INSIGHT WEEKLY : May 26, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

An easy to read, weekly summary to be well informed of the topical issues of our times.

🌐 Major indexes and major stocks

US Markets set new records this week mainly due to good earnings from Nvidia (Nvidia stock up 15% this week).

India’s Nifty 50 also set a new record this week.

Major stocks of interest :

SPOTLIGHT ON GDP :

Gross Domestic Product (GDP) is a major economic indicator.

GDP measures the total value of all goods and services produced within a country over a specific period, typically a quarter or a year. It serves as a key indicator of economic health. GDP can be calculated through production, income, or expenditure approaches.

Positive GDP growth indicates economic expansion, while negative growth suggests contraction and potential recession. A recession is generally considered to be two quarters of negative growth. See previous newsletter’s spotlight on recession .

Factors influencing GDP include consumer spending, business investment, government expenditure, and net exports. Policymakers, economists, and investors closely monitor GDP trends to make informed decisions about monetary and fiscal policies and investment strategies.

The US is over a quarter of global GDP and is the dominant economy in the world. The EU as a group of countries did surpass the US briefly in the early 1990s .

Percentage of global GDP - data from Visual Capitalist

GDP v GNP : These two indicators can be confused.

Gross Domestic Product (GDP) measures the total value of goods and services produced within a country's borders over a specific period.

Gross National Product (GNP) includes GDP but also adds income earned by residents from overseas investments and subtracts income earned by foreign residents within the country.

Essentially, GDP focuses on location, while GNP focuses on ownership.

🇬🇧 UK

Interest rates could be cut to 3.5% by end of 2025, say The International Monetary Fund (IMF) as it upgrades the UK's growth forecast for the year to 0.7%. The economy is nearing a "soft landing" post-recession, but the IMF warns against further tax cuts due to a potential £30bn deficit. Inflation should approach the 2% target but may rise slightly before stabilizing in early 2025. The IMF advises reducing the Bank rate to 4.75% or 4.5% by year-end, stresses the need for tough fiscal choices, and highlights concerns over labor shortages and the importance of maintaining climate policy commitments.

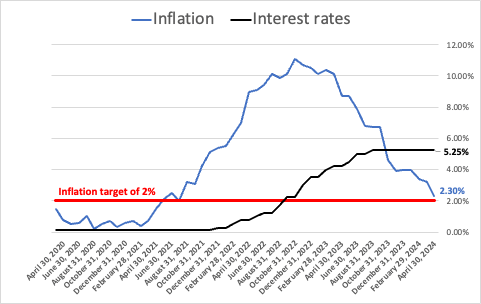

UK’s inflation and interest rate journey :

With interest rates at nearly +3% in real terms (actual - inflation) and inflation close to target, there is increasing pressure and expectation for a rate cut in June. Will the Bank of England make its first move in a few weeks time or will it wait another month ?

UK inflation and interest rates

Retail sales dropped 2.3% in April due to heavy rain, much worse than the expected 0.5% decline. Clothing, sports equipment, and furniture stores were particularly affected, and online sales fell by 1.2%. March’s figures were revised to a 0.2% fall. Despite a 0.7% rise over the previous three months, largely due to a poor December 2023, consumer confidence remains cautious, focusing on value. Economists anticipate improvement over the summer as wage growth outpaces inflation.

FTSE100 is -1.2% this week and +7.5% this year after hitting a record last week.

🇺🇸 US

Interest Rates and Bond Yields increased a little as the expectations of the Federal Reserve cutting interest rates worsened.

Inflation Concerns remain with higher business activity and growth and higher manufacturing costs.

US inflation and interest rate journey : Inflation has been sticky for almost a year. The Federal Reserve is unlikely to cut interest rates until the data suggests that inflation is running at target consistently.

US inflation and interest rates

NVIDIA’s Impact: The major news of the week was the release of Nvidia’s results.

- Earnings Report: NVIDIA's strong first-quarter results drove a 15% rise in its shares during the week

- S&P 500 Influence: NVIDIA accounted for 37% of the S&P 500’s EPS gains over the past 12 months and 25% of its YTD gain. Nvidia is now the third largest company in the S&P500 after Apple and Microsoft.

- Market Sentiment: Despite NVIDIA’s performance, nearly 90% of S&P 500 stocks closed lower on Thursday due to speculation that the Fed would delay rate cuts following positive growth data. Good news on growth can be inflationary !

Major Indexes:

Dow Jones Industrial Average: Suffered its biggest weekly loss (-2.33%) since early April despite hitting a record during the week.

Nasdaq Composite: Continued its record-setting march, driven by gains in technology stocks.

Small-Cap Stocks: Declined over the week.

S&P500 is up +1.5% in the week and nearly +11% so far this year. So far this year market sentiment has oscillated with changing expectations of rate cuts.

If you are liking this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

🇯🇵 Japan

Nikkei 225 Index was -0.3% this week, and up 15% in the year. After a 34 year bear market since 1989, the index exceeded that level for just over a month this year.

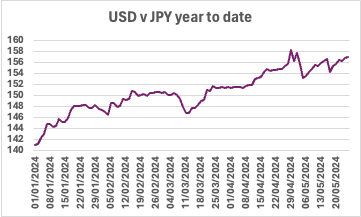

Yen continues to be of interest to investors and appears to be steady after unconfirmed government interventions. A weak currency brings in imported inflation. It also brings in investment from other countries who will find prices attractive. And it will bring in tourists.

Visitor numbers to Japan are trending higher in 2024.

A sushi breakfast at Tsukiji Fish Market, ramen, yakitori, visiting the onsens, riding the bullet trains, seeing Mt Fuji, seeing the super clean streets, sake tasting and much more are now more affordable !

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Power demand for AI seems insatiable. Generative AI, especially Large Language Models (LLMs), are major energy consumers, according to Sasha Luccioni of Hugging Face. Each query activates the entire model, making it computationally inefficient. LLMs, trained on vast datasets, generate text from scratch, requiring substantial computational power. A recent peer-reviewed study by Luccioni and colleagues found that Generative AI systems use about 33 times more energy than task-specific software.

This energy consumption occurs in data centers, not personal devices. In 2022, global data centers consumed 460 terawatt hours of electricity, with the International Energy Agency (IEA) predicting this will double by 2026 (about as much as Japan’s annual electricity use). The increasing energy demand is causing strain on local infrastructures, leading to moratoriums on new data centers in places like Dublin and reevaluation of tax breaks in the US. As mentioned in a previous newsletter, having a nuclear reactor supplying a data center may be a solution. A SMR (small modular reactor) is similar to a reactor in a nuclear submarine.

Advancements like Nvidia's Grace Blackwell chips aim to enhance energy efficiency for high-end processes, but they still require significant power. Despite data centers becoming more energy-efficient, their overall demand is expected to grow faster than efficiency gains. Efforts to develop energy ratings for AI systems are underway to promote more sustainable choices. This situation underscores the need for balancing technological advancements with energy sustainability.

Microsoft’s Copilot is now an enhanced version. It can support entire departments, not just individuals. This development is part of Microsoft's broader effort to compete with Google in AI business products. Copilot can now manage tasks such as assigning roles and handling meeting agendas for teams. Additionally, businesses can create custom "agents" that operate autonomously, like responding to emails or processing orders.

The updates were announced at Microsoft's annual developer conference, highlighting Copilot as a key product for future profits. Rajesh Jha, Microsoft's EVP of experiences and devices, emphasized Copilot's role in reducing workplace drudgery. Microsoft's advancements in generative AI stem from a $13bn investment in OpenAI, positioning it ahead in the AI race against Google and Amazon.

These announcements follow Google's introduction of multimodal AI capabilities, which can handle video, audio, and text queries. Other tech giants like Apple and Meta are also pushing AI-powered smart assistants. Microsoft introduced new AI-enhanced PCs and tablets to rival Apple, integrating Copilot into devices from Dell, HP, and Samsung.

Microsoft will soon allow business customers to use OpenAI's GPT-4o and Phi-3 models. The upgraded Copilot can connect to various data sources, enhancing its ability to reason and assist. Despite Copilot's potential, Microsoft ensures human oversight remains integral, allowing users to review AI actions. The upgraded tools will be available in preview later this year. Analysts note that while Copilot is central to Microsoft's AI strategy, its adoption among office workers has been slower than expected.

Economic effects of AI continues to be a hot topic. Goldman Sachs Research anticipated that generative AI would boost GDP and labor productivity over the next decade. While investment in generative AI has surged, its integration into the economy is lagging, delaying productivity gains. Joseph Briggs from Goldman Sachs notes that significant productivity impacts require widespread AI adoption in daily work processes, which hasn't yet occurred. Current adoption rates are around 5%, primarily in information services, finance, and media industries, using AI for tasks like marketing automation and data analysis.

Despite slow adoption, early signs of productivity gains are promising, with some studies showing a 25% increase in efficiency. However, broader use of AI requires significant investments in semiconductors and network capacity. The International Energy Agency projects a notable increase in electricity demand due to AI.

Adoption barriers include lack of AI knowledge, privacy and security concerns, and caution against early technology versions. While AI hasn't significantly impacted the labor market yet, it has generated job growth, particularly in IT. Goldman Sachs maintains that AI will drive long-term productivity and GDP growth, expecting noticeable effects by 2027. Overall, AI is seen as a positive force for job creation and economic enhancement, despite initial slow uptake.

🌐 Crypto Corner

Etheruem ETFs are in the process of being approved by the US Securities and Exchange Commission (SEC). The regulator approved rule changes on Thursday in favor of ETFs that will invest in Ether (the native cryptocurrency of the Ethereum blockchain). A second round of approvals is needed before these products can launch. This could be a major boost for crypto after the earlier approvals for Bitcoin spot ETFs.

ETH price has picked up in the last few days but it is still below 2021 highs.

See previous newsletter spotlight on Bitcoin halving.

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Bernard Arnault and family (LVMH) $205bn ⬇️ $9bn )a 4% reduction in LVMH shares in the week)

Jeff Bezos (Amazon) $198bn ⬇️ $4bn

Elon Musk (Tesla, SpaceX) $197bn ⬆️ $1bn

Mark Zuckerberg (Facebook/Meta) $167bn ⬆️ $2bn

Larry Ellison (Oracle) $152bn ⬇️ $1bn

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates each week.