INSIGHT WEEKLY: July 14, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

To be informed in just 5 minutes of the need-to-know topics of our times.

🌐 Major indexes and major stocks

Five records were set during the week (shaded in blue below) as markets continue to rise due to expectations of falling inflation and reduced interest rates, as well as resurgent growth.

Magnificent 7:

Apple, Amazon, Meta, and Alphabet hit all-time highs during the week. Meta subsequently declined 8% in the week.

Major Semiconductor stocks:

Another week of increases for the major stocks.

PHLX Semiconductor index (SOX):

A wider “capitalization-weighted” index composed of the 30 largest semiconductor companies traded on US exchanges.

Highest value companies (market capitalization) in $ trillion:

Apple regains the top spot from Microsoft.

🇬🇧 UK

Growth grew 0.4% in May after no growth in April. The services sector grew by 0.3%, while construction surged 1.9%. Over the three months to May 2024, the economy grew 0.9%, the quickest pace in over two years.

Interest rate cuts may be delayed due to stronger growth. Although inflation has dropped to below target, three members of the Bank of England (BOE) committee indicated that waiting for a little while longer may be better as growth and services inflation may push up inflation again. A sustained drop in inflation may be worth waiting for.

Some mortgage lenders have commenced cutting interest rates in anticipation of the BOE’s decision.

FTSE100 is +0.6% this week last week and +6.7% this year.

🇺🇸 US

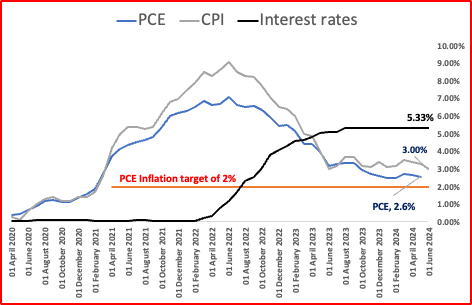

Inflation as measured by CPI fell 0.1% in June. This is the first fall since the start of the pandemic in early 2020. Looking at CPI year on year, it was +3.0% compared to +3.3% in May.

The Federal Reserve uses PCE as the preferred inflation measure. The target set is 2%. May inflation was at 2.6%. June is awaited.

The chatter in financial circles is that the 2% target may not be attainable and a combination of other economic factors may need to be considered.

Stock markets gained in the week with the Dow, S&P500 and Nasdaq making new record highs during the week. There was sector rotation with small-cap stocks higher by 6% in the week outperforming growth stocks.

S&P500 is +0.9% this week and +17.7% this year.

If you like this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

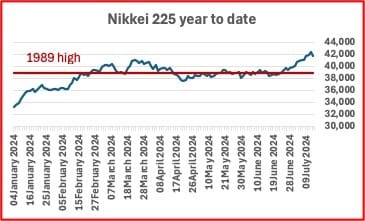

🇯🇵 Japan

Yen strengthened on Friday to around 158. It is not clear if there was government intervention but the sudden change on Friday indicated to observers that there might have been intervention.

Stock markets gained as the yen weakened, and then declined on Friday as the yen strengthened. The currency is seen as a factor for exporters, hence the inverse relationship between the currency and stock market performance.

Nikkei 225 Index gained +0.7% in the week hitting a new record in the week. It is +23% in the year.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Microsoft and Apple have opted not to take board seats at OpenAI amidst increasing regulatory scrutiny of Big Tech’s influence in AI development. Microsoft, after investing $13 billion in OpenAI, officially withdrew from the board, citing confidence in the new board's direction. Contrary to expectations, Apple will also not take an observer role. This retreat comes as both companies face heightened regulatory pressure, with investigations in Europe and the US examining their dominance in AI. Regulators are particularly concerned about Big Tech's partnerships concentrating access to advanced AI technologies. OpenAI expressed appreciation towards Microsoft and announced plans for regular stakeholder meetings to ensure collaboration on safety and security.

SoftBank has recently acquired British AI chipmaker Graphcore, continuing its strategy of investing in cutting-edge technology.

In 2016, SoftBank acquired ARM for $32 billion, aiming to enhance its presence in the semiconductor and AI sectors. The ARM acquisition was significant for SoftBank's Internet of Things (IoT) ambitions, although the subsequent attempted sale to Nvidia was blocked due to regulatory concerns. ARM was subsequently went public in an IPO in September 2023 with Softbank retaining a 90% stake.

In acquiring Graphcore, SoftBank is investing in a company known for its innovative AI processors, which are designed to accelerate machine learning tasks. This move comes as SoftBank continues to expand its AI capabilities, ensuring it remains a key player in the rapidly evolving AI and semiconductor industries. This acquisition is expected to bolster SoftBank's technology portfolio and drive further advancements in AI processing capabilities.

Data centers in space are being explored as a solution to the surging energy demands driven by the rise of AI. The ASCEND study, a 16-month initiative coordinated by Thales Alenia Space for the European Commission, found space-based data centers technically and economically feasible. These centers would use solar energy in orbit, significantly reducing terrestrial energy consumption. The project aims to deploy 1,300 building blocks by 2050, each offering substantial data storage capacity to help Europe achieve carbon neutrality.

Data Center demand for energy could reach 1,000 kilowatt hours by 2026, which is about the same as Japan’s energy consumption according to the International Energy Agency.

Despite the potential, sustainability and security concerns persist. The proposed data centers would orbit at approximately 1,400 kilometers, utilizing eco-friendly launchers developed by ArianeGroup. Launches will require significant amounts of rocket fuel, posing cost and environmental challenges.

Meanwhile, Microsoft, which has previously trialed an undersea data center, is collaborating with Loft Orbital to explore space-based data management. This highlights the global competition in AI and data innovation, with the EU striving to keep pace with the U.S. and China. ASCEND researchers are engaging with the International Space Agency to further the project, aiming to make it a flagship for European space development.

🌐 Crypto Corner

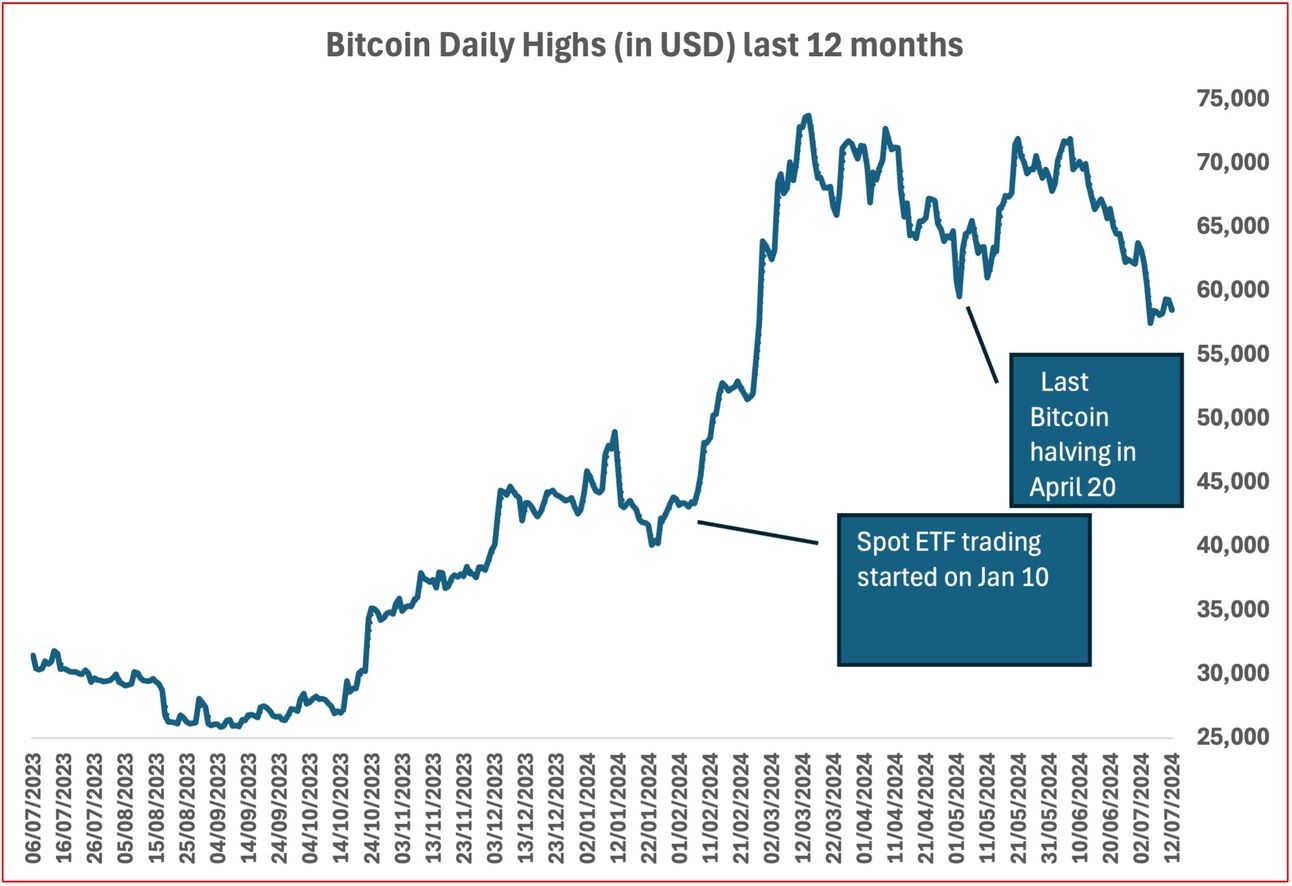

Tracking Bitcoin price:

Technical analysts who analyze charts would say that a double top has formed, and therefore a price drop is imminent. Mt Gox repayments and government selling pressure have added to Bitcoin’s decline.

Over different periods:

Ether ETFs are yet to be approved but the final sign-off is expected imminently.

see the previous spotlight on Bitcoin halving

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Elon Musk (Tesla, SpaceX) $249bn ⬇️ 2bn

Jeff Bezos (Amazon) $211bn ⬇️ 5bn

Bernard Arnault and family (LVMH) $200bn ⬆️ $4bn

Larry Ellison (Oracle) $179bn. Flat to last week. Up one place.

Mark Zuckerberg (Facebook/Meta) $174bn ⬇️ 15bn (Meta is -8% this week). Down one place.

If you liked this newsletter, please send this link to friends, family, and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.