INSIGHT WEEKLY: September 15, 2024

If the images do not load, you can just click to download external images in your email to see the newsletter in full, or click the link above to read online.

Reading time of just 5 minutes to be well informed of the need-to-know topics of our times.

🌐 Major market indexes and stocks

Major market indexes:

Markets recovered strongly during the week after last week’s losses. The gains this week were mainly driven by growth stocks, especially in technology.

India’s Nifty 50 set a new record on Thursday.

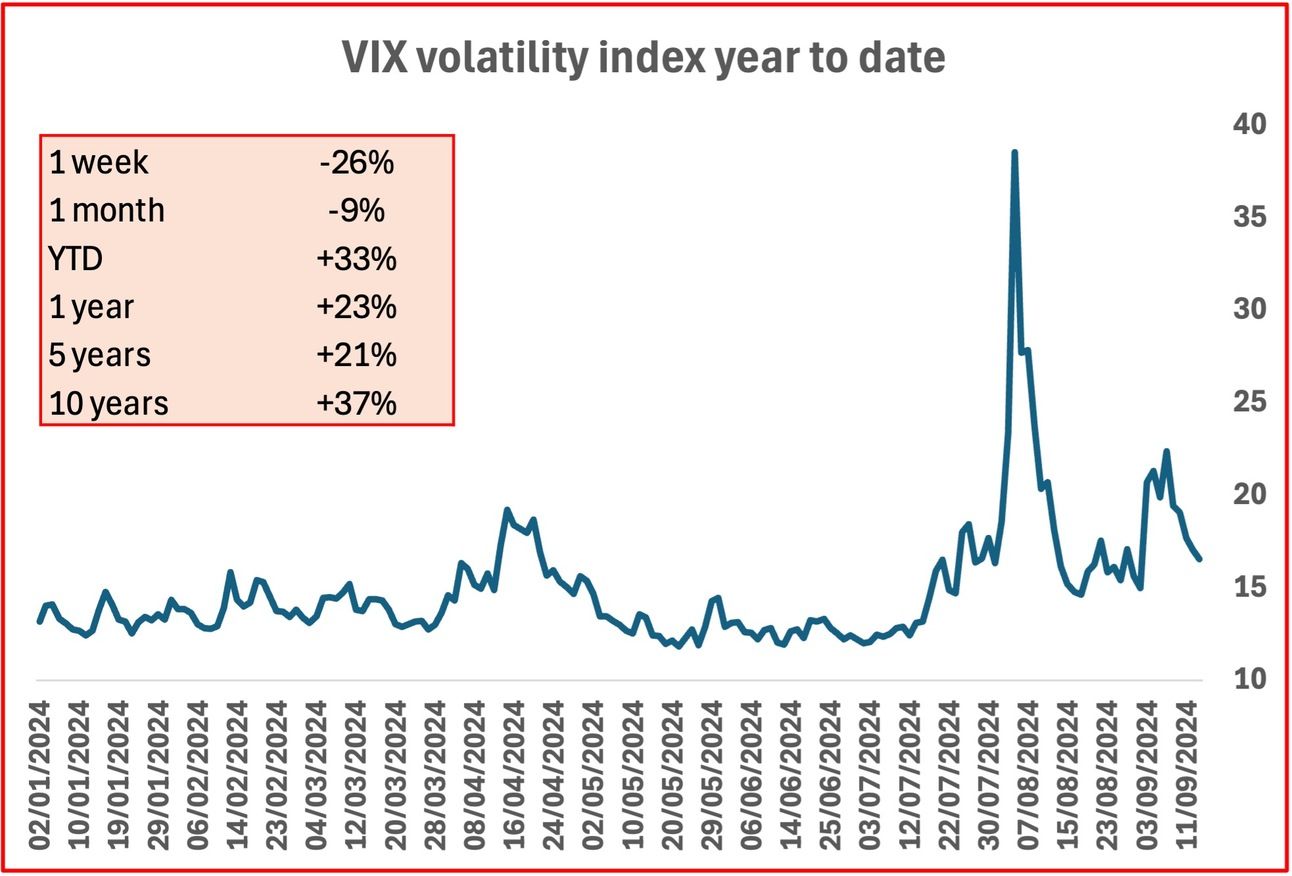

Market volatility in the US is shown below. The markets are moving up and down significantly with changing expectations on AI earnings of tech stocks, as well as on economic news.

S&P 500 gained on AI optimism mainly driven by Nvidia. It is just 1% below its all-time high.

After a downturn last week when the S&P500 had the worst weekly drop since March 2023, the S&P500 showed gains every day of this week. Growth stocks, mainly tech stocks, outperformed value stocks significantly.

What has changed? Last week, economic news weighed heavily on markets and there was skepticism about the prospects of good, future earnings from AI stocks like Nvidia. This week, there has been a reversal of sentiment, led by a more positive outlook on Nvidia.

Markets v all-time high:

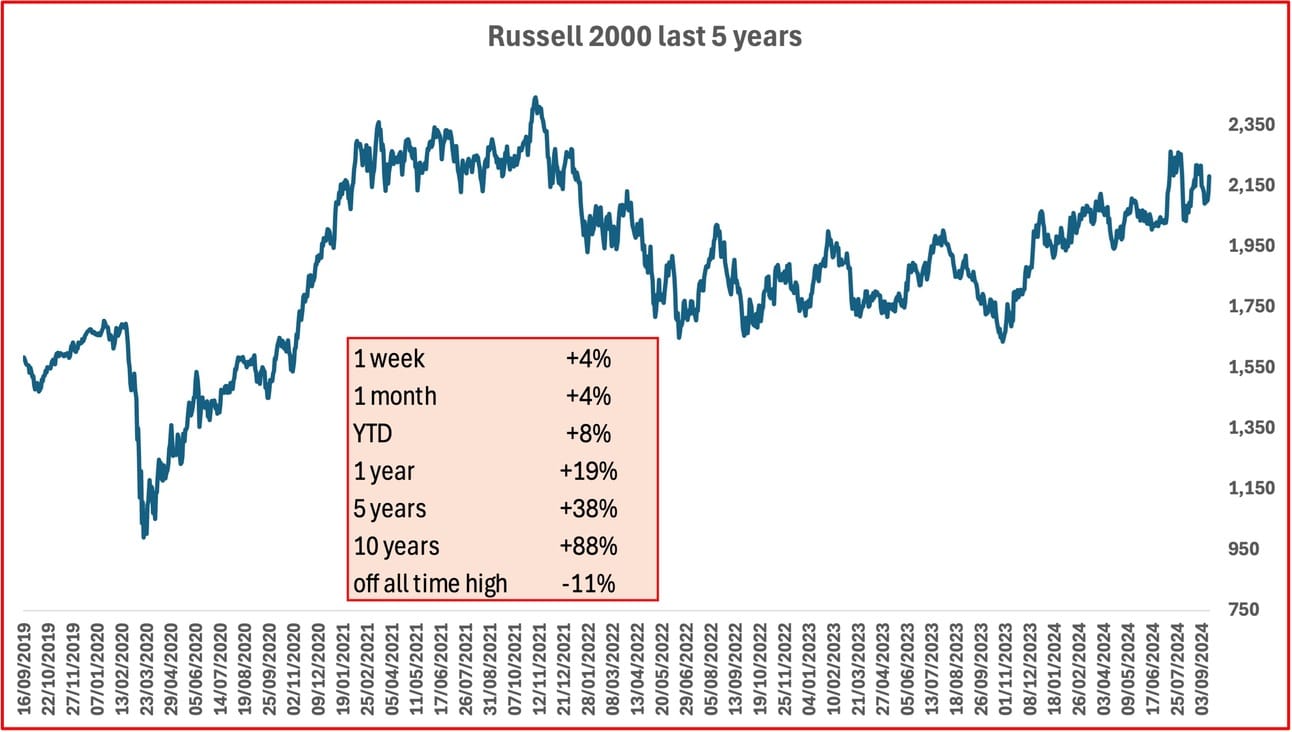

US Small and medium-sized companies (Russell 2000):

There is an increasing interest in small and medium-sized US companies. The Russell 2000 index is showing a rising trend. Lower interest rates, when they come, will be especially beneficial to smaller companies.

Magnificent 7:

In an about-turn, Nvidia is now back in favor!

Major Semiconductor stocks:

Chip stocks gained led by ARM, Broadcom, and Nvidia on AI hopes.

🇬🇧 UK

Growth in the UK economy unexpectedly stagnated in July, following no growth in June, defying forecasts of 0.2% growth. Despite a boost from the summer sports events like the Euros and Olympics, which helped the services sector, both production and construction output declined.

Within the services sector, health and computer programming, grew slightly, while other sectors like advertising and architecture declined.

The UK emerged from a short recession but it appears difficult to fire up growth.

Data centers are to be classified as critical national infrastructure, joining key sectors like healthcare, finance, and energy. This designation means data centers will receive additional government support to reduce disruptions during major incidents, such as cyberattacks or IT outages. Data centers, which power services like AI, have faced criticism for their heavy energy and water use. However, the new Labour government supports the sector, with Technology Secretary Peter Kyle calling them "the engines of modern life." The decision follows a consultation launched in 2023 and reflects the growing importance of data centers. Despite their critical status, no new regulations will be introduced, but a government team will be established to monitor threats and coordinate responses. Environmental concerns about data center power consumption remain significant.

Mortgage rates heading down as HSBC, Nationwide, NatWest and TSB cut rates with TSB cutting twice in one week. Further cuts are expected in the coming months. Headline two-year rates are 5.49% and five-year at 5.15%.

UK interest rates will be decided at the Bank of England’s next meeting on September 19.

FTSE100 is +1.1% this week and +7% in the year to date.

🇺🇸 US

CPI inflation for August was 2.5% (annual), compared to 2.9% for July. This is the lowest in three years. Groceries, fuel and other items fell while airline tickets, car insurance, rent and other housing costs increased.

Interest rate cut is expected next week. The debate is whether it will be 0.25% or 0.5%.

The next Federal Reserve meeting on interest rates is scheduled for September 17-18.

S&P500 is +4.0% in the week and +18% year to date.

If you like this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

Inflation and Interest Rates. There have been further comments from members of the board of the Bank of Japan (BOJ) that rates will need to rise if the economic conditions require it. The abnormally low rate of 0.25% (raised from negative rates) cannot be conducive to the normalization of the Japanese economy.

As rates increase, the Yen will get stronger.

Much as the BOJ may want to raise rates, they have already committed to market stability and so there will be some hesitancy. Mainly because carry traders, borrowing cheaply in Japan and investing in the US, created instability earlier by unwinding their trades as the Yen appreciated.

Yen has been strengthening, ending the week at 140 v the dollar.

Growth was revised lower. GDP grew by 2.9% quarter on quarter, less than the 3.1% earlier reading.

Stock markets gained over the week. Nikkei 225 Index is +0.5% in the week and +9.3% in the year to date.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Apple’s AI is not yet ready.

Apple's recent unveiling of the iPhone 16 series, its first AI-powered smartphone, has left many underwhelmed due to delayed AI features, still in beta testing and unavailable until next year. In contrast, Huawei launched its Mate XT, boasting advanced AI features powered by its in-house Kylin chips, posing a direct challenge to Apple, particularly in the crucial Chinese market.

Apple's AI, known as Apple Intelligence, won't initially include key features, raising questions about its readiness. In China, where AI integration is delayed further, customers expressed frustration, especially as Huawei’s Mate XT offers innovative AI tools right away. Huawei has already gained significant traction, receiving millions of pre-orders. But the trifold phone costs more than a 16-inch MacBook Pro. And a replacement glass is $1,100!

Huawei’s market share has surged despite U.S. sanctions. Delays in rolling out Apple Intelligence in China give Huawei a head start on AI phones.

OpenAI's newly released o1 model, codenamed "Strawberry," is designed to "think" before responding, offering multi-step reasoning for more complex queries. While it excels at breaking down larger tasks and delivering detailed answers, it struggles with simpler tasks, often overthinking them. This release may be good for tackling intricate problems, but its high cost around four times more expensive than GPT-4o raises questions about its value.

The AI community had high expectations for o1, but its initial release has not lived up to the hype. OpenAI's CEO, Sam Altman, tempered expectations, emphasizing that while o1 is a step forward, it is not revolutionary. Despite its advanced capabilities, it lacks the speed and multimodal features that made GPT-4o popular.

In conclusion, while o1 offers a unique approach to AI reasoning, its hefty price and occasional overthinking may limit its broader appeal, making it more suited to specific, complex tasks.

Meta is moving forward with plans to use publicly shared posts from UK Facebook and Instagram users to train its AI models, despite privacy concerns. The decision follows discussions with the UK's Information Commissioner’s Office (ICO) after a pause in June. The ICO has not given full approval but will monitor the situation as Meta introduces changes, such as offering users an easier opt-out option. Private messages and content from under-18s will not be included.

Privacy groups like Open Rights Group (ORG) and None of Your Business (NOYB) remain critical of Meta’s approach, accusing the company of using individuals as unwitting test subjects. Meta’s similar plans remain on hold in the EU due to stricter privacy laws. Meta claims its AI models will reflect British culture and be available in more countries soon. The ICO has reiterated the need for transparency and safeguards when using personal data for AI training.

Get your free guide to AI

See previous spotlight on AI chips

🌐 Crypto Corner

Tracking Bitcoin price (up to September 13):

Bitcoin rises to just under $60,000 on rate cut hopes.

Tracking Eth price (up to September 13):

Ether like Bitcoin rises in anticipation of an interest rate cut next week.

See the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $252bn ⬆️$9bn

Jeff Bezos (Amazon) $204bn ⬆️$14bn

Larry Ellison (Oracle) $197bn ⬆️$22bn

Mark Zuckerberg (Facebook/Meta) $181bn ⬆️$8bn up one place

Bernard Arnault and family (LVMH) $172bn ⬇️ 1bn down one place

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.