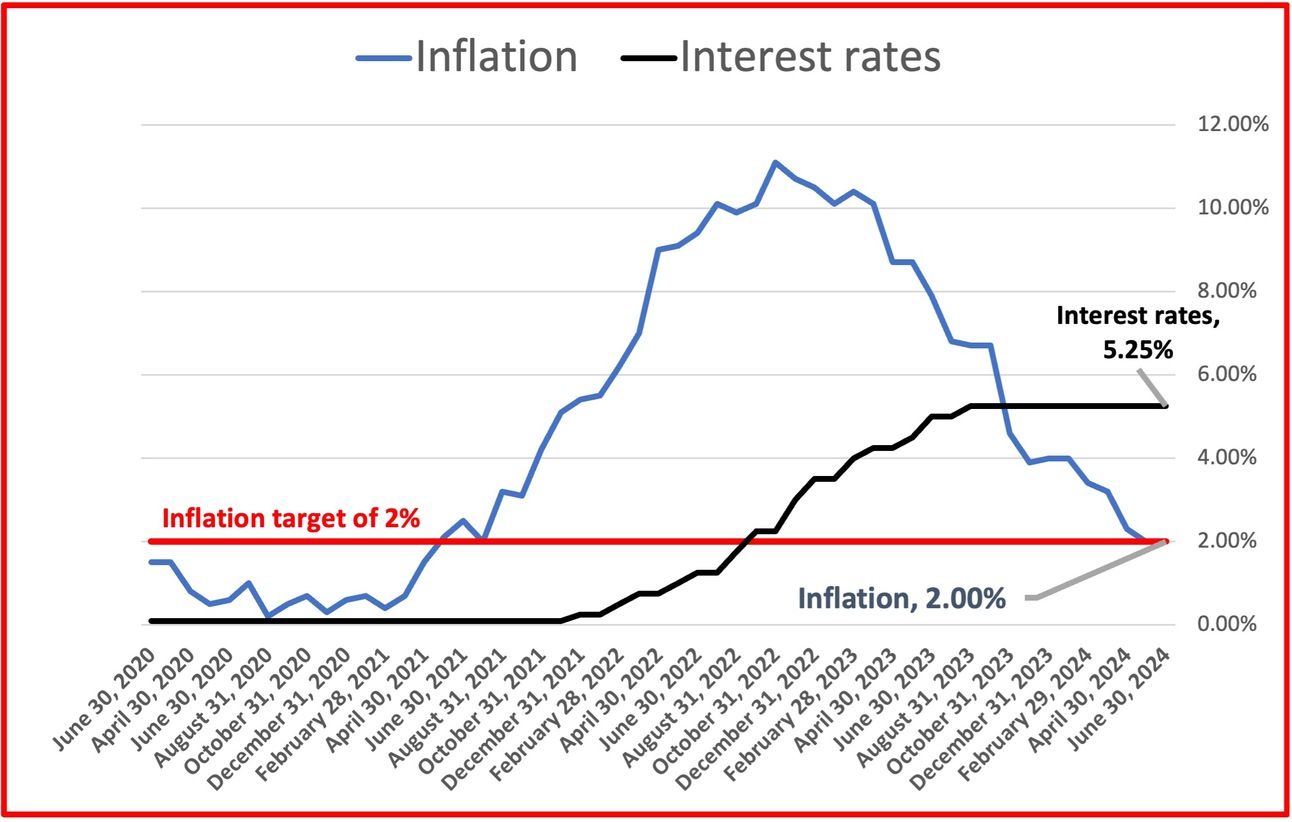

Also as inflation comes down, interest rates are expected to be lowered. There is also more growth expected in the economy. This combination tends to be good for more traditional stocks.

This rotation has resulted in an increase in the Russell 2000, an index of smaller and mid-sized companies.

But the Russell 2000 would have been a mediocre investment (v the S&P500) over the last few years.

Magnificent 7:

All of the Magnificent 7 declined in the week due to rotation.

Tesla declined the most after announcing a profit decline of over 45% due to price cuts for its cars. There was not much interest among investors in its Optimus robots or Robotaxis at this time.

Alphabet (owner of Google and YouTube) dropped due to falling advertising revenue.

Major Semiconductor stocks:

Nearly all of the major chip stocks continued to decline in the week due to fears of a US-China “chip war” and also the rotation, though there was a rally on Friday.

PHLX Semiconductor index (SOX):

A wider “capitalization-weighted” index composed of the 30 largest semiconductor companies traded on US exchanges.

There has been a rotation out of chip stocks and fears of a US-China trade war.

Highest value companies (market capitalization) in $ trillion:

🇬🇧 UK

Public finance audit results will be announced by the end of July say the new government. There has been speculation that there is a deficit of £20 billion which may lead to tax rises.

Interest rates may be cut when the Bank of England (BOE) meets on August 1st. With a low growth rate and inflation at target, the BOE has good reason to consider a cut in August. Experts think that savers could lock into a good rate now, while borrowers may be better off waiting.

FTSE100 is +1.6% this week and +7.1% in the year to date.

🇺🇸 US

Growth data released last week shows that the economy grew by 2.8% (annualized) in the second quarter, which was above expectations. Most of the increase was due to increased inventories and government spending.

Inflation data now shows a slight improvement. PCE (the preferred inflation metric of the Federal Reserve) is 2.5%, getting closer to the targeted 2%. Last month was 2.56%. This will increase pressure and encourage the Fed to cut interest rates, but this may not happen till September.

What about the 2% inflation target? It is not going to be achieved anytime soon. The Fed may cut interest rates in any case, balancing inflation and labor market priorities.

Housing market slump continues. The Commerce Department data shows 617,000 new homes sold, which was below the 640,000 expected.

S&P500 is -0.8% this week and +14.5% this year.

If you like this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

As in many global markets, Japan has gone through a trend reversal in the last few weeks.

Yen continues its strength after many months of weakness. Against the dollar, it ended at 154 on Friday, but still an 11% decline in the year to date. Has there been government intervention to support the currency? Probably earlier in the month.

Inflation was a little higher at 2.2%. Japan has been in a low inflation/low interest environment for a long time. Normalization efforts are going on currently. With the uptick in inflation, and with the prospect of an interest rate hike, the currency has strengthened.

Stock markets weakened further, as tech stocks continued to experience selling pressure following the declines in US tech stocks. The Nikkei 225 is now back below its 1989 high.

Nikkei 225 Index is -6% in the week and +12.6% in the year.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Meta announces Llama 3.1, which Mark Zuckerberg called “the first frontier-level open source AI model”. Will open source AI transform AI?

Zuckerburg’s contention is that open source AI will make AI safer by increased transparency and scrutiny.

There are three models the 405B, 70B, and 8B. Meta have stated that the more advanced 405B was trained for several months using over 16,000 Nvidia H100 GPU’s!

This is Meta’s introduction of their Llama 3.1

https://ai.meta.com/blog/meta-llama-3-1/

SearchGPT is a new prototype from OpenAI. This is in beta testing with some news publishers. Could this challenge Google’s search engine?

Elon Musk is claiming that he is training “the world’s most powerful AI by every metric” by December. A new xAI supercomputer is being built in Memphis with over 100,000 liquid cooled Nvidia H100 GPU’s on a single RDMA fabric. RDMA (remote direct memory access) allows highly efficient data sharing between computers.

This supercomputer, “a gigafactory of compute” is expected to draw a lot of energy from the local power grid, causing concern among local residents.

🌐 Crypto Corner

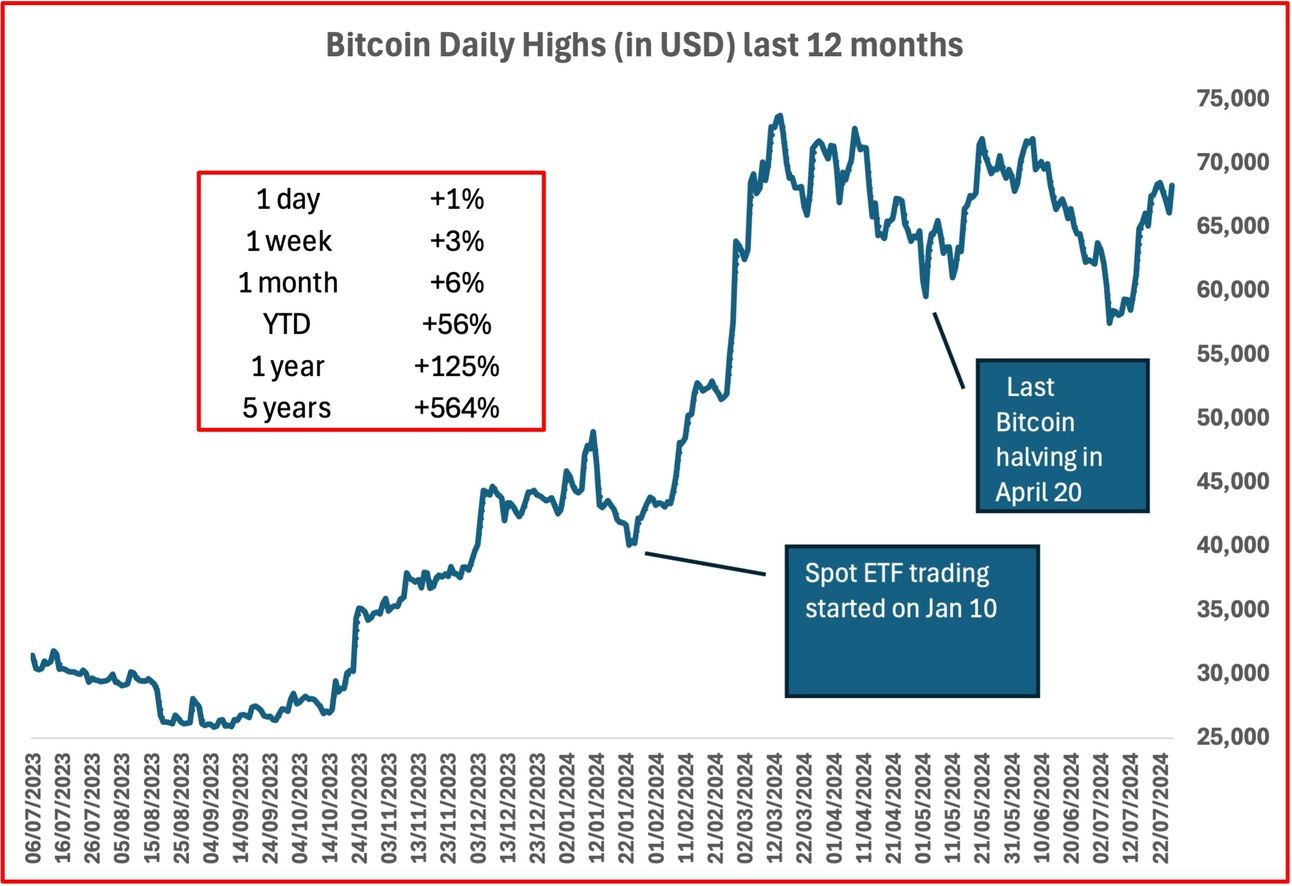

Tracking Bitcoin price:

Bitcoin experienced volatility after presidential contender Donald Trump spoke at the Bitcoin conference in Nashville. He announced the setting up of a national reserve of Bitcoin as a strategic asset if he wins the race for the White House.

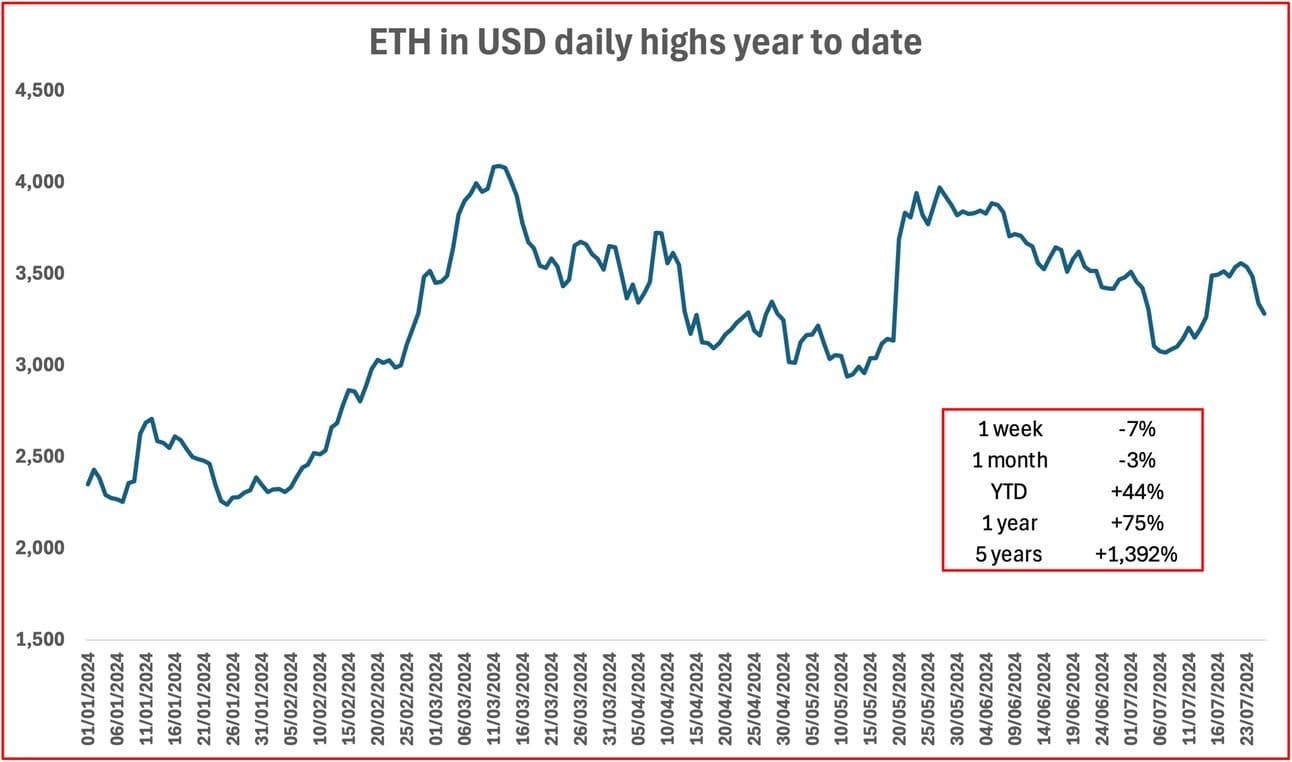

Ether ETFs have launched but there has not been the same level of enthusiasm seen during the Bitcoin ETFs.

see the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $233bn ⬇️ $11bn

Jeff Bezos (Amazon) $200bn flat this week

Bernard Arnault and family (LVMH) $183bn ⬇️ $4bn

Larry Ellison (Oracle) $171bn ⬇️ $1bn

Mark Zuckerberg (Facebook/Meta) $163bn ⬇️ $4bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.