INSIGHT WEEKLY: January 26, 2025

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of usually just 5 minutes to be well informed of the need-to-know topics of our times but this week is slightly longer.

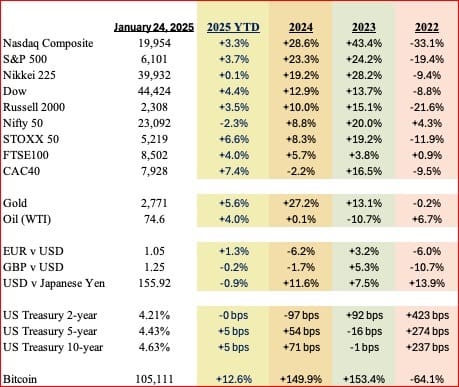

🌐 Markets Overview

Markets:

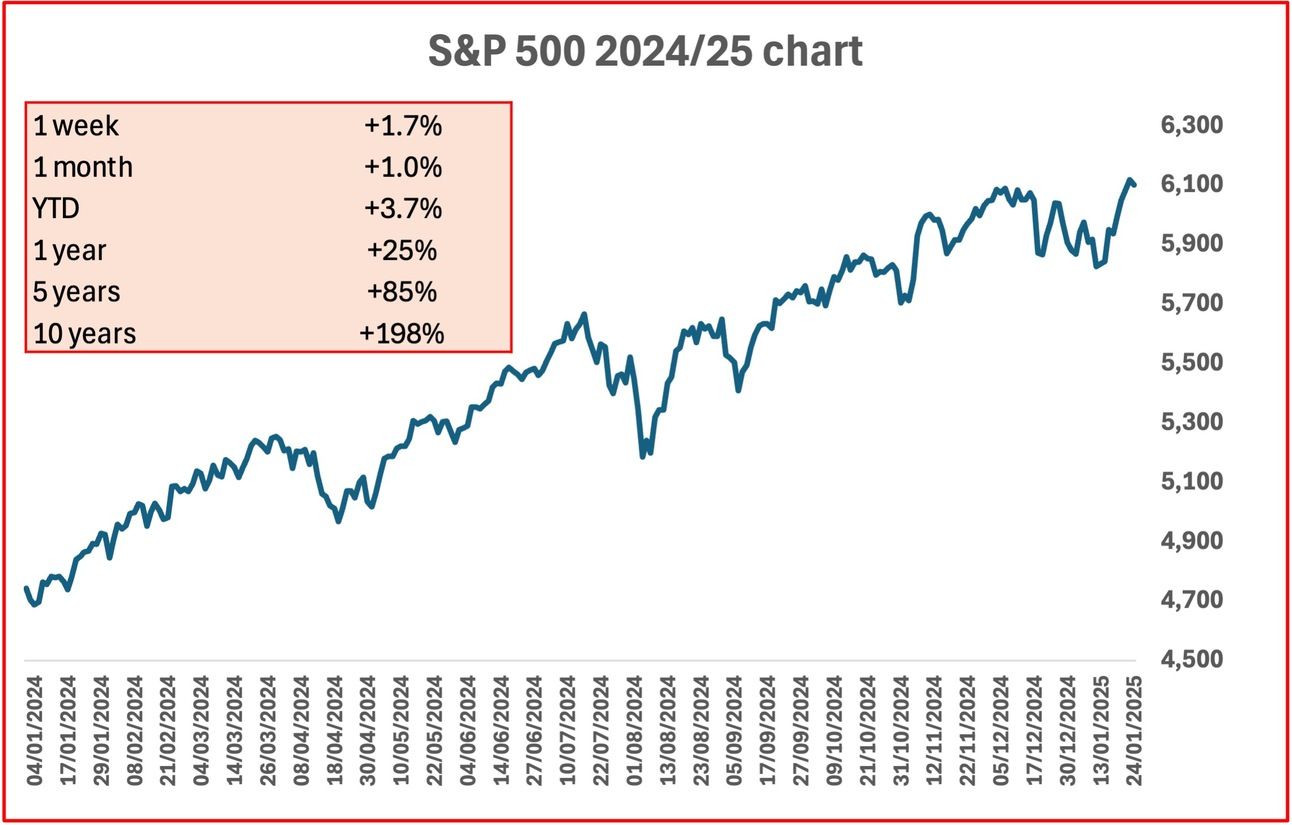

The U.S. stock markets have shown strength, with the S&P 500 reaching record highs, climbing 1.7% for the week and 3.7% year to date. The Nasdaq Composite, Dow Jones Industrial Average, and the Russell 2000 have also posted gains.

Investor optimism stems from pro-business policies and anticipated deregulation under the new administration. Continued optimism in the prospects for artificial intelligence has driven technology stocks higher.

What are the Trump 2.0 priorities for the economy?

Tariffs and new/revised trade agreements

Deregulation

Lower taxes

Investment and growth

More oil and gas production

Pro tech and AI

Pro crypto

Reduced government spending as budgets are cut

Supply chain independence from foreign nations

Immigration restriction and deportations

Other markets are mixed as the impact of US tariffs weighs heavily. France’s CAC40 gained over 7% in the year-to-date due to interest in luxury goods and energy.

Magnificent 7:

Meta (owner of Facebook, Instagram, and Whats App) announced it would spend $65 billion on AI capital expenditure this year (see AI section below). Despite this level of capex, the stock gained nearly 11% so far this year after gaining 65% in 2024. There are good expectations of its earnings which are due to be reported next week.

Apple has dropped 11% this year due to doubts about its AI prospects, its considerable exposure to the Chinese market, and the anti-trust action against Google’s payments to Apple for utilizing Google as the primary search engine.

The remaining five Magnificent 7 stocks performed well on AI prospects.

Major Semiconductor stocks:

Stargate (see AI section below) and other AI news pushed semiconductors higher in the year to date.

🇺🇸 US economy

Fiscal Policies and Debt are challenges for the new administration. The U.S. national debt stands at $36 trillion. The 2024 federal budget deficit was estimated at $1.4 trillion.

The new administration plans a new External Revenue Service to collect the revenue from tariffs applied to other countries. These funds are to be used to reduce debt.

Interest rates have been cut by the Federal Reserve by 1% in the last year, but the interest rate in the real economy for mortgages, auto loans, and personal loans has come down by around 0.5%. The reason is that real-world interest rates do not move in lockstep with the Fed cuts. The transmission to the real world depends on several factors, including lender behavior, risk premiums, and economic conditions. And there is a timing difference and could be up to over a year.

Inflation could increase as tariffs are applied. Imports will become more expensive.

The next Federal Reserve meeting on interest rates is scheduled for January 28,29.

S&P500 is +3.7% in the year to date.

🇬🇧 UK economy

Growth has become an issue. Q4 2024 is expected to be no growth. The UK government is seeking new ideas.

There has been an emigration of a significant number of high net worth individuals who will be taking their wealth with them.

Will the UK take a cue from Trump 2.0, and entice inward investment with lower taxes and pro-business policies?

Labor market was mixed. Wage growth, excluding bonuses, was 6.0% in the three months through November, which was in line with expectations. This was the highest in six months. Unemployment rate increased to 4.4%.

Mortgage interest rates are expected to fall in 2025 as the Bank of England expects to cut rates this year.

The next Bank of England meeting on interest rates is scheduled for February 6.

FTSE100 is +4% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan economy

Nikkei 225 is flat to year-end 2024. It has been oscillating around its 1989 high for a few months. The asset bubble of the 1980s had pushed stock prices far above their fair values.

Interest rates were increased by the Bank of Japan by 0.25% to 0.5%. This is the highest since 2008. This move comes in response to inflation reaching 3.6% in late 2024, surpassing the central bank’s target. More rate hikes are expected in 2025.

Upcoming:

The next Bank of Japan meeting on interest rates is scheduled for March 18, 19

See previous spotlight on Japan.

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Stargate, a joint venture between OpenAI, SoftBank Group, Oracle Corporation, and MGX aims to invest up to $500 billion in artificial intelligence infrastructure within the United States by 2029. The US is already a leader in AI and this venture is intended to preserve dominant capability in this area.

Additional technology partners will be ARM, Microsoft (closely connected to OpenAI), Oracle, and, of course, Nvidia (can there be a major AI project without Nvidia?).

What is Stargate? It is a plan to construct a network of data centers across the U.S., initially focusing on building ten facilities in Abilene, Texas. These centers are intended to support the advancement of AI technologies and are expected to create over 100,000 jobs nationwide.

The project has already started, with an initial investment of $100 billion, and will reach $500 billion by 2029. The funding is for data centers and also the power generation needed to run these power-hungry facilities.

The project’s leadership includes Masayoshi Son of SoftBank as chairman, with operational oversight managed by OpenAI.

What are the expectations of Stargate? In addition to preserving and extending US dominance, the expected benefits are advances in healthcare, including personalised, customized treatments such as vaccines for cancer, national defense, cybersecurity, and transformative effects across industries.

DeepSeek, a Chinese AI startup, is making waves with its impressive R1 model, a cutting-edge AI system built for solving complex problems and making smart decisions. What’s remarkable about R1 is that it matches the performance of leading U.S. models like OpenAI’s GPT, even though it was developed with fewer resources. Using creative training techniques like reinforcement learning, DeepSeek has managed to achieve top-tier results without relying on the advanced chips that are restricted by U.S. export controls.

What is reinforcement learning? It is a way for AI to learn by doing. The AI (called an agent) interacts with its environment, tries different actions, and gets feedback in the form of rewards or penalties. Over time, it learns to make better decisions to get more rewards. RL is used in areas like teaching robots to move, mastering video games, and improving financial strategies. It’s a trial-and-error approach that helps AI figure out the best way to solve problems.

Deepseek has taken an open-source approach, making the R1 model freely available for others to use and experiment with. They’ve also priced their AI services far lower than competitors, shaking up the market and encouraging more collaboration and innovation. Industry leaders, including Meta’s AI Chief Yann LeCun, have praised R1 as proof that open-source AI can rival and even outperform proprietary systems.

The emergence of R1 also highlights a growing challenge to U.S. dominance in AI. Despite facing hurdles like chip shortages and international restrictions, China’s AI scene is thriving, and DeepSeek’s R1 is a clear example of this. The model’s success raises questions about how the U.S. will maintain its competitive edge in an increasingly global AI race.

Meta, the company behind Facebook, Instagram, and WhatsApp, is making waves in artificial intelligence with a $60 billion investment in AI development for 2025. At the heart of this initiative is a commitment to open-source AI, a philosophy Meta firmly believes will drive innovation faster and more collaboratively than proprietary approaches.

Open-source AI involves sharing research, tools, and even entire models with the public, allowing developers worldwide to access, modify, and improve them. Meta’s Chief AI Scientist, Yann LeCun, has been a vocal advocate of this approach, arguing that open collaboration accelerates progress and democratizes AI. He often contrasts Meta’s philosophy with companies like OpenAI, which has shifted toward closed systems citing safety and control concerns.

Meta’s belief is that innovation flourishes when barriers to entry are removed.

Meta plans to allocate much of its $60 billion AI budget to open-source projects, from creating foundational AI models to developing tools for businesses and researchers. These investments are also expected to enhance Meta’s platforms, with AI improving content moderation, user recommendations, and even augmented and virtual reality experiences.

However, open-source AI isn’t without controversy. Critics worry that easily accessible models could be misused or lack accountability. Meta argues that the benefits outweigh the risks, emphasizing the importance of transparency and community-driven development.

Get your free guide to AI

See the previous spotlight on AI chips

🌐 Crypto Corner

Top 10 cryptos:

XRP was not only the best performer out of the larger cryptos in 2024 but has also gained over 50% this year! This surge is on continued optimism of looser regulation and wider adoption by investors, and possibly an ETF launch.

Solana gained over 30% this year, mainly due to $TRUMP and $MELANIA coins being launched on the Solana blockchain. Solana is also being seen as an alternative to Ethereum due to its higher scalability and lower transaction costs.

Cardano gained over 10%, also due to more interest from investors optimistic about the deregulation and wider interest from funds.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Elon Musk (Tesla, SpaceX) $422bn

Jeff Bezos (Amazon) $247bn

Larry Ellison (Oracle) $228bn

Mark Zuckerberg (Facebook/Meta) $223bn

Bernard Arnault and family (LVMH) $196bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.