INSIGHT WEEKLY: November 24, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Markets Overview

Major market indexes:

After last week’s declines, markets recovered as small caps and equal-weighted S&P500 outperformed the capitalization-weighted index.

The incoming US administration's policies and increased geopolitical tensions were major considerations for investors.

The utilities sector outperformed, driven by optimism around rising artificial intelligence-driven demand for clean energy.

Markets v all-time high:

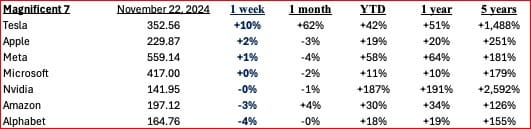

Magnificent 7:

Despite the prospect of the consumer tax credit of $7,500 for EV purchases being scrapped by the incoming administration, Tesla gained 10% on analyst ratings and also benefitted from the Trump trade.

Alphabet dropped 4% partly due to reports of the Justice Department filing a proposal to break up Google's parent company.

Major Semiconductor stocks:

Institutional investors and hedge funds buy into Micron following last week’s price decline.

NVIDIA's third-quarter earnings release met investor expectations, though fourth-quarter guidance was lighter than anticipated.

Gold gained over 5% this week mainly due to increased geopolitical risk in Europe.

🇺🇸 US economy

Labor market improved as there was a surprising decline in initial jobless claims for the week ending November 16, 2024. Claims fell by 6,000 to 213,000, marking the lowest level since April 2024.

Home sales increased year-over-year in October, the first rise since July 2021. The growth was driven by additional job gains, continued economic expansion, and stabilizing mortgage rates, which boosted housing demand.

Upcoming:

PCE (the preferred metric of the Federal Reserve) will be released on November 27.

The next Federal Reserve meeting on interest rates is scheduled for December 17-18.

S&P500 is +1.7% in the week and +25.1% year to date.

🇬🇧 UK economy

Inflation ticked up in October to 2.3%! September was 1.7%.

Higher energy costs pushed up inflation in October.

It is the highest level in six months. This news could mean that the Bank of England (BOE) will not cut interest rates in December.

Retail sales dropped 0.7% in October, significantly exceeding the anticipated 0.3% decline and following a revised 0.1% growth in September, according to the Office for National Statistics (ONS). The downturn was led by reduced spending on clothing and food, as consumers held back ahead of the Budget announcement. ONS statistician Hannah Finselbach noted that the decline was evident across various retail sectors.

Consumer confidence showed improvement in November, with GfK's confidence index rising by 3 points to -18, partially recovering from declines in the prior two months.

Upcoming:

The next Bank of England meeting on interest rates is scheduled for December 18.

FTSE100 is +2.5% this week and +6.8% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan economy

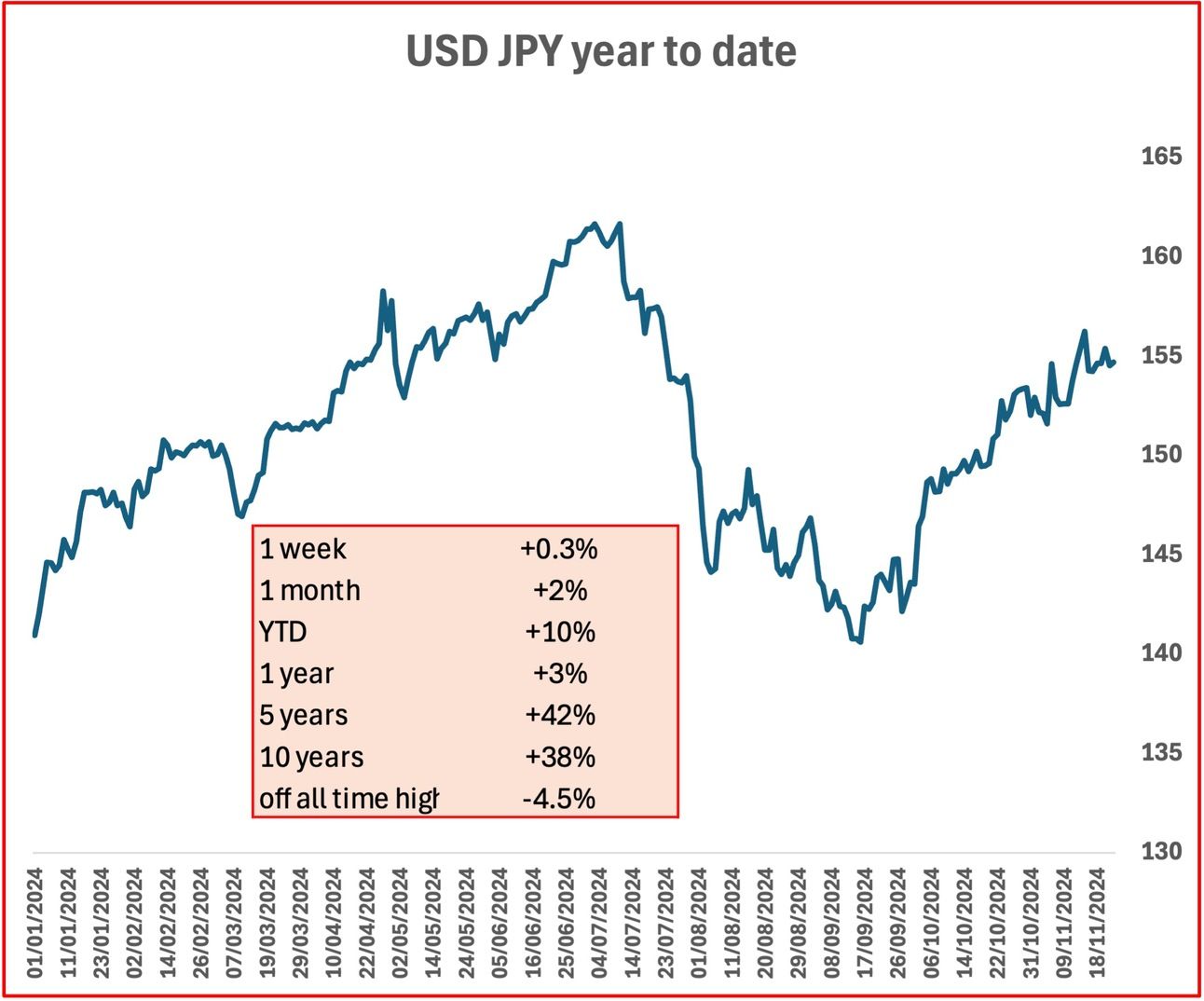

Yen depreciated to the JPY 155 range against the U.S. dollar, down from about JPY 152.6 the previous week. Japanese authorities reiterated their commitment to taking appropriate action against excessive currency movements. The yen's depreciation is partly attributed to expectations of inflationary policies from the incoming U.S. administration.

Nikkei 225 fell by 0.9% in the week. The yen's weakness provided some support to exporters, but concerns over potential tariff increases by the incoming U.S. administration weighed on companies heavily reliant on U.S. markets.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Amazon’s Expanding Partnership with Anthropic as Amazon deepens its investment in Anthropic, a generative AI startup, with an additional $4 billion, doubling its total to $8 billion.

This move solidifies Amazon Web Services (AWS) as Anthropic’s primary cloud and training partner. The collaboration includes work on AWS Trainium hardware, enabling advanced optimization for machine learning, and embedding Anthropic's Claude models into applications like Alexa and Amazon Bedrock. Claude is now widely used across industries, with notable applications in medicine, taxation, and government due to its scalability and customization features.

The partnership highlights Amazon’s competitive stance against rivals like Microsoft and Google in the AI space, as demand for AI infrastructure grows.

OpenAI is reportedly considering developing a web browser integrated with its ChatGPT chatbot, aiming to challenge Google’s dominance in search and browsers. Prototypes of the potential browser have been shared with organizations like Condé Nast and Redfin, although the project is still in its early stages with no immediate plans for launch.

To support this effort, OpenAI has recruited Ben Goodger and Darin Fisher, two key architects of Google Chrome, whose expertise could play a significant role in shaping OpenAI's browser initiative. This aligns with the company’s broader strategy of embedding AI into everyday tools, building on the recent introduction of ChatGPT’s search feature, which allows the AI to provide real-time, web-sourced answers.

While OpenAI’s ambitions are clear, the timeline for launching a browser remains uncertain as the project continues to develop.

OpenAI has shared updates on "red teaming," a process to find risks in AI systems by using both human experts and automated tools. This approach helps identify problems and make AI safer. OpenAI’s new research and a white paper detail methods for testing AI models, including campaigns with external experts and automated systems that simulate potential issues.

External red teaming focuses on setting goals, choosing experts, creating testing tools, and analyzing results.

Automated red teaming uses AI to generate many examples of model mistakes, helping find risks faster and at a larger scale.

While helpful, red teaming has limits, such as changing risks over time and the challenge of preventing misuse of findings. OpenAI highlights the importance of public input to shape AI behavior, ensuring AI systems are safe and beneficial for everyone.

LinkedIn co-founder Reid Hoffman has raised concerns about Elon Musk's potential conflicts of interest, particularly regarding his AI company xAI and his support for Donald Trump's 2024 presidential campaign. Hoffman suggests that Musk's dual roles could lead to biased AI outputs favoring Trump, especially given Musk's significant financial backing of Trump's campaign through America PAC. This situation underscores the need for transparency in AI development to prevent political biases. Hoffman emphasizes the importance of public awareness and scrutiny to ensure AI technologies serve the broader public interest without undue political influence.

Get your free guide to AI

See previous spotlight on AI chips

🌐 Crypto Corner

Top 10 cryptos:

XRP has continued to increase (this week 64%, last week 61%) due to optimism around its regulatory standing, following the SEC's legal troubles and favorable court rulings for Ripple. Market confidence has also been buoyed by shifting U.S. regulatory attitudes and increased institutional interest in its cross-border payment use cases.

Cardano also has continued to increase (this week 51%, last week 59%) has rallied on strong network growth, including nearing the milestone of 100 million transactions. Developer activity, ecosystem upgrades, and partnerships have fueled bullish sentiment, making it an increasingly attractive blockchain for DeFi and enterprise solutions.

Solana experienced significant gains driven by a sharp rise in active addresses and record decentralized exchange (DEX) volumes. Its efficiency, low fees, and growing ecosystem have propelled it past Ethereum in key metrics, while broader crypto market optimism has further boosted its appeal.

Overall, cryptocurrency markets showed resilience amid broader market volatility, with strong activity across decentralized applications, institutional interest, and regulatory clarity driving sentiment.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $334bn ⬆️ $31bn Tesla stock up 10% in the week

Larry Ellison (Oracle) $235bn ⬆️ $11bn

Jeff Bezos (Amazon) $213bn ⬇️ $6bn

Mark Zuckerberg (Facebook/Meta) $193bn ⬆️ $2bn

Bernard Arnault and family (LVMH) $155bn ⬇️ $3bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.