INSIGHT WEEKLY : May 5, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

An easy to read weekly summary to be well informed of topical issues in economics, finance, technology and AI, and cryptos.

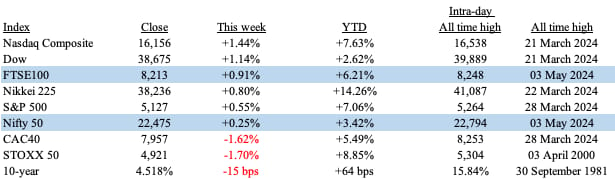

🌐 Major indexes and major stocks

Markets up this week, except in Europe. UK’s FTSE 100 and India’s Nifty50 break new records during the week. Markets accepted that US interest rate reductions may be much later, and that there might be just one cut in 2024. Also there has been an easing of tensions in the Middle East.

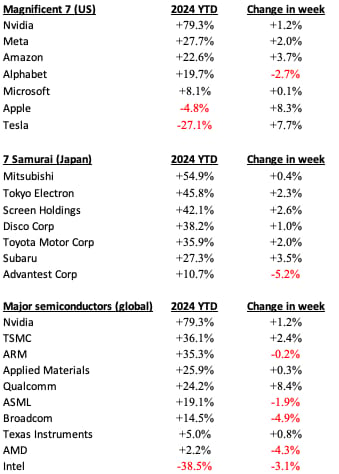

Major stocks of interest :

Tesla (Musk China visit, FSD) and Apple (results, planned share buy back) had a recovery in the week.

There has been a lot of interest in semi conductor stocks due to its role in powering the AI revolution. The SOX index is up 60% in the last 12 months. There was a dip a few weeks ago as the markets adjusted.

🇬🇧 UK

UK housing market saw an increase in mortgage approvals in March v February however, the Nationwide house price index fell 0.4% in April, marking the second consecutive monthly decline.

Slowest growth for the UK among the G7 nations in 2025, with an expected GDP increase of only 1%, according to the OECD. Factors contributing to this sluggish performance include the impact of successive interest rate hikes and persistent inflation concerns, which may deter investment. Despite fiscal measures like National Insurance cuts and incentives for business investments, these have not fully offset the negative effects of frozen income tax thresholds and a rise in corporation tax.

FTSE100 has risen more than +0.9% this week, and over +6.2% this year. It is another record this week due to expectations of two rate cuts this year, and easing of tensions in the Middle East.

🇺🇸 US

Employment numbers, as measured by non farm payroll, were +175,000 v the +243,000 expected. This news increased speculation that the interest rates could be cut sooner due to a cooling labour market. The unemployment rate is now 3.9%, marking the 27th consecutive month it has been under 4%. March job openings fell more than expected to 8.5 million, the lowest in 3 years.

Stagflation risk trends continue with news that employment costs rose 1.2% in the quarter which was above expectations. Chair Powell does not think that there should be stagflation concerns, pointing out growth and noting that inflation rate is around 3%.

Stock prices rose again this week after the release of employment data, and earnings. Apple performed well, despite slowing iPhone sales, on the news of a planned share buy back of 100 billion shares, the largest in history. Tesla also recovered well after Elon Musk’s visit to China, and a positive reception from the Chinese government regarding the self driving technology that Tesla has developed.

S&P500 at 4,918 is over +0.5% in the week and over +7% so far this year.

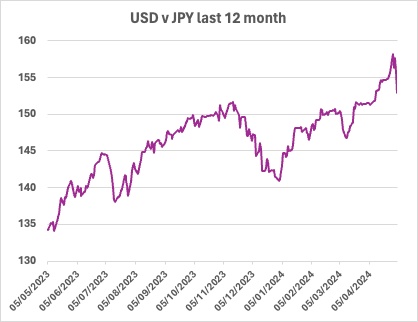

🇯🇵 Japan

Yen has weakened and the government appears to have made a few interventions in the week. After reaching 160, it is now fallen to around 152. The May 1 intervention is estimated to have cost the Japanese government around $23bn. The yen has depreciated over 8% against the dollar this year. There are indications that the government will continue to intervene to prop up the yen. Is 160 the new line in the sand ?

Tourism is benefitting from the weaker yen which has made Japan an attractive destination for tourists. A bowl of ramen noodles that cost $8.90 in 2019 is now $6.30. Shopping is now more affordable especially as many shops are able to exempt tourists from the 10% sales tax.

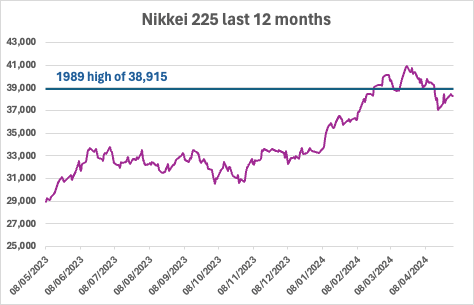

Nikkei 225 recovered +0.8% this week, and more than +14% this year. After the 1989 high, there was a 34 year bear market. Now the Nikkei 225 is below that level.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

Apple indicated that AI will be incorporated across all its devices, not just the iPhone. CEO Tim Cook highlighted AI's significant potential across Apple's product line, noting the integration in products like the M3 MacBook Air, Apple Watch's health monitoring, and also Vision Pro.

“I would just say that we see generative AI as a very key opportunity across our products. And we believe that we have advantages that set us apart there,” Cook said.

Four Chinese AI startups, Zhipu AI, Moonshot AI, MiniMax, and 01.ai, are pushing the boundaries in generative AI to match rivals like OpenAI and Anthropic. They have raised between $1.2bn and $2.5bn. With ChatGPT and others such as Character.ai unavailable in China, these 262 start ups are competing to release their own alternatives.

Claude is to be introduced to the iPhone. Anthropic will bring the third iteration of the Claude large language model to iPhones. There will be three versions: "haiku," a quick and simple model; "sonnet," a slower but more robust version; and "opus," a premium version that recently surpassed GPT-4 in the LMSys chatbot ranking. "Opus" has a very large "context window" allowing it to remember about 160,000 words of a conversation. That is about the size of a novel ! Additionally, Anthropic is enhancing its user experience with a new iOS app that enables functionalities like photo analysis, enabling users, for example, take a photo of a whiteboard diagram post-meeting and provide a summary.

Similarly, a photo of a plant or an animal can be used to get more information on it.

It is also expanding corporate solutions with a comprehensive team plan that provides chatbot access for all staff.

In response, on Wednesday, OpenAI adjusted its user data policies to allow users to access their entire ChatGPT history.

Amazon's profits surged in the first quarter of 2024 with revenue up 13% to $143b. This growth was attributed to advertising sales and AI, with Amazon stating that there is more room to grow, especially in its cloud computing unit.

Financial Times has agreed a deal to allow OpenAI to access its content to be used in training AI systems. In contrast, other organisations such as The New York Times are suing Open AI and its largest investor Microsoft, over their content being used by OpenAI.

🌐 Crypto Corner (including definitions)

Bitcoin price has recovered slightly during the week. Prices dropped following the halving. Outflows from the Bitcoin ETFs have decreased and there has even been a slight increase in inflows. The price increase happened shortly after the release of the US job report.

Lummis-Gillibrand Payment Stablecoin Act aims to regulate stablecoins, focusing on preventing tech platforms from acting like unregulated banks with access to Federal Reserve and FDIC resources. Critics argue it stifles competition, benefiting the banking sector by maintaining a controlled payment space. The bill favors established banks by making it tough for non-depository institutions to issue stablecoins and proposing to give the Fed decisive power over which banks can issue these digital currencies. This approach aligns with the Biden administration's restrictive stance on regulating stablecoins, potentially stifling innovation in the payments sector.

Different types of cryptocurrencies with brief descriptions:

1. Bitcoin: The first and most well-known cryptocurrency, used primarily as a digital form of money.

2. Altcoins: Any cryptocurrency other than Bitcoin, often with varying functionalities and blockchain technologies, such as Ethereum and Litecoin.

3. Stablecoins: Cryptocurrencies pegged to a stable asset like fiat currency or gold to minimize volatility, such as Tether or USD Coin.

4. Tokens: Digital assets built on existing blockchain platforms, representing assets or utilities within specific ecosystems, commonly used in decentralized applications.

5. Privacy Coins: Cryptocurrencies focusing on providing anonymous transactions, using sophisticated cryptographic techniques to ensure privacy, like Monero and Zcash.

6. Central Bank Digital Currencies (CBDCs): Digitized versions of fiat currencies issued and regulated by central banks, designed to blend the benefits of digital currencies with the regulatory oversight of government-backed money.

Each category serves unique purposes and targets different users within the digital economy.

Previous newsletter spotlight on Bitcoin halving.

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Bernard Arnault and family (LVMH) $212bn ⬇️ $2bn

Jeff Bezos (Amazon) $203bn ⬆️ $6bn

Elon Musk (Tesla, SpaceX) $198bn ⬆️ $7bn (Tesla +8% in the week)

Mark Zuckerberg (Facebook/Meta) $158bn ⬆️ $3bn

Larry Ellison (Oracle) $145bn no change

SPOTLIGHTS

Links to earlier spotlights :

Japan ;

AI chips ;

Last week : US National Debt

Coming soon : Future growth sectors, Gold and more !

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates in a 5 minute round up each week.