INSIGHT WEEKLY: November 3, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Markets Overview

Major market indexes:

Nasdaq Composite set a new record this week after good earnings from Meta, Amazon, and Microsoft, though ending the week 1.5% lower. It is not clear how the markets will react to the election results next week.

Markets v all-time high:

Are the markets leveling off after the August and September uptrend?

S&P 500:

Magnificent 7:

Major Semiconductor stocks:

US smaller cap companies (Russell 2000):

Gold keeps rising, and breaking another record this week.

🇺🇸 US economy

Jobs data provided mixed signals this week. The number of job openings fell to 7.44 million in September—the lowest since January 2021—while voluntary job quits, a key labor market indicator, remained stable. October payroll data was particularly affected by external disruptions, including Hurricanes Helene and Milton in the South, and the strike at Boeing.

Payroll firm, ADP reported a surprising 233,000 increase in private-sector jobs, twice consensus estimates.

However, the Labor Department’s overall nonfarm payroll data showed minimal change, with only 12,000 jobs added in October—the smallest gain since December 2020. The Boeing strike contributed to a significant decline of 44,000 transport equipment manufacturing jobs, and limited growth in other sectors did not offset this loss. Despite the lower job additions, average hourly earnings rose by 0.4%, slightly above expectations.

Manufacturing activity in the U.S. continued to decline in October, with the Institute for Supply Management’s (ISM) PMI dropping to 46.5—its lowest in 15 months and marking the seventh consecutive month below the 50-point threshold, which indicates contraction. Persistent weak demand, caution around potential inflationary pressures, and ongoing concerns about federal monetary policies have led companies to limit capital and inventory investments. The ISM’s survey also revealed a rise in prices for manufacturing inputs, with the “prices paid” index climbing to 54.8, the highest since December 2023.

The ongoing Boeing strike, which halted production, notably impacted manufacturing output and contributed to reduced industrial production. New orders saw a slight improvement, though output continued to contract, largely due to the strike's effects on Boeing’s supply chain. Factory employment showed minor gains but remained low overall, reflecting the broader downturn in manufacturing conditions.

10 year yield continues to rise. This is the seventh consecutive week of increases in the yield. Are bond vigilantes at work? Some consider the Federal Reserve’s earlier 0.5% rate cut as premature.

Bond vigilantes sell bonds, pushing yields higher, as a protest against massive deficits.

Interest rates:

The next Federal Reserve meeting on interest rates is scheduled for November 6-7.

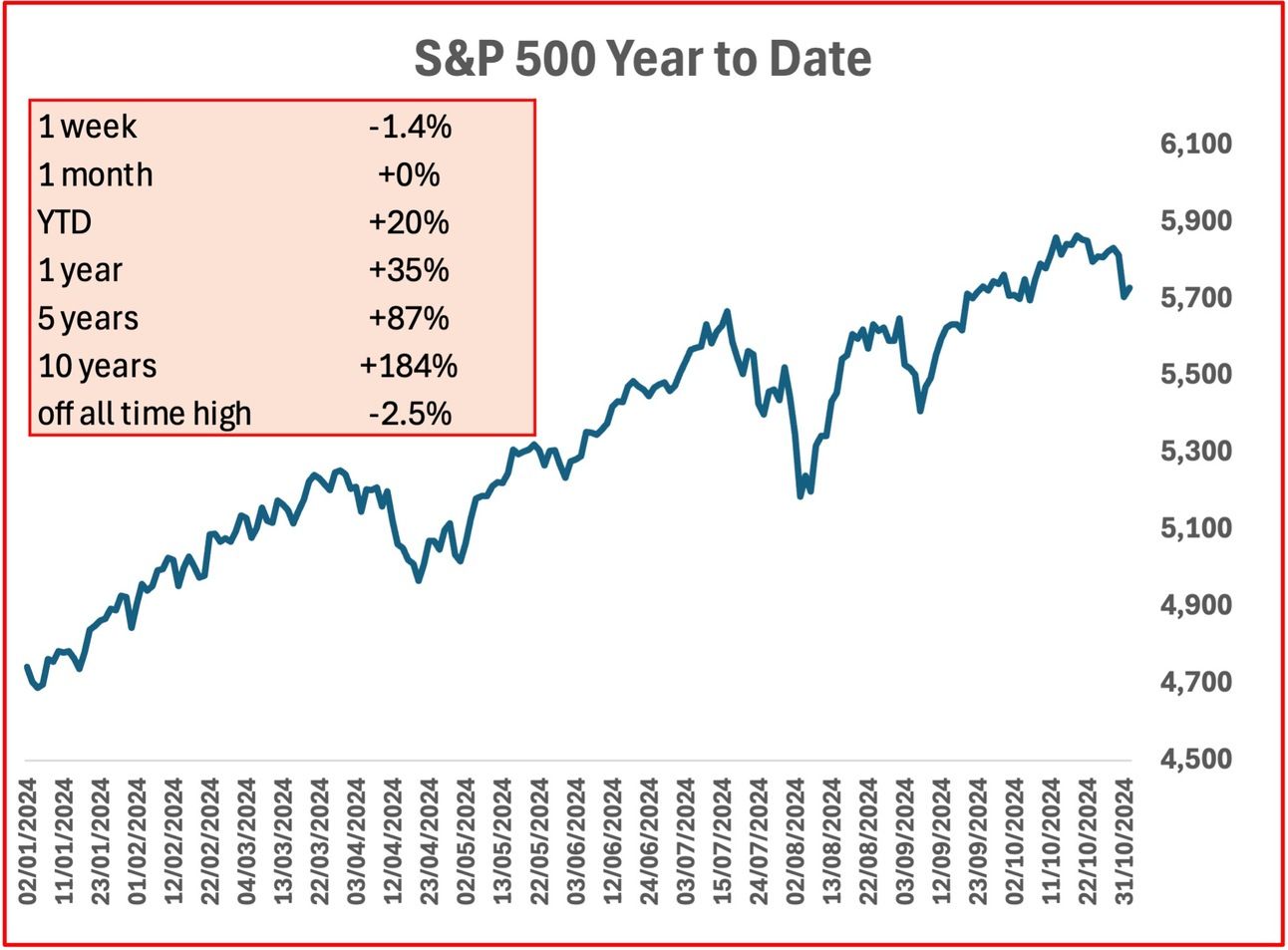

S&P500 is -1.4% in the week and +20.1% year to date.

🇬🇧 UK economy

UK national budget was announced this week by the new government. There will be higher taxes of GBP 40 billion, and borrowing of GBP 32 billion to fund GBP 70 billion of spending. This triggered a sell off in the bond markets (more bond vigilantism?) in the immediate aftermath of the budget announcements. The chancellor had to make reassuring statements that the government was committed to “economic and financial stability” to calm the markets.

Debt (fiscal) rules will be changed to allow the government to borrow more.

Growth is expected to be 1% this year and 2% in 2025, according to the Office of Budget Responsibility (OBR).

Interest rates are expected to be cut next month following the drop in inflation below the targeted 2%.

The next Bank of England meeting on interest rates is scheduled for November 7.

FTSE100 is -0.9% this week and +5.7% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan economy

Interest rates will be hiked, when economic conditions are right, say the Bank of Japan (BOJ). Much depends on what happens in the US. If the risks of carry trades being unwound lessen, the BOJ will then hike rates.

Nikkei 225 gained 0.4% v last week, but remains below its 1989 high.

Yen remains weak. Political uncertainty with the current Liberal Democratic Party unable to have a majority after the elections, did not help the yen to gain ground.

Nikkei 225 Index is +0.4% in the week and +13.7% in the year to date.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Robot training has advanced with MIT researchers’ development of a new technique that speeds up the skill acquisition process for general-purpose robots. This new architecture is called Heterogeneous Pretrained Transformers (HPT), which integrates data from various sensors and environments into a unified framework. Using a transformer model, HPT pulls together diverse datasets from simulations and real-world interactions, creating a "language" that the robot’s AI can understand across different contexts. The larger the transformer, the better the training output, enhancing the robot's adaptability. Users simply input the robot's design, configuration, and desired task, and the HPT framework enables the robot to learn and perform efficiently. This approach significantly reduces the need for specific data for each new skill, allowing robots to adapt more quickly to different environments and expand their practical applications.

OpenAI has introduced ChatGPT Search, a feature that enables ChatGPT to access real-time web information, providing users with timely answers and direct links to relevant sources. This enhancement allows ChatGPT to deliver up-to-date details on topics such as sports scores, news, and stock prices, blending conversational AI with current data. Users can initiate a web search by clicking the search icon within the ChatGPT interface. Currently, ChatGPT Search is available to ChatGPT Plus and Team users, with plans to extend access to Enterprise, Edu, and Free users in the coming months. This development aims to streamline the process of obtaining accurate information by combining natural language processing with live web data.

Elon Musk is encouraging individuals to submit their medical scans—such as X-rays, MRIs, and PET scans—to Grok, his AI chatbot developed by xAI, for analysis. He asserts that Grok is "quite accurate" in interpreting these images. However, medical professionals advise caution, emphasizing that while AI can assist in diagnostics, it should not replace evaluations by qualified healthcare providers. They highlight the importance of consulting with medical professionals for accurate diagnoses and treatment plans.

Get your free guide to AI

See previous spotlight on AI chips

🌐 Crypto Corner

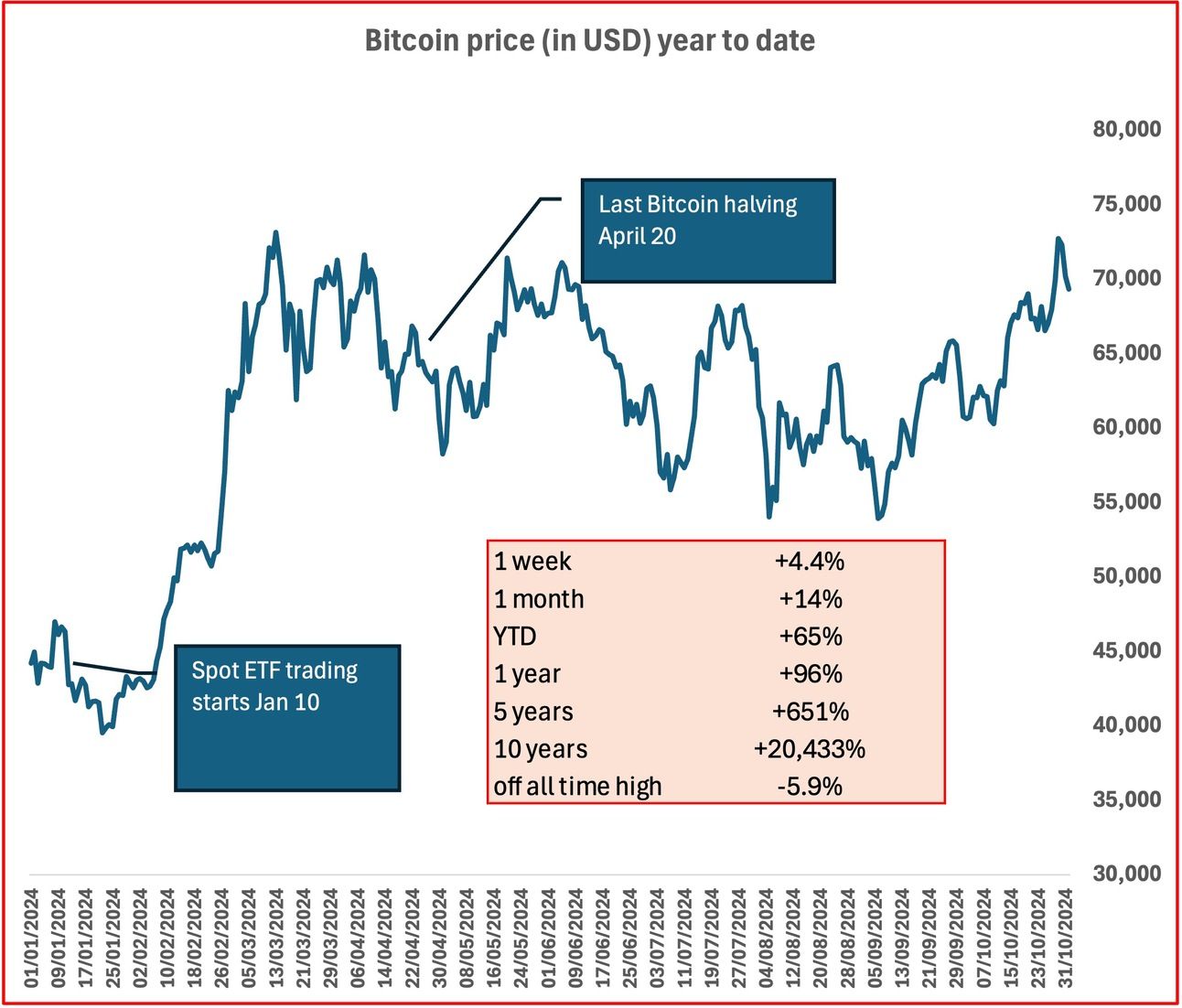

Tracking Bitcoin price (up to November 1):

Bitcoin increased and dropped later in the week in line with the polls for the two presidential candidates.

Tracking Eth price (up to November 1):

Ether price is correlated to Bitcoin in the absence of any news specific to Ether.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $273bn ⬇️ $11bn as Tesla stock pulls back 8%

Jeff Bezos (Amazon) $2w5bn ⬆️ $10bn Amazon up 5% on good results

Larry Ellison (Oracle) $207bn ⬇️ $4bn

Mark Zuckerberg (Facebook/Meta) $196bn ⬇️ $2bn

Bernard Arnault and family (LVMH) $169bn ⬇️ $4bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.