INSIGHT WEEKLY: September 22, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Major market indexes and stocks

Major market indexes:

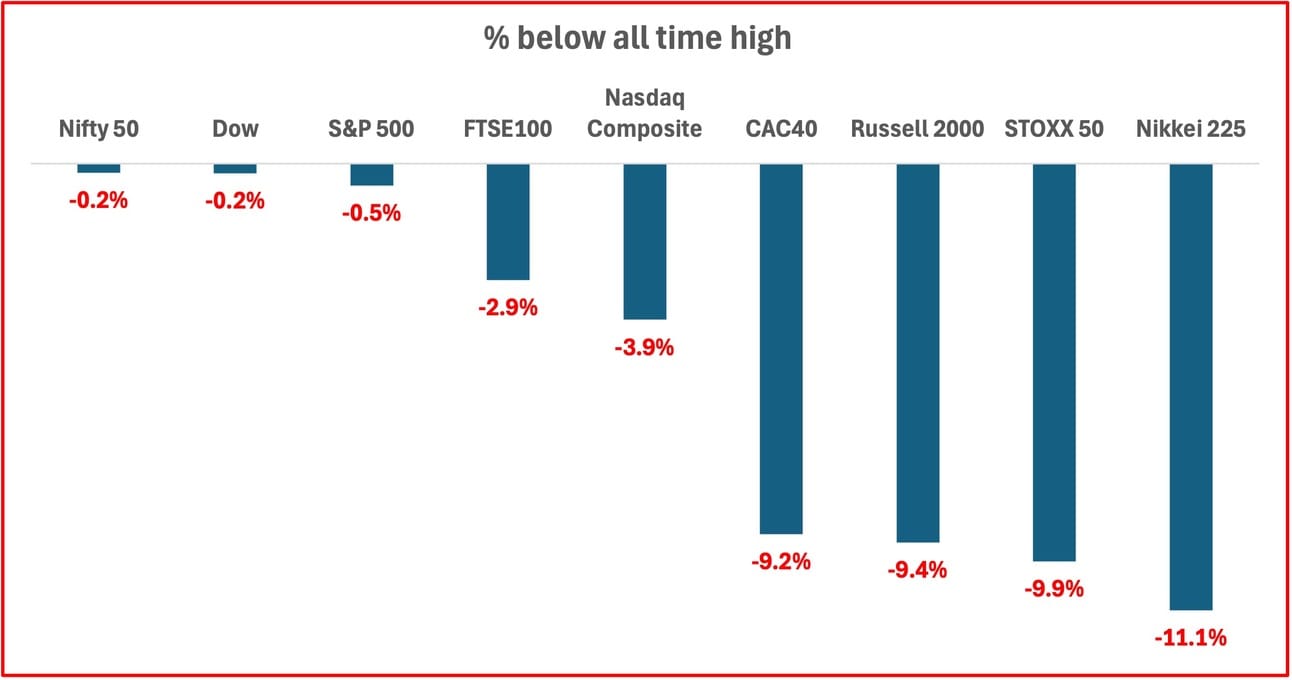

Markets made gains during the week after the Federal Reserve made a 0.5% cut in interest rates in what appeared to be the first of a series of cuts. The gains this week were across the board with both large cap and small cap indexes making gains.

S&P 500, Dow, and India’s Nifty 50 set new records during the week.

Markets v all-time high:

S&P 500 :

US smaller cap companies (Russell 2000):

Magnificent 7:

Meta gained as analysts see increasing profits in 2024 and 2025.

Major Semiconductor stocks:

Intel rises on a deal with Amazon to manufacture AI chips.

🇺🇸 US

Interest rate cut of 0.5% was made at the Federal Reserve meeting. This is being seen widely as a “catch up” cut as there was no cut in July, due to the need to shore up the labor market. In the days leading up to this meeting the markets began to price in a 0.5% cut rather than a 0.25% cut.

The next Federal Reserve meeting on interest rates is scheduled for November 6-7. Current expectations are that there will be a cut of 0.25% following this meeting.

And more cuts after that.

Bond yields increased slightly after the Federal Reserve's decision on Wednesday, with the 10-year U.S. Treasury note yield reaching its highest level since early September. Bond prices and interest rates move in opposite directions. 2024 was earlier billed as the year of the bond but that is yet to be seen.

S&P500 is +1.4% in the week and +19.6% year to date.

🇬🇧 UK

UK interest rates were left unchanged at 5% at the Bank of England (BOE) meeting on September 19. There was a cut of 0.25% last month to 5%, but the BOE did not want to cut again this month.

Why? Governor Andrew Bailey stressed the need for more consistent low inflation before additional cuts are made. Inflation dropped to 2.2% in August. The BOE forecasts inflation may rise to 2.5% by year’s end amid sluggish economic growth.

When will the next cut be made? The BOE expects that it will be in the next few months.

UK's national debt now equals 100% of its GDP, the highest since the 1960s. There was £13.7 billion in government borrowing in August. The rise in debt adds pressure on Chancellor Rachel Reeves ahead of the October 30 budget, with potential tax hikes and spending cuts on the horizon.

UK consumer confidence has dropped significantly to its lowest level since March, driven by concerns over the upcoming fiscal tightening. According to data provider GfK, the consumer confidence index fell to -20 in September from -13 in August. This sharp decline reflects rising pessimism about personal finances, spending intentions, and the broader economy.

The recent drop in confidence has nearly wiped out the gains seen earlier in the year, with renewed fears of financial strain and economic uncertainty ahead of potential government budget cuts and tax hikes.

Economists warn that further declines in consumer spending, a critical driver of the UK economy, could damage growth and job prospects. The slump in confidence comes as concerns mount over the next "painful budget" and its potential impact on household finances and broader economic stability.

FTSE100 is -0.5% this week and +6.4% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

Core consumer price index (CPI) rose 2.8% year on year in August up from 2.7% in July. The overall CPI rose 3.0% up from July’s 2.8%. Inflation is creeping up!

Interest Rates. The Bank of Japan (BOJ) decided to leave rates unchanged as expected at the abnormally low rate of 0.25% (raised from negative rates) but reiterated that rates will be increased if condtions allow, adding that Japan’s economy is moving in line with the bank’s forecasts. It is just a matter of time before rates are hiked but the BOJ did not indicate any timeline except to say that it would be “data dependent” and dependent on what may be happening in the US economy.

Yen has been strengthening in the last few months, though weakening a little this week.

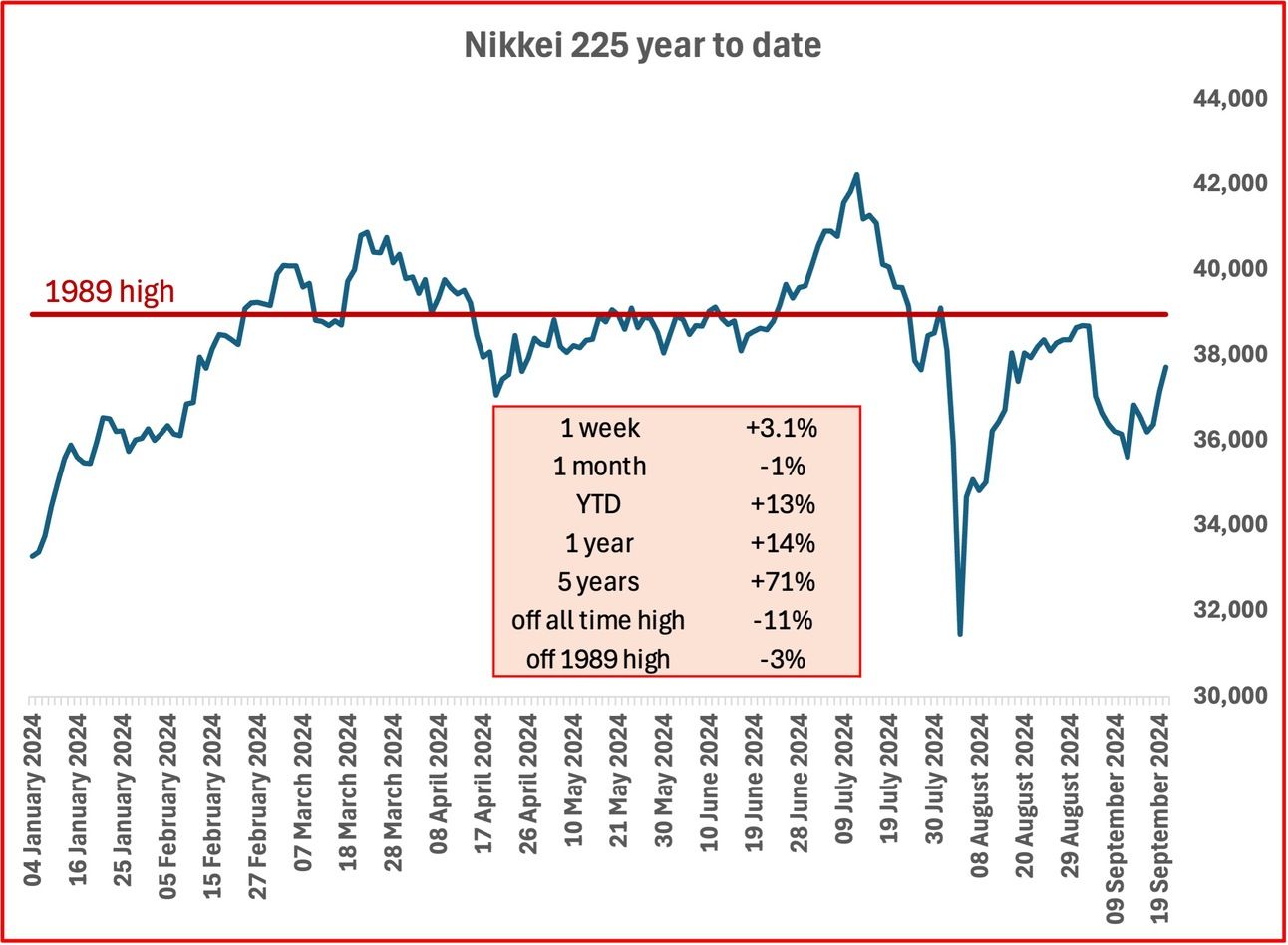

Stock markets gained over the week as the yen weakened. Nikkei 225 Index is +3.1% in the week and +12.7% in the year to date.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Alibaba Cloud has launched over 100 new AI models under the Qwen 2.5 branding during its Apsara Conference, marking a significant expansion in its AI offerings. The models range in size from 0.5 to 72 billion parameters and support more than 29 languages. They also feature advanced capabilities in areas such as math, coding, and multimodal applications, including a new text-to-video model. Alibaba Cloud’s plans to build a future AI infrastructure with its new infrastructure upgrades, such as CUBE DC 5.0 and enhanced cloud computing solutions. These innovations aim to meet the growing demands of AI development across sectors like automotive, gaming, and research. Additionally, the Qwen models have gained significant traction in the open-source community, with over 40 million downloads on platforms like Hugging Face.

Amazon has unveiled a new AI tool, Amelia, aimed at assisting its independent sellers with tasks like sales metrics analysis, inventory management, and product advertising. Amelia can answer broad questions, such as how to prepare for the holiday season or track business performance. Eventually, it will even resolve issues like shipment delays without human intervention. Dharmesh Mehta, Amazon’s VP of worldwide selling partner services, describes Amelia as a "personalized expert" for sellers. The announcement was made during Amazon’s annual seller conference, where 450,000 U.S. independent sellers gather. This move follows Amazon's launch of the generative AI tool, Rufus, to enhance product searches. Amelia is initially available to select sellers in English but will roll out to most U.S. sellers in the coming months. Although it may "hallucinate" and generate false answers, Amazon will address such issues based on their severity. Amelia aims to streamline seller operations and enhance efficiency.

NVIDIA CEO Jensen Huang unveiled an ambitious vision for telecommunications. During T-Mobile's Capital Markets Day, he announced the integration of AI and signal processing through the company's new AI Aerial platform. This groundbreaking platform, called AI-RAN, aims to revolutionize wireless networks by enhancing performance, efficiency, and new revenue opportunities, such as AI-computing-as-a-service. By combining AI models with radio signal processing, NVIDIA's innovation will optimize network performance across diverse environments, enabling telecommunications providers to deliver enhanced customer experiences and reduce energy consumption.

Huang highlighted the AI-RAN Innovation Center, a collaboration between NVIDIA, T-Mobile, Ericsson, and Nokia, which will fast-track the commercialization of AI-driven technologies. He emphasized the platform's role in improving network efficiency and creating new growth avenues, as well as its potential for sustainable technology, essential for addressing rising data and connectivity demands. This milestone marks a significant step forward in the telecom industry's evolution towards AI-powered networks.

Data Center news : BlackRock, Global Infrastructure Partners, Microsoft, and MGX have joined forces in a major infrastructure investment initiative to expand U.S. data centers. Their collaboration, known as the Global AI Infrastructure Investment Partnership (GAIIP), aims to unlock $30 billion in private equity capital. This funding will go toward developing new and expanded data centers and energy infrastructure to meet the increasing demand for AI computing power.

With AI server markets expected to grow at an annual rate of 18.5% through 2032, surpassing $180 billion, this partnership signals a significant long-term investment opportunity. Larry Fink, CEO of BlackRock, noted that building AI infrastructure such as data centers and power facilities will open multi-trillion-dollar prospects.

Additionally, the White House has announced its own AI-related initiative, forming an interagency task force to promote and accelerate data center development, following discussions with AI leaders including Sam Altman and Jensen Huang.

Get your free guide to AI

See previous spotlight on AI chips

🌐 Crypto Corner

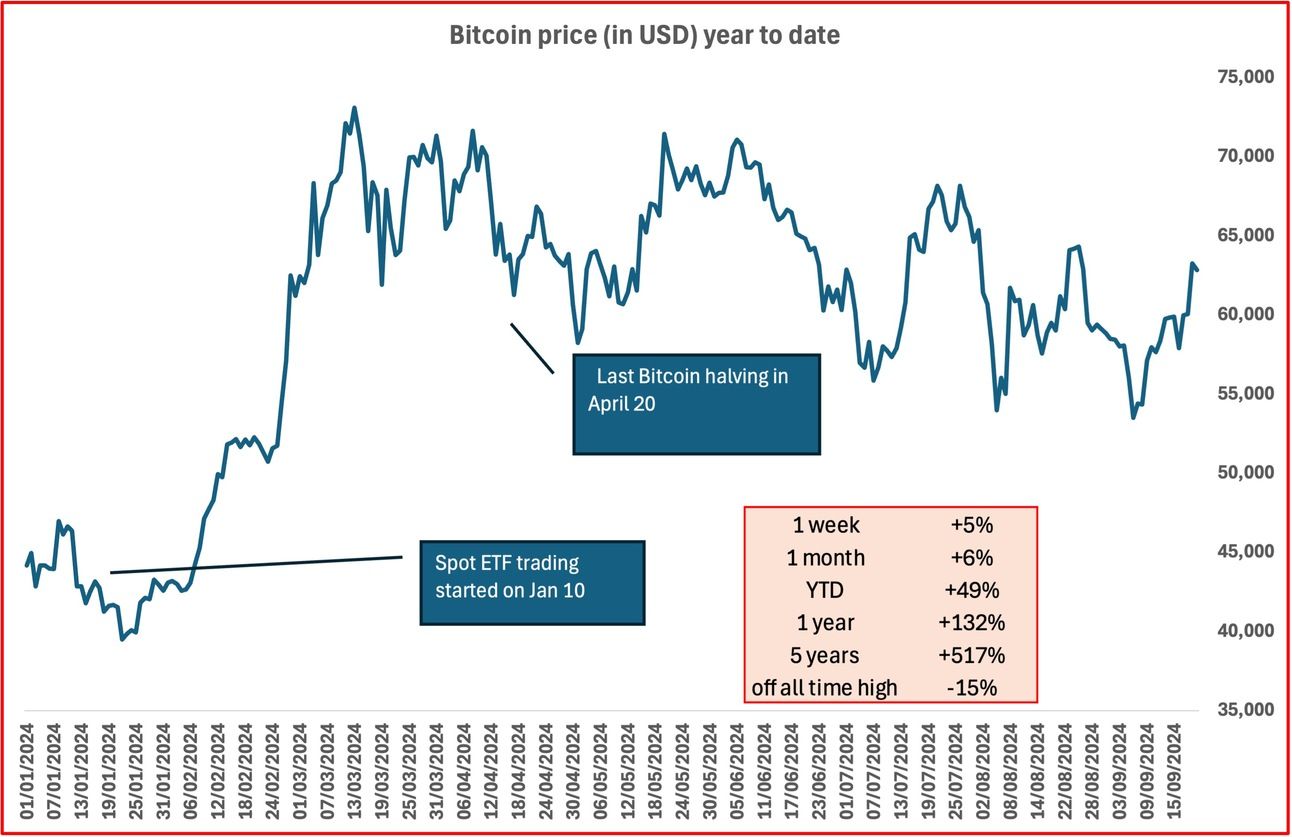

Tracking Bitcoin price (up to September 20):

Bitcoin is up to $64k after the Fed’s interest rate cur, but technical analysts point to a downtrend in the chart.

Tracking Eth price (up to September 20):

Ether rises after the Fed’s interest rate cut.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $257bn ⬆️ $5bn

Jeff Bezos (Amazon) $209bn ⬆️ $5bn

Larry Ellison (Oracle) $204bn ⬆️ $7bn

Mark Zuckerberg (Facebook/Meta) $194bn ⬆️ $13bn due to Meta’s stock price increase on expectations of increased profits

Bernard Arnault and family (LVMH) $168bn ⬇️ 4bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.