INSIGHT WEEKLY: September 1, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Major market indexes and stocks

Major market indexes:

Two new records as the Dow and India’s Nifty 50 hit new highs on Friday.

Markets continue to recover following good inflation and growth numbers in the US this week.

Markets v all-time high:

US Small and medium-sized companies:

Market “broadening” to smaller companies has stabilized with no sign of reversal back to large-cap companies.

Magnificent 7:

Growth of Magnificent 7 to July 2024:

Nvidia has grown to become the third-largest company.

Major Semiconductor stocks:

Intel rose 7% in the week, after a dismal 2024, as it works with bankers on new options.

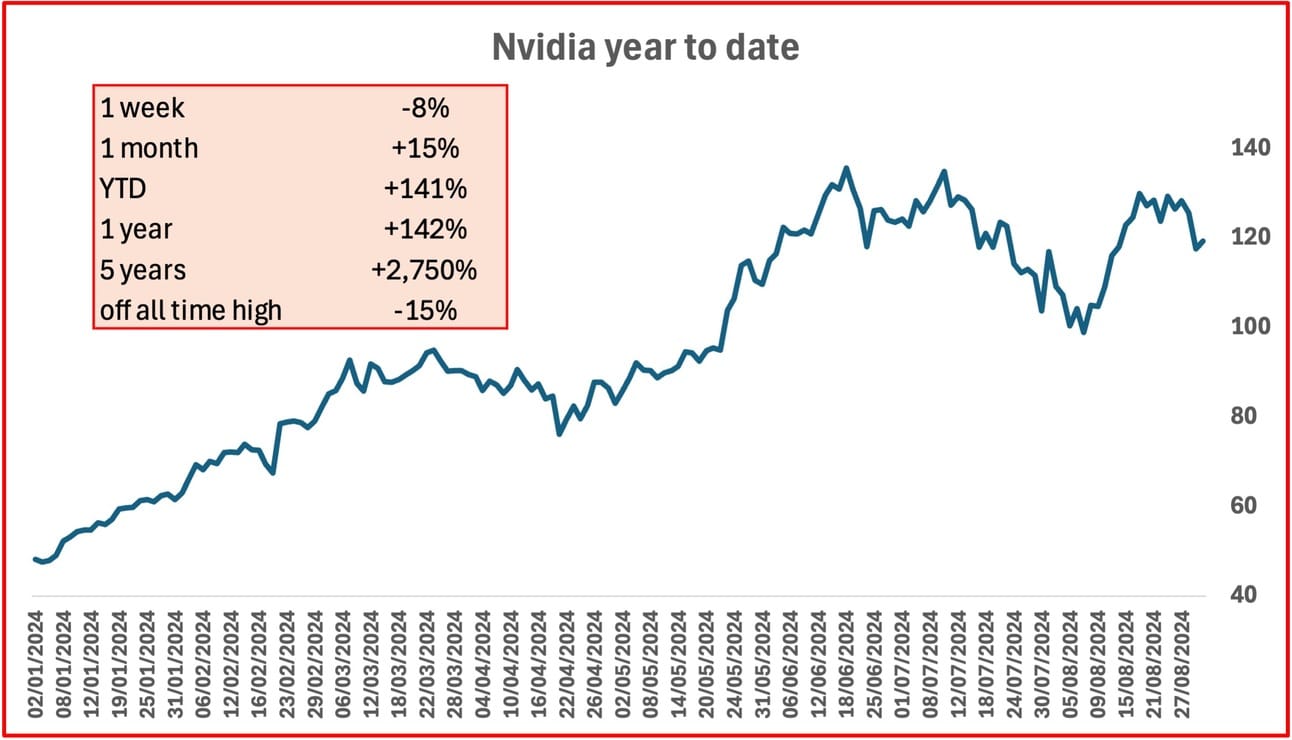

Nvidia dropped 8% in the week after good results beat expectations and news of a share buyback. Investors were not impressed and were expecting even better results, as well as assurance of the future. Such is the hype around Nvidia!

🇬🇧 UK

Inflation coming down? UK shop prices started disinflating for the first time in 3 years. The reasons - poor sales and bad weather. The British Retail Consortium said that shop prices were by -0.3% in August compared to +0.2% in July. The main drivers were non-food costs as retailers discounted stocks, so this may be a one-off, though it is welcome news for hard-pressed consumers.

Housing market optimism as net mortgage approvals increased to 61,985 in July, the highest level since September 2022. Net lending was GBP 2.7m, the highest level since November 2022. Also Nationwide Building Society’s house price index rose to 2.4% (annual) in August, rising from 2.1% in July.

Budget to be announced on October 30 will be “painful” says Prime Minister Starmer. This is understood to mean that public spending will be cut and taxes will be raised. The increased taxes will likely be on capital gains, inheritance, and possibly pensions.

FTSE100 is +0.6% this week and +8.3% in the year to date.

🇺🇸 US

Interest rate cut in September is looking more likely. This cut is expected to be 0.25%.

The next Federal Reserve meeting on interest rates is scheduled for September 17-18.

At the last meeting of the Fed, some members were warming to the idea of a cut, and that sentiment is likely to increase further.

Inflation, as measured by PCE (preferred metric of the Fed), was released on Friday, August 30. It rose by 0.2% in July in line with expectations, and the year-on-year increase was 2.6%. Not yet at the target of 2%, but hitting the target appears to be less important currently for the Fed as it now emphasizes the dual mandate of managing inflation and maximizing employment. The point is that inflation is under control at current levels, so managing employment becomes an increasing priority.

Personal incomes and personal spending both increased in July over June.

Housing appears to be weak. The National Association of Realtors reported Thursday that pending home sales had decreased to 5.5% in July, the lowest level in records since 2001.

US dollar has weakened over the last month as interest rate cuts in the next few months appear more likely.

S&P500 is +0.2% in the week and +18.4% year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

Inflation (CPI) in Tokyo, a keenly watched metric, rose 2.4% year on year in August.

Interest rates may need to rise. This increase in inflation brings back the need for “normalization” in Japan but the Bank of Japan (BOJ) had previously indicated no rate hikes in the near future to help stabilize global markets. The BOJ has said that it will not rush to raise rates but it looks like it will need to. Raising the rate will be risky at home and abroad. Not doing so will also be risky with inflation setting in and rising each month.

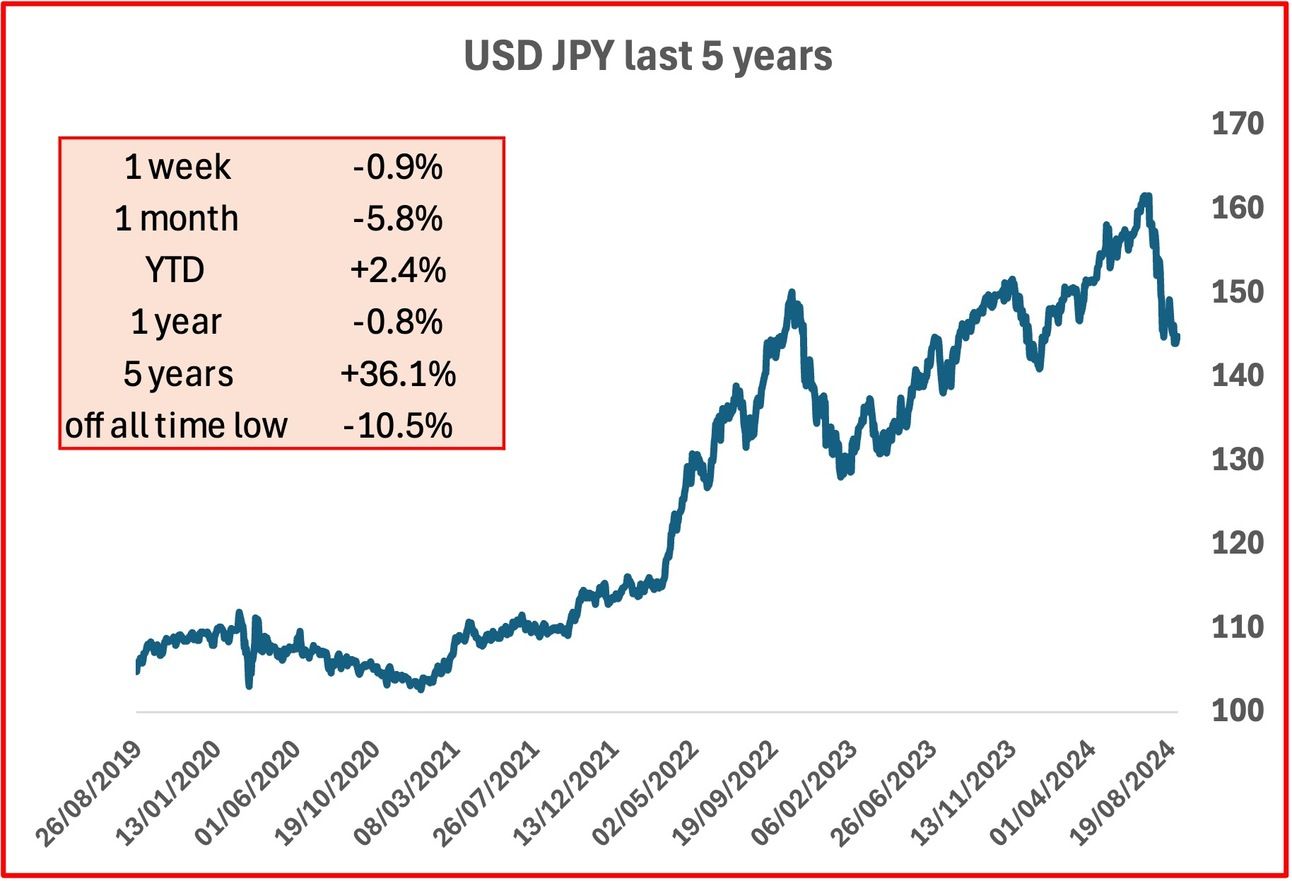

The practice of “carry trades” of investing in US stocks by borrowing cheaply in Japan will re-occur if interest rates in Japan remain low.

What will the BOJ do?

Yen ended the week at 145.

The Japanese government intervened before to support the Yen.

The prospect of interest rate increases in the future and the weakness of the dollar (see the dollar index chart above) will make the Yen stronger v the dollar.

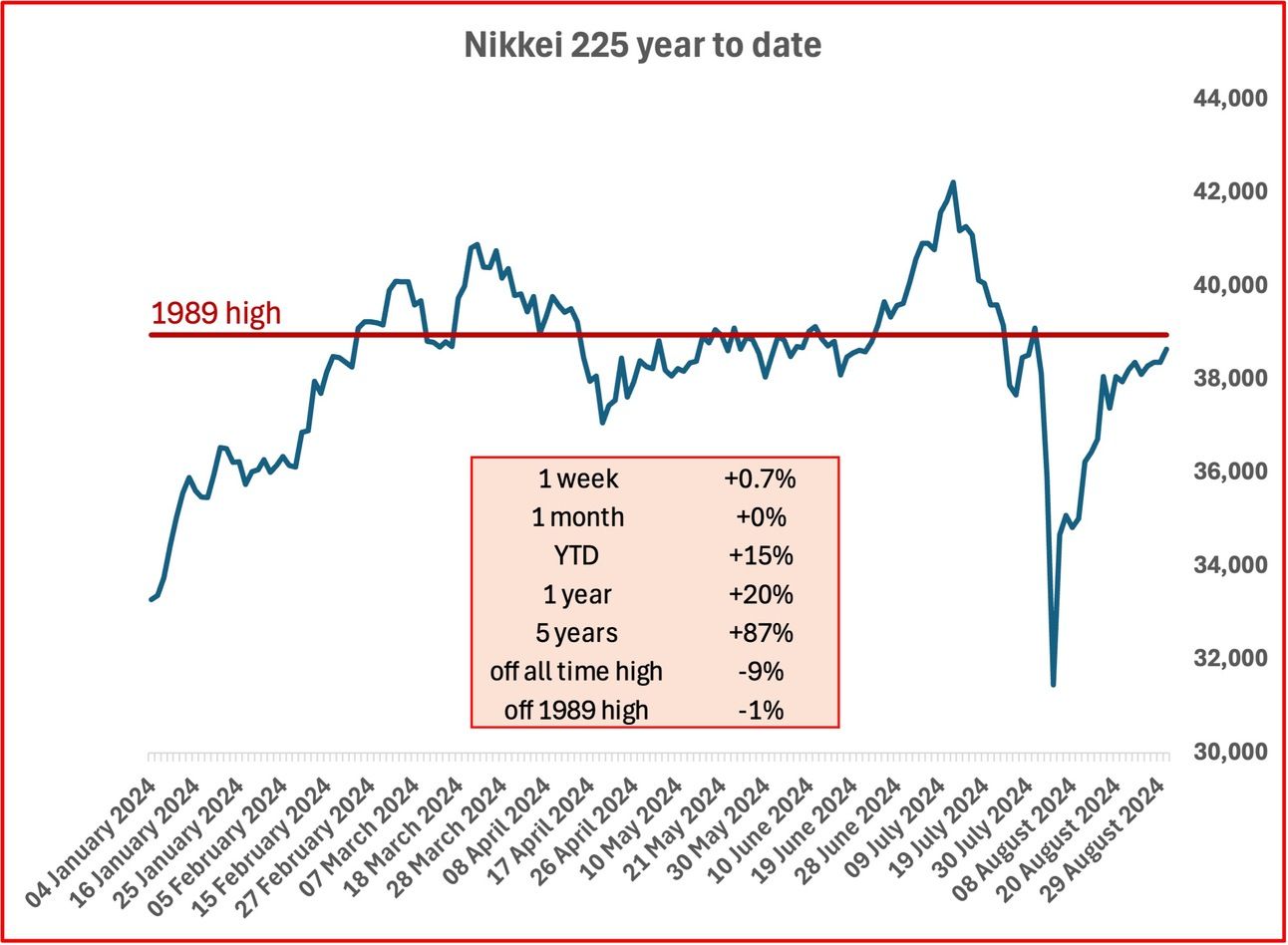

Stock markets stabilizing, with Nikkei 225 getting closer to the 1989 high. Japan stagnated for 34 years since 1989.

Nikkei 225 Index is +0.7% in the week and +15.5% in the year to date.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Nvidia's slowing growth and production concerns hit its stock price. It dropped 8% this week. It is still up 141% this year. While revenues of $30bn have more than doubled in the quarter compared to the same period last year, the concerns are about the future.

The next generation chip called the Blackwell (with 208bn transistors) will be delayed by several months. The previous indication was that it would contribute to revenue this year but the delays push the revenue into 2025. The Blackwell chips will be manufactured by TSMC, the Taiwanese company that builds the most advanced chips. TSMC is building samples that are being distributed to key customers. Will future results match the hype?

(see Nvidia stock price chart above)

Cerebras, an AI hardware startup, has unveiled a new AI inference solution that could challenge Nvidia's dominance in the enterprise market. Utilizing their Wafer-Scale Engine, Cerebras claims their tool achieves impressive speeds of 1,800 tokens per second on Llama 3.1 8B and 450 tokens per second on Llama 3.1 70B, outperforming Nvidia’s GPUs in both speed and cost-efficiency. As AI applications expand within enterprises, the focus is shifting from training to the cost and speed of inferencing, creating opportunities for companies like Cerebras. However, despite its performance advantages, Cerebras faces challenges due to Nvidia’s established presence in the industry. Enterprises may hesitate to adopt Cerebras’ system, given the need to adapt their engineering processes. As the AI hardware market grows, Cerebras will also compete with specialized cloud providers and hyperscalers like AWS, Microsoft, and Google. The future of AI inference may hinge on the balance between performance, cost, and ease of implementation.

Plaud has a new product. It is a wearable pin - called the NotePin. It is a note-taking device, and is able to record meetings, take note dictation and have these notes transcribed by OpenAI’s GPT4o. It costs $169 with free and paid subscriptions for transcription. Plaud already has the PlaudNote which attaches magnetically to your phone and even has recording of phone conversations automatically if enabled.

See previous spotlight on AI chips

🌐 Crypto Corner

Tracking Bitcoin price (up to August 30):

Bitcoin is in a range of 60,000 to 65,000 and dropped below 59,000. Global uncertainties and ETF outflows are the main reasons.

Tracking Eth price (up to August 30):

Ether price is also stuck in a price range with little enthusiasm among investors following the earlier ETF launch.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $243bn ⬇️ 4bn

Jeff Bezos (Amazon) $197bn ⬆️$2bn

Bernard Arnault and family (LVMH) $189bn ⬇️ 4bn

Mark Zuckerberg (Facebook/Meta) $180bn ⬇️ 2bn

Larry Ellison (Oracle) $174bn ⬆️$2bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.