INSIGHT WEEKLY : March 31, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

An easy to read summary of topical issues in economics, finance, technology and AI, and cryptos.

🌐 Major indexes and major stocks

Quarter 1 stock markets performance was record breaking on great expectations from AI and technology, and also a period of uncertainty on when interest rates might be cut. Inflation continues to be sticky, and market expectations on the number of interest rate cuts in 2024 may turn out to be too optimistic.

Japan’s Nikkei 225 was the best performer in Q1 as investors bought into Japan, breaking a 34 year record.

Two records set in this short trading week. US’s S&P500, France’s CAC 40 continue a record breaking run.

Magnificent 7 (US) :

Chips, AI and cloud computing are the drivers of growth. These stocks have been dubbed the “Magnificent 7”.

Nvidia has had a standout performance due to demand for its high performance chips for use in AI.

Apple faces declining sales for its iPhone which contributes around half of its revenue.

Tesla is experiencing competitive pressures for electric vehicles. Other electric vehicle makers stocks are also down significantly, such as Lucid (-31% YTD) and Rivian (-48% YTD) . BYD became the world’s biggest seller of EV’s in Q4 2023 (-5% YTD).

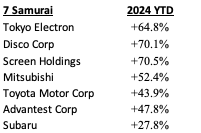

7 Samurai (Japan) :

Nikkei 225 is up 21% this year. These stocks have been dubbed the “7 Samurai”.

Semiconductors (global) :

Powering the AI revolution.

The S&P Global Semiconductor Index, comprising 50 companies is up 19% YTD. This table shows the major companies in this space.

🇬🇧 UK

Recession in 2023 was confirmed by official data. The Office for National Statistics (ONS) confirmed that GDP shrank by 0.3% in Q4 of 2023. This news came as no surprise.

Q1 2024 is expected to show an increase so the expectation remains that the UK is out of recession.

Interest rate cuts are still expected but one member of the committee said this week that cuts are a “long way off”. Just a week ago, the governor of the Bank of England said that cuts are “in play” and the UK is “effectively disinflating at full employment”. The financial markets are expecting three rate cuts this year of 0.25% each.

FTSE100 is +2.99% since the start of the year. Most of the positive performance has been in the last few weeks.

🇺🇸 US

Baltimore bridge collapse has resulted in the closure of one of the busiest ports, and the primary port for car and truck shipments. The economic implications are not known yet.

Consumer confidence declined slightly in March.

Inflation as measured by the Federal Reserve’s preferred measure, the CPE, ticked up to 2.5% moving further away from the target of 2%. Chair Powell stated that it was “pretty well within our expectations”. So it is within a band, but not coming down.

Interest rates are not expected to be cut anytime soon.

S&P500 at 5,254 is up 0.38% in the week and up over 10% this year.

🇯🇵 Japan

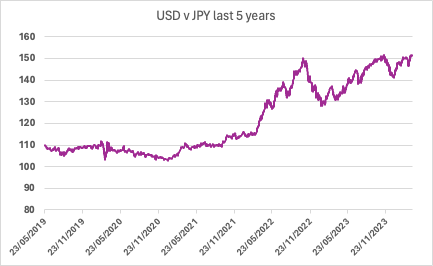

Nikkei 225 is up 21% in the year to date, breaking two records in the quarter, following a 34 year bear market.

Yen has depreciated further against the dollar. At 151 yen to the dollar, the Japanese government is considering intervention to support the yen. The trigger point talked about is 152, so intervention appears to be imminent. The exchange rate is at a 34 year low. Intervention may not help as the FX rate reflects long term concerns on the economy.

Some benefits of a weaker yen are that it has helped with investment in the stock market and with increased tourism.

Interest rates will need to increase sooner than planned. As the intervention to support the yen will be monetary policy measures, interest rates will be increased to attract more buying of yen.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

ChatGPT 5.0 could be out by mid year. The current premium version is 4.0. Version 5.0 is currently being tested by some business users and is expected to be significantly better with features such as performing tasks autonomously.

Prompt engineering is likely to produce better results from large language models. OpenAI have a useful guide.

Data center power will become a major issue due to both AI and quantum computing. Both have huge power requirements and data centers may have to get ready for up to 6X current power needs. Some have commented that a dedicated nuclear reactor could provide a solution. This technology is called Small Modular Reactor (SMR). It could be similar to a reactor used in a submarine.

Jobs at risk due to AI in the UK could be as much as 8 million according to the Institute for Public Policy Research (IPRR). It warns that younger workers, women and the lower paid are most at risk from automation. This is a worst case scenario over a three to five year period. IPRR warned UK was facing a “sliding doors” moment as growing numbers of companies adopt generative technologies – which can read and create text, data and software code – to automate everyday workplace tasks.

The think tank identified three different scenarios and also recommends that the government “develops a job-centric industrial strategy for AI”.

Worst case scenario – full displacement: all jobs at risk are replaced by AI, with 7.9 million job losses and no GDP gains

Central scenario: 4.4 million jobs disappear, but with economic gains of 6.3 per cent of GDP (£144bn per year)

Best case scenario – full augmentation: all jobs at risk are augmented to adapt to AI, instead of replaced, leading to no job losses and an economic boost of 13 per cent to GDP (£306bn per year)

🌐 Crypto Corner

Bitcoin spot ETF’s (Exchange Traded Funds) have been the biggest development in the crypto world so far this year. Since SEC approval in January, around $12bn has flowed into the ETF’s. It has been the most successful ETF launch in history. This inflow has since slowed as the pent up demand appears to have been satisfied. There have also been some outflows. Growth is still expected as more institutions and advisors start to use these ETF’s. Bitcoin looks like it about to enter the mainstream, though its use as a currency may be some way off. As an investment/asset class, it continues to be of great interest.

The next development for Bitcoin is the halving in April which was covered in last week’s newsletter Bitcoin halving.

Ethereum spot ETF’s may be the next big thing in the crypto world. Like Bitcoin, futures ETF’s already exist, so the next logical step is for spot ETF’s to be approved. A precedent has been set with Bitcoin, so why not have Ethereum spot ETF’s too ? SEC approval could come around the mid year point.

Ethereum is the second biggest blockchain after Bitcoin, and has recently been through an upgrade called Dencun intended to improve efficiency and reduce transaction fees on the Layer 2 network. The Layer 2 network are small blockchains than run alongside the main blockchain in order to speed up transactions by reducing the load on the main blockchain.

The price of ETH picked up in March, attributed to the Dencun upgrade, accumulation by “whales”, as well as macroeconomic factors such as possible interest rate reductions which may make cryptos more attractive to buyers. And also possibly due to speculation of ETF approvals.

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Bernard Arnault and family (LVMH) $226bn ⬆️ $1bn

Jeff Bezos (Amazon) $198bn ⬆️ $2bn

Elon Musk (Tesla, SpaceX) $195bn ⬆️ $3bn

Mark Zuckerberg (Facebook/Meta) $170bn ⬇️ $8bn (Meta down 4% in the week)

Larry Ellison (Oracle) $155bn ⬇️ $2bn

and watching

18. Jensen Huang (Nvidia) $79bn ⬇️ $3bn. Down 1 place this week. Potential entrant to the top 5.

SPOTLIGHTS

Earlier :

Japan ;

AI chips ;

Coming soon : More on National debt, future growth sectors, Gold and more !

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates in a 5 minute round up each week.