INSIGHT WEEKLY : April 28, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

An easy to read weekly summary to be well informed of topical issues in economics, finance, technology and AI, and cryptos.

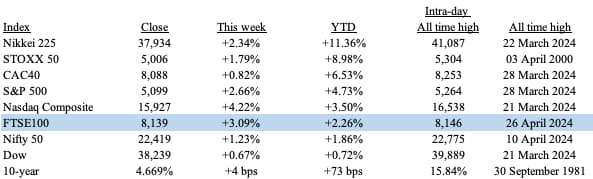

🌐 Major indexes and major stocks

Markets are up this week, after a few down weeks, with UK’s FTSE 100 hitting a new high. Investors were buying the dips. There was also not good news on the economic front, which makes stocks go up.

Bad news seen as good news ? Here’s why.

Bad news on the economic front can make interest rate cuts more likely.

The sensitivity of stock prices globally appears to be 1) prospects for interest rate cuts and 2) prospects for AI and tech 3) tensions in the Middle East

Major stocks of interest :

Markets fell for a few weeks and is now up again. There are down weeks and up weeks, but the long term trend has been up. Smart investors know that and they also know that if there is a bear market, these are likely to be shorter in duration than a bull market. Also the average drop in a bear market is more than compensated by the upswing in a bull market.

It is not easy to predict a bull market or a bear market.

Tempted to sell when prices drop ?

Consider the history of bull and bear markets since 1962 :

Market | Average Return* | Average Duration |

|---|---|---|

📈 Bull Market | +151.6% | 51.0 Months |

📉 Bear Market | -34.2% | 11.1 Months |

Here is a quote from Warren Buffett :

“The stock market is a device to transfer money from the impatient to the patient”

🇬🇧 UK

Government borrowing was £120bn in the year to March, which is lower than the previous year but more than expected. Debt is at 98.3% of GDP. This is a setback for any plans for tax cuts this year. Debt can only be decreased by a combination of tax increases and reduced spending. Not a good proposition in election year.

FTSE100 is more than +3.9% this week, and over +2.26% this year.

🇺🇸 US

Staglation (rising prices and slow growth) risk increases as inflation (PCE) rises at an annualised rate of 3.7% in Q1 and above fourth quarter of 1.7%. The Federal Reserve target is 2%.

Stock prices rebounded this week after the easing of tensions in the Middle East. Not so good economic news on the economy, namely an estimate that the growth will 1.6% in Q1 rather 2.5% expected and at the slowest pace in nearly two years. Consumer spending is also down, and capital spending has increased though at a slower pace. This increases the expectation of interest rate cuts but only marginally.

S&P500 at 4,918 is +2.6% in the week and up nearly 5% so far this year.

🇯🇵 Japan

Yen continues to weaken. It is 158 against the US dollar down this week (-2%), and well above the 152 level for expected government intervention. The Yen v USD is -8.6% since the start of the year. It looks like the government is wary of intervention. Think UK and the ERM in the 1990’s.

Interest rates will be increased in the second half of the year as hinted by the Bank of Japan as it continues its drive to monetary policy normalisation.

Nikkei 225 rebounded more than +2% this week, and more than +11% this year.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Microsoft introduces the Phi-3 family of small language models (SLMs), claiming unmatched capability and cost-effectiveness for their size. The Phi-3-mini, with 3.8 billion parameters, is now available and outperforms models double its size. This launch marks a shift towards offering a variety of models tailored to specific customer needs, according to Sonali Yadav, Microsoft's Principal Product Manager for Generative AI. Additional models with more parameters will soon follow, broadening the choices available for different applications.

Microsoft's AI strategy includes a range of both small and large language models (SLMs and LLMs) to cater to diverse customer needs, from on-device deployment for fast, offline responses to complex reasoning for large-scale data analysis. SLMs, being smaller, enhance privacy and reduce latency by keeping data on the device. This is good for for applications like smart sensors, cameras and similar devices. Meanwhile, LLMs handle more complex tasks and reasoning. For example, drug discovery by understanding interactions across scientific literature. Microsoft emphasizes the development of models using curated data and specialized training to improve efficiency without the heavy computational costs associated with very large models.

Google share price surged over 10% during the week, as it showed great earnings in the last quarter, news of a planned stock buy back, and as it indicated that “the transition to AI is a once in a generation opportunity”.

Meta’s share price fell nearly 10% as investors got nervous as Meta announced significant expenses on AI, which may not generate revenues quickly enough. The release of Llama 3 last week was well received.

🌐 Crypto Corner

Bitcoin price is down 5% in the week following the halving which reduced the rewards paid to miners from 6.25 bitcoins to 3.125 bitcoins. The supply side shock that some have predicted is yet to happen.

Coinbase share price is up over 50% in the last twelve months. It is a cryptocurrency exchange with Bitcoin at around 34% of its volume.

Cleanspark share price is up 384% in the last twelve months. It is one of the larger Bitcoin miners.

Microstrategy share price is up 300% in the last twelve months. It is well known as a holder of Bitcoin - it holds more than 214,000 which are worth nearly $14 billion. It also provides analysis and business intelligence solutions.

Previous newsletter spotlight on Bitcoin halving.

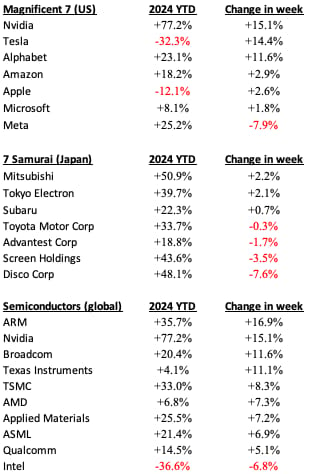

🇺🇸 Spotlight on US National Debt

Size of debt is $34 trillion and has grown rapidly over the last decades. It is rising by $1 trillion every 100 days.

Lenders hold Treasury securities (bills, notes and bonds issued by the US Treasury). Most of it is owed domestically with about $5.4 trillion owed to non US investors.

Major non US holders of US debt are investors in Japan ($1.1t), China ($0.8t), UK ($0.8t), Luxembourg ($0.4t) and Canada ($0.3t).

Relative to the size of the economy(GDP), debt is now at 123%.

This is a good way of looking at debt. As the economy grows, debt can grow but the growth in debt has been far bigger than the growth in GDP. A projection from the Congressional Budget Office is that this ratio will increase to 172% by 2054, an unsustainable level.

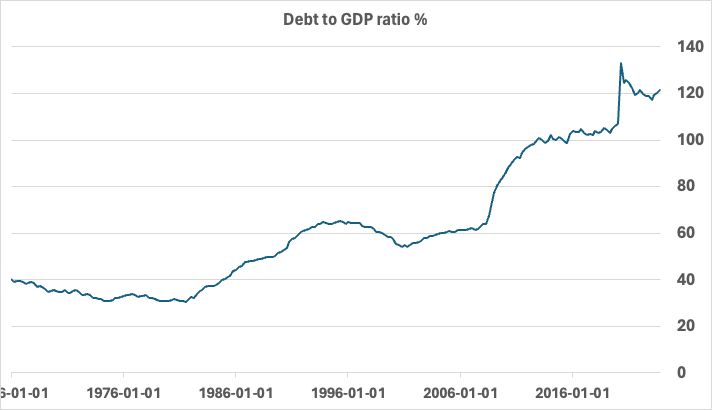

Uses of the National Debt :

In theory, the expenditures of the government are to be funded out of taxation. Taxes paid by companies and individuals should be used to fund social services, defense, salaries of government employees etc.

In theory, the National Debt should be used to fund exceptional or extraordinary expenditures that go beyond what is covered by routine tax revenues. These might include major infrastructure projects, economic stimulus packages, or emergency relief efforts. Examples are the financial crisis or 2008 and the Covid pandemic.

However these two types of expenditures have been conflated.

Growth of the National Debt :

There have been exceptional expenditures such as the wars in Iraq and Afghanistan, the 2008 financial crisis and the Covid pandemic. These are fiscal responses to exceptional events that cannot be funded by the current year’s taxation revenues. Tax cuts have made the deficits increase and further increased the debt.

Interest (annualised) on the National Debt is now over $1 trillion per year.

Interest is 13% of the budget, equalling defence spending and may exceed it in the future.

Ferguson’s Law (from the historian Niall Ferguson) is a principle that any nation that spends more on interest payments on the debt than on military spending will slip into decline. It happened to Hapsburg Spain, the Ottoman Empire, the British Empire and pre-revolutionary France.

Consequences of not reducing the national debt are the degradation of the credit rating for US debt (Fitch has already removed the AAA rating) which will make it necessary to increase the interest rate on future debt in order to make it attractive for investors, reduced demand for the US dollar as the world’s reserve currency, and a market shock as debt soars. And the inevitable recession risks as a major downturn in the economy looms. If there is less ability to raise more debt, government expenditure will need to be cut and taxes raised in a much more dramatic manner.

Remediation of the debt issue will need some combination of reduced expenditure, higher taxes and growth of the economy, all of which are challenging.

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Bernard Arnault and family (LVMH) $214bn no change

Jeff Bezos (Amazon) $197bn ⬆️ $4bn

Elon Musk (Tesla, SpaceX) $191bn ⬆️ $12bn (Tesla +14% in the week)

Mark Zuckerberg (Facebook/Meta) $155bn ⬇️ $13bn (Meta -8% in the week)

Larry Ellison (Oracle) $145bn ⬆️ $3bn

SPOTLIGHTS

Earlier :

Japan ;

AI chips ;

This week : US National debt

Coming soon : Future growth sectors, Gold and more !

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates in a 5 minute round up each week.