INSIGHT WEEKLY: June 16, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online. An easy to read, weekly summary to be well informed of the need to know topics of our times.

🌐 Major indexes and major stocks

There were three new records in the week (shaded in blue below).

S&P500 and Nasdaq set new records, with Apple, Nvidia and Broadcom pushing the indexes higher.

India’s Nifty 50 rose to a new record on good inflation news.

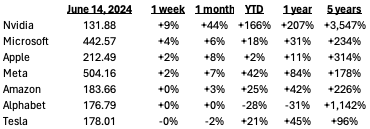

Magnificent 7:

Semiconductor stocks:

Broadcom's stock surged 12% on Thursday, reaching an all-time high after exceeding quarterly earnings expectations, largely due to a 280% year-over-year increase in its AI business. Broadcom provides semiconductor and infrastructure software solutions. Could Broadcom become a trillion dollar company? At $807bn, Broadcom is now more valuable than Tesla, JPMorgan Chase, ExxonMobil and Walmart.

ARM stock continues to climb. It will soon join the Nasdaq 100.

🇬🇧 UK

Public expectations of UK inflation have fallen to a near three-year low, returning to their long-term average. According to a Bank of England (BoE) survey, the average Briton in May predicted a 2.8% price growth rate for the next 12 months, down from 3% in February. This marks the lowest level since August 2021 and aligns with the 2000-2021 average.

This news is favorable for the BoE's Monetary Policy Committee, which meets next week to decide on interest rates. Lower inflation expectations are crucial as they influence consumer spending and wage setting, key factors in domestic price pressures.

The BoE is expected to maintain interest rates at a 16-year high of 5.25%. Annual inflation dropped to 2.3% in April from 3.2% in March, significantly lower than the 11.1% peak in October 2022.

UK unemployment has reached its highest level in nearly three years as the country approaches its next general election, rising to 4.4% between February and April, up from 4.1% in the previous quarter.

Wage growth including bonuses was unchanged at 6% between February and April (5.9% excluding bonuses). This does not help the Bank of England to cut rates, though the target inflation rate is the key driver for a cut.

Interest rates will be considered at the Bank of England meeting on June 20th. Will the BOE cut interest rates? Current pricing and sentiment indicate no chance of a cut in June, a 36% chance in August and 60% in September.

Growth in the UK economy in April stalled, failing to grow due to wet weather that deterred shoppers and slowed construction. This came after a 0.4% growth in March, ending a recent recession. With the general election approaching, the economy is a major focus. The Office for National Statistics reported growth in services spending for the fourth month, offset by declines in production and construction. Despite a 0.7% growth over the last three months, high living costs continue to impact consumers. The Bank of England will review these figures for its upcoming interest rate decision, but a cut is unlikely.

FTSE100 is flat to last week and +5.0% this year.

🇺🇸 US

Inflation as measured by the headline consumer price index (CPI) was flat in May compared to April. This is the first time in almost two years that it didn't climb.

Core inflation dropped to 3.4%, a drop of 0.2% and the lowest since April 2021.

Producer price index (PPI) fell by 0.2% in May, against expectations of a slight increase, with core PPI dropping to 2.3% year-over-year. Import prices also declined by 0.4% in May, marking their first decrease in four months.

Interest rates were left unchanged by the Federal Reserve at a two-decade high of 5.25% to 5.5% as they wait for more signs of inflation cooling. The expectation is now just one cut in rates this year, down from the three cuts projected in March. Fed Chair Powell noted that while price growth is "still too high", recent data shows it has eased slightly, with the consumer price index rising 3.3% annually in May, down from 3.4% in April. Minor changes in inflation but not a downward trend.

The core consumer price index, excluding food and energy, rose by a modest 0.2% monthly.

The Fed emphasized that they will only reduce rates once they are confident inflation is sustainably moving towards their 2% target. Despite high interest rates, the labor market remains strong, with unemployment below 4% and job growth surpassing expectations.

Consumer sentiment slips for the third consecutive month. Despite positive signs like stock market highs and falling gas prices, the overall mood remains cautious.

If you like this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

Yen remains at low historic levels, around 157 against the dollar. The weakening yen reflects broader market trends and uncertainties.

Interest rates were unchanged as the Bank of Japan (BoJ) decided to stick to their current policy. They announced plans to gradually reduce their bond-buying activities, but detailed plans will only be revealed in July. BoJ also hinted that, depending on the economic data in July, they might consider raising interest rates. The BoJ’s cautious approach indicates that any move towards tightening monetary policy will be slow and measured.

Nikkei 225 Index closed flat to last week, and up 16% in the year.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Apple announced its partnership with OpenAI at its Cupertino headquarters, introducing "Apple Intelligence”, a suite of models built and trained by Apple and to be embedded in its new operating systems: iOS 18, iPadOS 18, and macOS Sequoia. This collaboration, with OpenAI’s GPT-4 positions Apple to offer personalized AI experiences emphasizing privacy and security. Apple’s models will operate mainly on-device, with some functions offloaded to Apple-controlled servers. Features include custom emojis, smart photo editing, and an enhanced Siri with more contextual awareness. This strategic move aims to boost Apple's AI capabilities and drive hardware upgrades, targeting the latest devices like iPhone 15 Pro and Pro Max.

Apple expects this AI integration to herald a new era of intelligent devices and a potential sales supercycle. Investors had been concerned that Apple may be behind in the generative AI race.

After an initial drop, Apple’s share price picked up and hit an all time high. And pulling it ahead of Nvidia at the number two position of the most valuable companies. For a brief period last week, Apple became the most valuable company, ahead of Microsoft.

Apple share price over different time periods :

Microsoft delays new Recall feature on security concerns. What does it do? It takes snapshots of your laptops every few seconds. The security concerns are that Recall can be a target for criminal activity where all the information can be picked up in one grab. Recall is intended for users to “easily find and remember things you’ve seen using natural language” according to Microsoft. Additional security measures are being worked on.

ChatGPT costs are well described in this article:

Natural Language Embedded programs (NLEPS) could be the next development.

What are NLEPS and what problem is it going to solve?

One of the shortcomings of Large Language Models (LLM) like ChatGPT is that the use of natural language has some limitations such as numerical or symbolic reasoning. What NLEPS try to do is to prompt a language model to create and execute a Python program to solve a user’s query, and then output in natural language. The results are expected to get better accuracy on reasoning tasks.

🌐 Crypto Corner

Tracking Bitcoin price :

Bitcoin price over different time periods :

A drop in the last week due to the Federal Reserve not cutting interest rates last week, but analysts at Bernstein have set their end 2025 target at $200,000! How? By the growth of Bitcoin spot ETFs (Exchange Traded Funds) to about 7% of bitcoin in circulation.

see the previous spotlight on Bitcoin halving

🚢 Shipping

Ocean freight rates from the Far East to the U.S. have risen by 36%-41% month-over-month. DHL predicts that ocean freight rate inflation may continue until the Chinese New Year in early 2025. Some forecasts suggest rates could climb to between $20,000 and the Covid-era peak of $30,000.

Red Sea attacks continue with another ship struck this week. Longer transits avoiding the Red Sea are increasing shipping costs.

Demand has decreased, so rate increases are supply driven.

Air freight prices have seen a 9% increase this year.

Potential port strikes on the East and West coasts in the US may cause further difficulties for shippers

Inflation concerns from higher shipping costs adding to concerns on getting inflation under control.

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $210bn ⬆️ $1bn

Jeff Bezos (Amazon) $201bn ⬆️ $7bn (up one place)

Bernard Arnault and family (LVMH) $192bn ⬇️ $16bn (down one place after a near 5% drop in LVMH share price)

Mark Zuckerberg (Facebook/Meta) $176bn ⬆️ $4bn

Larry Ellison (Oracle) $168bn ⬆️ $13bn (Oracle share price up nearly 10% on AI hopes)

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.