INSIGHT WEEKLY: September 29, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

The next newsletter will be on October 13, 2024

🌐 Major market indexes and stocks

Major market indexes:

Markets made gains on new stimulus measures in China and AI prospects. China cut interest rates and injected liquidity to increase growth to the target of 5%.

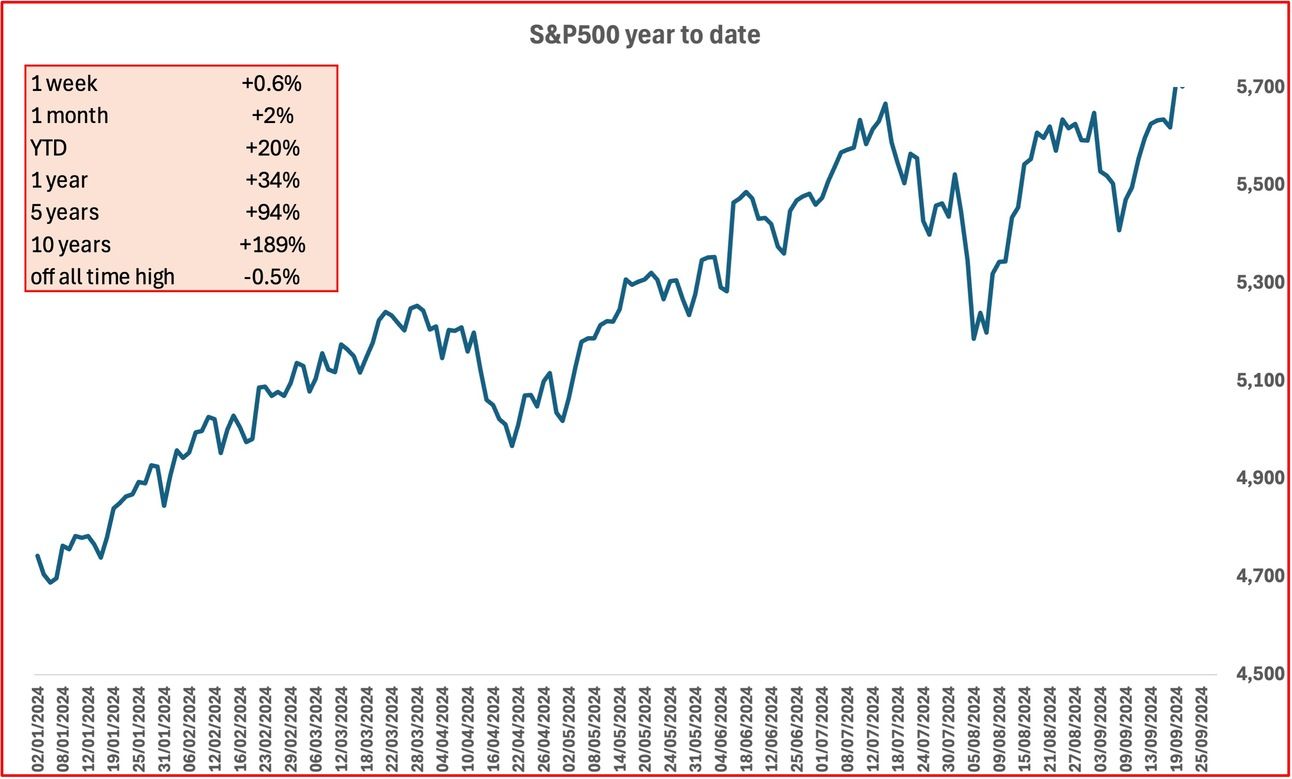

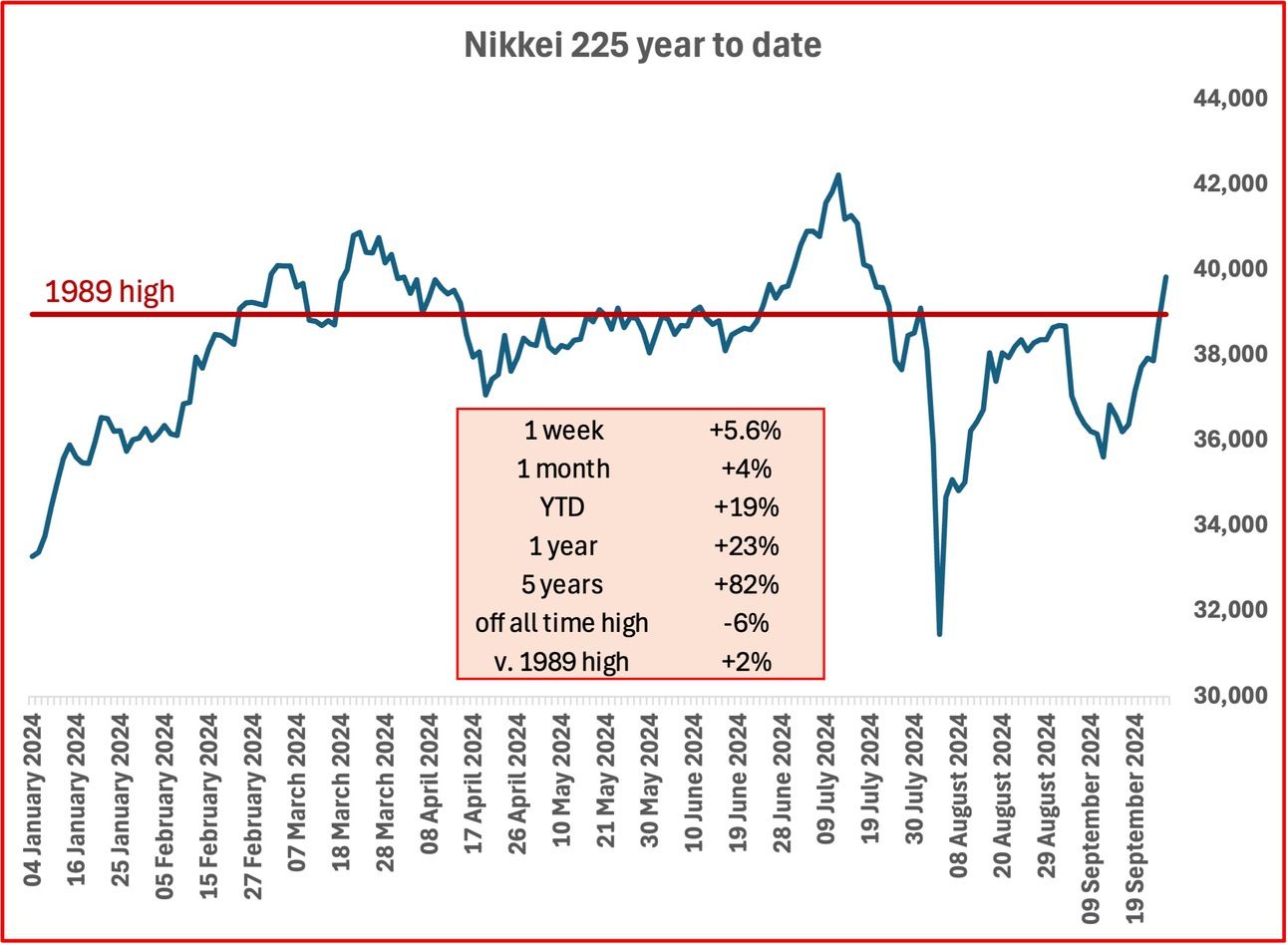

S&P 500, Dow, and India’s Nifty 50 again set new records during the week. Nikkei 225 breaks 1989 high.

Markets v all-time high:

S&P 500 :

Large-cap stocks outperform the smaller-cap Russell 2000 by 2X in the year to date.

US smaller cap companies (Russell 2000):

Magnificent 7:

Tesla gains on expectations of Q3 deliveries and the Robotaxi reveal in October.

Nvidia is up on news that CEO Jensen Huang has ceased sales of his shares in the company.

Major Semiconductor stocks:

Intel gains on take-over, break-up, and deal rumors.

🇺🇸 US

Interest rates are expected to be cut at the Federal Reserve meeting. There is increasing pressure for another cut of 0.5%. The Fed has a dual mandate, but now the focus is shifting to the labor market rather than inflation.

Recent data in the form of PCE (the Fed's preferred metric) shows inflation drifting lower.

The next Federal Reserve meeting on interest rates is scheduled for November 6-7.

S&P500 is +0.6% in the week and +20% year to date.

🇬🇧 UK

Growth in the UK is now predicted to be 1.1% this year, which is faster than the OECD's previous estimate. This level of growth puts the UK in second place in the G7, tied with France and Canada.

This is partly due to a more stable political situation and government support for the economy. The rate cut of 0.25% by the Bank of England is expected to help.

However, challenges of rising inflation and geopolitical risks lie ahead. The government is considering changes to its fiscal rules to give itself more flexibility in its budget plans.

UK interest rates outlook remains uncertain. Inflation is expected to linger for some time but if there is another cut in interest rates, it will most likely be later in the year.

FTSE100 is +1.1% this week and +7.6% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

Stock markets gained this week on news of China’s stimulative actions on the economy. Also, comments from the Bank of Japan pushed the market higher.

The Nikkei 225 is now back up above the 1989 high, which preceded 35 years of stagnation in the Japanese economy.

Interest Rates. The Bank of Japan (BOJ)’s governor Kazuo Ueda, said that the BOJ has enough time to assess conditions before hiking rates, signaling that rate hikes are not imminent.

Inflation may be slowing down. The Tokyo-area core consumer price index (CPI) rose 2.0% year on year in September, down from 2.4% in August. This metric is often considered to be a leading indicator of inflation in the country.

Yen weakened a little in response to the interest rate outlook.

Nikkei 225 Index is +5.6% in the week and +19% in the year to date.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

OpenAI, the company behind ChatGPT, is raising another $6.5 billion, according to a report in the Wall Street Journal. This new funding round could close very soon. It appears to be related to the change from a non-profit to a for-profit company. Investors can pull their money out if this doesn't happen within two years.

The article says that while OpenAI has made a lot of money, it has some issues. It's still losing billions, experiencing technical delays, and has a “burn-out” culture.

Sources close to Bloomberg are quoted as saying that Sam Altman is about to be given a 7% stake in the company that could be worth $10 billion.

There have been recent high-profile departures from the company.

Google's new AI, AlphaChip, has revolutionized chip design by using reinforcement learning to create layouts for computer chips in hours, as opposed to the months it traditionally took. Already, Google has used AlphaChip to design several generations of its Tensor Processing Units (TPUs) and is now collaborating with MediaTek to extend this technology to mobile devices.

Get your free guide to AI

See previous spotlight on AI chips

🌐 Crypto Corner

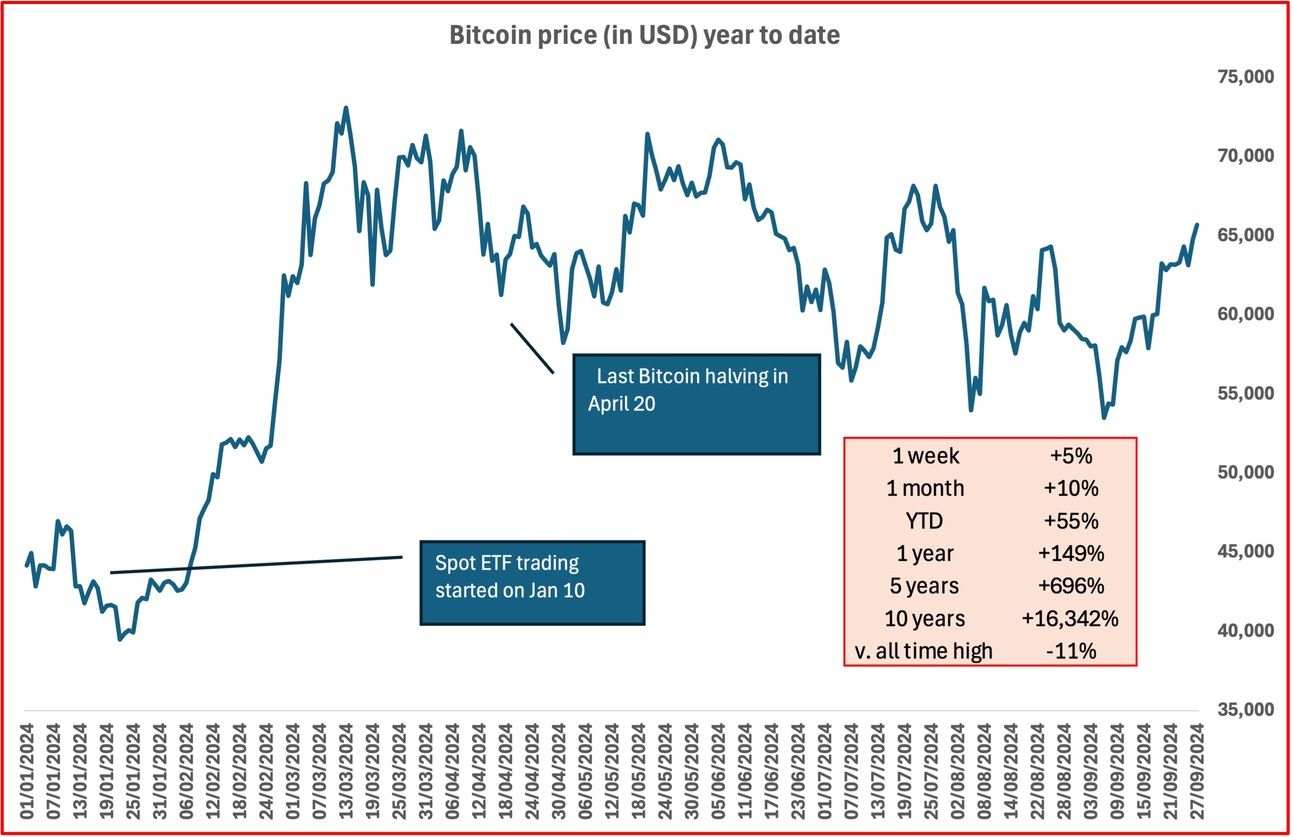

Tracking Bitcoin price (up to September 27):

Bitcoin gains 5% in the week, due to inflows and the China stimulus rally.

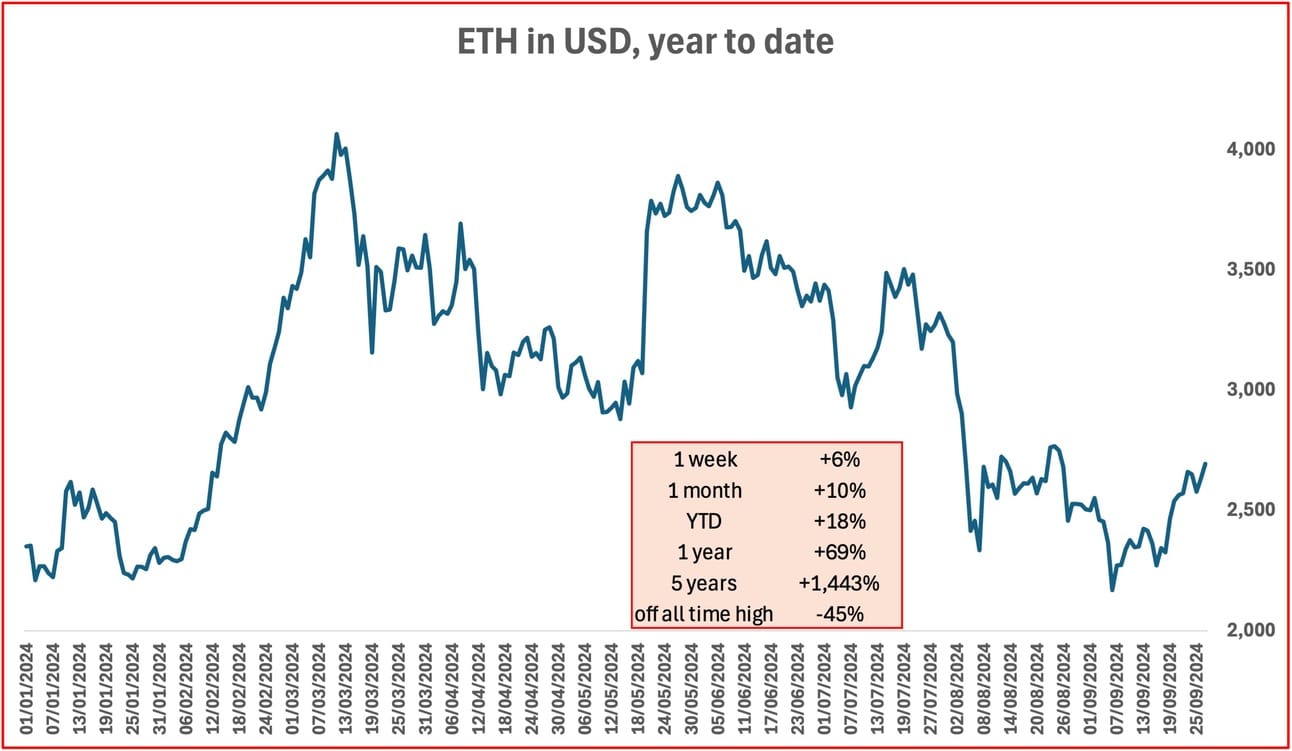

Tracking Eth price (up to September 27):

Ether mirrors Bitcoin’s rise.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $269bn ⬆️ $12bn as Tesla gains 9%

Larry Ellison (Oracle) $206bn ⬆️ $2bn up one place

Jeff Bezos (Amazon) $205bn ⬇️ 4bn down one place

Bernard Arnault and family (LVMH) $199bn ⬆️ $31bn up one place. LVMH gains over 20% in the week on China stimulus news

Mark Zuckerberg (Facebook/Meta) $196bn ⬆️ $2bn down one place.

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.