INSIGHT WEEKLY: August 25, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Major market indexes and stocks

Major market indexes:

Further recovery in the markets is anticipated as expectations increase of lower interest rates worldwide. Fears of recession, the risk of Japan carry trades, and geopolitical tensions in the Middle East were forgotten and there was renewed confidence.

Geopolitical tensions flared up over the weekend, and the markets may react next week depending on the level of escalation or de-escalation.

Volatility back at usual level

The VIX index which measures volatility has settled following the turbulence in the markets a few weeks ago.

Markets v all-time high:

Small and medium-sized companies:

Market “broadening” remains of interest to investors as the Russell 2000, index of smaller and medium-sized companies picks up again. There are about 11% of smaller tech companies in the Russell 2000.

In the year to date, there has been a 9% increase in the Russell 2000 compared to 18% in the S&P500.

Investors who buy tracker funds tracking the major indexes like the S&P500 are unlikely to be tempted by the Russell 2000 trackers but perhaps in buying just some of the underlying stocks.

Magnificent 7:

Nvidia continues to gain on increased confidence of rising earnings.

Major Semiconductor stocks:

Chip stocks continue to rise on AI and earnings optimism.

🇬🇧 UK

Government borrowing to cover the difference between spending and tax revenue grew to £3.1bn in July, which is the highest level since 2021, fuelling speculation of tax increases in the autumn budget. The tax increases are not likely to be on VAT, national insurance, or income tax.

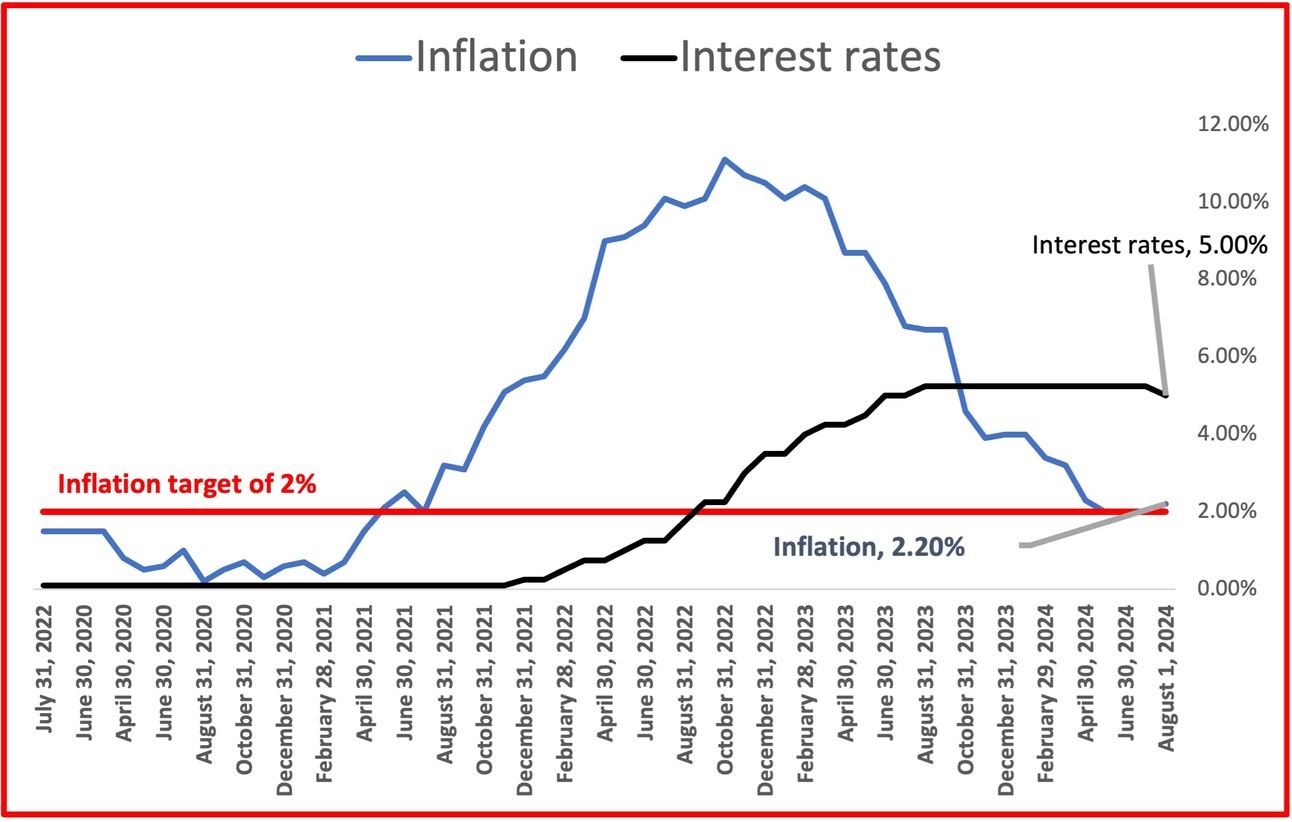

Interest rates will be discussed at the Bank of England meeting on September 19. Governor Bailey mentioned that inflation’s “persistent element is still with us but it is smaller in magnitude now than we expected a year ago”. This sounds like inflation is getting better and therefore interest rates can be cut, but of course he won’t say that explicitly.

FTSE100 is +0.2% this week and +7.7% in the year to date.

🇺🇸 US

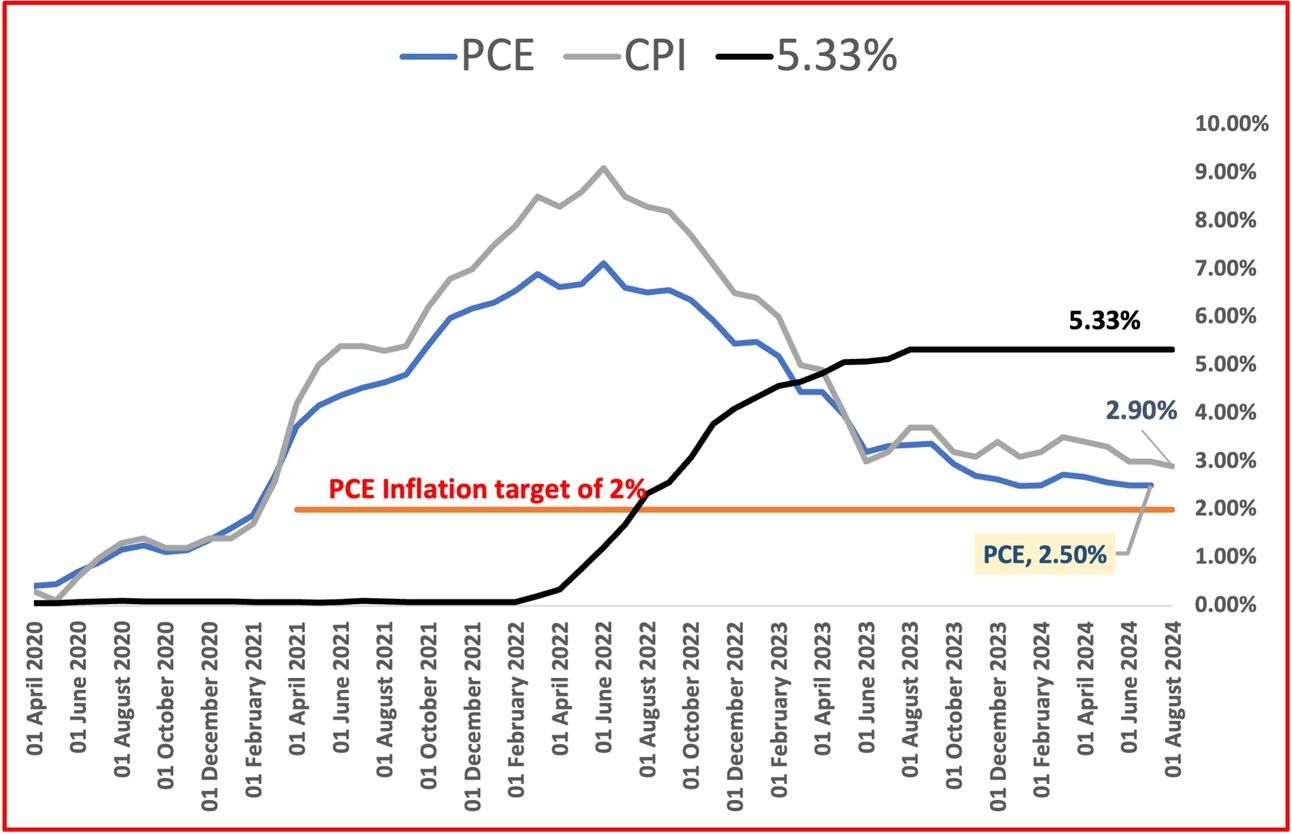

Rate cuts were not mentioned explicitly in Chair Powell’s speech at the Jackson Hole symposium, but he stated that “the time has come for policy to adjust” which is being interpreted as a cut in September, and that it is more likely that this will be a 0.25% cut than the 0.5% cut called for by some. But both are possibilities.

PCE (preferred metric of the Fed) will be released on August 30.

The release of the minutes of last month’s meeting showed that there was some support for a cut in July and a larger number saw a good case for cutting in September.

Home sales rose in July to break a run of declines over the previous four months.

The next Fed meeting on interest rates is scheduled for September 17-18.

S&P500 is +1.4% in the week and +18.1% year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

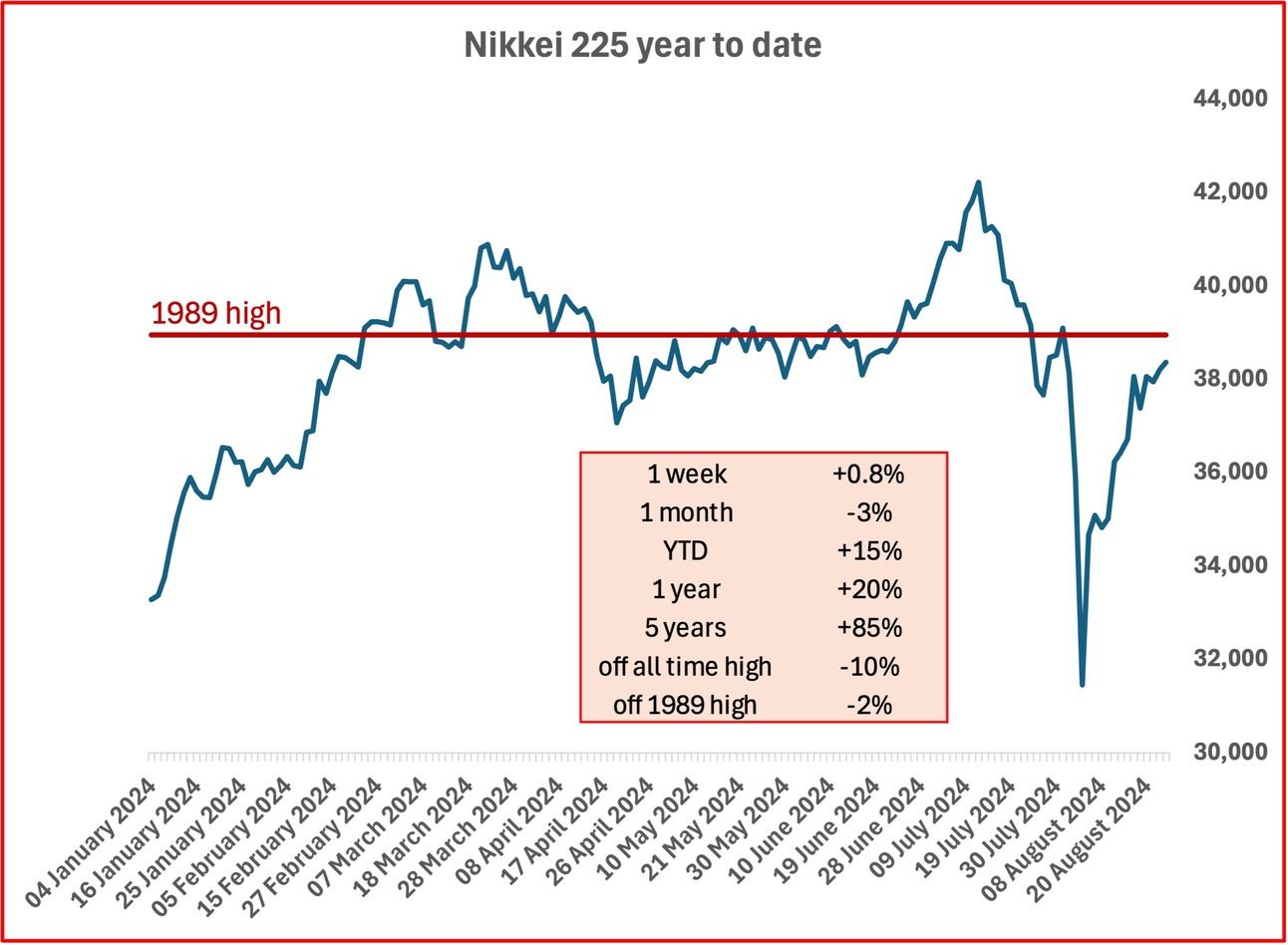

Interest rates will be normalized say the Bank of Japan (BOJ) but looks like not just yet. The events of the last few weeks are fresh in the minds of policy makers. Probably no interest rates hikes this year.

Yen ended the week at 146. The BOJ is closely watching the USD JPY rate. The current strength following several bouts of intervention appears to be stabilizing. It had previously weakened to 160.

Stock markets with Nikkei 225 approaching the 1989 high (after which there was the 34-year stagnation). Volatility has decreased in the last two weeks.

Nikkei 225 Index is +0.8% in the week and +15% in the year to date.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

OpenAI has launched fine-tuning for GPT-4o, a highly requested feature for developers. The update allows developers to fine tune to get better performance at a lower cost. The idea is that the fine tuning will improve the structure and tone of the responses and also the ability to follow complex instructions. Open AI claims that fine tuning will improve model performance “from coding to creative writing”.

To encourage adoption, OpenAI is offering one million free training tokens per day to organizations until September 23rd. Fine-tuning is available for all paid usage tiers.

Additionally, GPT-4o mini fine-tuning is also available with two million free tokens daily until the same date.

Condé Nast and OpenAI have signed a deal allowing OpenAI to use content from Condé Nast's properties, including The New Yorker and Vogue, in its AI tools like ChatGPT and SearchGPT. The deal aims to generate revenue for the media giant amid industry challenges while ensuring proper attribution and compensation for content use.

Condé Nast CEO Roger Lynch emphasized the importance of adapting to new technologies and protecting intellectual property. The partnership marks a shift as publishers increasingly cooperate with AI firms, moving away from traditional web-scraping practices that have led to legal disputes.

However, the deal has raised concerns among Condé Nast employees, who worry about the potential impact on journalism and the ethical implications of training AI models with their content. The NewsGuild of New York, representing Condé Nast's editorial staff, is seeking more transparency about how the partnership will affect their work.

See previous spotlight on AI chips

🌐 Crypto Corner

Tracking Bitcoin price (up to August 23):

Bitcoin rallies after Fed Chair Powell’s speech, on signs that interest rates will be cut. Cryptos generally perform better in low interest rate environments.

Tracking Eth price (up to August 23):

Ether price had been on a downtrend as interest in the ETFs waned. But a pick-up in the last week? As with Bitcoin, the anticipation of lower interest rates pushed the price up. ETH bulls talk of good conditions for a rally.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $247bn ⬆️ $25bn

Jeff Bezos (Amazon) $195bn no change

Bernard Arnault and family (LVMH) $193bn ⬆️$9bn up one place

Mark Zuckerberg (Facebook/Meta) $182bn ⬇️ 2bn down one place

Larry Ellison (Oracle) $172bn ⬆️$3bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.