INSIGHT WEEKLY: January 5, 2025

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Markets Overview

Major market indexes by year:

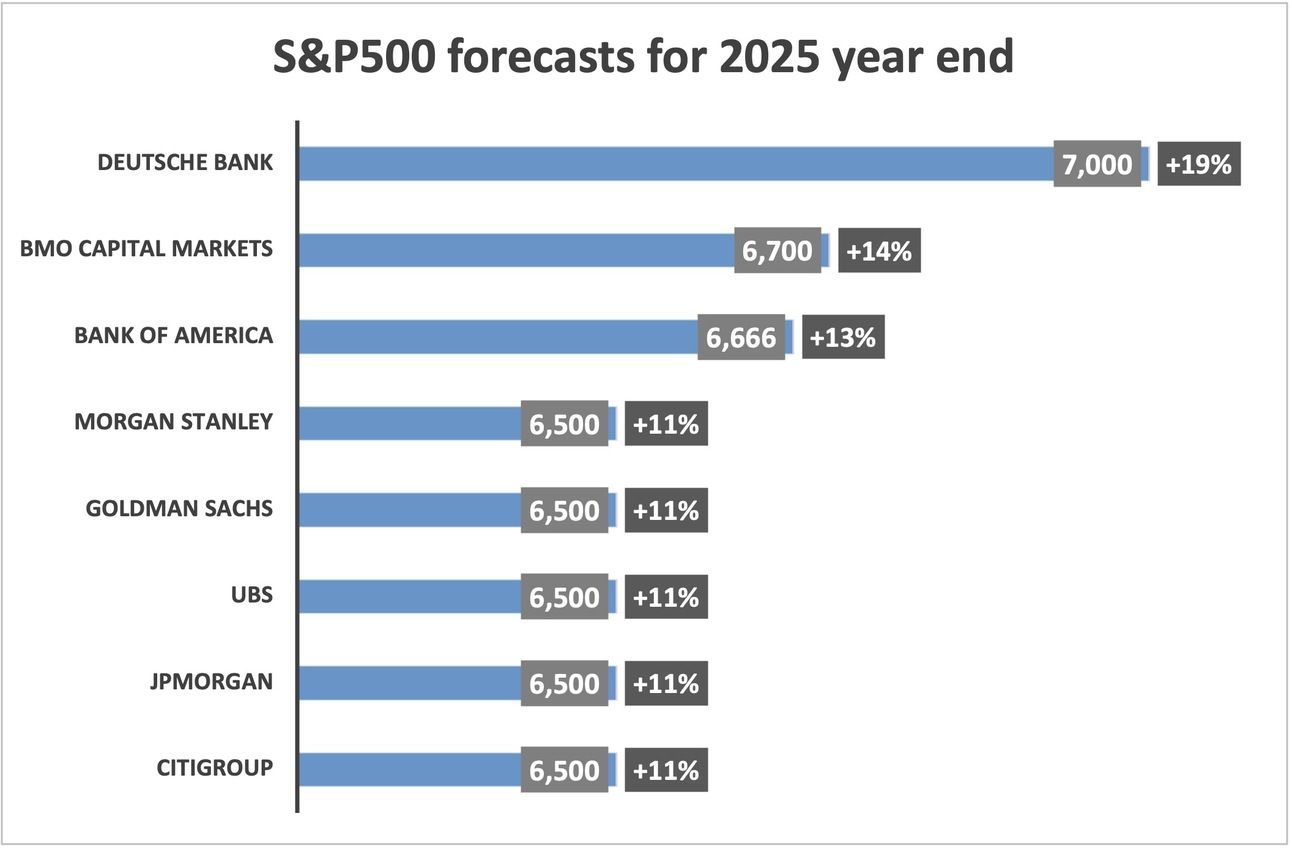

After the exceptional performance of the Nasdaq and the S&P500 over the last two years, the performance in 2025 may not be at similar levels. However, the forecasts are still positive - see S&P500 forecasts for 2025 below.

The main concern is how the planned US tariffs on imports may impact global trade.

Outlook for 2025:

This is how analysts view the prospects and risks in 2025.

S&P500 outlook:

The S&P500 is the most watched index, despite its very high weighting of big tech companies.

S&P500 closed at 5,881 on December 31, 2024.

Here are some of the forecasts for 2025.

Markets v all-time high on January 3, 2025:

US markets are a few percentage points off the all-time intra-day highs.

Magnificent 7:

Over the 5 years, Nvidia, Tesla, and Meta have been the best performers.

Tesla gained 743% in 2020!

Major Semiconductor stocks:

On a cumulative basis, Intel is the only stock in this group that is lower than 5 years ago - it is lower by 66%.

🇺🇸 US economy

Chicago Purchasing Managers Index dropped to 36.9, reflecting a deeper contraction in manufacturing than anticipated. This index is mainly a manufacturing index in this region. This was the thirteenth consecutive monthly contraction.

GDP growth estimates was revised down by the Atlanta Fed for Q4 down from 3.1% to 2.6%, pointing to weaker-than-expected private investment.

Jobless claims hit an eight-month low at 211,000, reflecting the ongoing resilience of the labor market.

Treasury yields declined, and municipal bonds benefited from subdued issuance. While the economy is slowing, investor optimism remains intact, supported by a robust labor market and a positive outlook for corporate earnings heading into 2025.

The next Federal Reserve meeting on interest rates is scheduled for January 28,29.

S&P500 is -0.5% in the week and +1.0% year to date.

🇬🇧 UK economy

House prices rose by 0.7% in December, marking the strongest annual growth since 2022, with suburban markets driving demand. Consumer lending grew at the lowest pace since November 2022 and mortgage approvals were fewer than expected.

Consumer confidence improved slightly in the final quarter, supported by easing inflation and energy price stability.

Wage growth remains muted, and high interest rates are continuing to weigh on household budgets and borrowing.

GDP growth flat lined between July and September, despite the government’s intention to boost growth.

The Bank of England is expected to maintain its cautious stance as inflation trends lower but remains above the 2% target.

The next Bank of England meeting on interest rates is scheduled for February 6.

FTSE100 is +0.9% this week and +0.6% in the year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post it on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan economy

Manufacturing PMI in December inched up to 49.6, remaining in contraction territory but showing incremental improvement.

Tokyo’s inflation rate continued to rise, spurring speculation about potential near-term policy shifts.

Nikkei 225 was up 19% in 2024. The current trend is oscillating above and below its 1989 high. Japan remains a market to watch in 2025, with its corporate reforms and innovation in robotics and AI offering significant upside, even as monetary policy uncertainties loom.

Upcoming:

The next Bank of Japan meeting on interest rates is scheduled for January 23, 24

See previous spotlight on Japan.

🌐 Artificial Intelligence and Tech

This cover has been designed using assets from Freepik.com

Microsoft is planning to invest about $80 billion in fiscal year 2025 to develop data centers to train artificial intelligence models and for AI and cloud applications.

The surge in AI investment, especially since the launch of OpenAI’s ChatGPT in 2022, has led to increased demand for specialized data centers capable of handling the immense computing power required for AI models. Microsoft’s planned expenditure reflects this growing need, with analysts projecting the company’s total capital expenditure for fiscal 2025 to be around $84.24 billion. In the first quarter of fiscal 2025 alone, Microsoft’s capital expenditure rose by 5.3% to $20 billion.

A significant portion of this investment will be directed toward the United States.

This ambitious plan positions Microsoft as a formidable contender in the AI industry, especially given its exclusive partnership with OpenAI. The company’s substantial investment in AI infrastructure aims to meet the escalating demand for AI integration across various sectors, ensuring that Microsoft’s platforms can support the next generation of AI and cloud-based applications.

OpenAI, the company behind ChatGPT, has announced plans to restructure its business next year, creating a public benefit corporation (PBC) to oversee its operations. This move, detailed in a recent blog post, marks a significant shift from its original non-profit model and aims to attract greater investment to support its ambitious goals in artificial general intelligence (AGI).

Under the new structure, OpenAI’s for-profit PBC will handle operations and business initiatives, while a non-profit arm will focus on charitable projects in sectors like healthcare and education. The change is intended to help raise the substantial capital required to compete in the rapidly evolving AI landscape.

OpenAI has faced growing financial demands, particularly as its recent $6.6 billion funding round hinged on restructuring to attract conventional equity investors. Microsoft, OpenAI’s largest backer with a 49% stake, and other investors have sought clarity on ownership stakes under this new model.

The move aligns OpenAI with rivals like Anthropic and xAI, which already operate as public benefit corporations. OpenAI says the restructuring will provide the flexibility needed to secure investment and remain competitive in the AI race.

Get your free guide to AI

See previous spotlight on AI chips

🌐 Crypto Corner

Top 10 cryptos:

XRP was the best performing of the top 10 cryptos in 2024.

If Bitcoin is positioned as a strategic asset by the incoming administration, will it go on to become the top performing crypto in 2025?

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Elon Musk (Tesla, SpaceX) $424bn

Jeff Bezos (Amazon) $237bn

Larry Ellison (Oracle) $209bn

Mark Zuckerberg (Facebook/Meta) $209bn

Bernard Arnault and family (LVMH) $161bn

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.