INSIGHT WEEKLY: March 2, 2025

📩 Images not loading? Click “Download external images” or read the full magazine online via the link above.

⏳ 5 minutes. One magazine. The insights that matter. No fluff, no overload—just what you need to stay well informed

🌐 Markets Overview

Markets:

As US markets start to decline, what are smart investors doing?

Warren Buffet, probably the greatest investor of all time, has been in the news. Buffet’s Berkshire Hathaway cash pile has increased to $334 billion from $167 billion the previous year.

In 2024, Berkshire Hathaway was a net seller, selling $134 billion while buying $9 billion.

Commentators have said Berkshire Hathway considers the market to have high valuations and fewer opportunities, as well as concerns about economic uncertainty.

Hedge funds have been reducing their positions in US tech and media stocks.

Some investors have become much more stock-selective rather than buying index funds.

S&P 500 is +1.2 % so far this year. The chart below shows the S&P 500 over the last 25 years.

Will long-term investors be the ultimate winners?

Over the years, many investors have adopted a position of taking a longer-term view and not selling in times of declining markets, even adding to their positions at lower prices.

Previous crises included the Global Financial Crisis and Covid. Those who decided not to sell and weather the storms gained very good returns.

Looking back, the S&P 500 has had an average annual return of 10% over the last 100 years.

The proponents of the long-term-hold strategy invest continuously over time based on the notion that it is not timing the market (when to buy or sell), but time in the market that produces the good returns.

Are we in an AI stock bubble?

What are the typical features of a bubble?

These include market sentiment that is overwhelmingly optimistic on prices rising with unsustainable price increases, valuations rising beyond what could be justified by earnings, excessive exuberance, and FOMO (fear of missing out).

Here is a historical summary of bubbles:

Source: Visual Capitalist

Will the AI bubble burst, or will it deflate slowly as investors move into other areas?

Will there be a second AI boom?

US stock markets

European stocks have done well this year due to some rotation out of the US into other markets.

So, why do global investors focus on the U.S.?

Here’s why.

The US stock markets are the largest by far and account for nearly half of the entire world stock markets by value. Most of the world’s most innovative companies are in the U.S., especially in the tech sector.

Investors are still heavily invested in the U.S. despite some rotation out.

Many global funds use the MSCI World Index as a benchmark. This index has a weighting of over 70% for the U.S.!

Want to know more about the MSCI World Index? See their factsheet:

https://www.msci.com/documents/10199/178e6643-6ae6-47b9-82be-e1fc565ededb

Magnificent 7:

Tesla stock fell further (-13% this week) after EU and UK sales dropped in January. Competition from other EV manufacturers and also some blowback from Elon Musk’s political activism. The price drop has brought the price down to November levels, when prices started rising with Musk’s ascendancy as “first buddy” to the incoming President.

The first buddy premium has been eliminated by the market.

Major Semiconductor stocks:

Semiconductors declined across the board as AI interest declined.

Tariff Watch:

This week:

Canada, Mexico, and South Korea are considering imposing tariffs on China to avoid/mitigate tariffs from the US.

China retaliated by imposing tariffs on US coal and Liquefied Natural Gas (LNG).

Copper imports could be subject to tariffs.

🌐 Economy Overview

🇺🇸 US economy

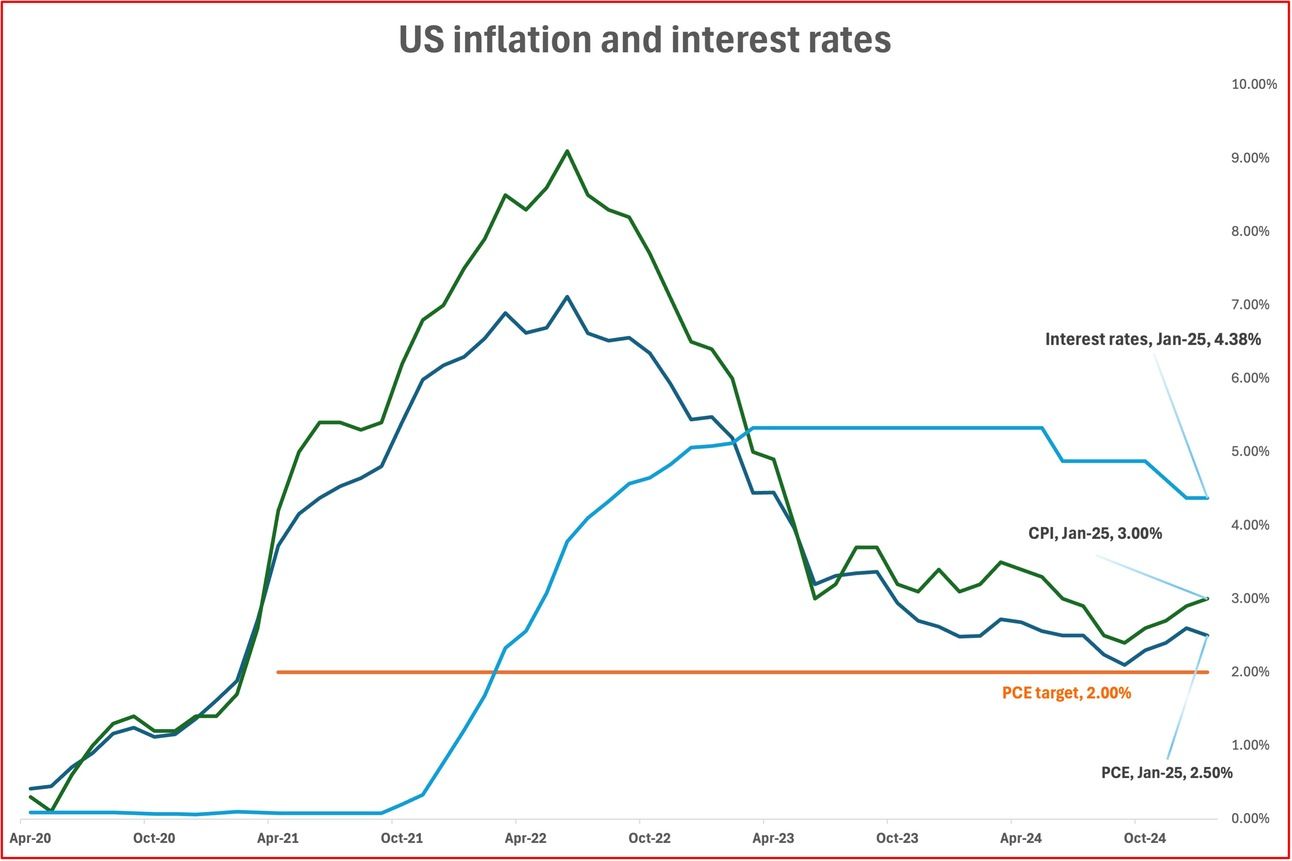

PCE Inflation (Personal Consumption Expenditures price index) dipped from 2.6% in December 2024 to 2.5% in January 2025. A slight drop, but inflation is still sticky.

There is some confusion in media reporting on headline PCE, and core PCE (excludes energy, food). While both measures are watched closely, the two measures are being conflated in reporting.

The 2% target is for headline PCE and not core PCE.

Consumer Spending in January 2025 was down by 0.2%, marking the first decline in nearly two years. Reasons? Economic uncertainties and potential tariff impacts.

Consumer Confidence in February fell to 98.3 from 105.3 in January. It was the biggest monthly drop in over four years. Reasons? Economic uncertainties

The next Federal Reserve meeting on interest rates is scheduled for March 18,19.

S&P 500 is +1.2% in the year to date.

🇨🇳 China

Manufacturing improved to 50.2 in February from 49.1 in January, the highest in three months. The increase is due to government stimulus measures aimed at reviving growth.

🇯🇵 Japan

Nikkei 225 dropped below its 1989 high in line with the global markets decline.

The yen strengthened against the dollar on expectations of interest rate increases in 2025.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

AI Singularity is a hypothetical point where artificial intelligence surpasses human intelligence, triggering uncontrollable, transformative growth, as proposed by thinkers like Vernor Vinge and Ray Kurzweil. It’s often likened to a black hole’s event horizon, suggesting an inevitable, rapid shift in technology and society.

What do the tech bro’s have to say about singularity?

Elon Musk (xAI): “We are on the event horizon of the singularity,” he posted on X on February 23, 2025, linking it to xAI’s Grok 3 and predicting superhuman AI by 2025, viewing it as transformative.

Dario Amodei (Anthropic): Amodei predicts, “The singularity could occur by 2026,” citing Claude’s progress, focusing on safe, aligned AI for human-AI transformation.

Jensen Huang (Nvidia): Huang forecasts, “AI will match or surpass human performance by 2029,” emphasizing that Nvidia’s hardware is driving this singularity.

Sam Altman (OpenAI): Altman suggests, “AGI might arrive by 2035,” but 2025 advancements could accelerate this, prioritizing safety while sharing Musk’s transformative vision.

Demis Hassabis (Google DeepMind): Hassabis believes “AI is progressing toward human-level intelligence by the late 2020s or early 2030s,” focusing on practical applications over imminent singularity.

Evo2, unveiled this week, is a groundbreaking AI model for biological research developed by the Arc Institute in partnership with NVIDIA, Stanford, UC Berkeley, and UC San Francisco. It was trained on 9.3 trillion nucleotides from over 128,000 genomes, making it one of the largest AI models in biology.

Let’s demystify – what is a nucleotide?

A nucleotide is like a tiny puzzle piece that builds DNA and RNA, the instructions for life. Each nucleotide has three parts: a sugar, a phosphate, and a letter (A, T, C, G) that carries genetic information. These pieces link together to create the code that directs how cells work.

Let’s demystify – what is a genome?

A genome is like a book of instructions for life. It is the entire collection of DNA that tells a living thing how to develop, grow, and function. This genetic code includes all the genes that shape traits like eye color or height. Every species has a unique genome, and within a species, every individual has a unique genome (except for identical twins).

Evo 2 can identify genetic patterns, predict disease-causing mutations, and even design entirely new genomes. It processes sequences up to one million nucleotides long, helping scientists explore complex DNA interactions.

Now accessible through NVIDIA’s BioNeMo platform, Evo 2 is set to accelerate discoveries in genomics, synthetic biology, and disease research—reshaping how scientists decode the building blocks of life

Apple has announced a plan to invest over $500 billion in the U.S. over the next four years, marking its largest domestic investment to date.

This initiative includes building a new manufacturing facility in Houston, Texas. The facility will produce servers to support Apple Intelligence, the company’s personal intelligence system. The 250,000-square-foot facility is expected to create thousands of jobs and is slated to open in 2026.

Additionally, Apple plans to double its U.S. Advanced Manufacturing Fund to $10 billion, focusing on promoting advanced manufacturing and skills development nationwide.

The company also aims to expand its research and development investments in areas such as artificial intelligence and silicon engineering, with plans to hire approximately 20,000 new employees over the next four years.

Also, Apple will establish a manufacturing academy in Michigan to train the next generation of U.S. manufacturers.

Want to know more? See Apple’s announcement:

https://www.apple.com/newsroom/2025/02/apple-will-spend-more-than-500-billion-usd-in-the-us-over-the-next-four-years/

Get your free guide to AI

See the previous spotlight on AI chips

🌐 Crypto Corner

Top 10 cryptos:

Prices moved down further this week, reflecting the wider economic conditions as well as concerns about security following the Bybit breach, as well as record outflows from ETFs.

Are cryptos once again moving into a period of obscurity, after which there may be another spurt in prices?

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Elon Musk (Tesla, SpaceX) $359bn ⬇️ $25bn

Mark Zuckerberg (Facebook/Meta) $230bn ⬇️ $6bn

Jeff Bezos (Amazon) $227bn ⬇️ $3bn

Larry Ellison (Oracle) $204bn ⬇️ $4bn

Bernard Arnault and family (LVMH) $186bn ⬇️ $3bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.