INSIGHT WEEKLY: December 22, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Markets Overview

Major market indexes:

Markets fell as investors reacted to the Federal Reserve's cautious outlook. After the 0.25% cut on Thursday, the Fed signaled a slower pace of rate cuts in 2025 than previously anticipated. There was a recovery on Friday but sentiment was still down.

Further, there were concerns about a potential government shutdown which added to market volatility, though Congress passed the bill on Saturday, avoiding the shutdown.

Rising Treasury yields further pressured rate-sensitive sectors.

Investors are now considering what 2025 may be like and if future returns will be a fraction of the performance in 2024.

Markets v all-time high:

Magnificent 7:

Apple stock has reached record highs, as its new AI features are included in iOS 18.2. These new features include ChatGPT integration with Siri and custom emoji capabilities.

Tesla and Meta declined after significant increases in the last few months.

Major Semiconductor stocks:

Arm Holdings’ stock saw volatility last week, closing at $132.15 with a range of $123.37 to $135.50. There was a mistrial in its legal case against Qualcomm over licensing and Nuvia, the startup Qualcomm acquired, adding uncertainty to Arm’s licensing business. While the jury upheld Qualcomm’s chip licenses, the unresolved breach claim against Nuvia leaves questions that could impact investor sentiment. This legal saga could continue.

Micron declined after the results were announced last week. This outlook has raised concerns among investors about ongoing challenges in the memory chip market, particularly in the PC and smartphone segments.

Despite these challenges, Micron’s data center business, driven by demand for AI-related chips, has shown robust growth. Revenue from high-bandwidth memory (HBM) chips, essential for advanced AI systems, more than doubled sequentially. Analysts view HBM chips as a key growth driver.

In response to the mixed outlook, several analysts have adjusted their positions on Micron, some neutral and some still positive.

🇺🇸 US economy

Inflation remains a concern. The Personal Consumption Expenditures (PCE) price index (closely watched by the Federal Reserve) showed a modest 0.1% increase in November, slightly cooler than October’s 0.2%. Annually, the PCE was 2.4% in November, up marginally from October’s 2.3%, suggesting persistent inflationary pressures. Will PCE ever reach the 2% target? Perhaps the target reflects a bygone era and needs revisiting in 2025.

Interest rates are not going to be cut as much, and as frequently in 2025. That was the hawkish messaging from the Federal Reserve. These comments spooked the markets on Thursday before recovering partly on Friday. As long as inflation remains sticky, the Fed will be unlikely to consider interest rates cuts.

Growth continues to impress. The Commerce Department revised third-quarter GDP growth upward to an annualized 3.1%, driven by robust consumer spending. Retail sales in November exceeded expectations, rising 0.7%, indicating that consumers remain active despite higher interest rates. The labor market also demonstrated resilience, with initial jobless claims hitting multi-month lows.

The next Federal Reserve meeting on interest rates is scheduled for January 28,29.

S&P500 is -2.0% in the week and +24.3% year to date.

🇬🇧 UK economy

Inflation increased to 2.6% in November from 2.3% in October, mainly due to higher fuel and clothing costs.

Interest rates were held at 4.75% at the Bank of England meeting (as expected), though three out of nine members voted for a 0.25% cut.

The next Bank of England meeting on interest rates is scheduled for February 6.

FTSE100 is -2.6% this week and +4.5% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan economy

Interest rates were kept steady at 0.25% at the Bank of Japan (BOJ) meeting on December 18,19. This exceptionally low rate may even be maintained at the next meeting as the BOJ seems nervous of any increases. In Japan (and in many other countries), the incoming US administration’s policies will be viewed carefully before any changes are made.

Inflation rose in November to 2.6%, up from 2.3% in October putting additional pressure on the BOJ to react. However, the BOJ has constructed a set of criteria covering wage growth, prices, and the economy and will react in accordance with this model.

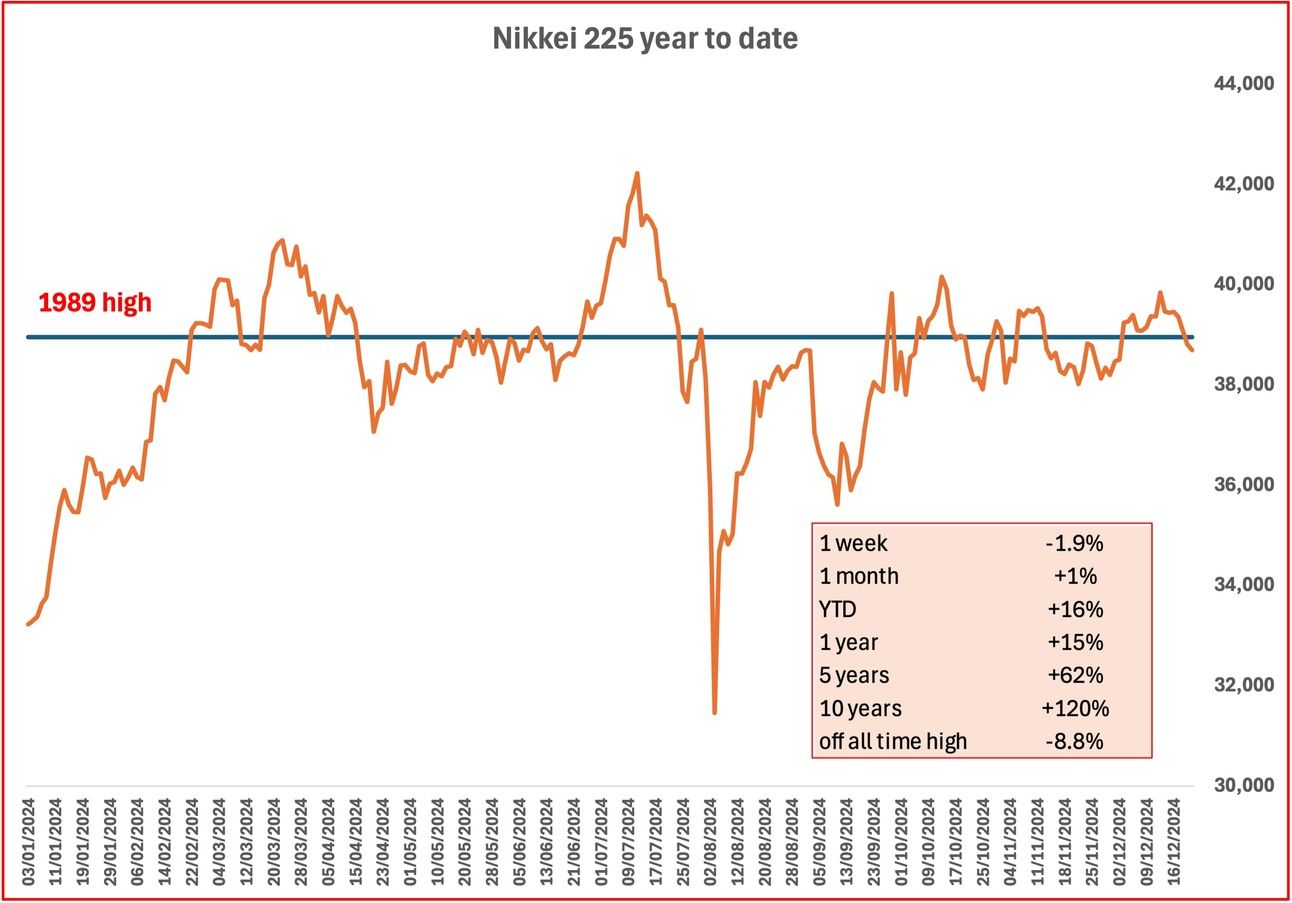

Nikkei 225 has dropped below its 1989 high, which was achieved during the bubble, as some investors question if investing in Japan should be part of their global portfolio.

Upcoming:

The next Bank of Japan meeting on interest rates is scheduled for January 23, 24

See previous spotlight on Japan.

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Google has launched Trillium, its sixth-generation Tensor Processing Unit (TPU), now available for general use. Trillium delivers over four times the training performance and three times the inference throughput of its predecessor while being 67% more energy-efficient. The upgraded TPU boasts double the High Bandwidth Memory capacity and enhanced interchip bandwidth. Integrated with Google Cloud’s AI Hypercomputer, Trillium supports training across 100,000+ chips within a Jupiter network, offering improved scalability. These advancements cater to the growing needs of enterprises and startups working on large-scale AI projects.

OpenAI’s GPT-5, codenamed “Orion,” is reportedly facing delays and underwhelming early feedback, according to The Wall Street Journal. Initial testing suggests that performance gains over GPT-4 are more incremental than groundbreaking, particularly in areas like reasoning and comprehension. OpenAI appears to be reevaluating its approach, emphasising addressing safety and alignment concerns before rolling out the new model. While expectations were high for GPT-5 to deliver a significant leap, it seems the focus has shifted to refining the technology for more reliable and secure deployment.

Get your free guide to AI

See previous spotlight on AI chips

🌐 Crypto Corner

Top 10 cryptos:

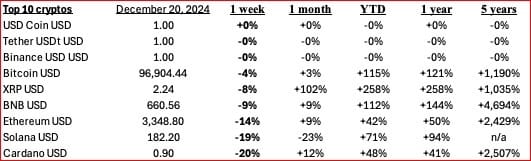

After much anticipation in the last weeks, cryptos have declined and settled within a range. Is the price spurt over for now? There was talk about the incoming administration setting a Bitcoin reserve and deregulation but it looks like investors are waiting to see what this might look like.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Elon Musk (Tesla, SpaceX) $430bn

Jeff Bezos (Amazon) $238bn

Larry Ellison (Oracle) $213bn

Mark Zuckerberg (Facebook/Meta) $202bn

Bernard Arnault and family (LVMH) $167bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.