INSIGHT WEEKLY : April 7, 2024

If the images do not load, click to download external images in your email to see the newsletter in full, or click the link above to read online.

An easy to read summary of topical issues in economics, finance, technology and AI, and cryptos.

🌐 Major indexes and major stocks

Markets down this week, as the prospect of interest rate cuts are receding. These may be fewer and later than assumed. The fall this week is not considered to be a “correction” which is defined as a drop of more than 10%.

Japan’s Nikkei 225 has been the best performer this year after a 34 year bear market, though there was a 3.4% pull back in the week.

Only one record set in this short trading week. India’s Nifty 50 was the only one to breach new heights. After many weeks of records broken in stock markets, this could be the first signs of the markets levelling off.

Major stocks of interest :

🇬🇧 UK

Growth was impressive in the UK economy in March, surpassing other developed economies. The Purchasing Managers' Index (PMI) stayed in positive territory at 52.9, marking the manufacturing sector's first growth since July 2022. This strong performance in 2024 can be linked to declining inflation, expectations of reduced interest rates, and a robust labor market. Meanwhile, the eurozone's manufacturing sector is encountering difficulties, particularly in Germany and France. The UK's resilience and positive trajectory highlight a promising outlook amidst global economic fluctuations.

The February 2024 GDP number will be released on April 12. It is expected to be positive. If so, the UK will be out of recession.

Housing market improved in terms of mortgage approvals 60,400 in February (from 56,500 in January), which is the highest since June 2022. However, prices nationally were down 1% in March, which was the first drop in six months.

Brexit repercussions continue as the UK introduces charges for companies importing EU foods from April 30. Fees up to £145 aim to fund border biosecurity, impacting goods from fish to cheese (it will be charged per type of good imported - the "commodity line" - and capped at £145 for mixed consignments. Individual products will face charges of up to £29). The government justifies the fees as essential for biosecurity, following industry consultation and a cap to support smaller businesses.

This shift from pre-Brexit free trade raises concerns over cost increases.

FTSE100 is +2.46% since the start of the year. Most of the positive performance has been in the last few weeks, reflecting an increase in optimism.

🇺🇸 US

Non farm payroll, a keenly watched metric, showed the addition of over 300,000 jobs last month, marking the most significant increase in nearly a year. The unemployment rate dipped to 3.8%, with sectors such as health care, construction, and government expanding their workforce. The chart shows a steady, ongoing recovery since the pandemic.

Interest rate cuts may not be until later in the year. The jobs growth outpaced economists' expectations and the resilience of the US economy has led analysts to cast doubt on the Federal Reserve making any immediate moves to loosen monetary policy by cutting rates. The year started with the markets expecting 1.75% in cuts this year, but now it could be 0.75%. Or maybe not at all this year?

Wall Street stocks rebounded on Friday due to the good jobs numbers. The S&P 500 and Nasdaq Composite rose, countering a previous sell-off triggered by Middle East tensions.

Bond yields increased during the year due to the diminishing prospects of the Federal Reserve cutting interest rate cuts. Bond prices and yields move in opposite directions. Investors who bought bonds late last year in anticipation of rate cuts will have to wait longer to take profits.

S&P500 at 5,254 is -0.95% in the week and up nearly 10% so far this year. After a great start to the year, driven by tech, AI and optimism on interest rate cuts, there has been a minor reset this week.

🇯🇵 Japan

Yen remains at a low level against the dollar and yet to reach the expected trigger point of 152 for government intervention. The rate has been hovering around the 151 level. The low rate has helped Japanese exporters, inward investment and tourism. However imported inflation due to higher exchange rates remains a concern.

Nikkei 225 is -3.4% this week mainly due to the uncertainties on the exchange rate issue, as well as other external factors such as geopolitical issues and also the expected delays in US interest rate cuts. The index is up 17% so far this year.

See previous spotlight on Japan.

🌐 Artificial Intelligence

This cover has been designed using assets from Freepik.com

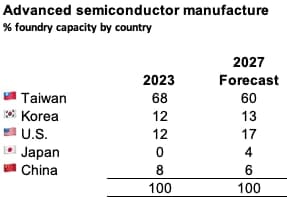

Taiwan earthquake affects chipmaking in the world’s biggest foundries. TSMC and UMC halted some production. TSMC makes nearly 70% of the advanced global semiconductors used in AI. Production is expected to resume soon if there are no further tremors.

Elon Musk's xAI is in discussions to raise $3 billion, valuing it at $18 billion according to the Wall Street Journal. Investors like Gigafund and Steve Jurvetson are said to be considering an investment. This funding aims to position xAI as an alternative to OpenAI and Google, with Musk launching it last year to compete in the AI space. Despite earlier denials of fundraising, momentum has grown, especially with xAI's introduction of Grok-1.5, a chatbot rivaling OpenAI's ChatGPT, now accessible to some X (formerly Twitter) users.

Apple's home robots are in development, with capabilities like following their owners around and assisting in video calls by moving screens for enhanced interaction. Leveraging technology from a halted car project, these robots aim to innovate home device categories. However, Apple is cautious about the potential high cost for consumers, according to Bloomberg.

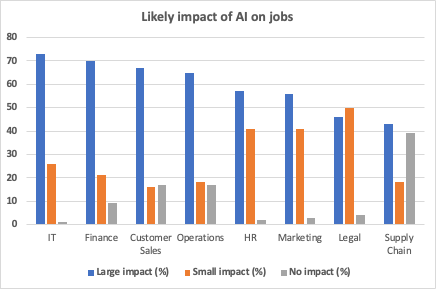

Jobs impacted by AI : According to research carried out by the World Economic Forum and Accenture, the likely impact on jobs has been visualised below.

The likely impact is estimated as the disruptive impact of AI on jobs rather than job losses specifically, but there will be “displacement” but there will job creation as well according to WEF :

AI talent is highly sought after, with top talent commanding seven-figure salaries amidst intense competition from tech giants. Microsoft hired key members from AI start-up Inflection to lead projects. Elon Musk wrote that Open AI has been seeking Tesla’s AI talent and has “unfortunately been successful in a few cases”. There have been other moves between Meta, Google, Open AI and others.

AI safety initiatives have taken a significant step forward with the UK and US signing an agreement to collaborate on the secure development and deployment of artificial intelligence. This pact will allow for the exchange of scientific methodologies, aiming to create standardized procedures for AI safety evaluations and risk mitigation.

Large Language Models (LLMs) could revolutionize the Finance sector within two years, enhancing efficiency and safety by detecting fraud, generating insights, and automating services. The Alan Turing Institute's findings indicate growing adoption for both internal processes and external activities, like advisory services. Despite the potential, regulatory challenges necessitate collaboration across the sector to ensure responsible implementation.

🌐 Crypto Corner

Bitcoin prices are in discussion as the halving date approaches, which is expected to be on April 20. The halving may create a supply side shock as some have stated. However the recent introduction of spot ETF’s may have changed the expectation of higher prices. If demand for Bitcoin has already been satisfied (because of the ETF’s), the halving may not be of much interest to investors.

Previous newsletter spotlight on Bitcoin halving.

🏅5️⃣ Billionaire Leaderboard

Mostly driven by stock market performance :

Change in week :

Bernard Arnault and family (LVMH) $218bn ⬇️ $8bn (LVMH down nearly 4% this week)

Jeff Bezos (Amazon) $202bn ⬆️ $4bn

Elon Musk (Tesla, SpaceX) $189bn ⬇️ $6bn

Mark Zuckerberg (Facebook/Meta) $184bn ⬆️ $14b (Meta up 8% in the week)

Larry Ellison (Oracle) $153bn ⬇️ $2bn

and watching

19. Jensen Huang (Nvidia) $77bn ⬇️ $2bn. Down 1 place this week. Potential entrant to the top 5.

SPOTLIGHTS

Earlier :

Japan ;

AI chips ;

Coming soon : More on National debt, future growth sectors, Gold and more !

If you liked this newsletter, please send this link to friends, family and colleagues and post on social media. https://insight-weekly.beehiiv.com/subscribe

Stay tuned for more insights and updates in a 5 minute round up each week.