INSIGHT WEEKLY: February 23, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes. One magazine. The insights that matter. No fluff, no overload—just what you need to stay well informed

🌐 Markets Overview

Markets:

Records were broken in the week by STOXX50 (up 11.8% this year), and Nasdaq before it declined at the end of the week.

Stocks are declining due to geopolitical reasons and the potential impacts of tariffs on imports and the supply chain. The outlook for inflation and interest rates is also weighing on the markets. European stocks have benefited by rotation out of the US into Europe.

Right now, there are headwinds for the US markets.

Will tariffs be a net win for the US markets? And the other measures such as the reduction in public spending and reduction of debt? If these work well, tailwinds may appear, but it might take a while.

Russell 2000, an index of smaller companies, has declined by 1.6% this year. These stocks are even more interest rate sensitive and tariff sensitive.

Magnificent 7:

Mag 7 stocks declined during the week due to ongoing concerns about the impact of tariffs. Microsoft’s shares failed to gain, despite the announcement of the Majorana 1 quantum chip (see AI and Tech section below). Amazon dropped over 5% in the week, influenced by broader macro trends.

Major Semiconductor stocks:

A mixed week for semiconductors as Intel and Texas Instruments continue the gains, but the rest of the stocks continue to be subdued, though some had strong gains in previous weeks.

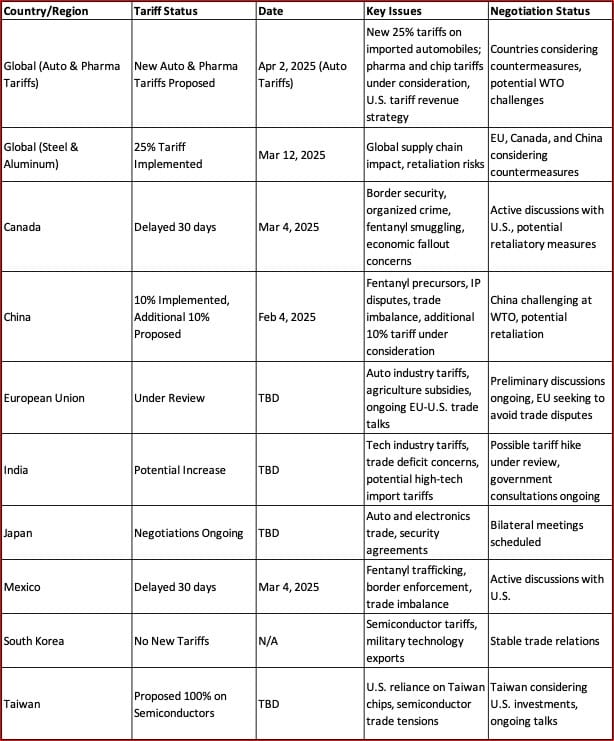

Tariff Watch:

Escalating tensions as countries consider responses to US tariffs.

🇺🇸 US economy

Consumer sentiment as measured by the University of Michigan Consumer Sentiment Index fell nearly 10% in February to 64.7, the lowest since November 2023. The decline reflects rising concerns over inflation, tariffs, and economic uncertainty.

Inflation expectations for the next five to ten years rose to 3.5%, the highest since 1995, raising concerns that higher prices could weigh on consumer spending.

Weak retail sales data further signaled that households may start tightening budgets, potentially slowing economic growth. Analysts are watching closely to see whether this dip in sentiment translates into reduced consumer activity in the coming months.

Interest rates and monetary policy remain in focus as the Federal Reserve takes a cautious approach amid rising trade tensions. New U.S. tariffs could potentially push prices higher, but some officials believe the impact will be temporary, while others warn of long-term inflation risks.

Are interest rate cuts unlikely in the first half of the year? It is certainly looking that way. And maybe just one or even none in the second half.

The next Federal Reserve meeting on interest rates is scheduled for March 18,19.

S&P500 is +4.7% in the year to date.

🇬🇧 UK economy

Government borrowing forecast has been exceeded, with a £15.4 billion surplus in January missing expectations of £20.5 billion. A surplus is better than a deficit but a lower surplus upsets the calculations. This puts pressure on Chancellor Rachel Reeves to balance the books by 2029.

Borrowing for the year stands at £118.2 billion, largely due to weaker tax receipts and higher debt costs. With public debt at 95.3% of GDP, the government insists there will be no further tax hikes in 2025, but economic challenges may force tougher spending measures later this year.

Job cuts are at the fastest rate in over four years, anticipating higher taxes. The UK S&P Composite PMI dipped to 50.5, with employment levels hitting a 14-year low as firms brace for a £25 billion increase in social security contributions.

Rising costs and weaker demand have led many companies to accelerate automation.

While the services sector grew slightly, manufacturing fell to a 14-month low, partly due to global trade concerns.

The Bank of England now faces a stagflation risk, balancing slow growth with persistent inflation.

Inflation increased to 3% in January, up from 2.5% in the previous month. Now interest rates and inflation now have a smaller gap, but there may be some one-offs in the January inflation number. The Bank of England may wait another month or two before considering any rate cuts.

The next Bank of England meeting on interest rates is scheduled for March 20.

FTSE100 is +6.5% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

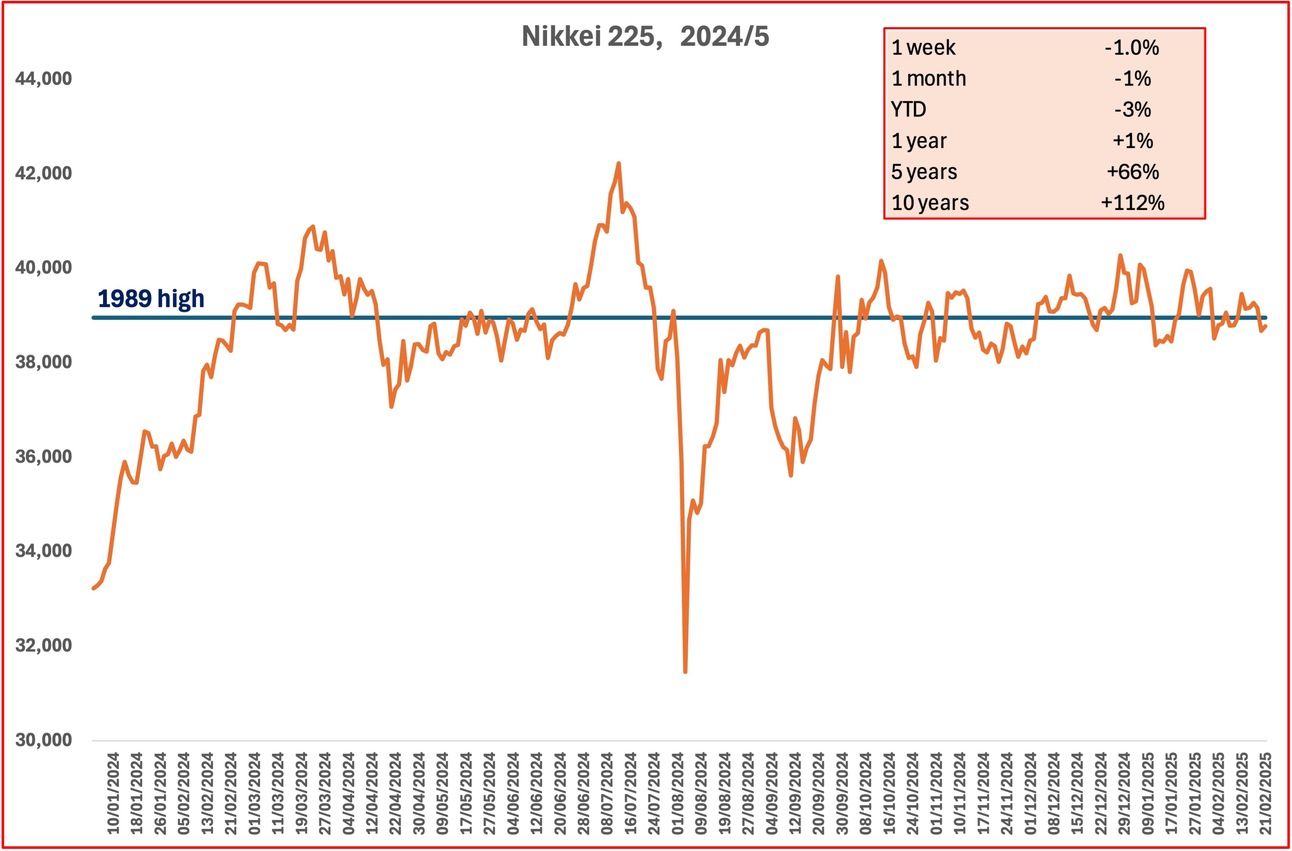

🇯🇵 Japan economy

Nikkei 225 converges to its 1989 high, dropping 1% in the week. Reason? US tariffs!

Growth was 2.8% annually in Q4 2024, exceeding expectations.

Stronger business investment and consumer spending helped drive this growth, showing signs of recovery.

Core inflation climbed to 3.2% year-on-year in January, up from 3.0% in December, driven by rising rice and energy costs.

As inflation remains above its 2% target, an interest rate hike is inevitable. But when?

Upcoming:

The next Bank of Japan meeting on interest rates is scheduled for March 18, 19

See previous spotlight on Japan.

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Microsoft says that it has built a new quantum chip (QPU) named the Majorana 1, marking a significant step toward scalable quantum computing.

This chip is based on topological qubits, a unique approach that enhances stability and error resistance, addressing one of the biggest challenges in quantum computing.

Unlike traditional qubits, which are highly sensitive to environmental noise, Majorana 1 leverages Majorana particles—exotic quantum states that help create more stable and reliable qubits. This could allow for a dramatic increase in quantum computing power, with Microsoft aiming to scale up to one million qubits on a single chip in the future.

What is a qubit?

A qubit (short for quantum bit) is the building block of a quantum computer - but it’s way more powerful than the 0s and 1s of a regular computer (bits). Unlike a normal bit, which can only be on (1) or off (0), a qubit can be both at the same time thanks to something called superposition.

Also, Qubits can be entangled, meaning two qubits can be instantly connected no matter how far apart they are. This allows quantum computers to solve complex problems much faster than today’s most powerful supercomputers.

The challenge? Qubits are super fragile and easily disturbed by their surroundings. That’s why companies like Microsoft, Google, and IBM are racing to build stable, scalable qubits—like the ones in Microsoft’s new Majorana 1 chip. If they succeed, quantum computers could revolutionize everything from drug discovery to cybersecurity.

Want to know more? See their video which is over 12 minutes long.

How is it different from Google’s chip, the Willow? There is no comparative data available but generally the Majorana 1 focuses on achieving stability and scalability through topological qubits, whereas Willow emphasizes error correction and computational prowess with its superconducting qubit architecture.

The Future’s Ultimate Tech Trinity:

Quantum Computing → Super-fast problem-solving beyond classical computing limits.

AGI (Artificial General Intelligence) → Machines that think, reason, and innovate like (or beyond) humans.

Nuclear Fusion → Limitless, clean energy to power everything.

Grok 3, the next evolution step by xAI was launched. This is a next-generation AI model designed to rival GPT-4o and DeepSeek V3. This latest iteration is powered by 10x more computing power than Grok 2 and introduces new reasoning modes, including “Think” and “Big Brain”, to enhance problem-solving.

Early testing suggests Grok 3 performs strongly in math, coding, and science, positioning xAI as a serious competitor in the AI space. Currently available to X Premium+ subscribers for $40/month, xAI plans to expand access via a standalone platform.

Additionally, xAI has launched Deep Search, an AI-powered search tool aimed at reducing the time users spend looking for information. These advancements signal xAI’s growing ambition to challenge OpenAI and Google in the AI race.

OpenAI has launched Operator, an AI-powered agent designed to complete online tasks much like a human. Using its Computer-Using Agent (CUA) model, Operator can navigate websites, fill out forms, book travel, and even create memes by interacting with digital interfaces.

What is an AI agent?

An AI agent is a system that automates tasks and makes decisions independently, using AI to analyze, adapt, and interact with its environment. Unlike traditional software, it doesn’t just follow fixed instructions—it learns and improves over time. AI agents can navigate websites, fill out forms, analyze data, or control devices, reducing the need for human input. Examples include chatbots, automation tools, and OpenAI’s Operator, which helps users complete online tasks with minimal effort.

Get your free guide to AI

See the previous spotlight on AI chips

🌐 Crypto Corner

Top 10 cryptos:

Prices moved down as stock markets declined during the week.

Ethereum in addtion to losing market share to competitors like Solana (which has scalability, speed and lower costs), also felt the impact of the Bybit security breach, with over 401,000 ETH stolen with a value of around $1.5 billion.

Despite this setback, the Ethereum community remains optimistic due to ongoing developments in Layer 2 solutions and staking.

What is staking?

Staking lets you earn rewards by locking up your crypto to help secure networks like Ethereum or Solana. Your staked coins verify transactions, and in return, you earn more crypto—like interest in a savings account. It’s a great way to earn passive income, but your coins may be locked for a while, so you can’t sell them instantly.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Elon Musk (Tesla, SpaceX) $384bn ⬇️ $10bn

Mark Zuckerberg (Facebook/Meta) $236bn ⬇️ $18bn

Jeff Bezos (Amazon) $230bn ⬇️ $11bn

Larry Ellison (Oracle) $208bn ⬇️ $7bn

Bernard Arnault and family (LVMH) $189bn ⬇️ $4bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.