INSIGHT WEEKLY: February 16, 2025

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of around 5 minutes to be well informed of the need-to-know topics of our times.

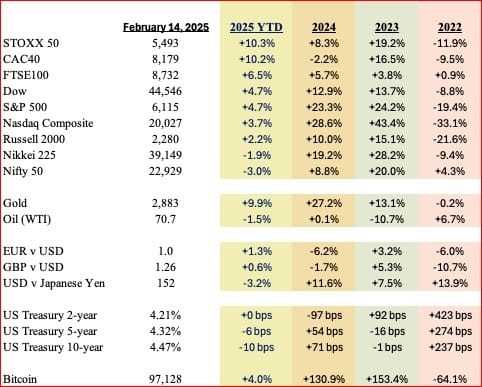

🌐 Markets Overview

Markets:

Records were broken in the week by STOXX50 (up over 10% this year) and UK’s FTSE100 (up over 6% this year).

Why are European stocks outperforming the US so far this year?

Mainly because European stocks were cheaper at the start of the year, the outlook for interest rate cuts is positive, there is some rotation by investors away from the US to Europe, and there is a possible end to the conflict in Ukraine.

India’s Nifty 50 is over 12% off its all-time high. The market sold off due to the potential impact of US tariffs, slowing corporate earnings, and inflation concerns.

Investors feel that they can get better returns from rising Treasury yields in the US.

Japan’s Nifty 50 is losing favor due to the potential for higher interest rates in 2025.

Russell 2000, an index of smaller companies, lost ground due the sector’s sensitivity to US interest rates, which are likely to remain unchanged in the near term.

Magnificent 7:

Meta (the owner of Facebook, Instagram, and WhatsApp) continues to gain favor with investors due to high expectations of earnings and AI potential.

Tesla experienced falling sales in Europe, as consumers view Musk’s political activism as a negative.

Also, the removal of government subsidies for electric cars and operational difficulties with the Cybertruck being recalled for issues with the accelerator pedal and windscreen wipers kept the downward pressure on Tesla stock.

Nvidia has fallen out of favor due to the DeepSeek effect.

Major Semiconductor stocks:

Intel gained nearly 24% in the week on reports that Taiwan Semiconductor Manufacturing Company (TSMC) is considering acquiring a controlling stake in Intel’s manufacturing facilities. The US government is generally not in favor of overseas companies acquiring stakes in US chip manufacturing. The Trump administration is planning the promotion of domestic design and manufacturing of AI chips.

ARM’s stock has risen approximately 29% year-to-date as it prepares to launch its chip in 2025. ARM does not manufacture its own chips. Instead, it licenses its chip architectures and designs to other companies like Apple, Qualcomm, Nvidia, and MediaTek.

ARM’s customers then customize and manufacture the chips using foundries like TSMC and Samsung.

SoftBank is reportedly considering a $6.5 billion acquisition of Ampere Computing, a chip company specializing in ARM-based processors for data centers. SoftBank remains the majority investor in Arm, actively shaping its strategy and expansion into AI and High Performance Computing (HPC).

🇺🇸 US economy

Inflation is creeping back up, and the latest data shows it’s not showing any signs of abating.

In January, the Consumer Price Index (CPI) jumped 0.5%, pushing the annual inflation rate to 3.0%, up from 2.9% in December. If you strip out food and energy, core CPI still climbed 0.4% month-over-month.

Meanwhile, the Producer Price Index (PPI)—which tracks wholesale prices—also ticked up 0.4%, coming in higher than expected.

The major reason? Housing costs are continuing to put upward pressure on inflation.

Aren't housing costs driven by interest rates, which are driven by inflation - circular?

This is the paradox. Higher interest rates drive higher housing costs, which drive inflation, which is combatted by higher interest rates.

Chair Jerome Powell of the Federal Reserve has made it clear: the Fed isn’t ready to ease up on interest rates just yet. Inflation is still not where it needs to be.

Will there be interest rate cuts this year? Maybe later in the year, so borrowing costs are going to stay higher for longer.

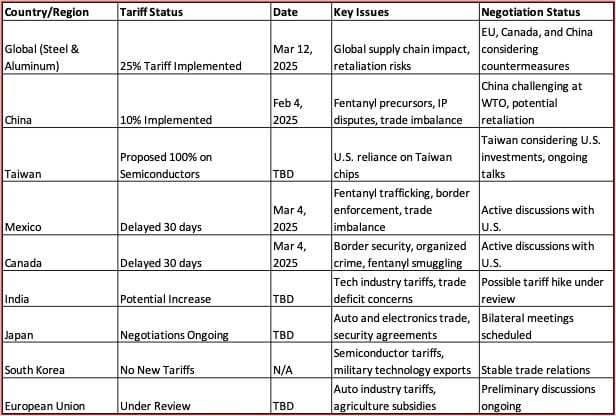

Tariff Watch:

Some retaliation and some negotiations are under way. Global trade is being fundamentally changed into a more protectionist world order. Trade rules and agreements are going to re-written, new partnerships will be formed and existing ones will be strengthened.

Conventional economic wisdom is that tariffs are mutually damaging for trading partners but this thinking is being upended.

The next Federal Reserve meeting on interest rates is scheduled for March 18,19.

S&P500 is +4.7% in the year to date.

🇬🇧 UK economy

Tariffs on steel from the US will be 25%, so the UK government has fast-tracked a £2.5 billion investment plan to support the domestic steel industry. This is a mitigation exercise involving innovative projects and the use of British-made steel in public infrastructure. Also, it is considering the blocking the influx of cheaper foreign steel into the UK.

The UK government will also be seeking exemption from the US tariffs.

Inflation could rise, say the Bank of England. It is expected to rise to about 3.7% in 2025. It was 2.5% in December. January inflation will be announced on February 19.

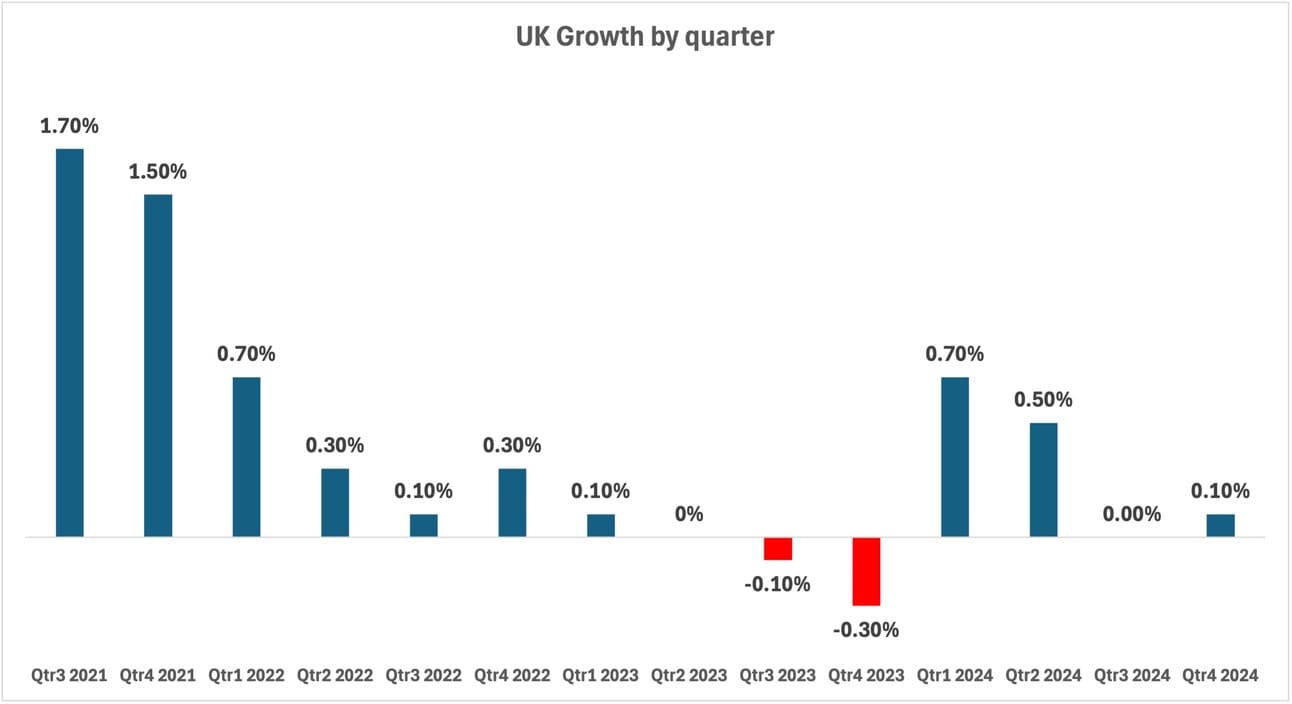

Growth was 0.1% in Q4 2024, following a revised no growth in Q3.

With limited growth in the UK economy and higher taxes, 10,800 millionaires left the UK in 2024. The number who left in 2023 was 4,200.

The government has set growth as its major economic priority.

The Bank of England’s outlook is 0.75% for 2025, citing high energy costs and lower business investment.

The next Bank of England meeting on interest rates is scheduled for March 20.

FTSE100 is +6.5% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan economy

Nikkei 225 oscillates around its 1989 high. Concerns remain about the impact of US tariffs, as well as future interest rate increases.

Inflation outlook is 2.5% by the end of 2025, compared to 3.6% in December 2024.

Interest rate outlook is 0.5% by the end of 2025, though some expect it to rise to 0.75% or even 1%.

Upcoming:

The next Bank of Japan meeting on interest rates is scheduled for March 18, 19

See previous spotlight on Japan.

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

OpenAI’s CEO, Sam Altman has said that the company is laser-focused on reaching Artificial General Intelligence (AGI)—AI that can match or surpass human intelligence—within the next five years.

What is AGI?

AGI is different from today’s Narrow AI (ANI - Artificial Narrow Intelligence), which is limited to specific tasks like answering questions, generating images, or summarizing text.

AGI, on the other hand, would:

Match or surpass human intelligence across all cognitive tasks.

Learn, reason, and adapt across different domains without retraining.

Understand abstract concepts, think critically, and even develop self-awareness (depending on definitions).

OpenAI is ramping up its use of autonomous AI agents that can perform complex tasks without human intervention. While Altman acknowledges that this could bring massive economic and societal shifts, he insists that AI will be a net positive if managed responsibly.

Is there governmental oversight of AGI development?

xAI, Elon Musk’s AI startup is looking to scale up in a big way. Reports suggest that xAI is close to finalizing a $5 billion deal with Dell Technologies to supply high-performance AI servers powered by Nvidia’s latest GB200 chips.

This deal would dramatically expand xAI’s computing capacity, especially for its Memphis-based supercomputer, Colossus. The goal? To grow Colossus from 100,000 GPUs today to over a million in the coming years.

Did DeepSeek highlight that AI models can be built more cheaply? Yes!

So why the big spend by xAI?

DeepSeek uses Mixture-of-Experts (MoE) architecture proficiently, but the spend by xAI is for more than Large Language Models and for a variety of advanced AI models such as Grok 3, with superior reasoning capabilities, and moving towards AGI.

What is a Mixture of Experts?

Mixture of Experts (MoE) activates only a few specialized networks per task, reducing GPU use and costs. A gating system selects the best experts, improving efficiency. DeepSeek and Google use MoE, while xAI’s $5B GPU investment suggests broader AI ambitions, possibly beyond LLMs toward AGI or advanced AI models.

Get your free guide to AI

See the previous spotlight on AI chips

🌐 Crypto Corner

Top 10 cryptos:

XRP is up 30% year to date due to anticipation of the launch of Exchange Traded Funds (ETFs). There has been volatility but cryptos always have volatility!

Ethereum has been losing market share to competitors like Solana, which has scalability, speed and lower costs.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Elon Musk (Tesla, SpaceX) $394bn ⬇️ $3bn

Mark Zuckerberg (Facebook/Meta) $254bn ⬆️ $8bn

Jeff Bezos (Amazon) $241bn ⬇️ $1bn

Larry Ellison (Oracle) $215bn ⬇️ $1bn

Bernard Arnault and family (LVMH) $193bn ⬆️ $11bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.